One Good Turn Deserves Another

Friday, January 11th, 2008From time to time Bill Luby at the vixandmore.blogspot.com has kindly pointed his clientele to my blog starting with the blog notes I wrote on the Hindenburg Omen and as recently as yesterday on the discussion on the “retrospective play-by-play account of the Bernanke speech and the market’s reaction.” I felt it was time for me to return the favor and mention that since the VIX is an important tool in our assessment of the Market trends, you might find some interesting articles on the subject at that site.

-

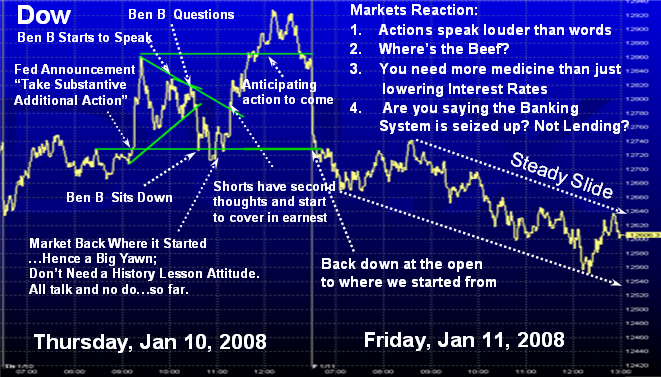

Since mine was highlighted as “one of several posts that may have some archival significance well beyond the day they were posted”, I felt it might be worthwhile to continue this discussion and format for just one more day.

-

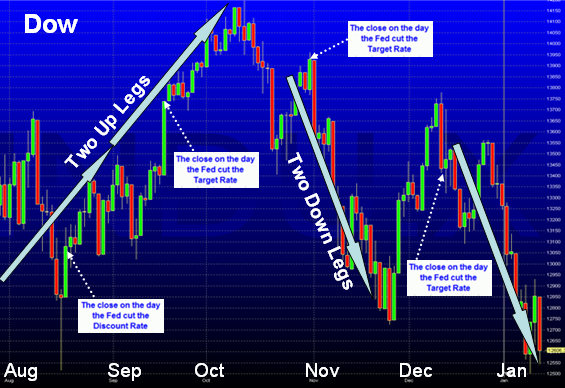

In addition I have expanded the timeframe to show the reaction of the markets for the four previous Interest rate cuts starting from August 16, 2007.

-

I also suggest that if you have not done so, please read the “Comments” made at the bottom of the previous blog with my good friend Maynard Burstein on the motivations and priorities of the FOMC relative to its allegiance to the financial structure of the Country or to save the market.

The Grand Ole Duke of York may soon be running out of rabbits to pull out of the hat to provide a cure

Let’s Review the Bidding of the Stock Market’s Reaction to Helicopter Ben:

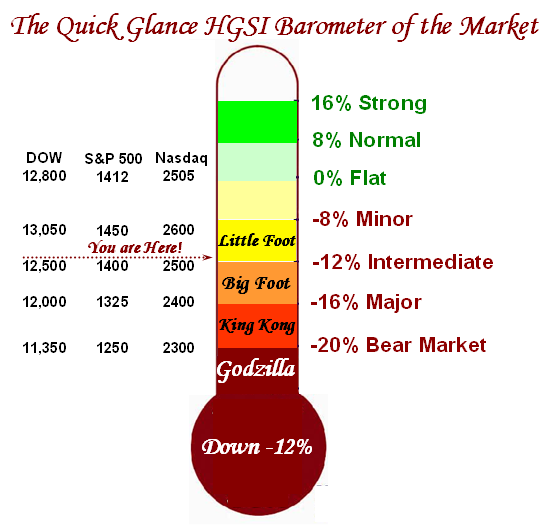

As far as the Stock Market is concerned, the quick assessment over five months is the Grand Ole Duke of York has marched his ten thousand men up to the top of the hill and marched them down again. It is now five months since Helicopter Ben made his first surprise appearance, and saved the market from the abyss on August 16, 2007, when his first injection to the Sub-prime problem started a strong drive upwards in the Stock Market. His first two recovery pills helped buoy the stock market as the Financial Markets applauded the actions to assist in the sub-prime debacle coupled with the Administrations actions to assist bona fide household owners keep their homes.

However, with the general concerns about the slowing Economy, the Weak Dollar, the poor Retail Results at its peak selling period, the last two infusions have done nothing for the stock market. It would seem that the general conclusion is that the entire Economy is beginning to stagnate and these infusions are not having the effect that was intended as the Banking System is seizing up.

Likewise it is becoming apparent that after yesterday’s initial fillip of hope on Chairman Bernanke’s strong assertion of substantive action, there is still a growing concern that they are behind the curve as witnessed by Friday’s sobering downdraft of -247 points down or -1.92% on the DOW. It seems the Market is saying “Where’s the Beef” and actions speak louder than words.

Now I must turn my attention for the next few days to the newsletter which is due on the 15th of the month. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog