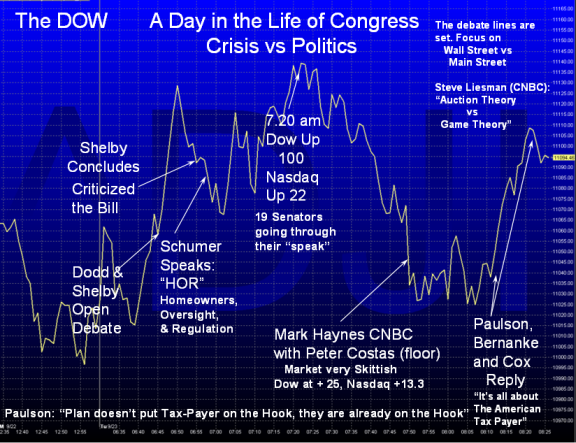

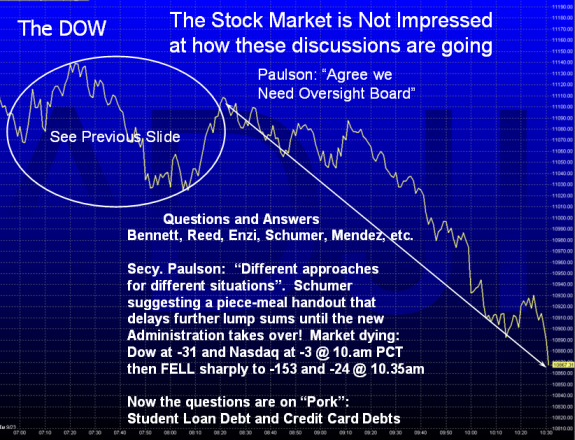

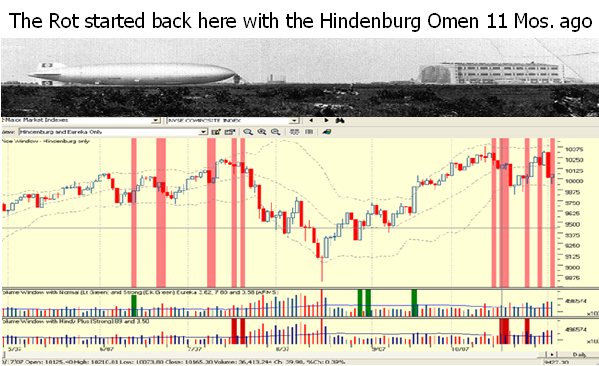

Wall Street and Main Street are in Shock!

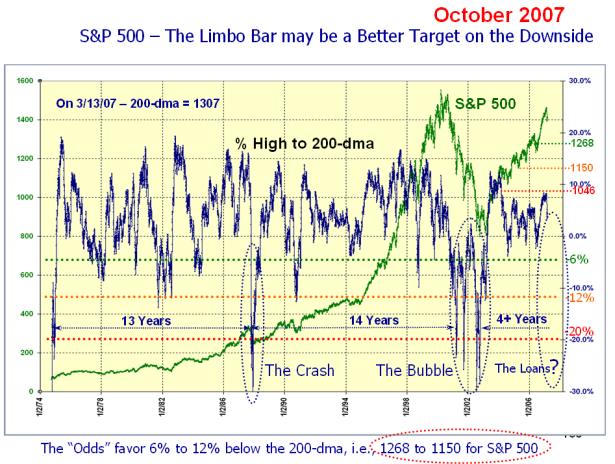

Monday, September 29th, 2008As angry as Main Street are they will be a lot angrier if Congress does not act. It didn’t take long before the finger pointing started after the Bill failed to pass. The sadness is there will now be spillover to every American, rich or poor, which has already suffered from the experience of the crash of 1987 or the dot.com bubble bursting from 2000 to 2002. Their hard earned 401K’s have shrunk overnight and it will be years before they recoup that portion of their nest egg which took hard work over years of faithful due diligence to their companies and their families. Some may be unfortunate to find they have to postpone their intended retirement or go back to work as a result of this debacle.

It is little consolation to say “Been there, done that” when I think back to that fateful day in 1987. By the looks of things this could be worse, as tomorrow is the last day of the month and of the quarter, and Congress cannot do anything until Thursday.

I have no words of wisdom that I haven’t covered, especially these last few weeks. In times like these “Cash is King”, but make sure that your money is FDIC Insured in the Bank and that if you have >$100K in the account that it is registered with the Bank as a Trust and that you and your dependents add up to the multiple of $100K that is in the account. For example, suppose you have $320K in the bank just to pick a number, and you and your wife have named two dependents in the trust; that provides $400K worth of coverage for you, so you are covered. You should talk to your Bank Manager to make sure your money is safe.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog