Stock Market: The K.I.S.S. Approach

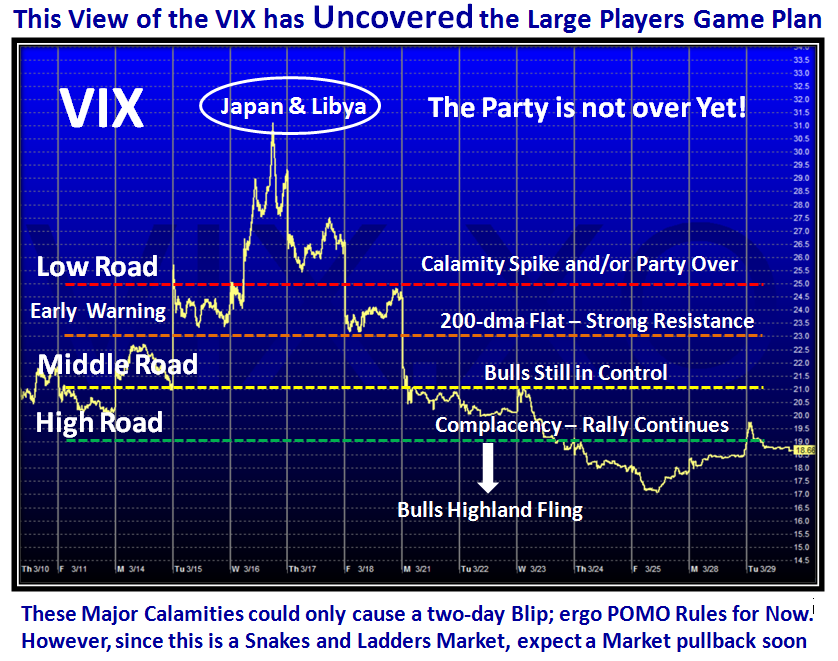

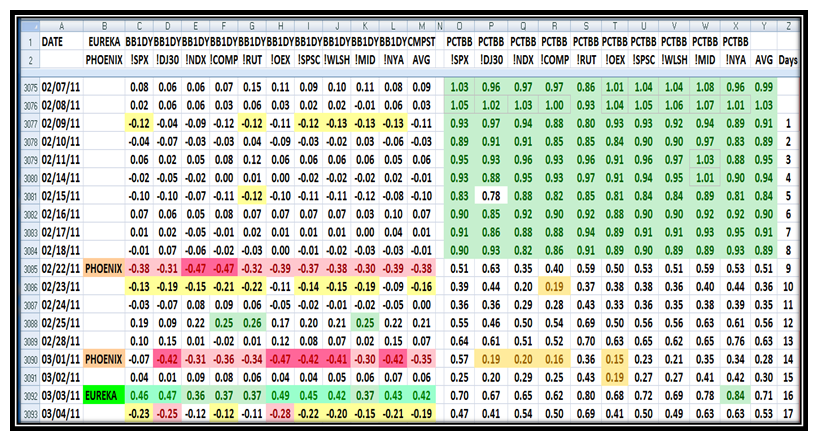

Tuesday, March 29th, 2011The Roller Coaster Ride is not over yet, so you know you are playing Snakes and Ladders. However, over the course of the last couple of weeks we have learned a lot about the Game Plan for the Large Players. The Magic of POMO, i.e., QE-2, is still alive until “May be Out”:

There is an old Scottish saying which is “Ne’er Cast a Clout till May be Out!” which translated means “Do not discard your Winter Woolies until May has come and gone”. So, take a tip from that old saying and don’t be too quick to get rid of your stocks until May is out”. Likewise, the big boys trot off to the Hamptons with “Go Away in May and Come back in October”, so expect things to get a trifle dull and in the doldrums in the summer months. We shall see what we shall see. Judging from the volume these days, they may have already trotted off into the sunset.

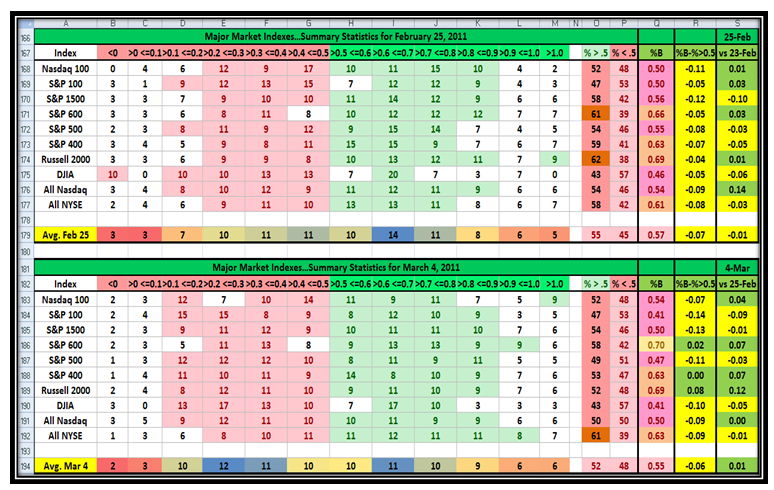

The net result is that the KISS Approach for the High, Low and Middle Road Scenarios become pretty straightforward:

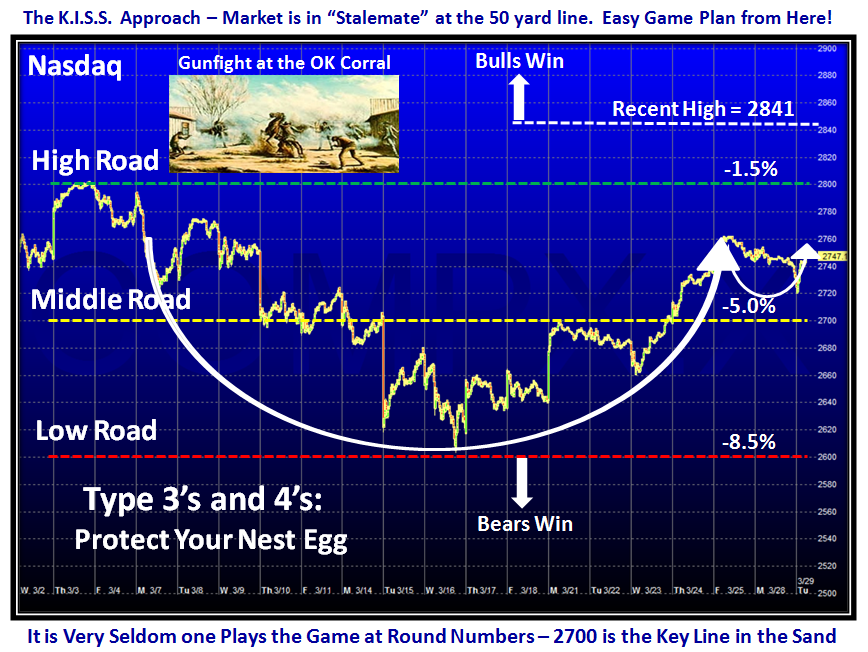

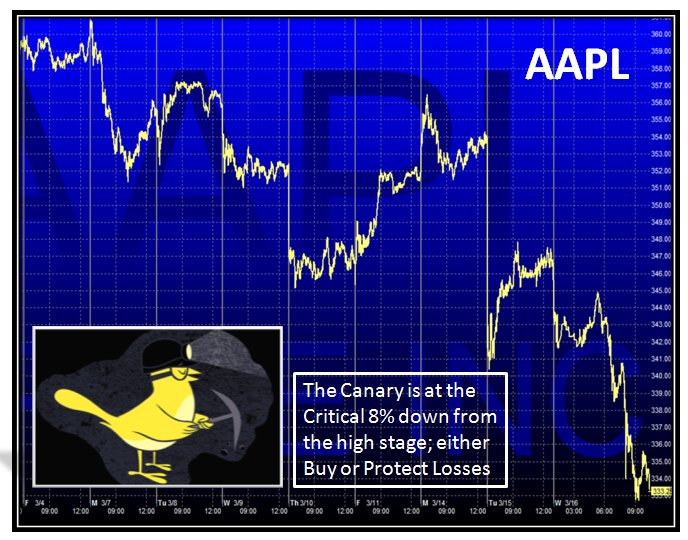

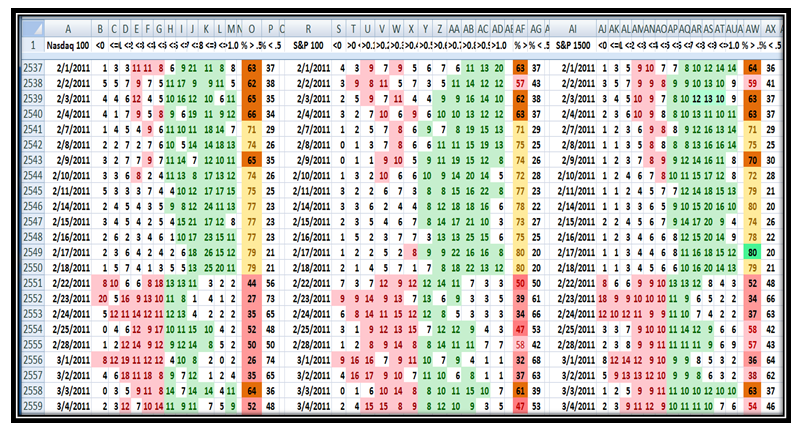

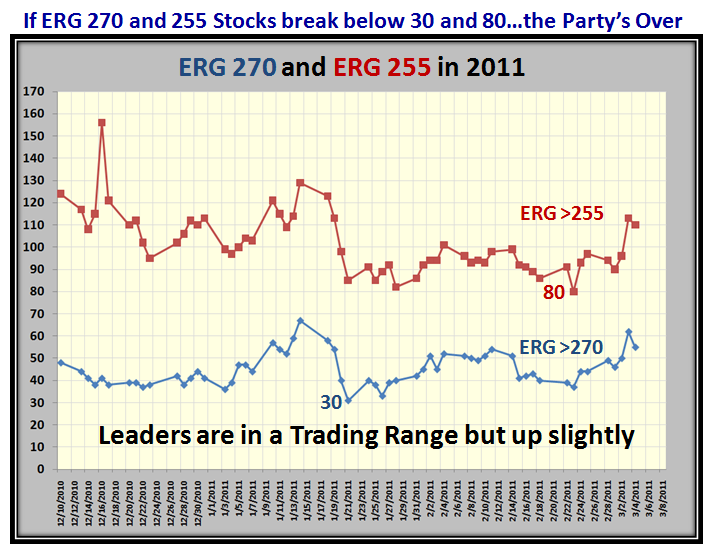

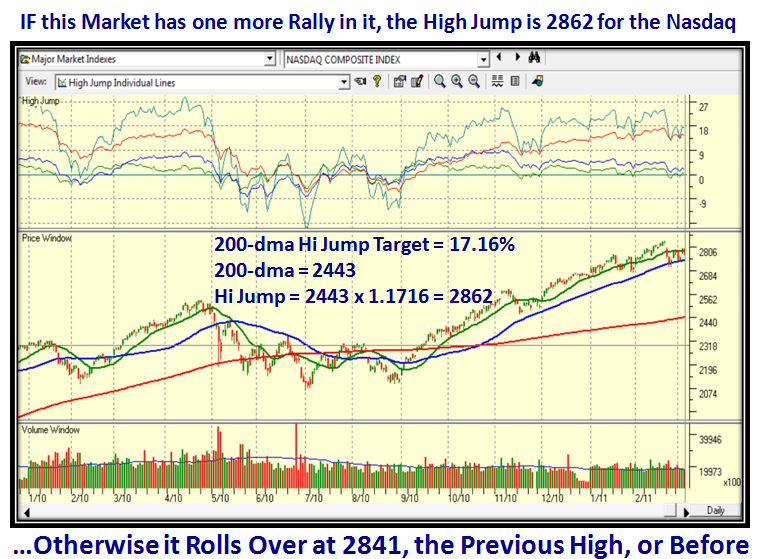

The bottom line “So What” Message is the Market is still in Stalemate at the 50-yard line and the Bulls have the ball and are attempting a new move to the High Road Scenario yet one more time. I feel it is time to dust off my old favorite view at this time for another fight at the OK Corral between the Bulls and the Bears which I have used many times before in the past. In all these years I have never seen the game plan to be around numbers that are easy to remember – the Market always likes to play around 100’s and 1000’s. In the case of the Nasdaq the current game is being played between 2600 and 2900, with the 50-yard line at 2700. Below 2614 is 8% DOWN from the current high of 2841 and as you well know by now history shows that 77% of the time the S&P 500 turns back up at or around this number. Below that it can land anywhere. Therefore, Type 3’s and 4’s longer term Investors should take heed if it breaks down at this level to protect their Nest Egg:

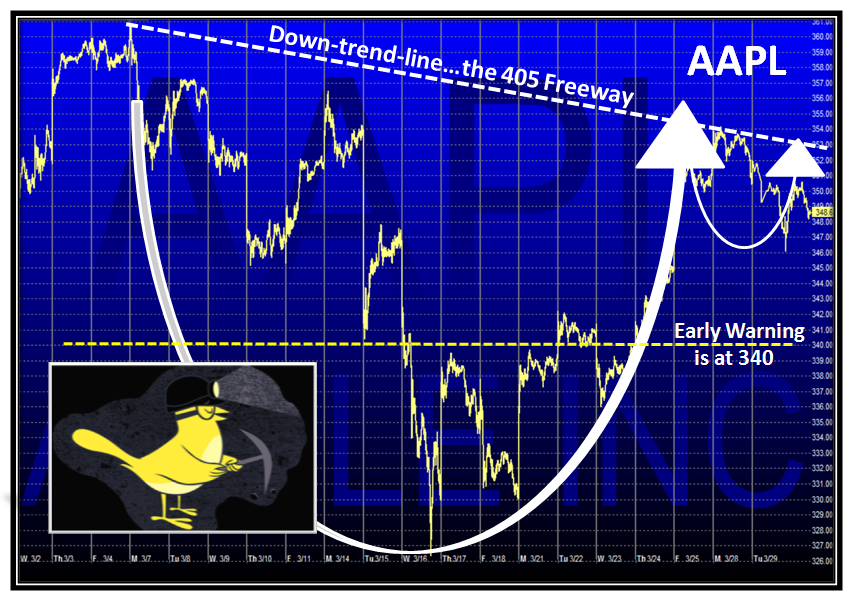

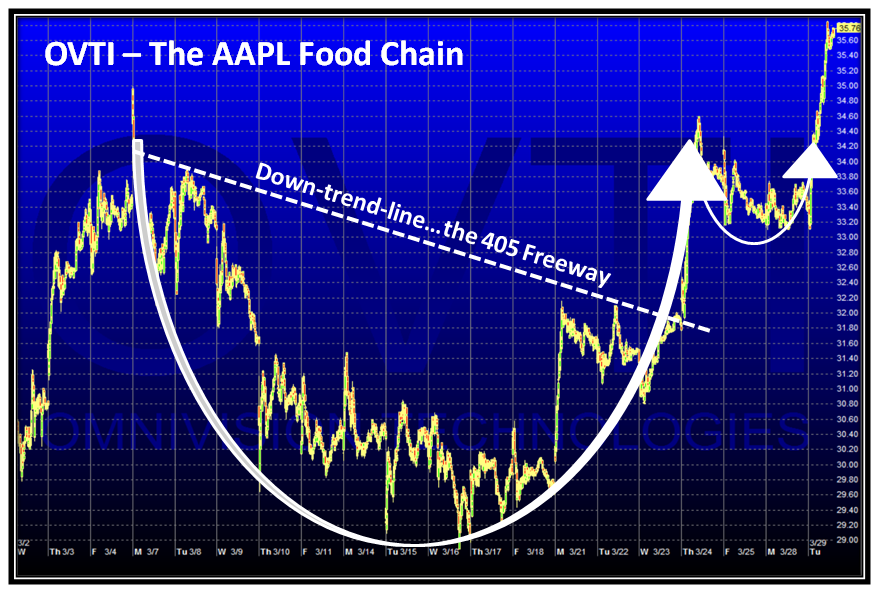

As I told you in my last blog, you need to watch the Canary in the Coalmine and that is AAPL. In addition it pays to watch the Apple Food Chain and in the next two slides I show charts of AAPL and OVTI, with the latter already breaking out based on its recent strong earnings report as this market turns up:

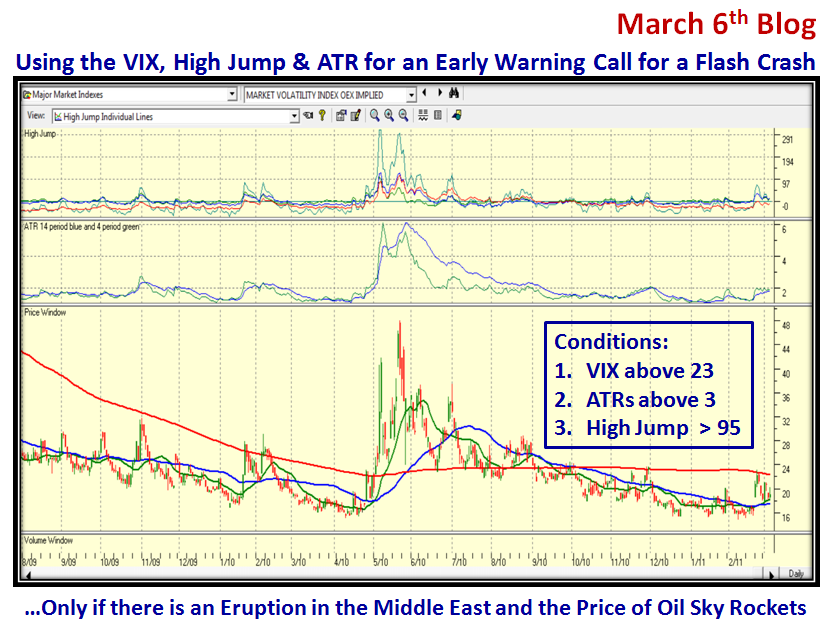

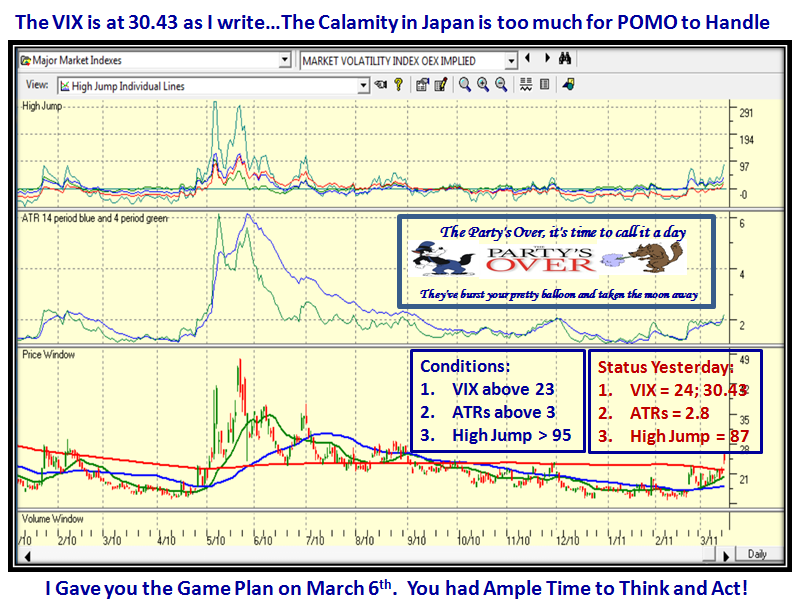

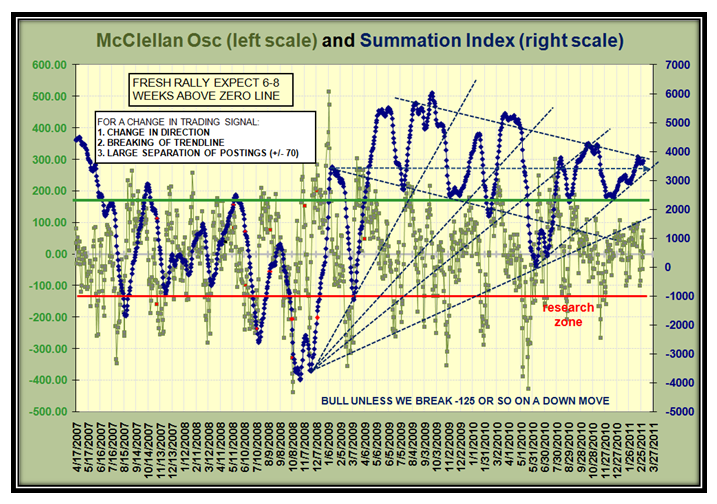

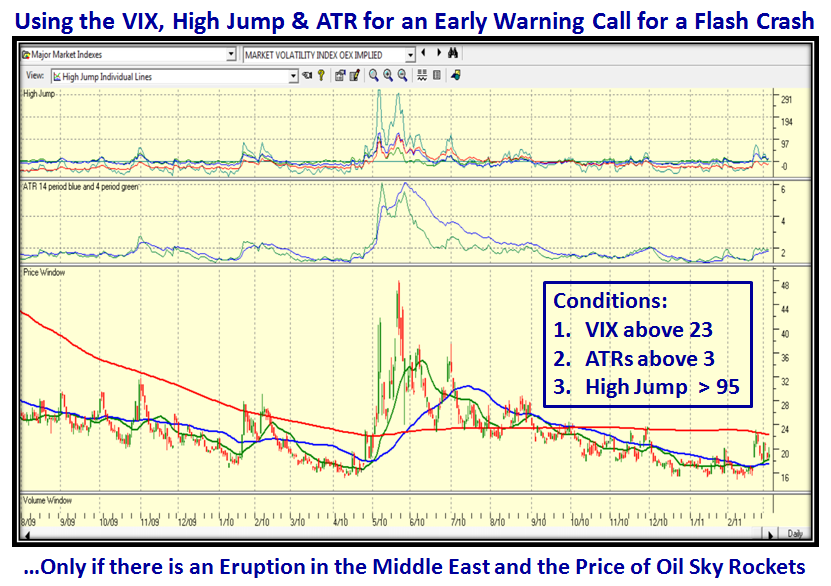

I mentioned in my last Blog that the way the Markets behaved after these terrible Calamities both in Japan and in the Middle East and particularly in Libya, would give us a great clue as to what is the Large Players Game Plan. It for sure has shown us that POMO still rules the roost in their minds and they are not yet ready to let this market die. Can you imagine in other times the VIX giving a spike up for only two days to just collapse into tranquility again. It is now well below 20, which is what is needed for a long haul rally to continue. At any rate we now have an excellent cushion as I show on this next chart, as the real resistance is above the 200-dma:

We all enjoyed an exhilarating seminar and we thank you all for your support. As you will see I have recouped from an exhausting three days of hard work and fun and have been able to collect my thoughts to give you all a Game Plan that should last you for a while. Let’s see how it plays out.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog