Stock Market: Santa Stuck Up the Chimney

Although we have been in a Yo-Yo Market these past couple of weeks, to say nothing of the months previous, we have become accustomed to what is almost a daily occurence driven entirely by news. The general short term bias is up, but my headline says it all in that Santa Claus is stuck up the Chimney:

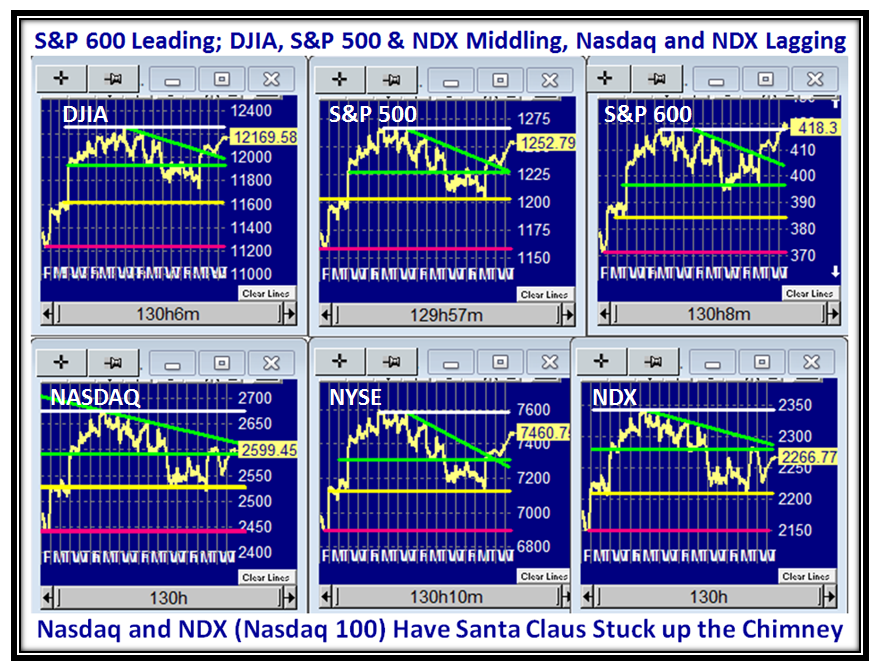

A quick Comparison of the Major Market Indexes show that the Small Cap S&P 600 is leading the charge, breaking out above the 200-dma today, with the DJIA, S&P 500 and NYSE knocking on the door, and the Nasdaq and NDX lagging:

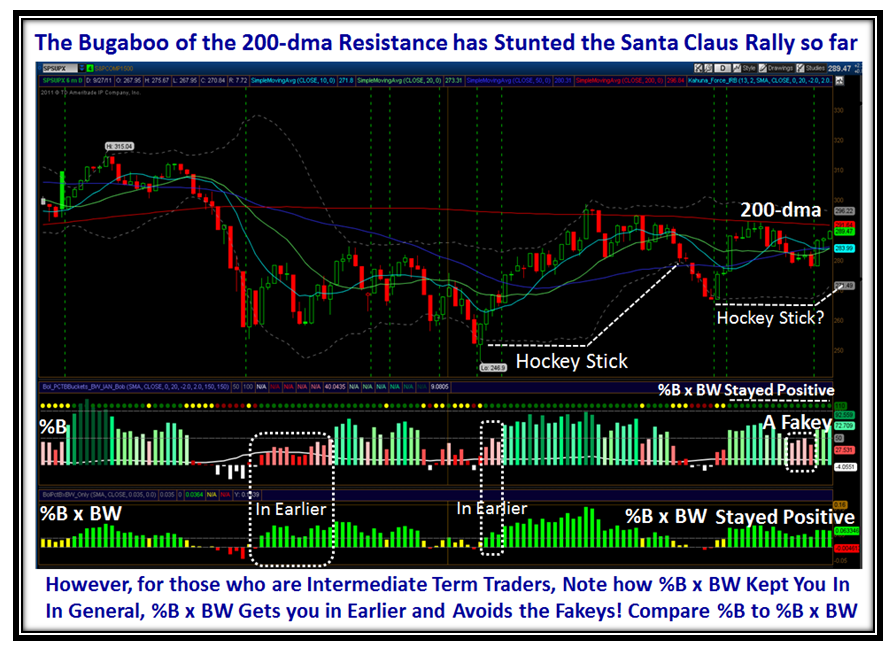

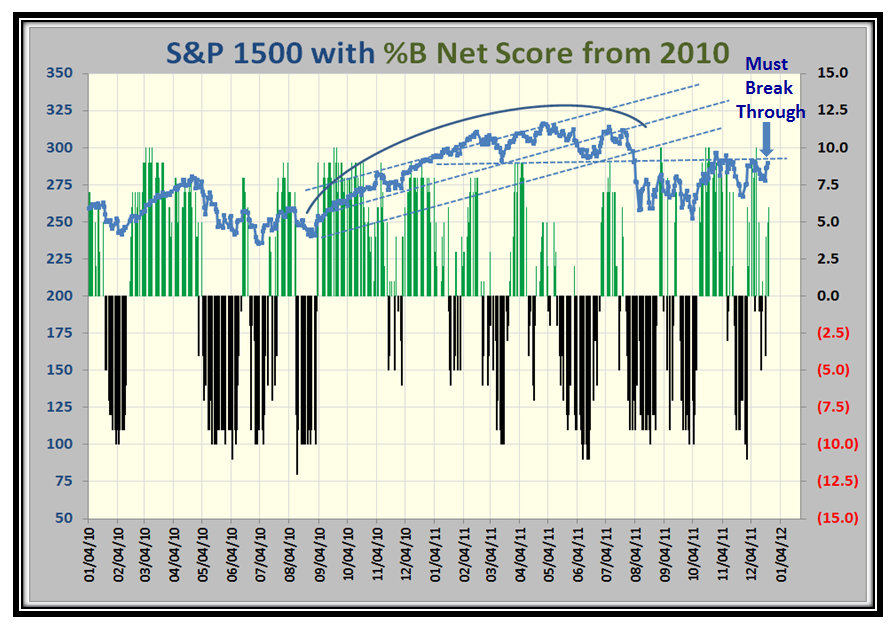

Now let’s look at the S&P 1500 comparing %B x BW versus %B, and the notes on the chart speak for themselves. It is little consolation for those who are intra-day or day traders, since they by definition are playing extremely short term moves, but for those who are driving to take advantage of Intermediate Term moves of a few weeks (at least), watching both %B and %B x BW can be very valuable in knowing when the wind is either at your back, wavering and/or swirling, or totally in your face. If you compare the two Windows carefully, you will see where you can avoid Fakeys and get an edge of acting earlier to catch the big moves up or down:

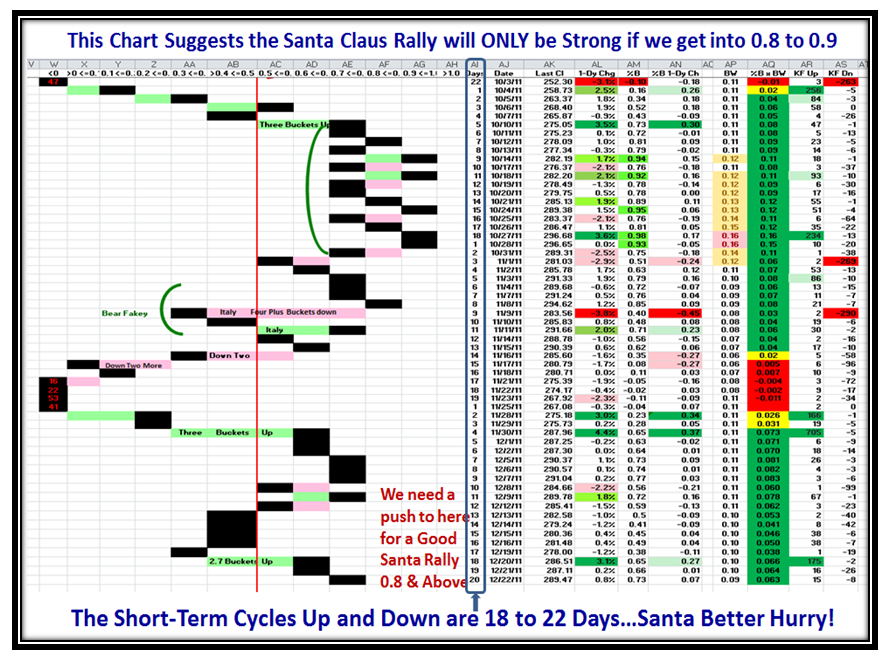

The bottom line is that we need a big push tomorrow and next week if the year end rally is to burst out, and well it may given that there is at least a short term settlement on the Capitol Hill debacle that has been a farce for the last several months. Hence the Yo-Yo market we have suffered as investors are skittish to make major commitments. Although it seems the short term cycles are down to 18 to 22 trading days both up and down, if the S&P 1500 can blow through 0.8 for %B Stocks we may have a fighting chance of a decent move above the 200-dma for most Indexes. At least that’s the “Hope” for the Bulls, and we shall see how it unfolds.

At least the % Net Score picture is brighter as it is now at 6.0, though we can immediately see the ying-yang in the market these last several weeks with a week or so of “Green”, followed by a few days of “Black” and now three days of “Green”.

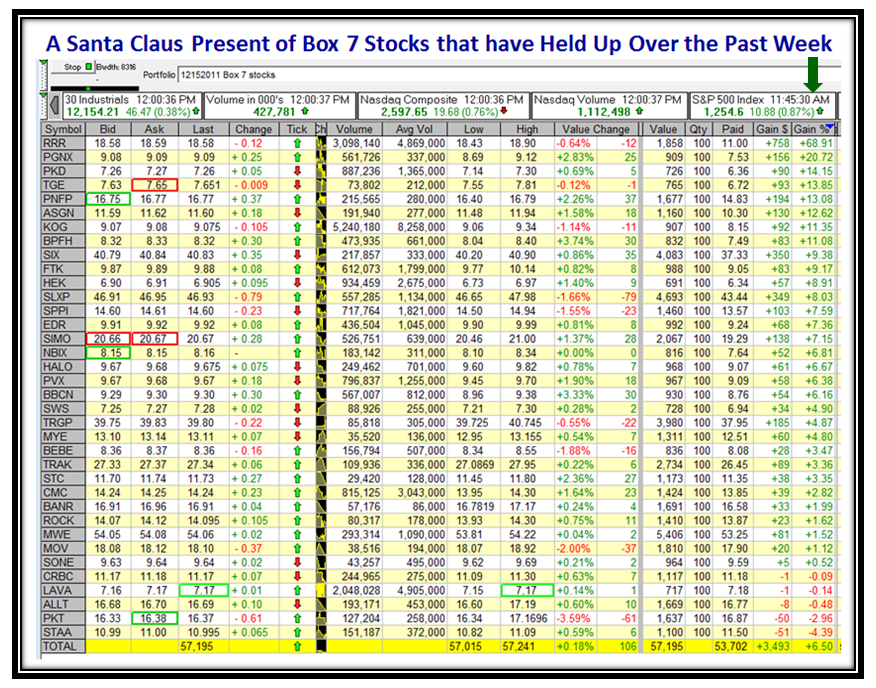

Let me wind up with a list of HGSI Box 7 stocks I captured a week ago that as a large group has delivered a 6.5% Gain and are mostly in the Green. There are gems in this list, but you are on your own to do your due diligence and see if you can ferret out the ponies for yourself. It’s my Christmas Present to you for you to do your own homework.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog