Stock Market: Bears Are Hungry!

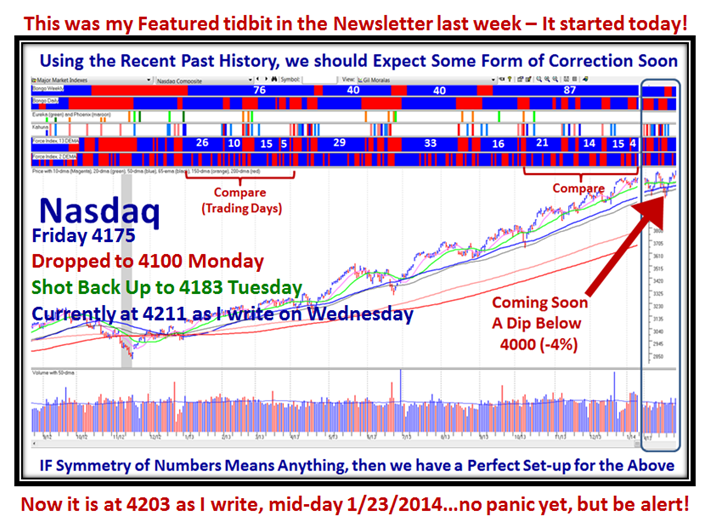

Sunday, January 26th, 2014At long last the Bears have made a meaningful penetration in the Bulls’ Rally and now we shall see whether they gain complete control or this is just another Knee Jerk. However, far more damage has been done this time so do not expect a quick bounce back as we have had before…but who knows in this crazy market?

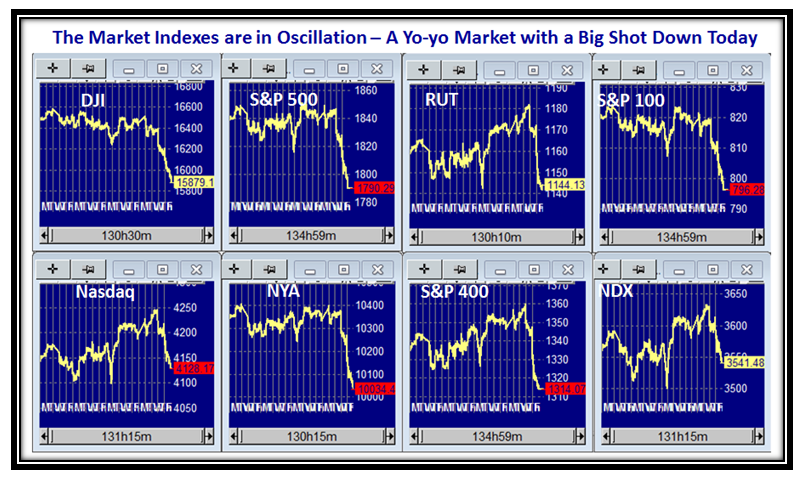

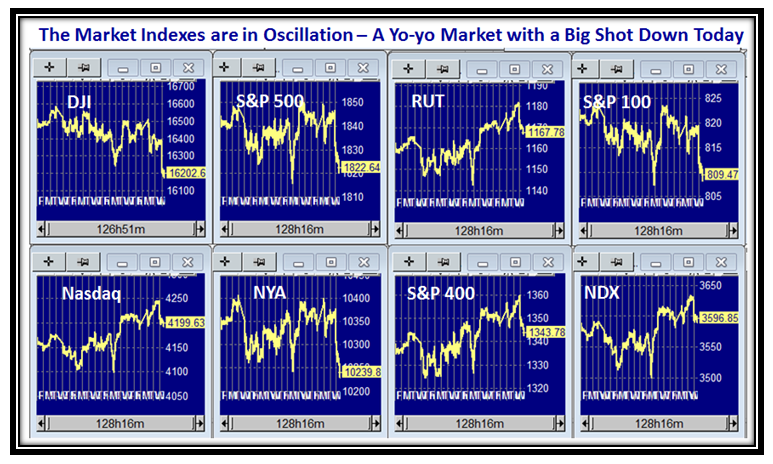

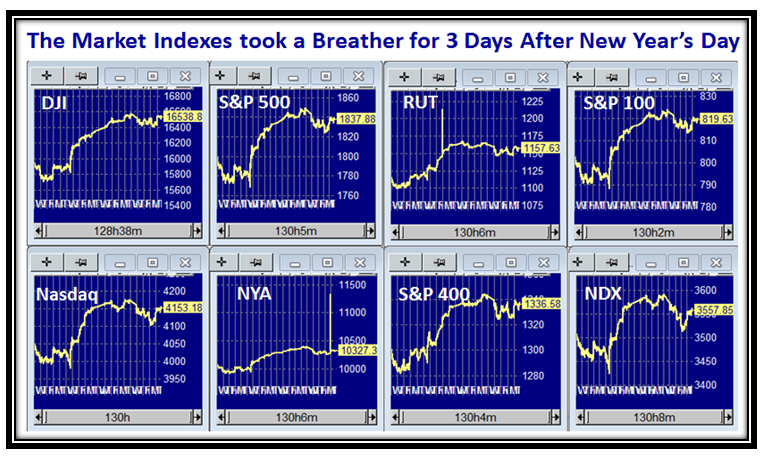

Here is the usual summary picture of the eight Market Indexes which shows the major drop in the last two days:

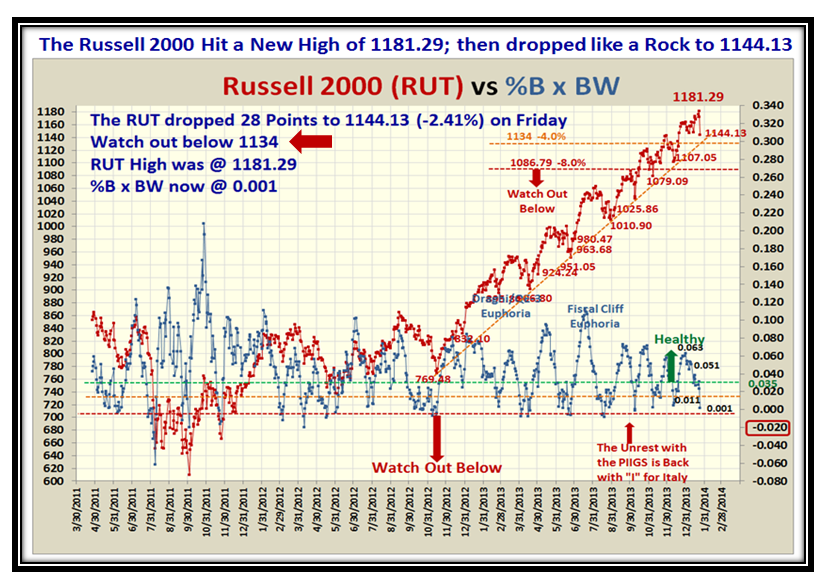

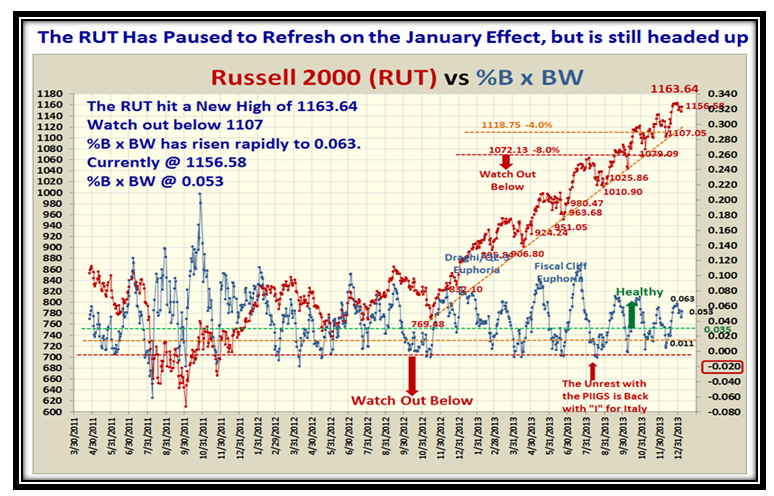

The Russell 2000 took a Major hit and is now just 10 points away from the high for a -4% Correction:

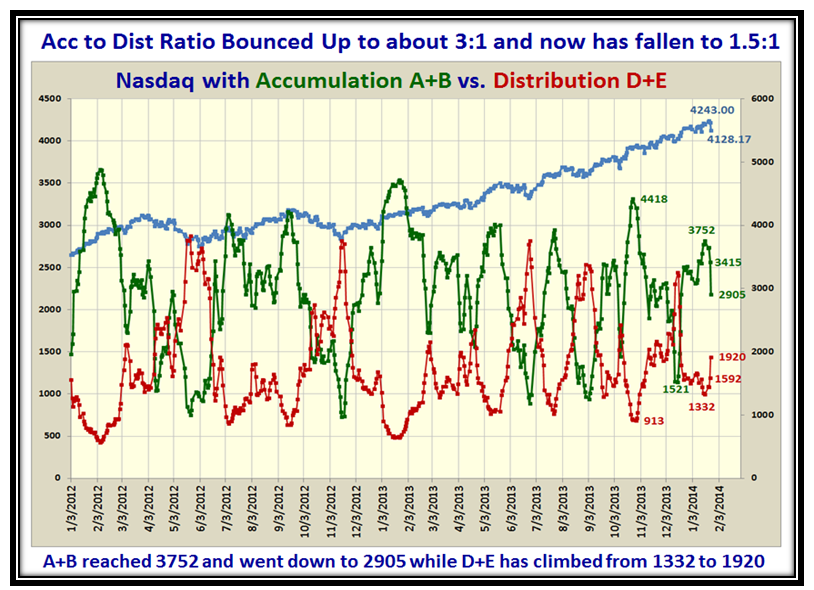

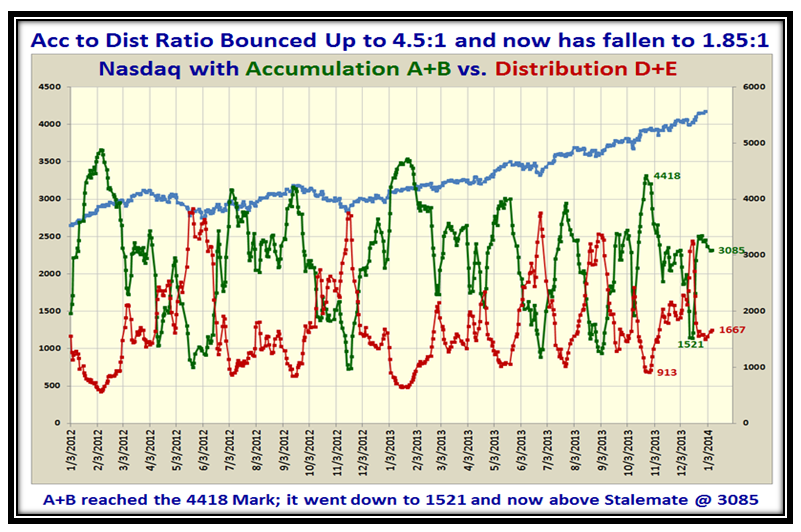

As we would expect, the Internals of the Market also took a beating as the Acc. to Dist. ratio is also down to 1.5:1

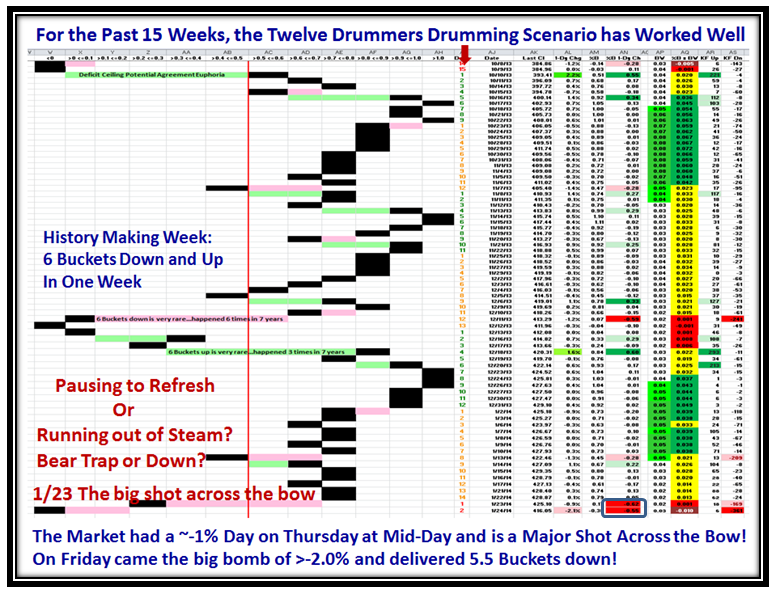

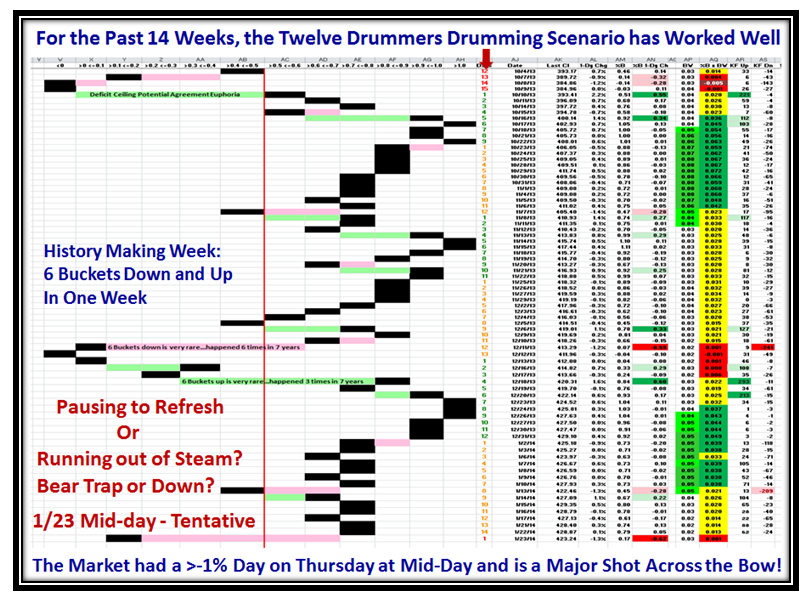

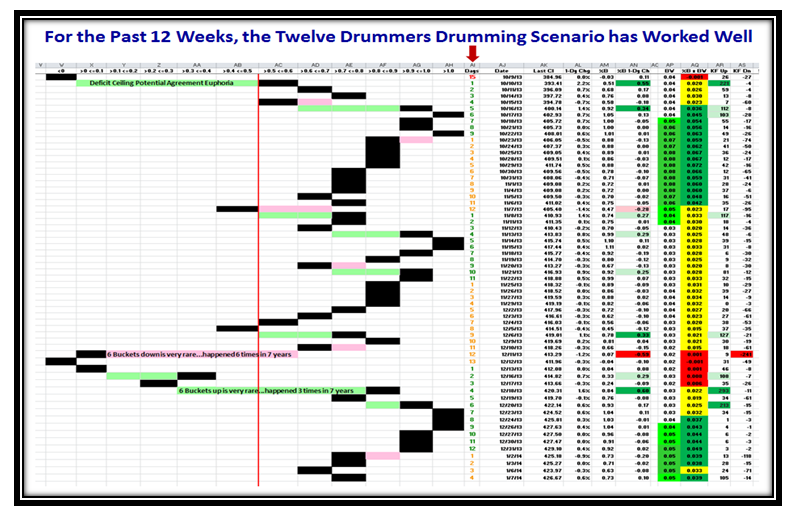

Over 11 Buckets down in %B in two days for the S&P 1500 shows the damage that has been done, so don’t expect a big snap back soon despite the market being so oversold.

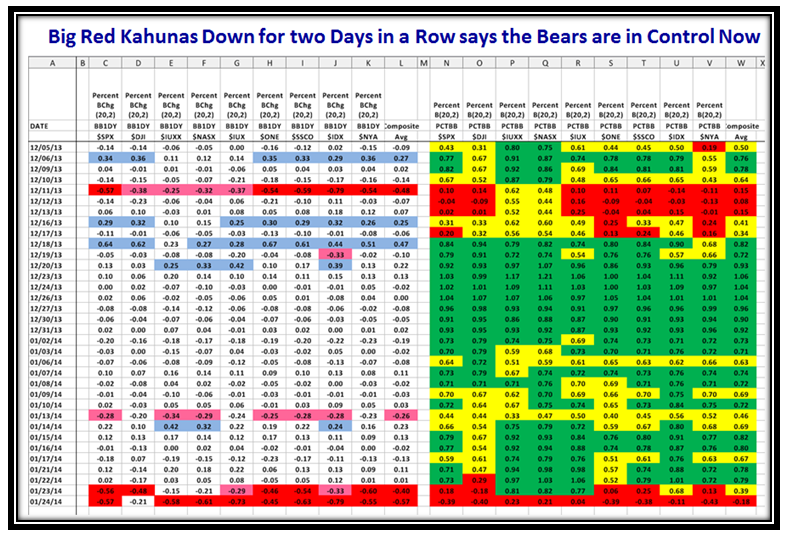

The Big Red Kahunas at the bottom of this next chart says it all, and going by past history, the Bears have control:

…And Finally, the VIX Cushion disappeared in two days so be careful:

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog