Stock Market: Q-E 3 Bubbles in the Air!

It has been a couple of weeks since I posted a blog note and I thank you for being patient, as I am sure you have constantly been reminded that this Continuation Rally is coming to an end. I also remind you that as long as his nibs, Uncle Ben, keeps printing money ala Q-E 3 and doesn’t throw a monkey wrench in the pot by announcing that interest rates are about to be raised, we will continue to be confounded. I hope you find the wait has been worthwhile as I feel I have some “good stuff” to show you in this blog note. Give me feedback, please.

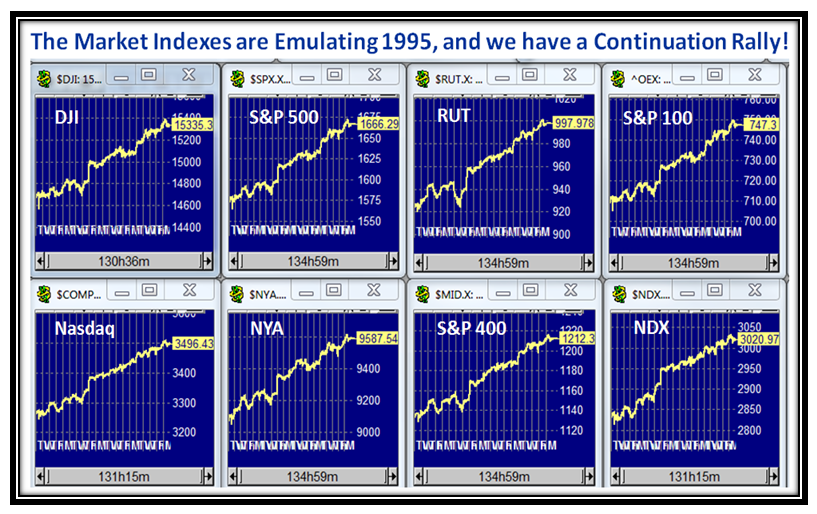

The Market Indexes are emulating 1995 when they also defied the saying “Go away in May and come back in October” , but we shall see how much longer this steady climb can continue as I see the first signs of being truly overbought and I will show you why I say that:

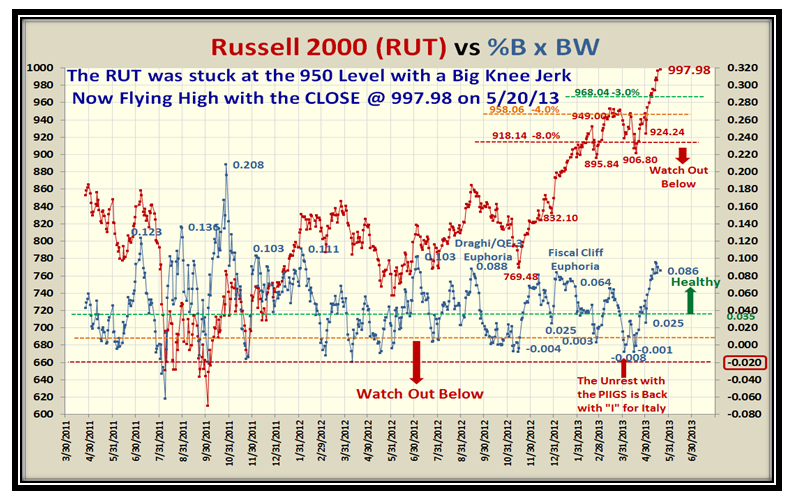

The RUT has just today broken through the 1000 Barrier so the beat goes on:

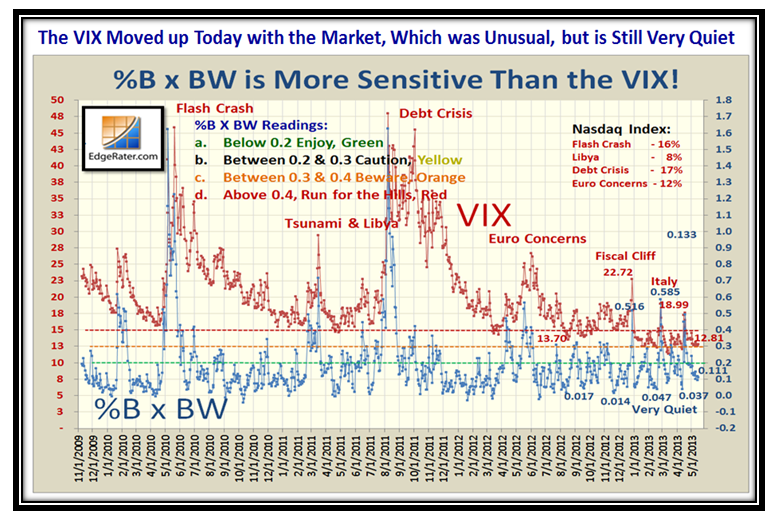

The VIX remains quiet despite bulletin board chatter that tries to turn the tea leaves for any sign of a change in Volatility:

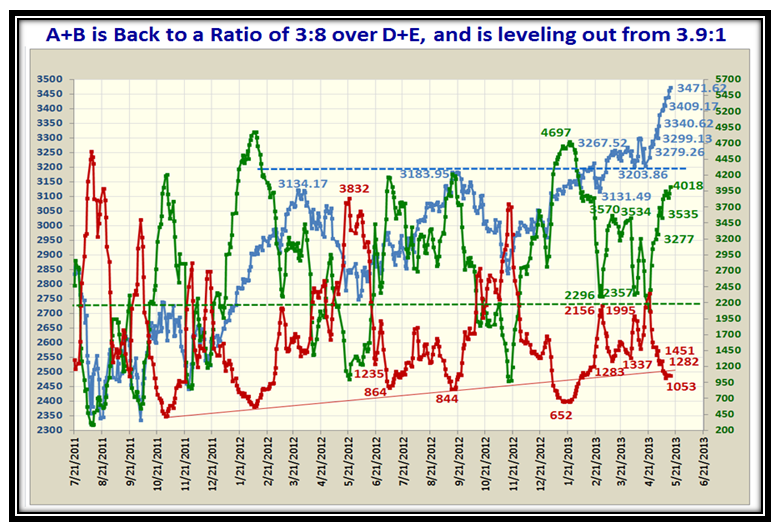

…And as we would expect the Accumulation vs. Distribution Ratio continues to improve though slowly:

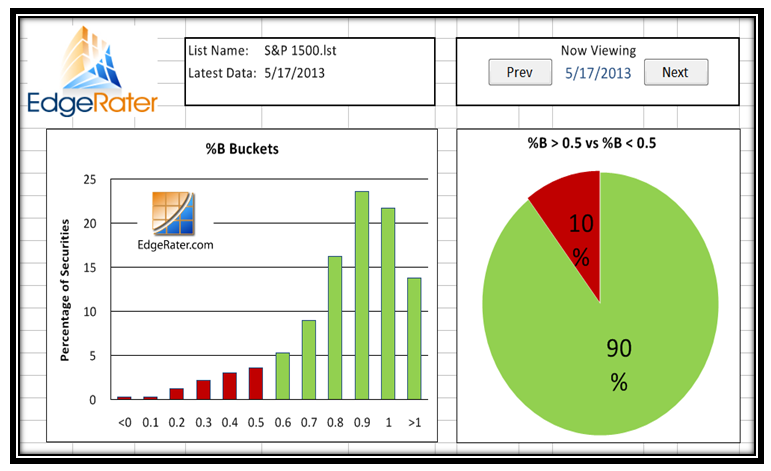

Likewise, Grandma’s Pies continue to rise to being overbought with a 90:10% ratio:

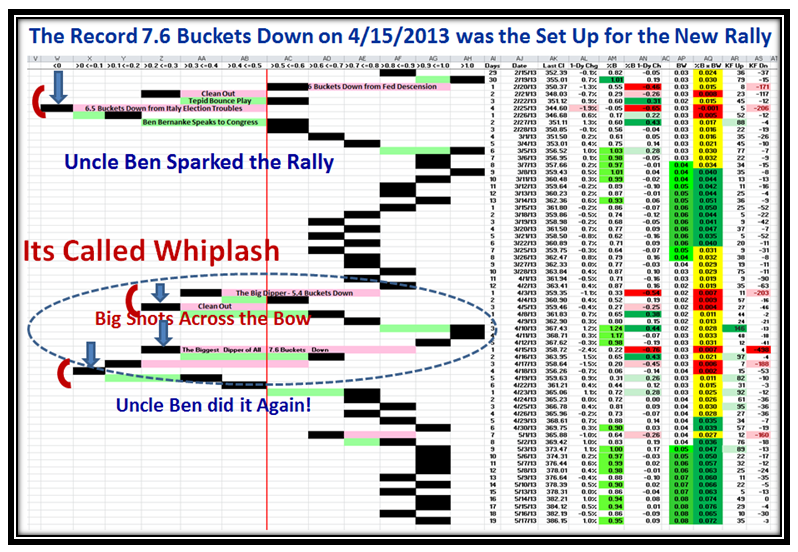

After the Whiplash where we suffered the 7.6 Buckets down in one day on April 15th, the %B is back to highs:

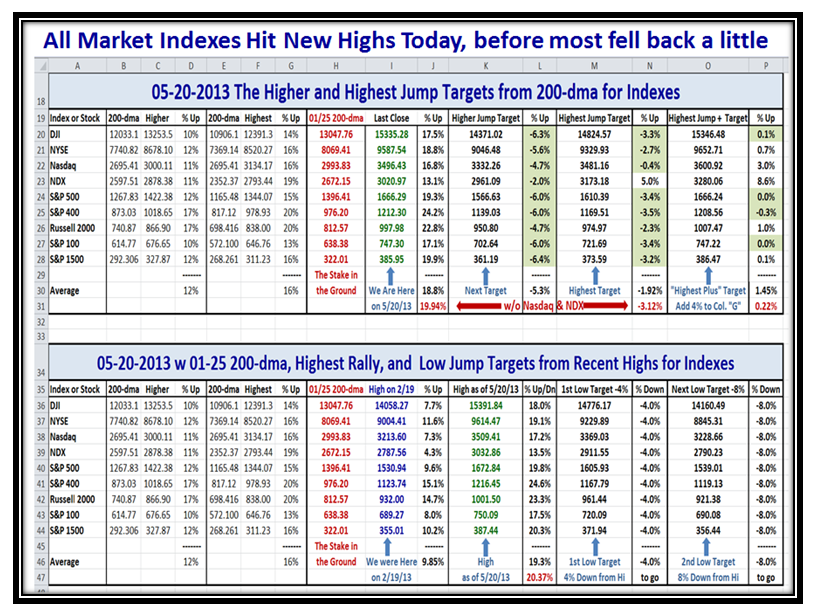

Now we are reaching for New Highs and you will be glad to see that I feel that I have broken the code for when to be really cautious based on the fresh work I have done since my last blog note, which has kept me busy to hopefully keep you on the right side of the Market.

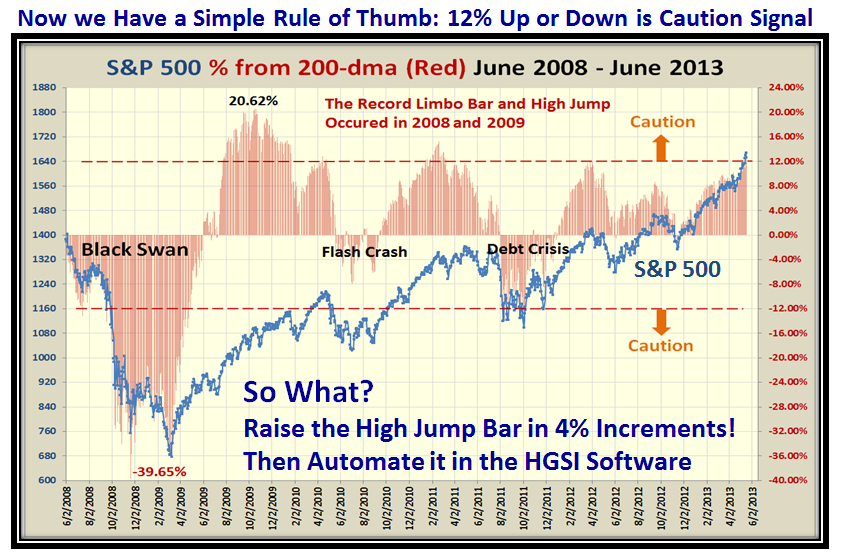

As we can quickly see we are now reaching new highs on most Indexes and that led me to a brainwave to show the relationship between the S&P 500 and the % of the Index from the 200-dma through the period from 2008 to 2013. Note how one can readily see that both on the High Jump and on the Limbo Bar (the downside) that the key point for CAUTION is when the % from the 200-dma is + or – 12%, respectively. Note that the scale on the right for the % from the 200-dma is in increments of 4% and that gives us the clue for the next three charts!

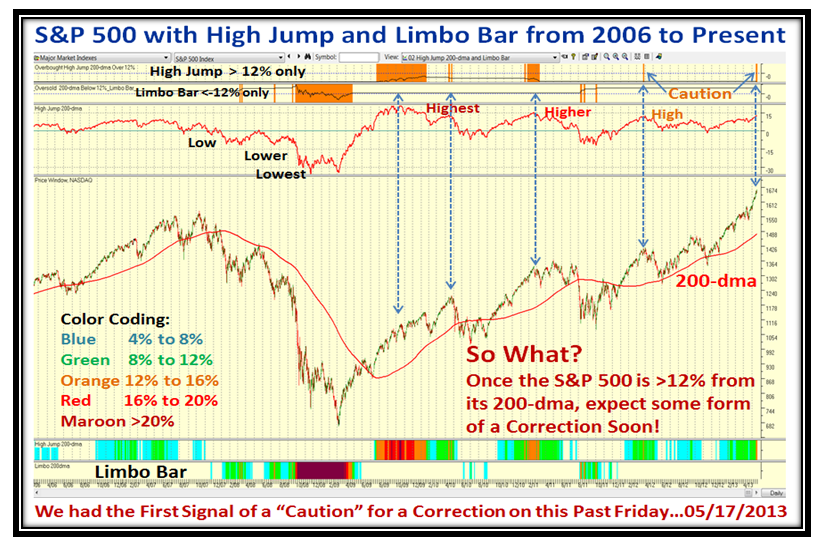

As we well know, 2009 was the year we came out of the Black Swan swoon with a brand new Rally, so it is not surprising that we stayed above 12% for several months, but since then note how few times we broke above 12% for 2011, 2012 and just this past Friday in 2013. So I say now is the time for Caution…but we need to build on this idea in the HGSI Software so that we can immediately see when we measure the degree of extension with a color coding requiring 4% increments as shown. The whole intent is to make life easier and know when to really be uptight for potential corrections. Hopefully the Blue arrows on this next chart should stiffen up your backbone that some form of correction is imminent whenever the % from the 200-dma gets above 12%. Of course, it doesn’t tell us how much the correction will be, but at least the warning is consistent.

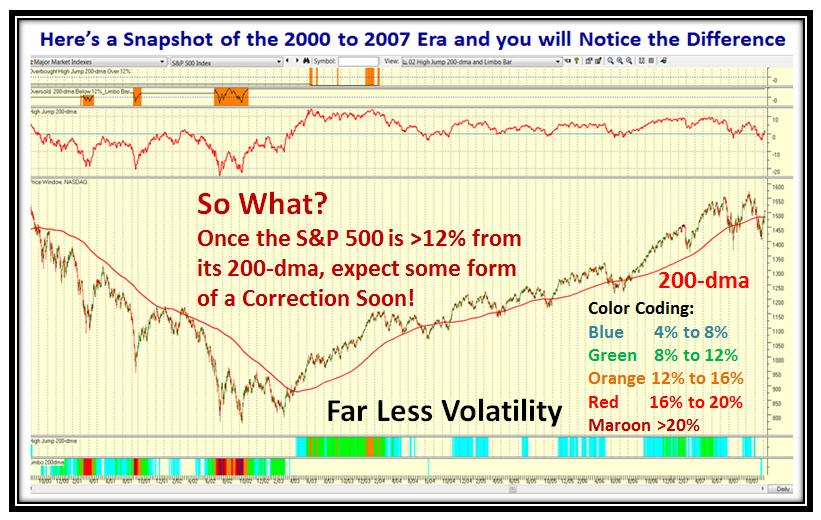

Note the color coding goes in steps of 4% and we are able to show both the High Jump and the Limbo Bar on the same chart so that we have a good feel for where the market is sitting over time. I’m sure by now you are saying “Show me what the 2000 to 2007 period looked like before I am convinced”, so here it is. The surprising conclusion is that the days of Wine and Roses back then was far less Volatile…you judge for yourself:

With this chart in the HGSI Software which will soon be incorporated we not only can look back in time with the S&P 500, but with any of the other Market Indexes and in a wink know when to be really cautious and when to play with impunity!

Enjoy, with best regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog