Stock Market: Let’s Get Ready to Rumble

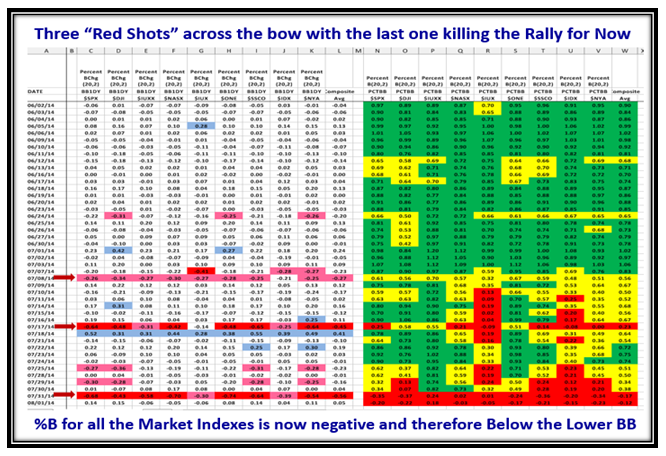

With three Major Shots across the bow in the last month and the last big one only a few days ago on Thursday 07/31/20114, we are probably in for some big fights between the Bulls and the Bears as they get ready to rumble!

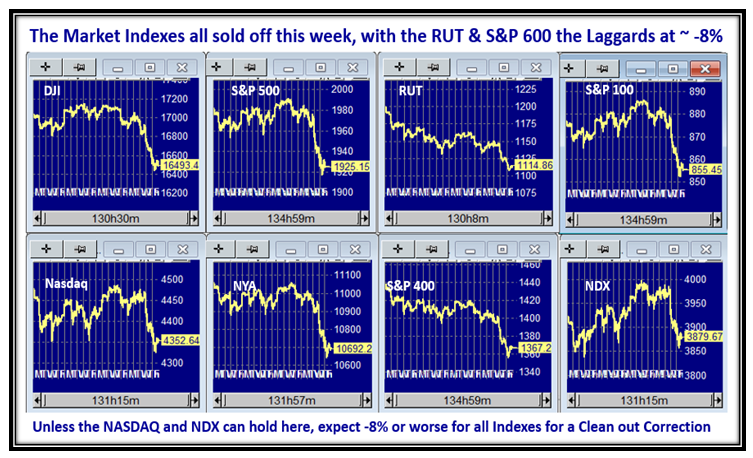

The Market Indexes sold off this past week and we are now at the Caution level with the NASDAQ & NDX holding up best of all with only 3% down from their highs. The RUT and S&P600 are worst at ~-8% down:

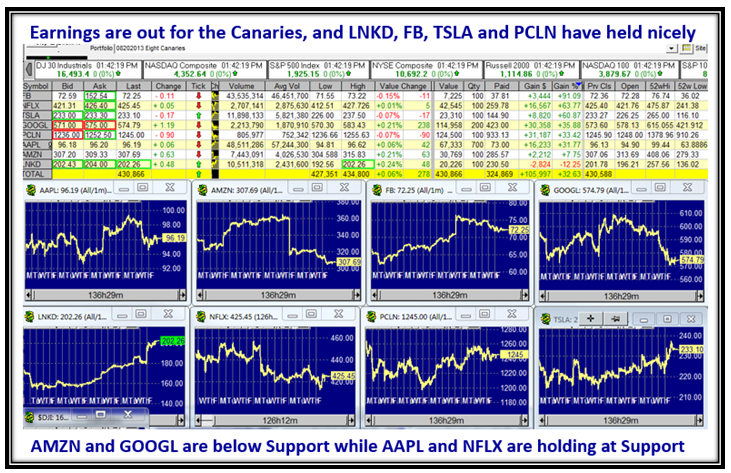

With Earnings out for the Canaries, they are looking respectable though they have given up some ground:

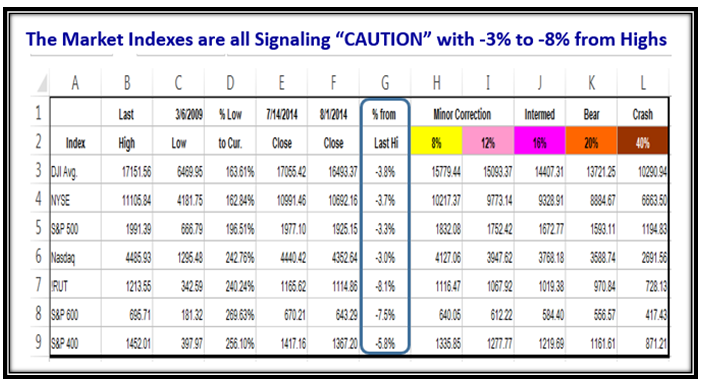

But now comes the bad news…the Market Indexes are all below -3% from their highs with the RUT and S&P600 as the laggards.

The VIX has run out of cushion and is now on the borders of going into Oscillation, so watch this carefully:

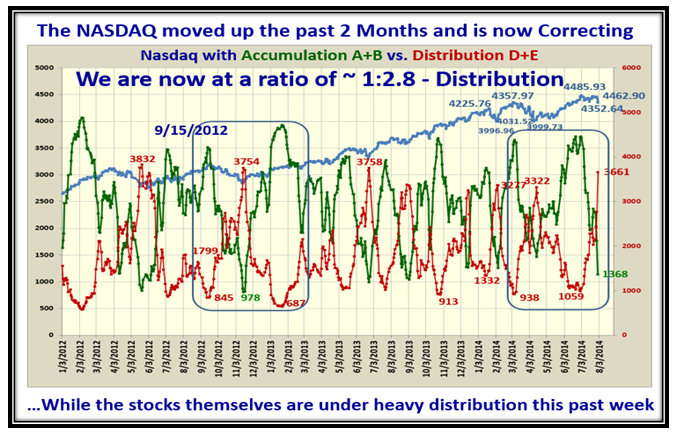

Internals are rotten with Distribution well underway. Not far from extreme capitulation so look for a bounce:

This last big red day on Thursday killed the Rally for now and it will take time to repair:

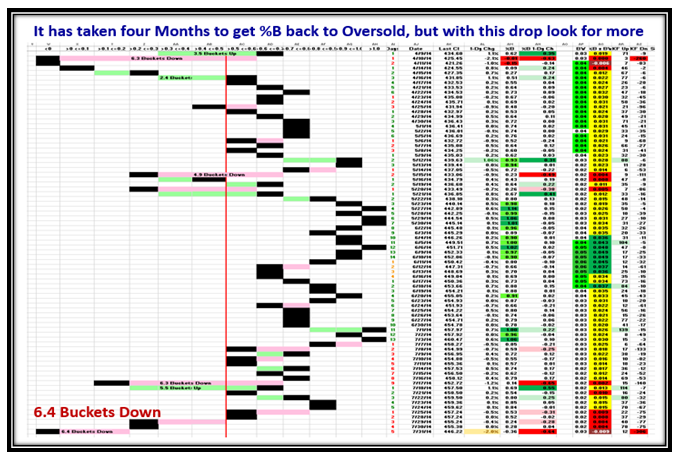

…And here is the -6.4 Buckets down in %B to prove the Market is in deep doo-doo!

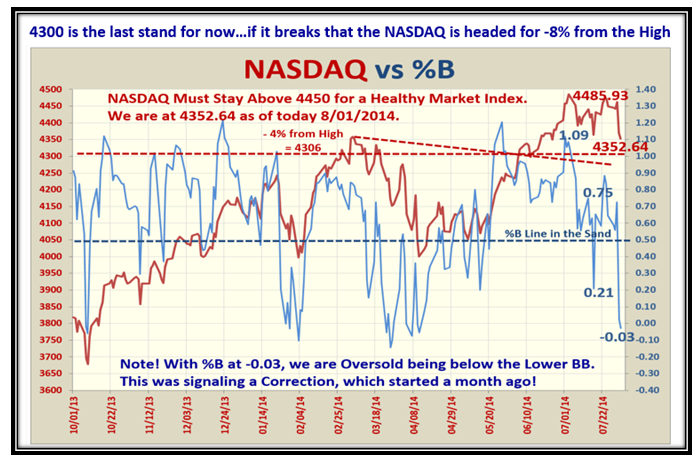

4350 was key Support for the NASDAQ and it held, which was a good sign. However the last call is 4300 otherwise we head down with a vengeance:

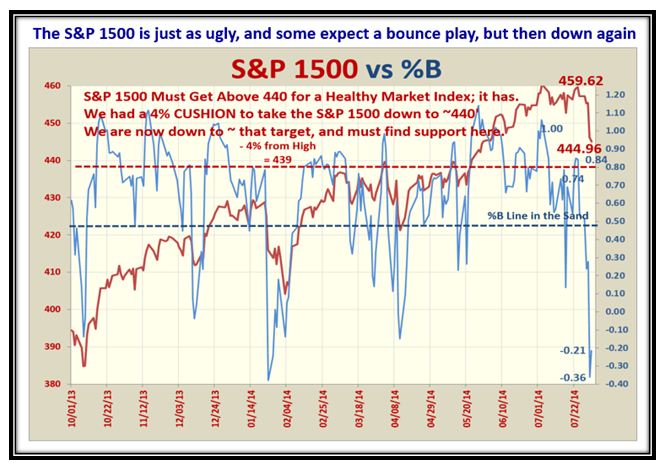

…And here is the picture for the S&P 1500. My guess is it will take a while to right itself:

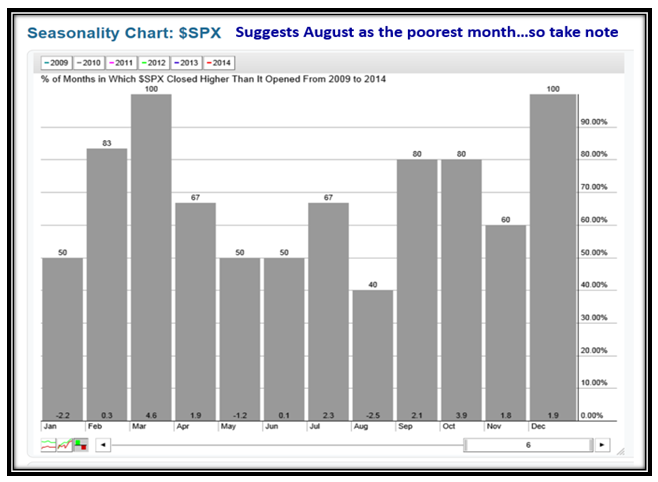

The latest vogue is “Seasonality” so here is the picture from 2009 forward for the S&P 500, which shows that August is the poorest month for these last six years:

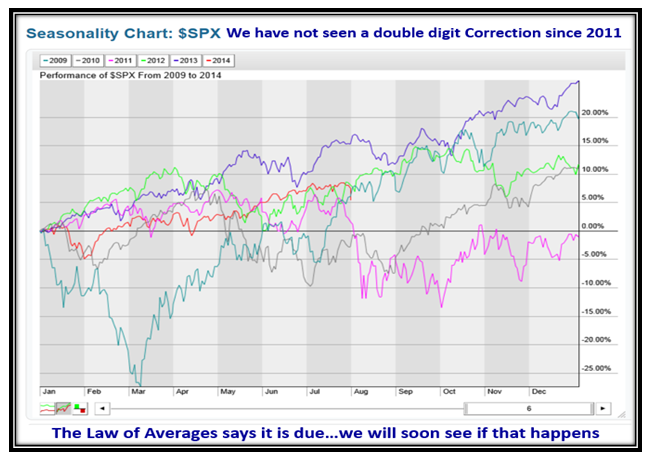

We are due for a double digit correction, since we haven’t had one these past 18 months:

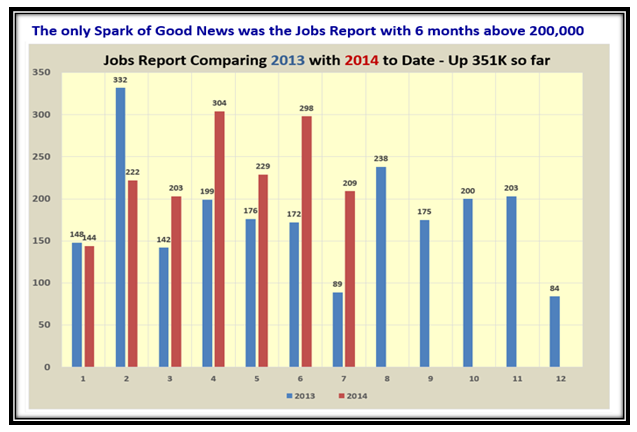

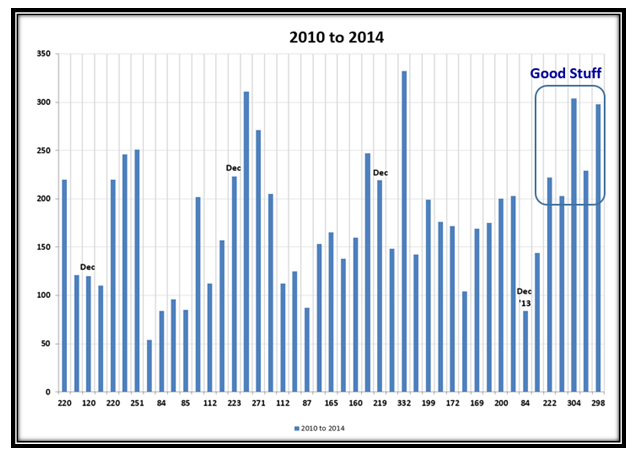

We continue to have good news on the Jobs Report scene with yet another month of >200,000 Jobs posted:

…And here is the long term picture which is very encouraging:

Well, there you have it with a long blog note this time while watching Rory McIlroy take the lead in the golf. Keep your powder dry and next week should give us a clue if we are in for more trouble or get out of being Oversold.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog