Dead Cat Bounce or an Irish Jig

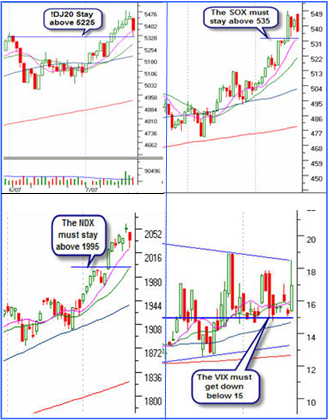

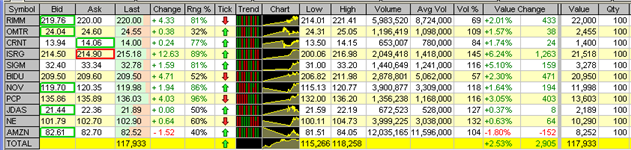

Monday, July 30th, 2007Last night I gave you eleven stocks which had recent stellar earnings reports and were bucking the trend of a down market. I called it the “Last Chance for the Last Dance.” The $64 question is whether the strong performance today of the stocks in the Index is the expected Dead Cat Bounce or an Irish Jig with this Index leading the way to new highs.

One day does not a market make, but I note that the Index is up 2.53% already, based on buying 100 shares of each stock for a total outlay of $117,102, up $2905 already. Of course the outlay can be scaled to just $10,000 for a gain of ~$291. Ten of the eleven stocks are up so this clearly shows this group is made up of leaders, with only Amazon (AMZN) taking a breather after its stellar earnings announcement. Now, let’s come back down to earth and reality. The purpose of this Case Study is to show you that there are all kinds of opportunity in the market if your timing is right and you are nimble with Strong High Growth Stocks (HGS).

Here is the lesson learned:

- When a market is badly oversold, the pendulum invariably swings the other way

- When Earnings Reports are out, look for those that have reported stellar earnings

- If you are a very short term trader, select a basket and be at the ready for the next day

- Wait for how the market reacts the next day and then decide whether to take the basket or selected stocks from that basket depending on their behavior and the Market.

- If the Market goes up, you will invariably be on a winning trade. Now you are in the driver’s seat and can play for short or longer term gains.

- Recall I said the purpose of this select list was to determine when the Party might be over

- So the tactics must be to look only for short term gains and play close to the exits

- At some point these OVERBOUGHT glamorous stocks will be too fat with profits that they become a target for a correction.

- The best way to measure that point is to use the High Jump Indicator…another proprietary HGSI Indicator. It is the sum of the 17-dma, 50-dma and 200-dma from the Stock Price.

- So play close to the exits and you will do an Irish Jig with the money you make

We will know if this was a Dead Cat Bounce for the Last Dance or if the Market has had a minor perturbation like the week of Feb 27, 2007 in the fullness of time. Nobody knows how the cards will play out, but if “You know when to hold them and when to fold them” you will be a winner.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog