Inch by Inch Market Indexes Climb to New Highs

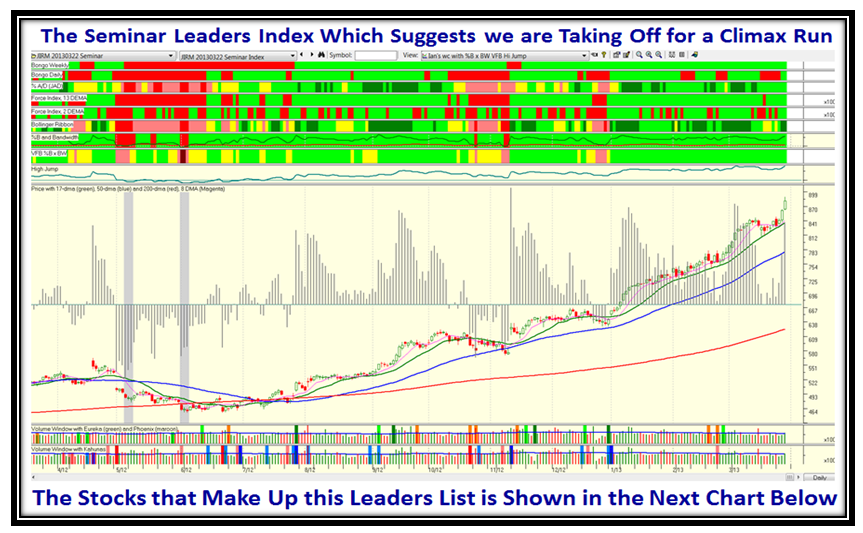

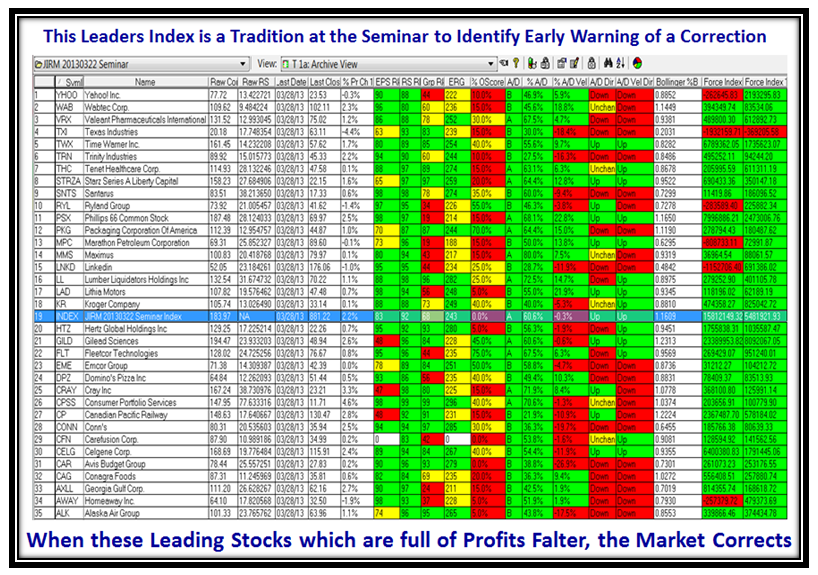

Sunday, March 31st, 2013Thank you for your patience as I took a well deserved “Pause to Refresh” after an invigorating 3-Day Seminar last weekend. I will give you a couple of bonus snapshots to enjoy of the Leaders Index we always develop at such events.

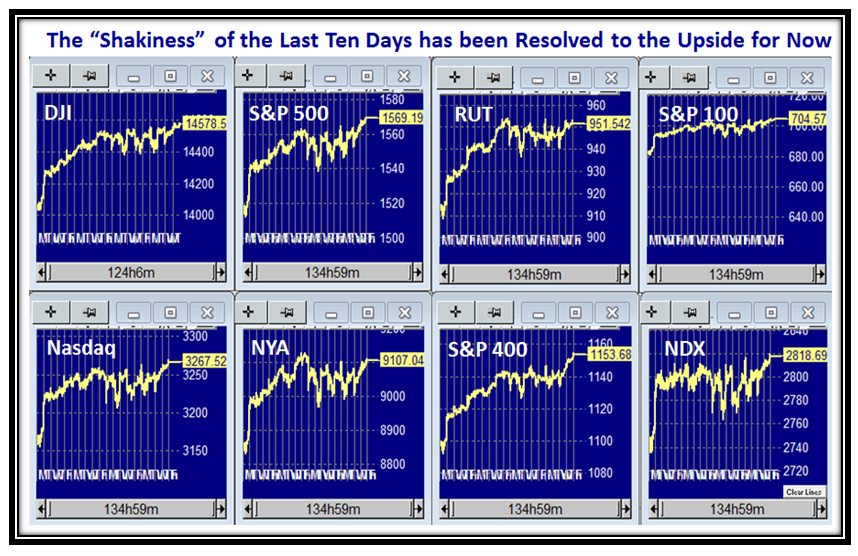

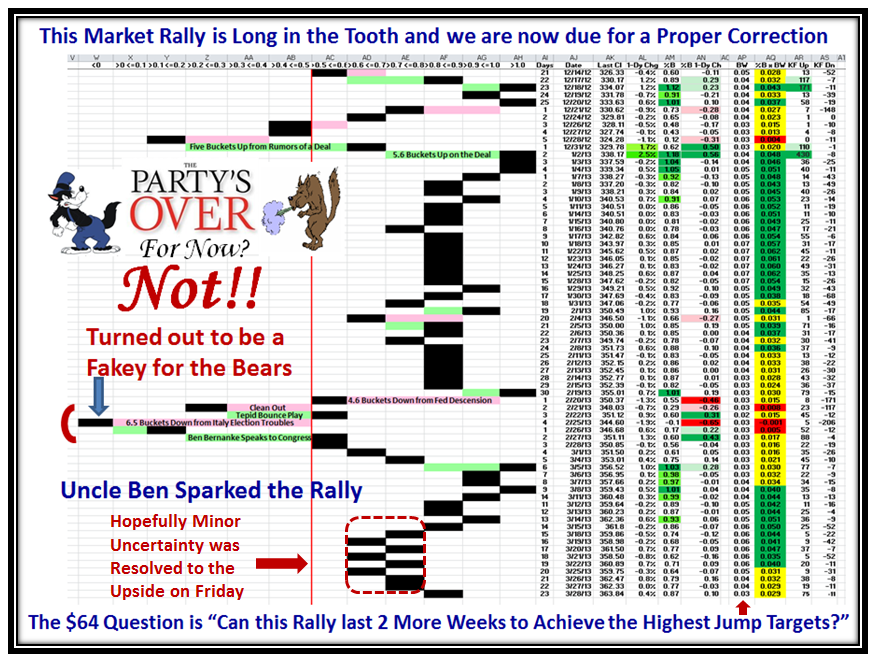

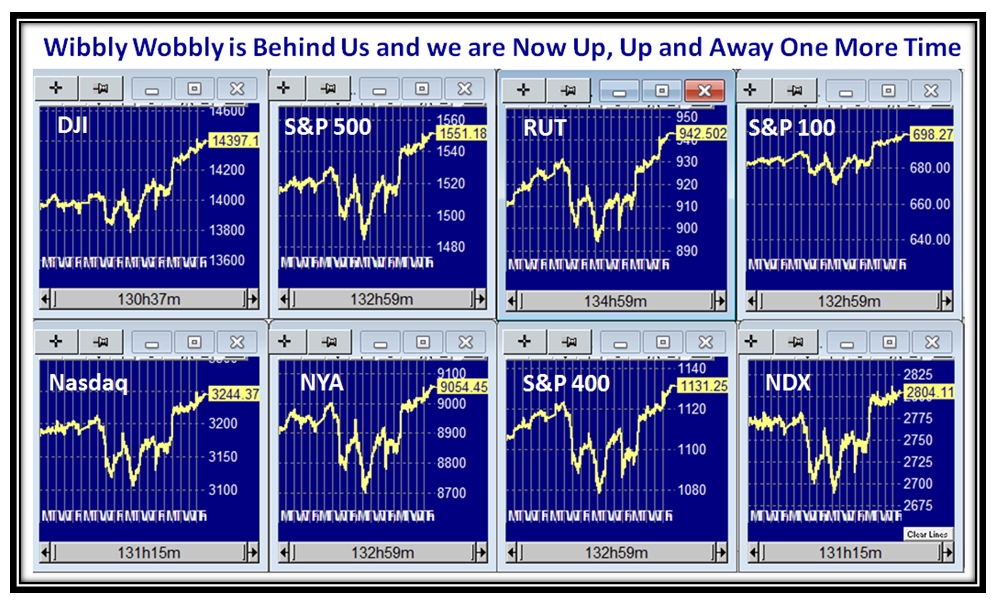

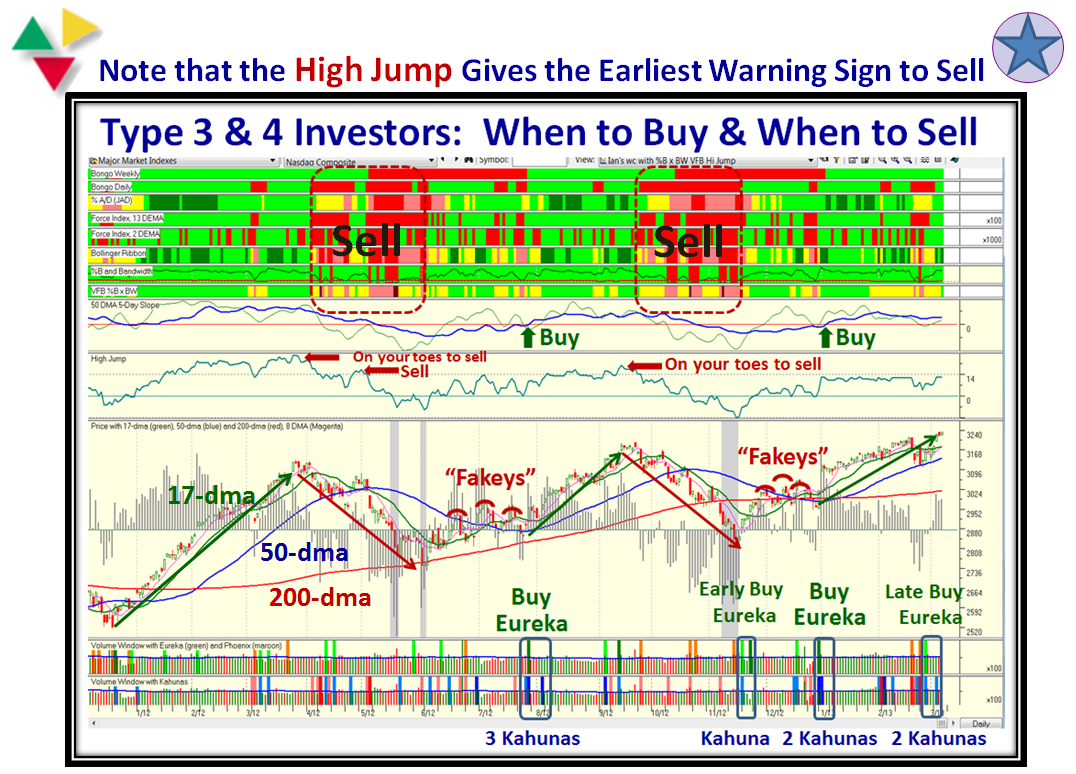

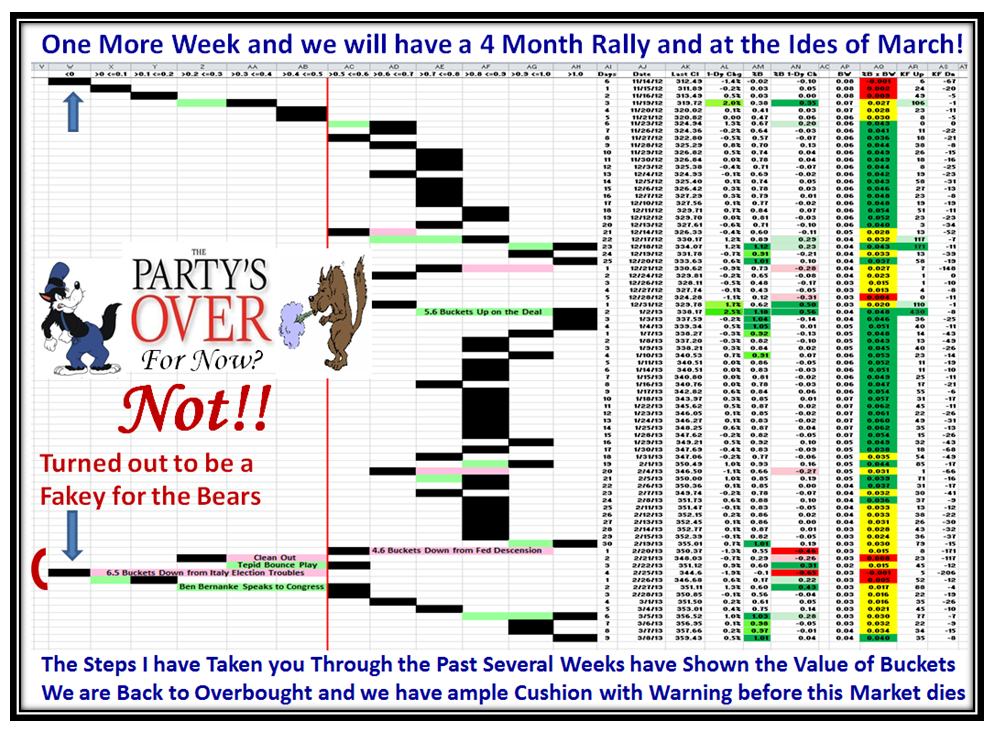

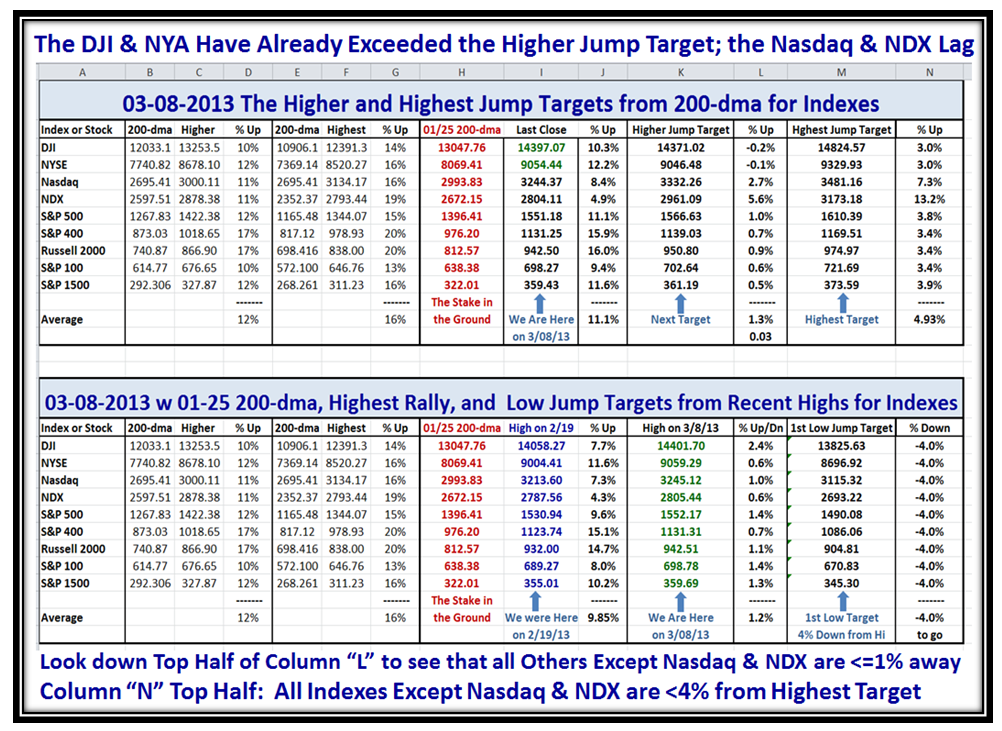

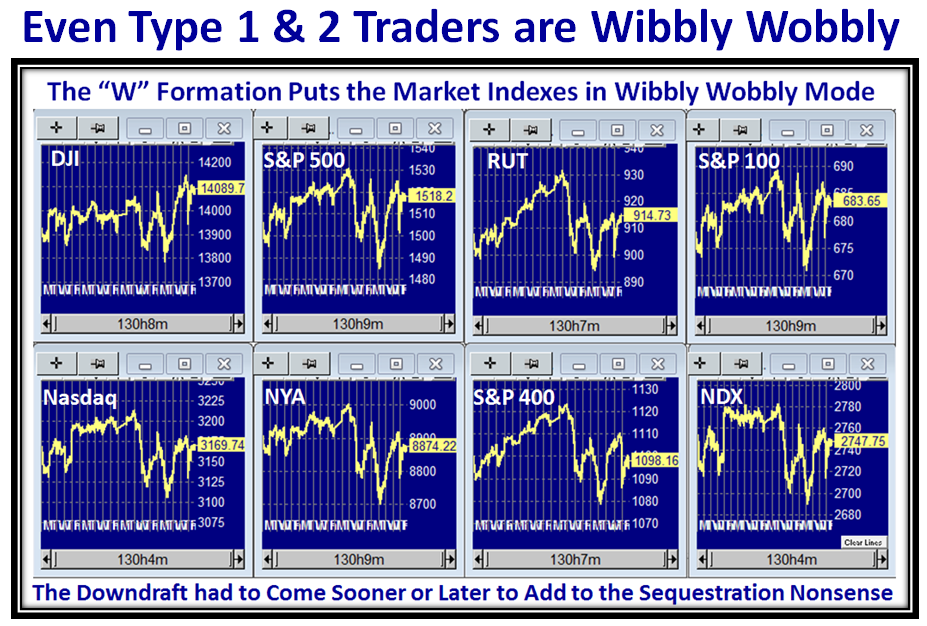

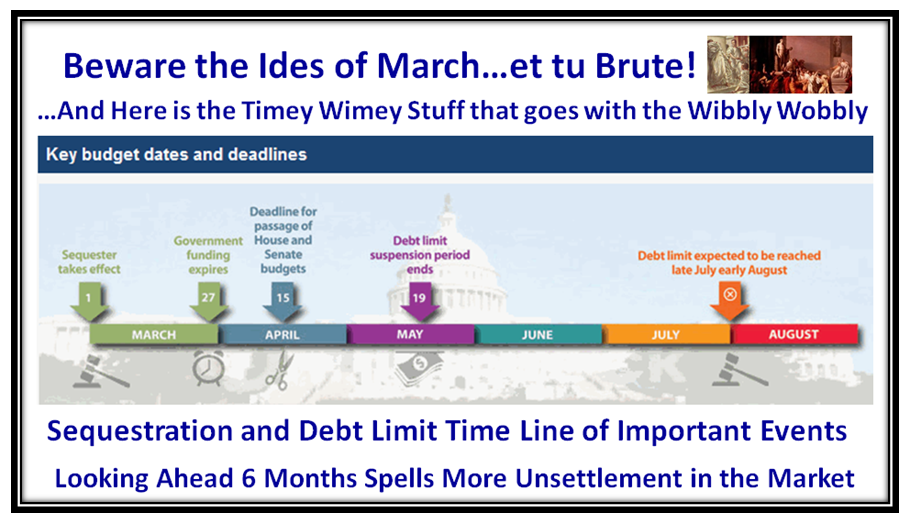

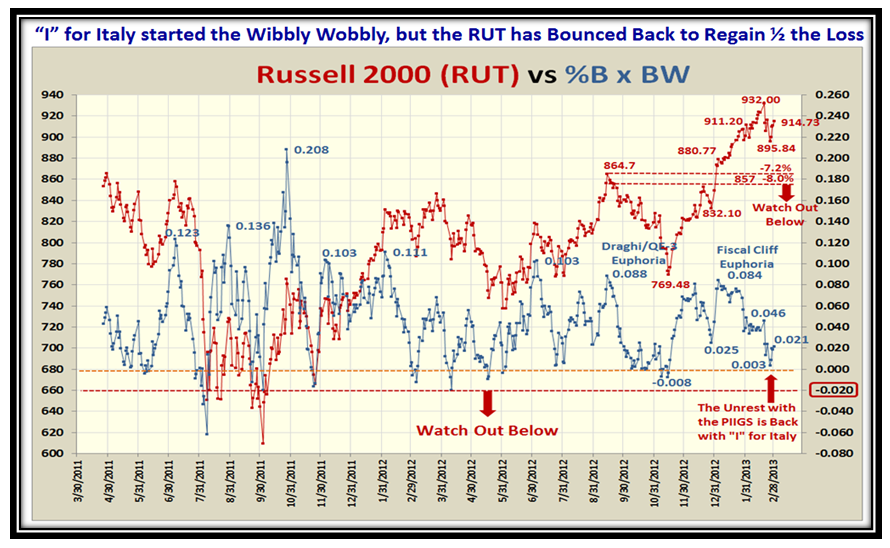

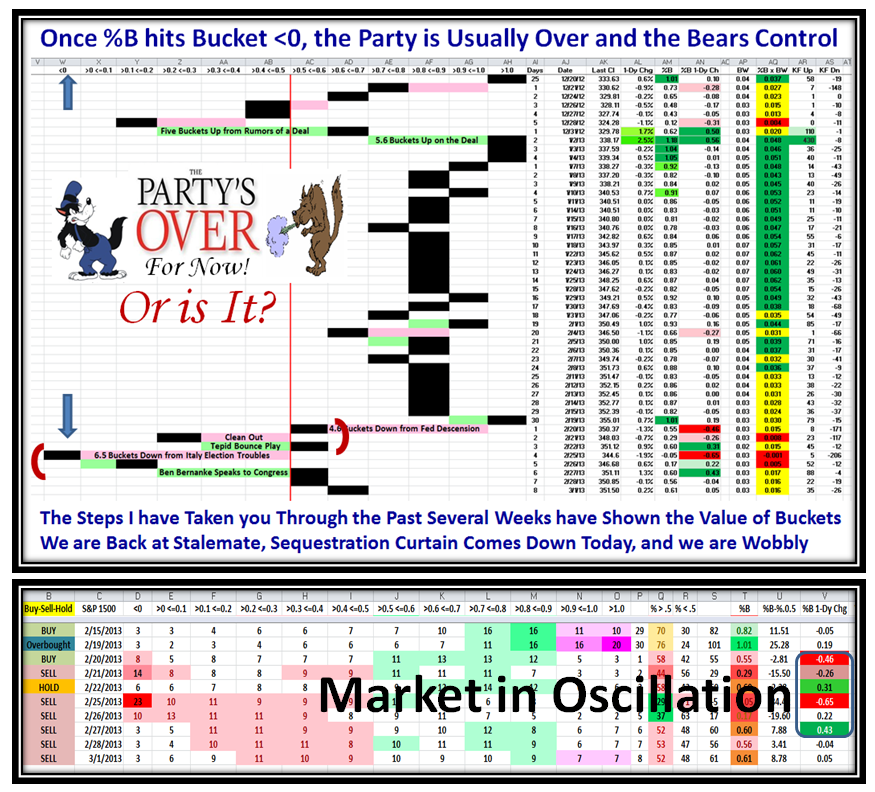

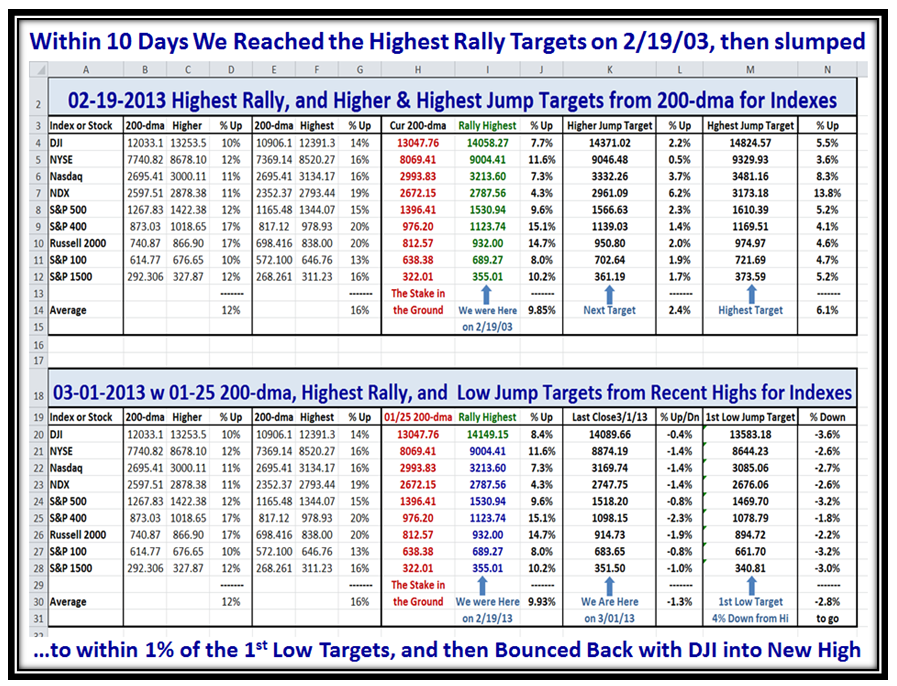

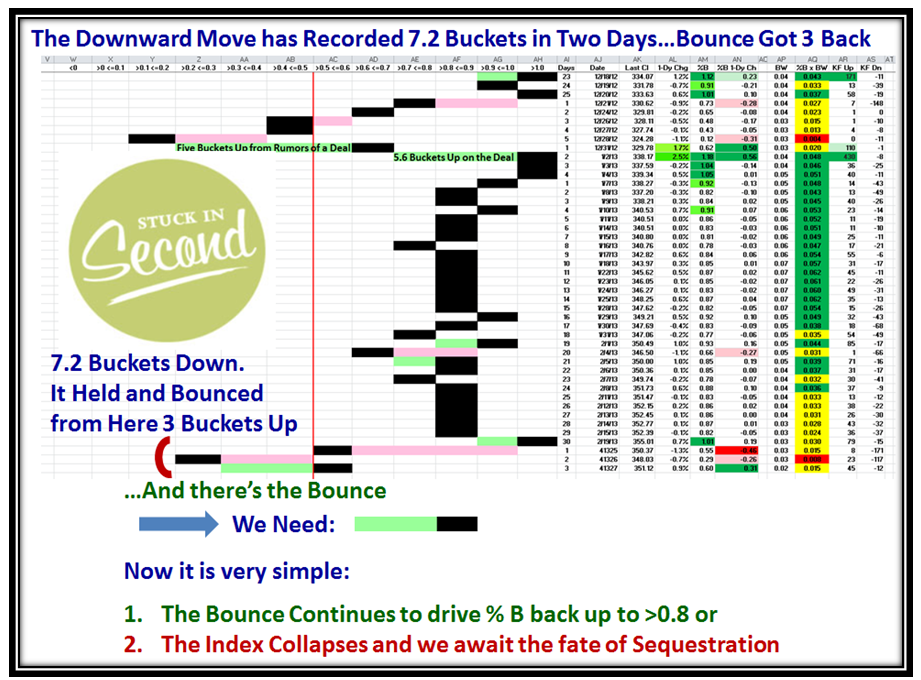

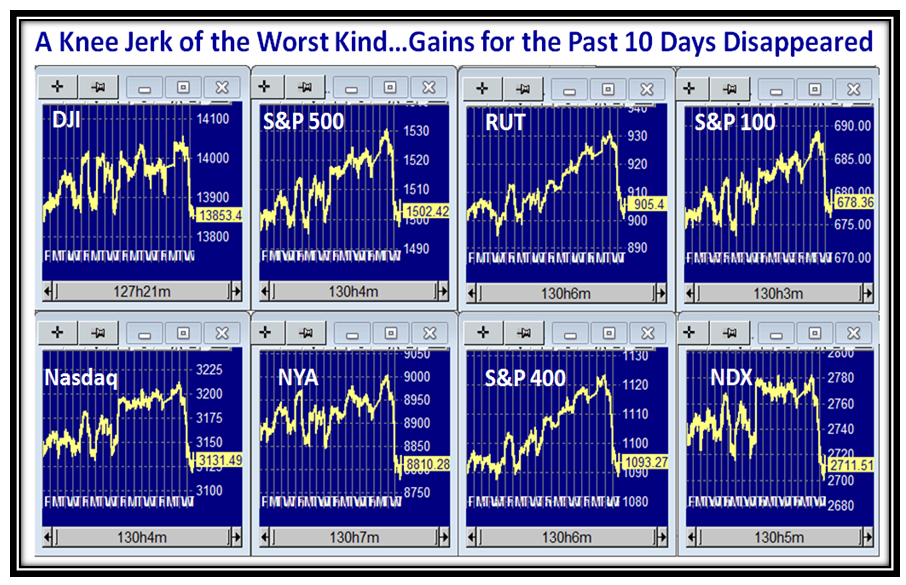

It’s unfortunate that the Market Indexes are still showing the “Wibbly Wobbly” phenomenon of a few weeks ago, but not to the same degree. Of late it has been a one day up and the next day down affair with no serious spikes down. To say that this Rally is long in the tooth is hardly an exageration, but hopefully we will eke out a couple of weeks more to the upside to achieve the Highest Jump Targets for the Market Indexes, except for the laggards…the Nasdaq & NDX:

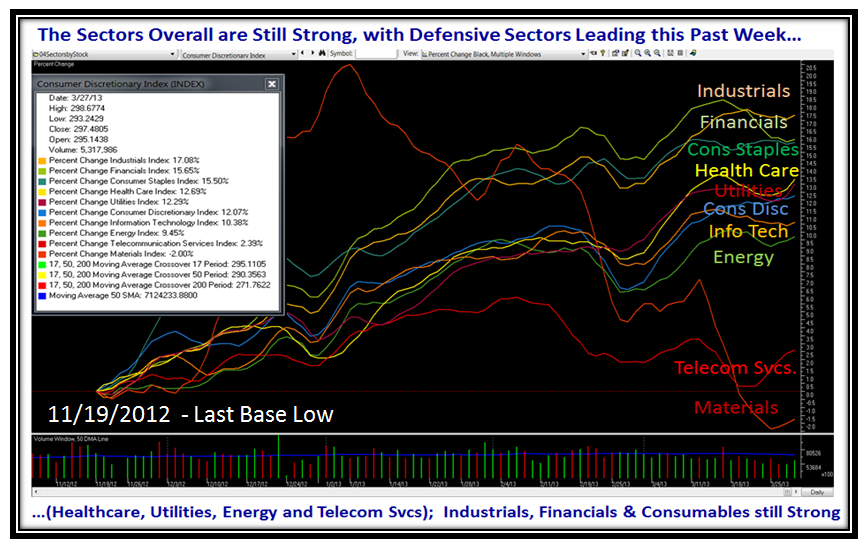

The Market Sectors are still holding up, with a very recent perceptible shift to Defensive Sectors as shown on the next chart. Materials have been totally trashed, but Telecom Services which was the laggard has shown signs of life especially with VZ and T showing progress:

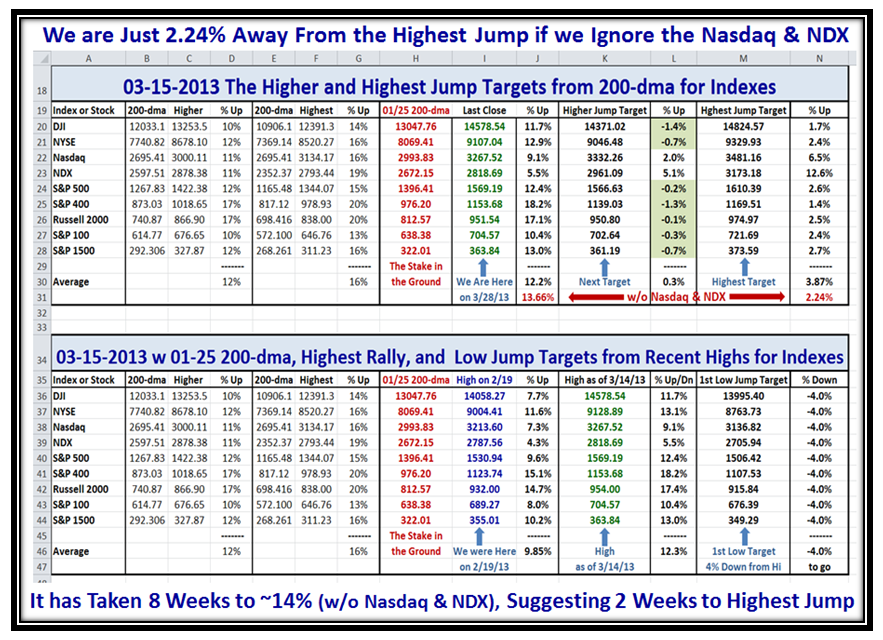

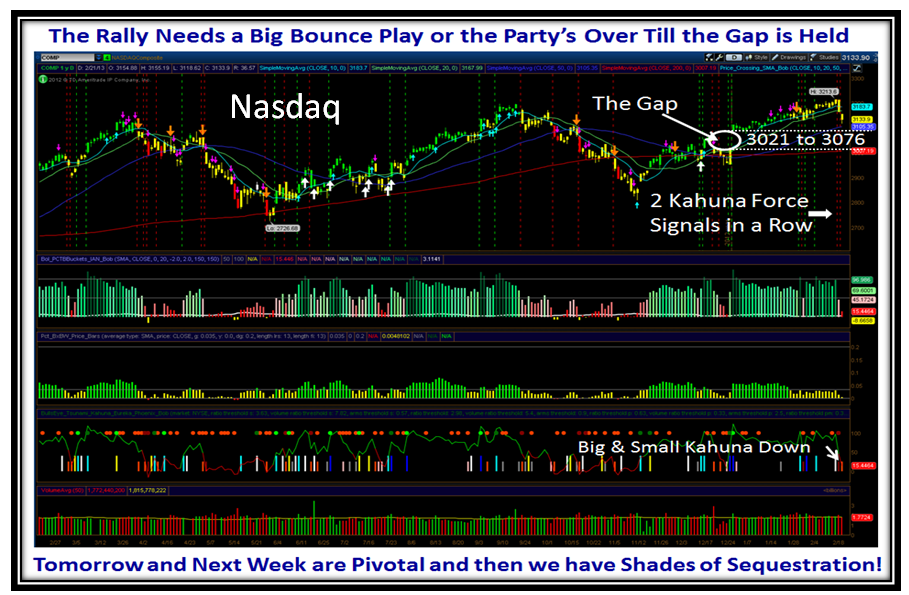

The Nasdaq has shown signs of new life as it has poked its head out of a tight 14 Day Base, but there is no conviction with volume remaining very placid. If this is to be the last hoorah for the Market we need a burst of enthusiasm by the Bulls in the form of a Kahuna as hopefully in the next two weeks the Leading Market Indexes reach their Highest Jump Targets which on Average is only 2.24% away discounting the NASDAQ and the NDX. However, for there to be irrational exuberance we now need to see the likes of AAPL and GOOG burst upwards with some sparkle. More on this when we review the Spreadsheet of the Higher and Highest Jump Targets, a few charts down:

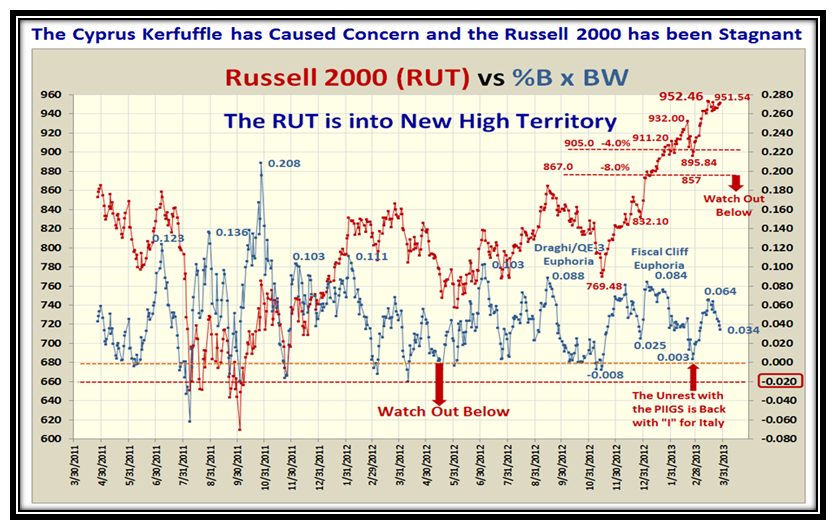

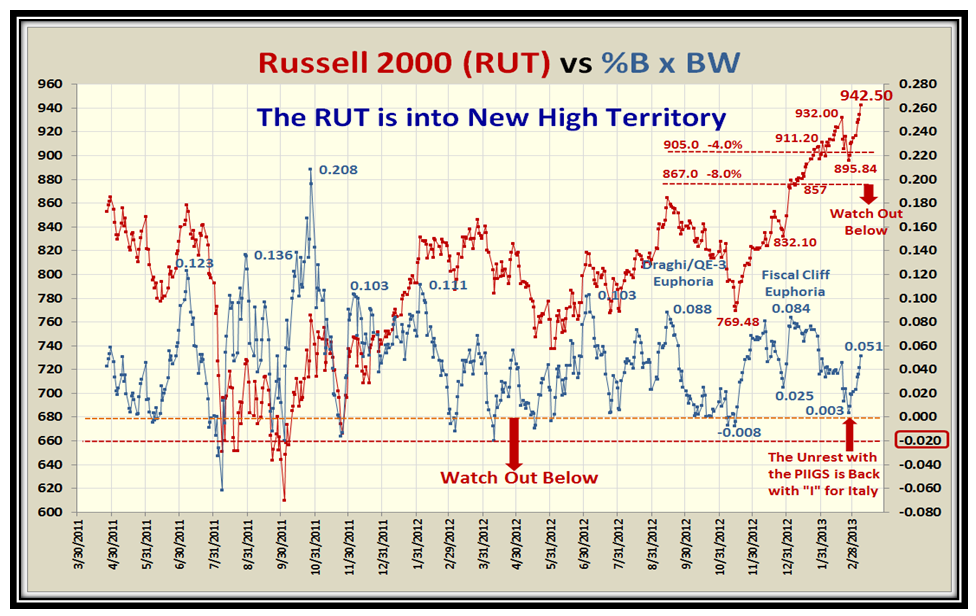

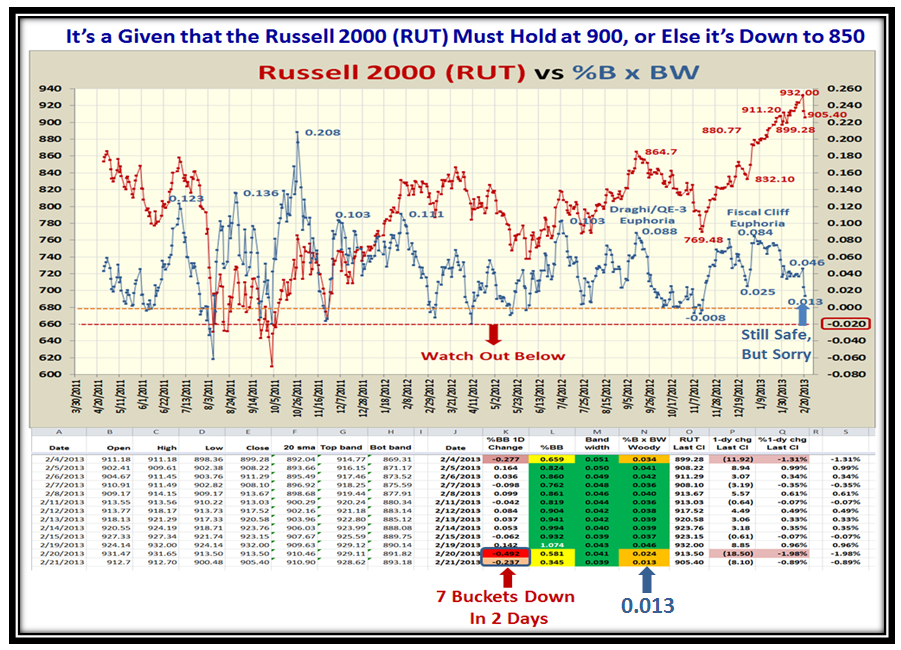

The Russell 2000 essentially took a breather this past week which was a result of the Cyprus Banking kerfuffle, but hopefully will plough through to New Highs this week, to catch up to the lead by the Mid Cap S&P 400:

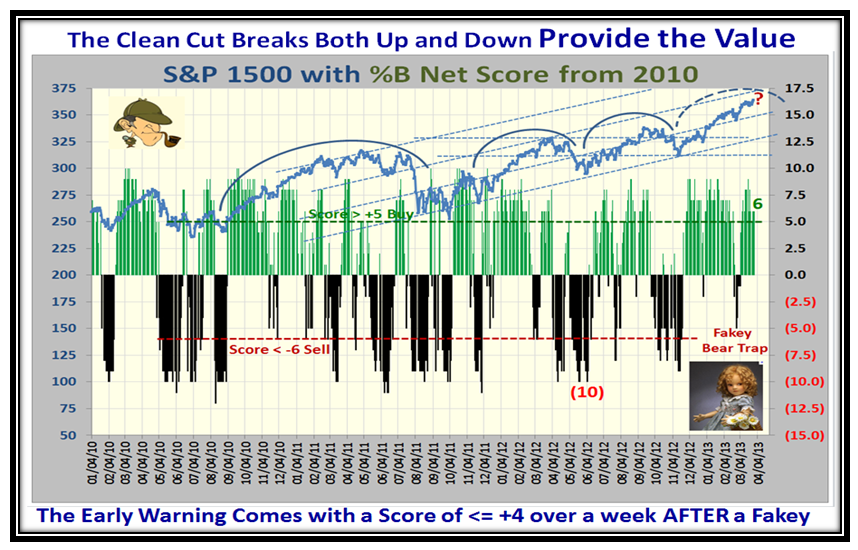

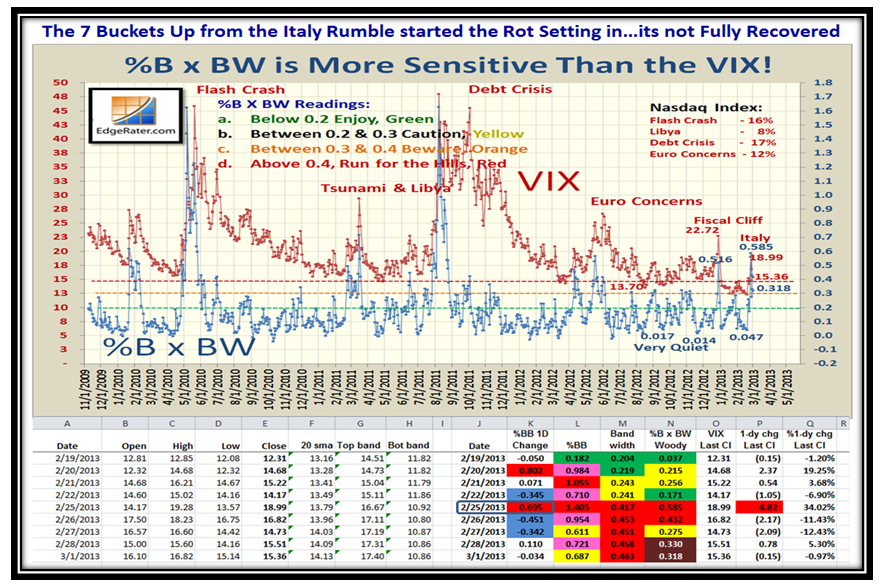

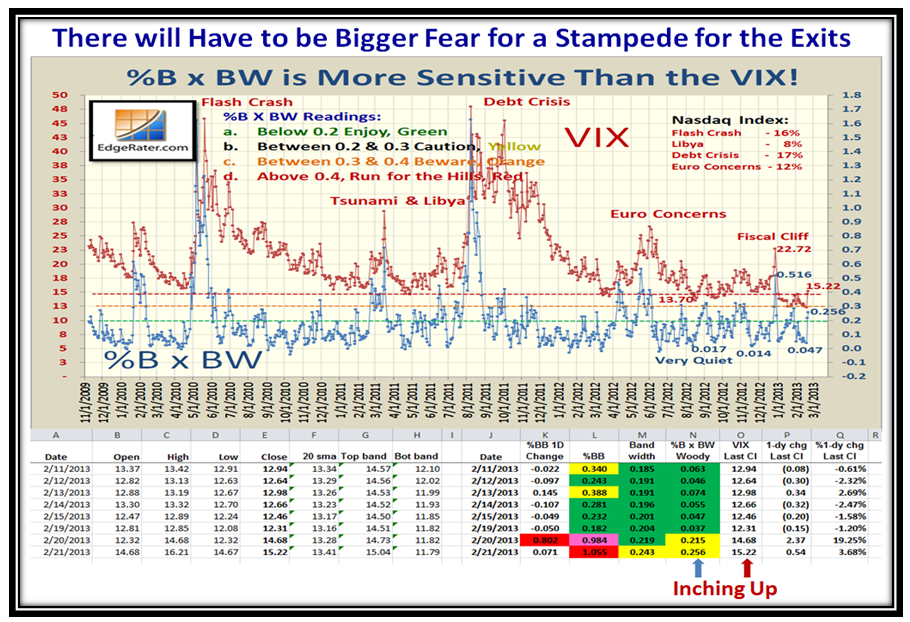

Hopefully the minor back and forth last week has been resolved with Friday’s action, but unfortunately any little bit of disturbing news, especially out of Europe can set this Market into a tailspin. Barring that, I sense the Market still wants to go up, in which case a strong move can lead to a climax run and hopefully achieve the Highest Jump Targets. Please note the tiny red arrow I show at the bottom right of the next chart, which cautions us that the Bandwidth of the S&P 1500 is once again in a tight squeeze at a reading of 0.03, which invariably implies that a Correction is not far behind:

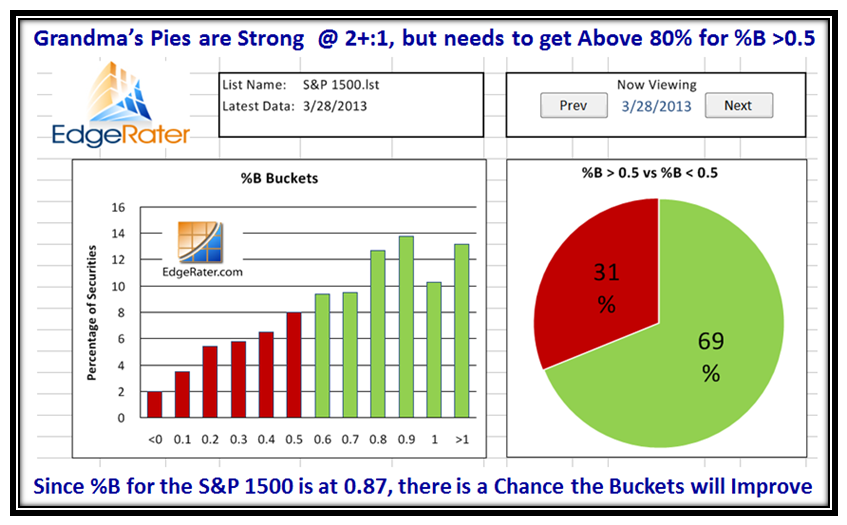

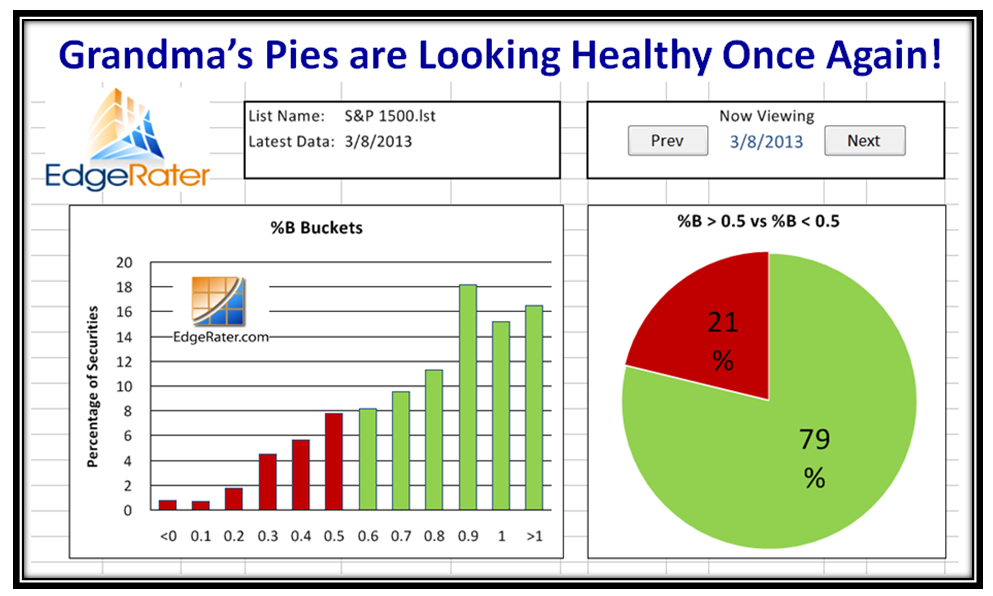

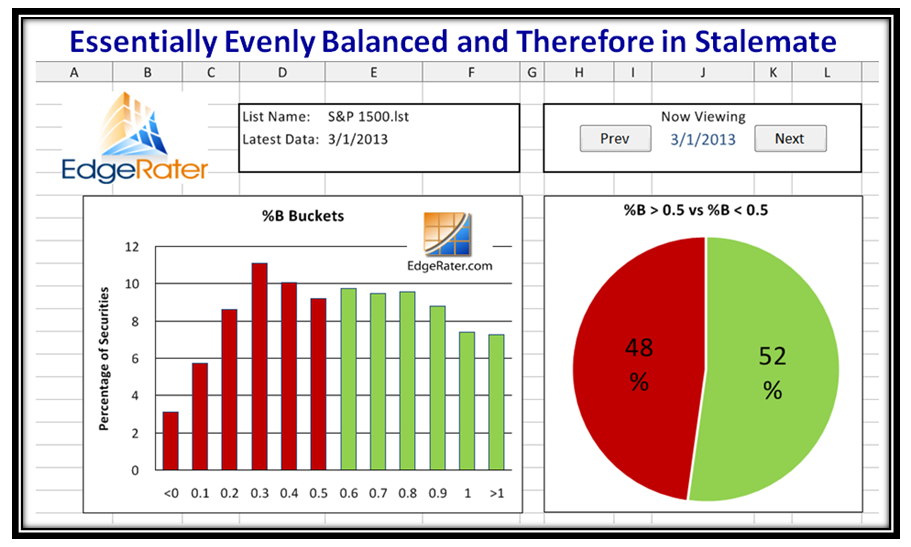

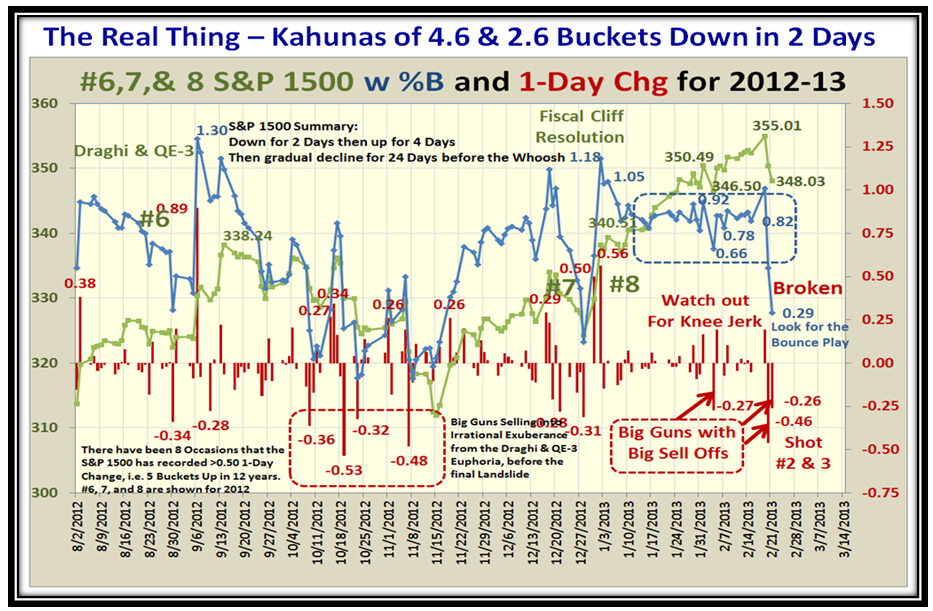

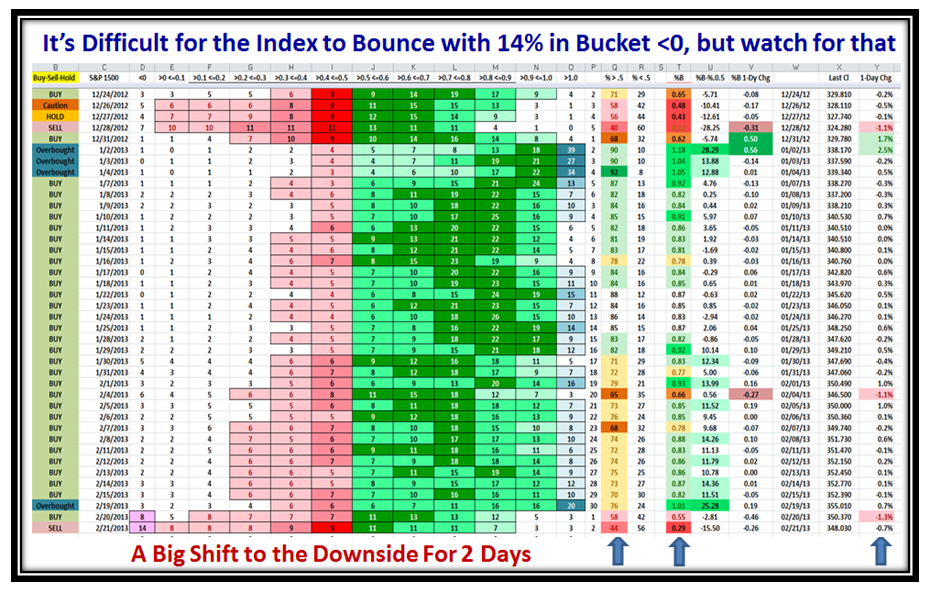

Please note that the %B of the S&P 1500 is at 0.87 (87%), while the %B of Stocks >0.05 is 69%…this invariably implies that the Buckets can still improve to the Upside being pulled up by the sudden burst of enthusiasm in the Index itself. If that does not occur, we can again expect that %B will fall back. Please also understand that with a reading of 0.87, %B would jump into overbought territory if we were to get a Kahuna to the upside which is unusual at this level. In which case “Overbought” on either the %B and/or %B >0.5 would signal the rally days are numbered, especially at this late stage:

The %B Net Score stays healthy at 6, and as I caution you the time to worry is when this trots down to 4 as the early warning sign that the internals are giving up the ghost and we can expect a Correction or another Fakey!

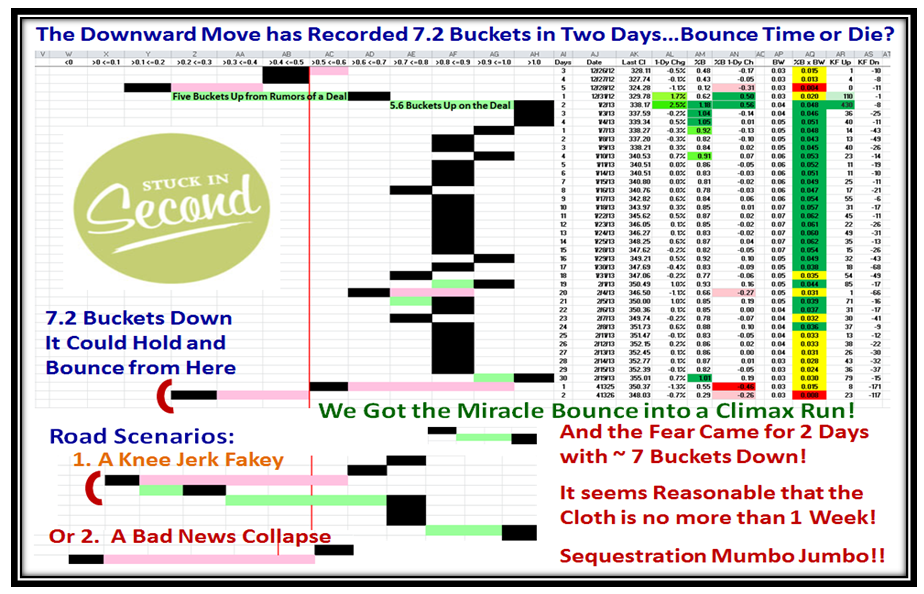

Folks, we spent a good deal of time understanding Fear and especially Greed at the Seminar, and I hope you now realize that this High Jump mumbo jumbo (good stuff), will keep you on the sunny side of the street. The Spreadsheet you have come to know and love shows that 7 out of the 9 Market Indexes are now past the Higher Jump Target, and if we IGNORE the Nasdaq and NDX, the rest of the Indexes are but 2.24% away from their Highest Targets. As I mention on the bottom of the chart it has taken us 8 weeks to achieve ~14% up since 01/25/2013, so with any luck the Targets can be reached within the next two weeks. Notice that the S&P 400 and the DJI are leading the charge by looking down column N20 to N28. The only thing preventing this is a SURPRISE negative piece of News…we shall see. I have to make that Caveat since that is the world of investing these days which is all News Driven. But let me tell you that in all the years we have given seminars, we have never witnessed so many tight Lower Left to Upper Right Charts (LLUR) in our life! Ultimately they die through profit taking, but for now this is a very healthy market:

Here are the couple of bonus snapshots to enjoy of the Leaders Index we always develop at the Seminar, which will give you insight of what we learned at the Seminar as mentioned above:

Well, that’s it for today…I hope all of this is of value to you and helps to see through the fog!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog