Stock Market: In Early Correction

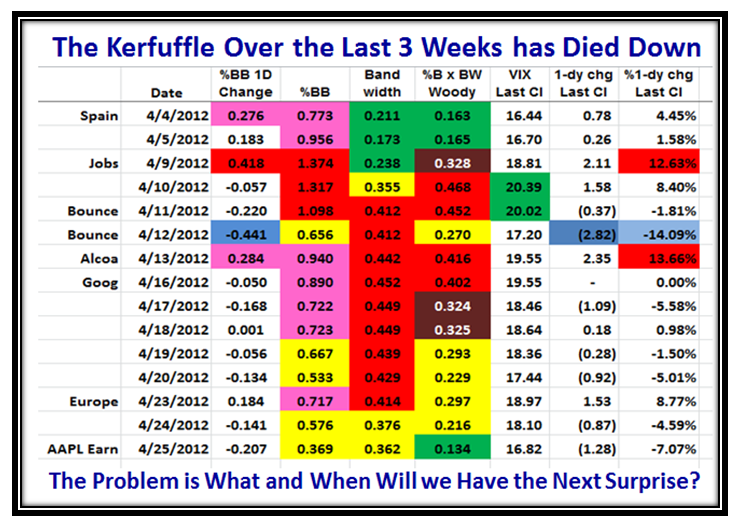

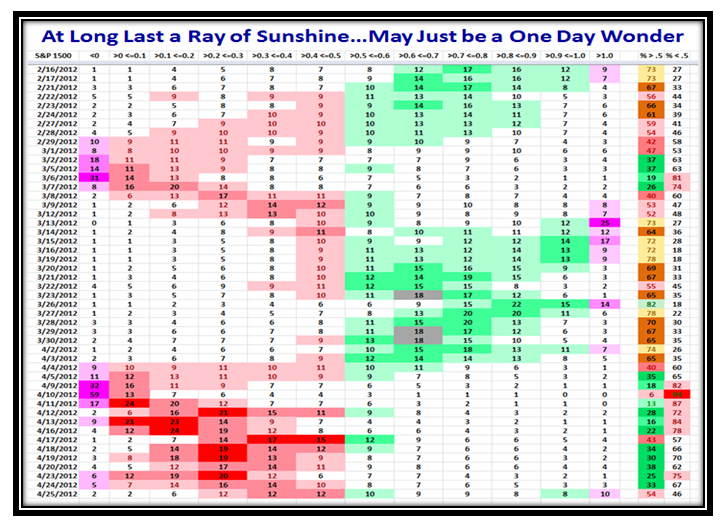

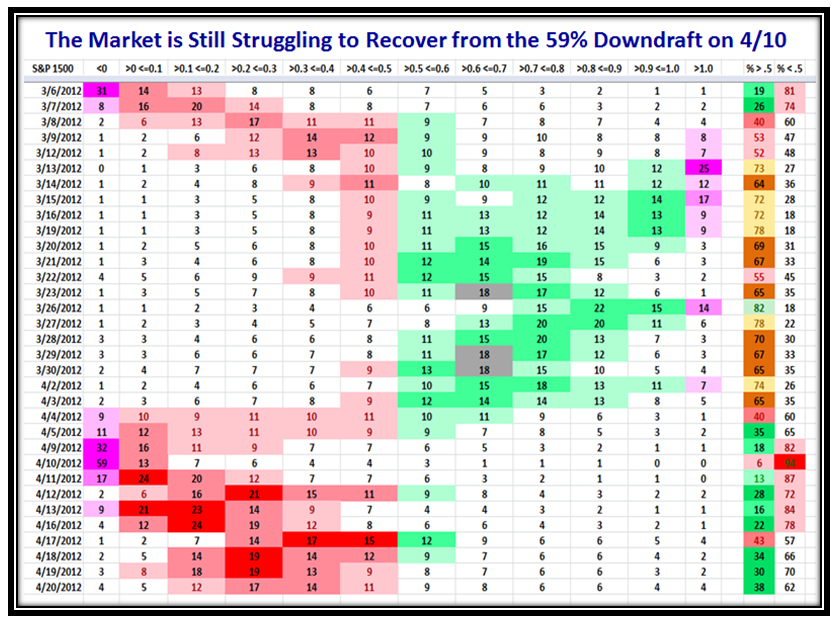

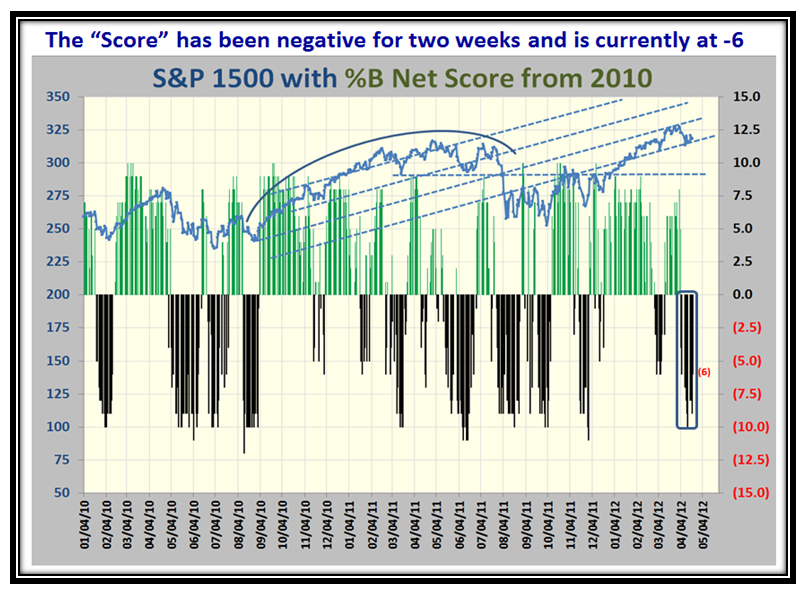

Saturday, May 5th, 2012Everything was looking promising this time last week, but the Jobs Report on Friday was very bleak. The Bears are rubbing their hands with glee as they have been thwarted several times the past month since we had that strong warning sign on 4/9 and 4/10/2012, when the poor Jobs Report last month first gave a strong signal and the Market swooned.

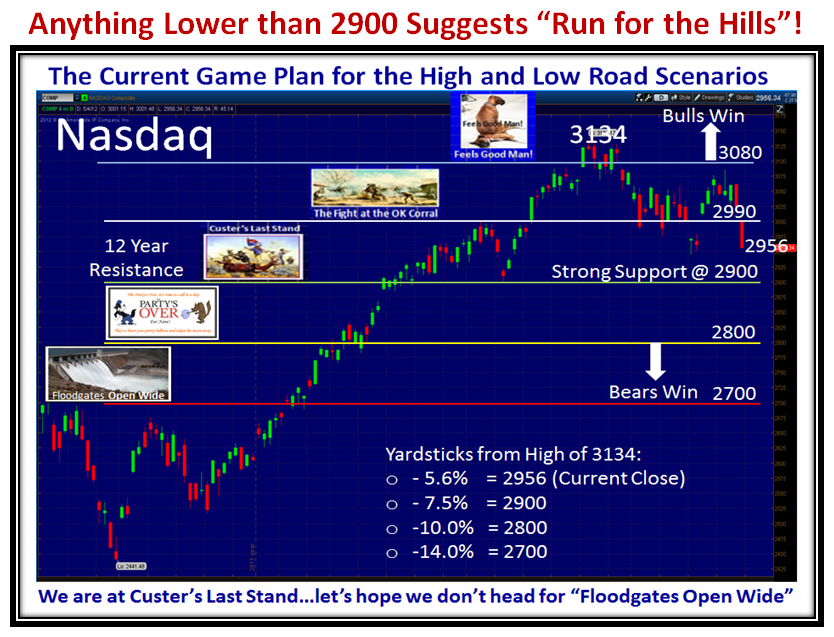

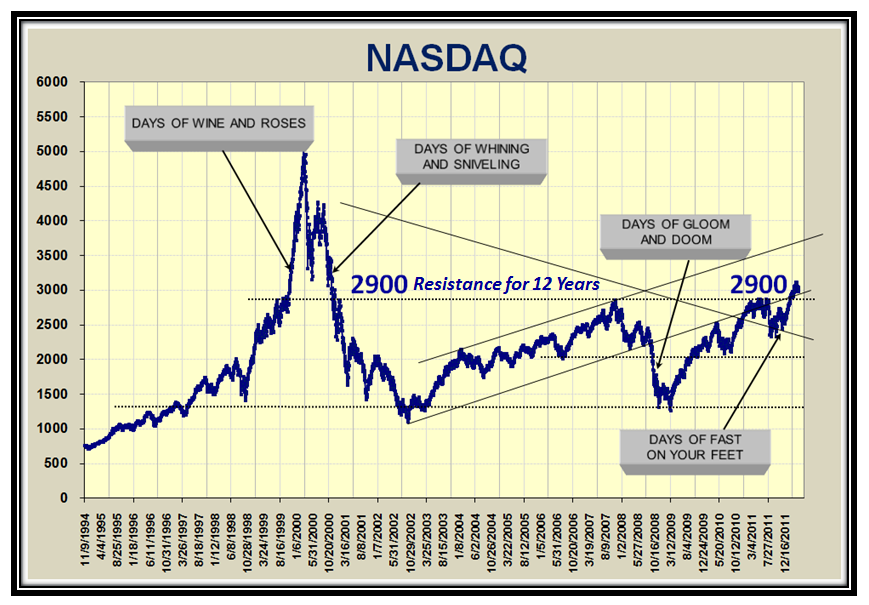

The Game Plan I have given you before shows that we have now slipped down to Custer’s Last Stand and the real test will come if the Nasdaq droops down to 2900, the 12 Year Line in the Sand between New Hope or back into the Doldrums:

2900 on the Nasdaq takes on even more significance as it is 7.5% down from the High at 3134, and as I am sure you well know by now the Nasdaq has turned back up 70% of the time at -8% down from the high. So let’s not forget that this statistic coupled with it being the 4th Year of the Presidential Cycle where there has been only one occasion in 72 Years or 18 Presidential Cycles that we suffered a Bear Market to not panic yet. However, you are forewarned to be on your toes, especially if all the Market Indexes and Leading Canaries give up the ghost:

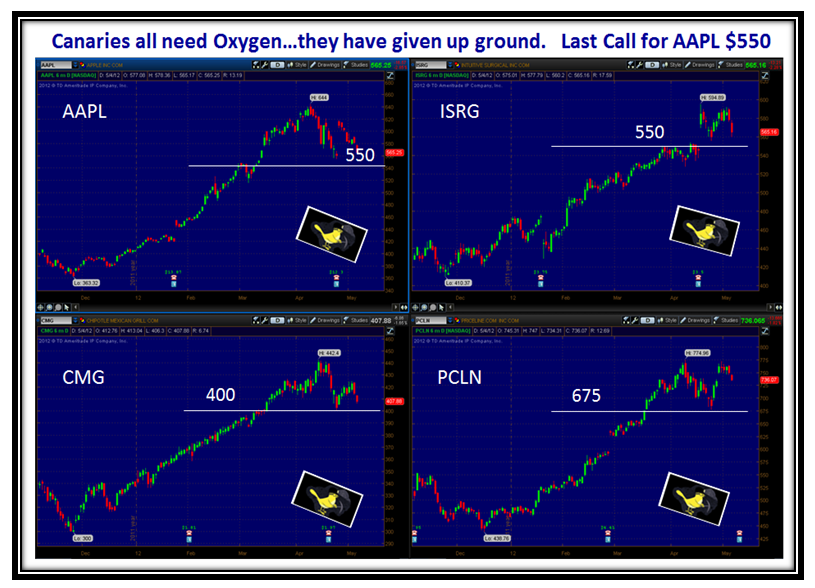

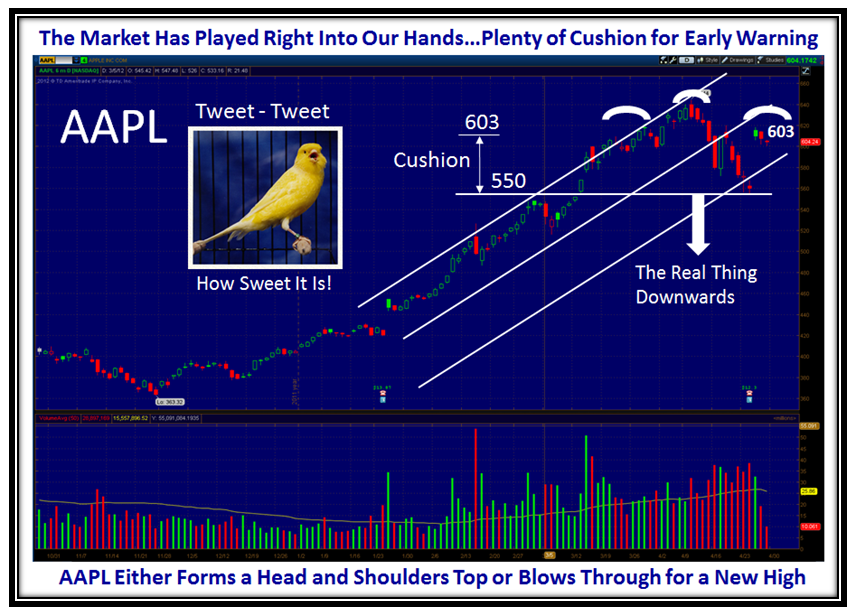

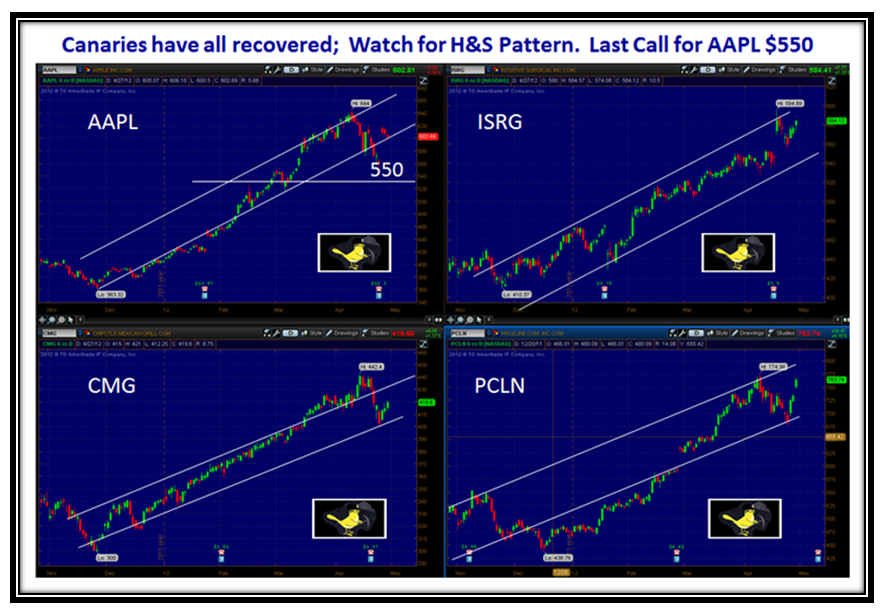

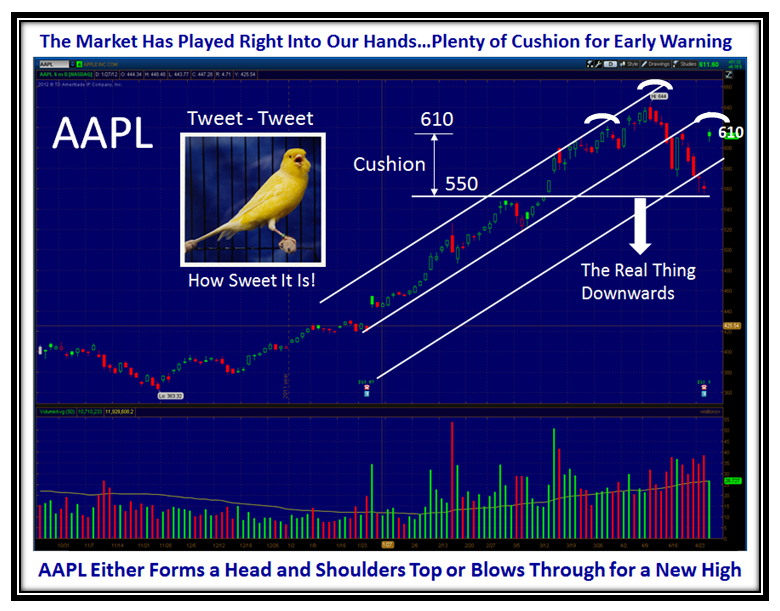

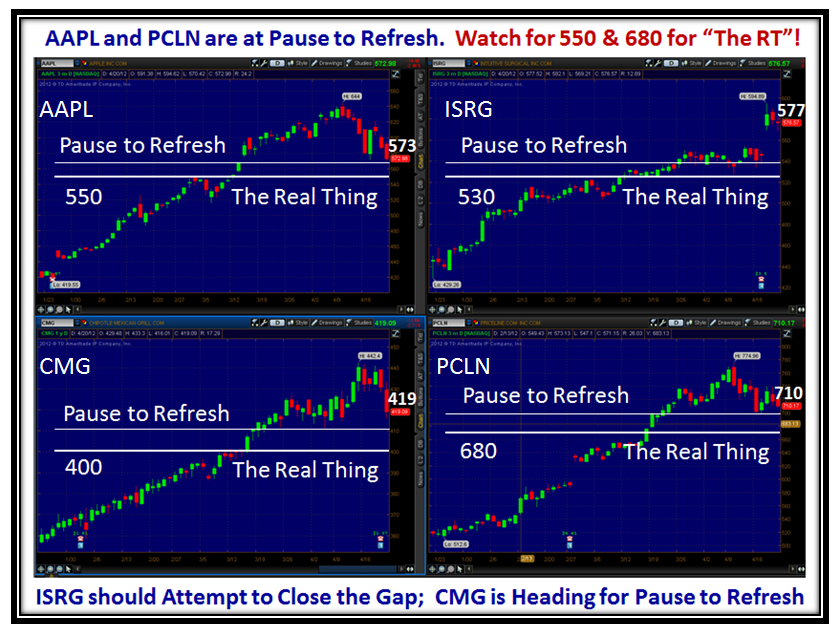

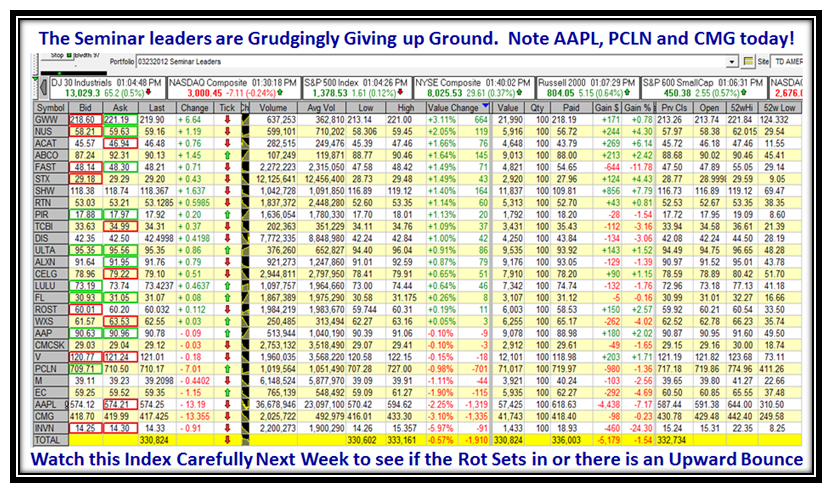

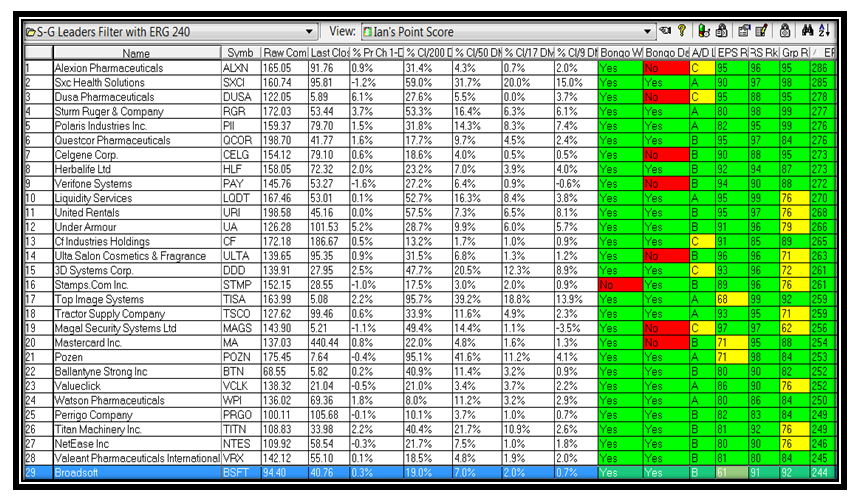

…And here is the picture of the Canaries which are tilting down:

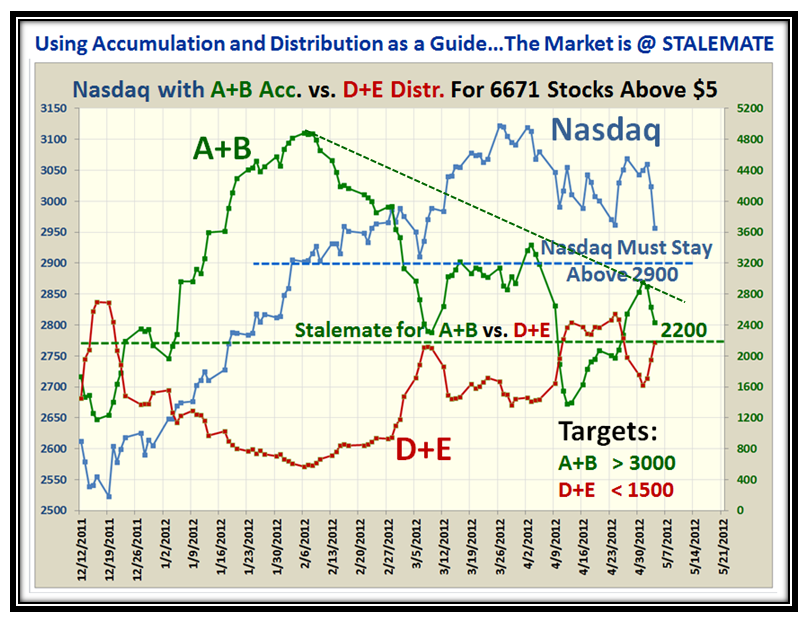

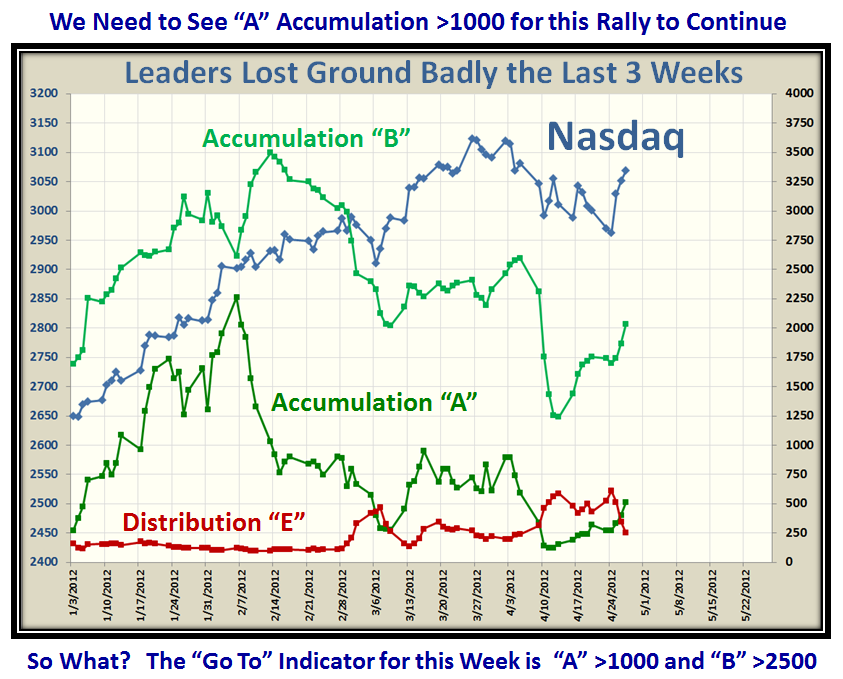

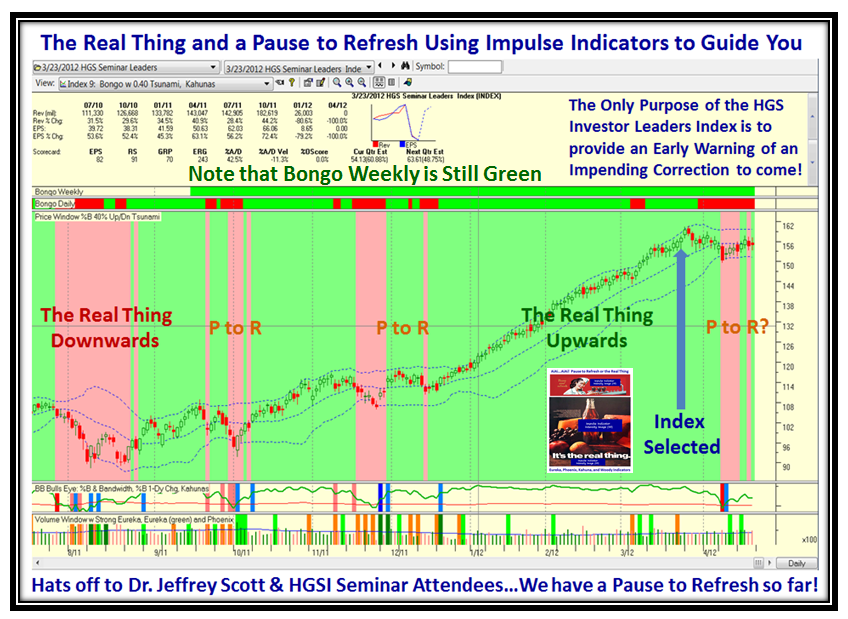

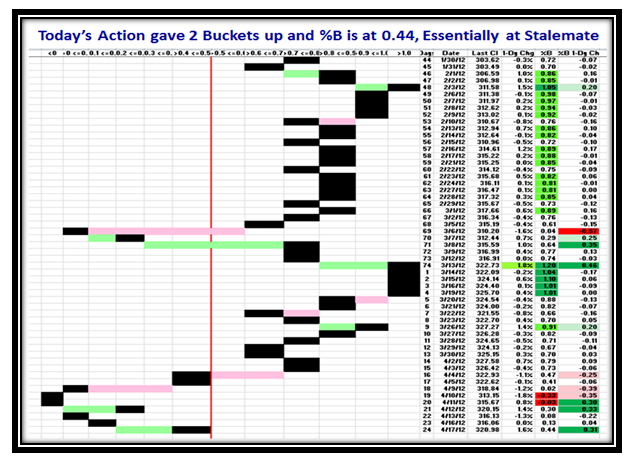

Here is a New Chart to chew on…I have combined the A+B Accumulation and the D+E Distribution stocks for above $5 for the past five months history and you can readily see that Leadership stocks slumped this past week to the point where we are at Stalemate on this score. We need to quickly get above the down-trend line to 3000 and higher for A+B.

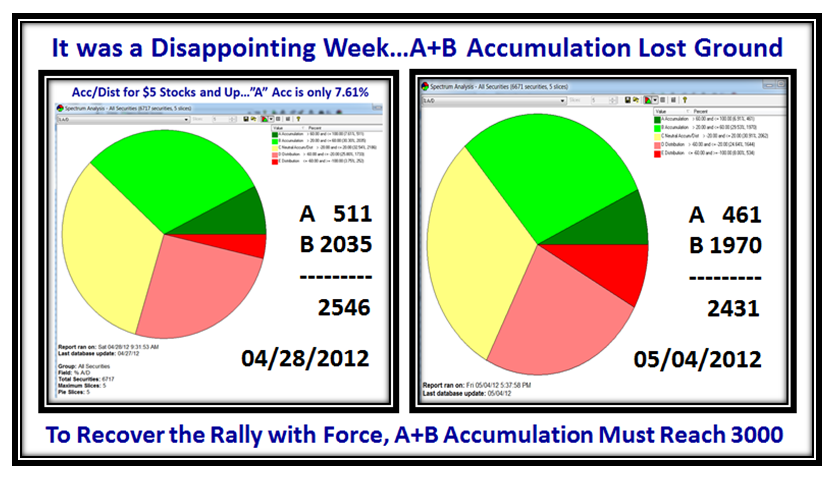

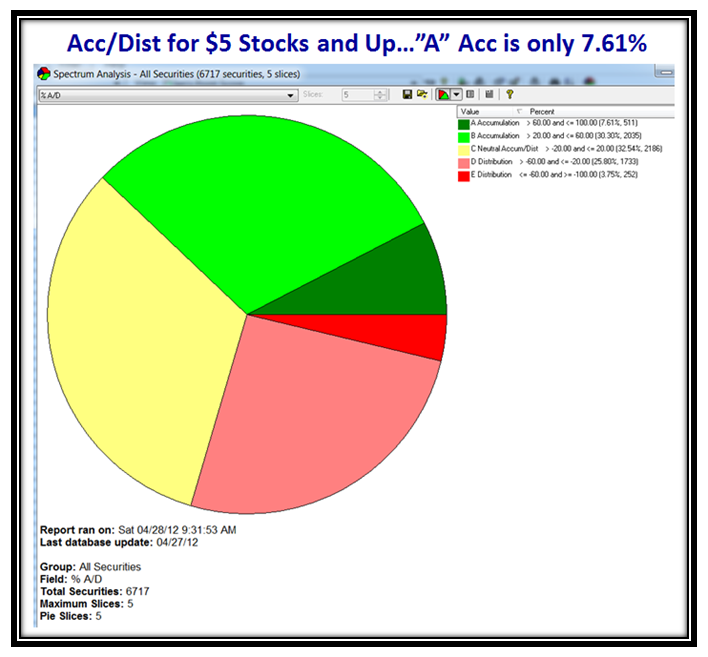

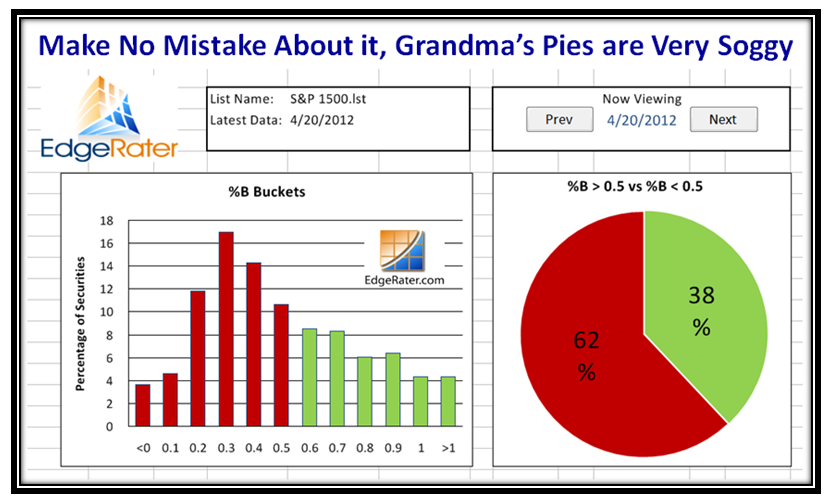

The next Pie Charts show the deterioration last week in leadership with A+B Accumulation giving up ground:

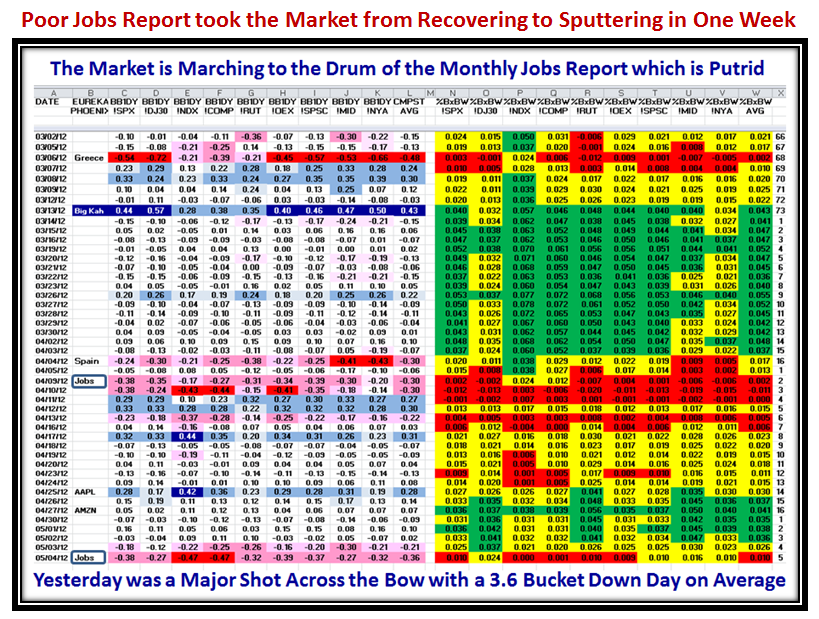

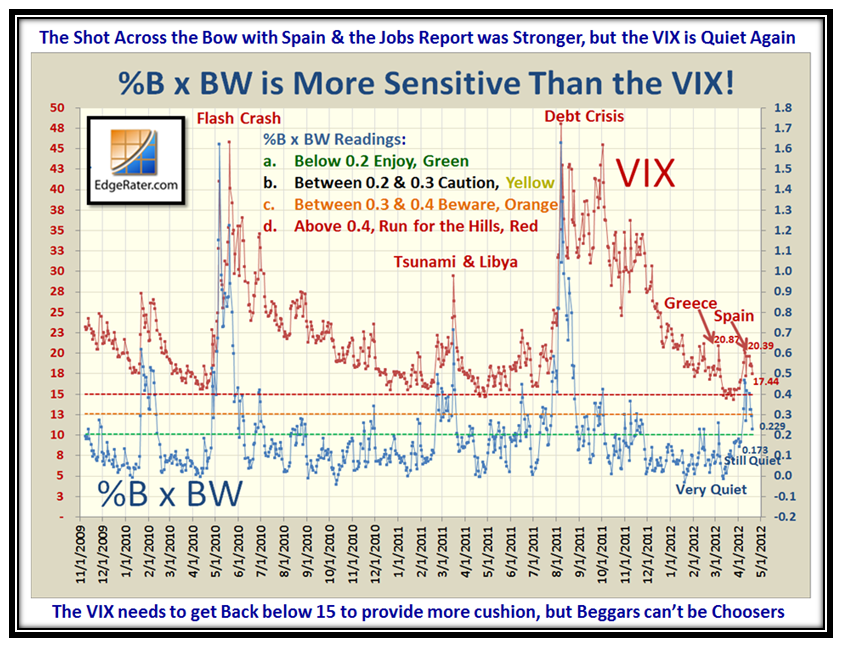

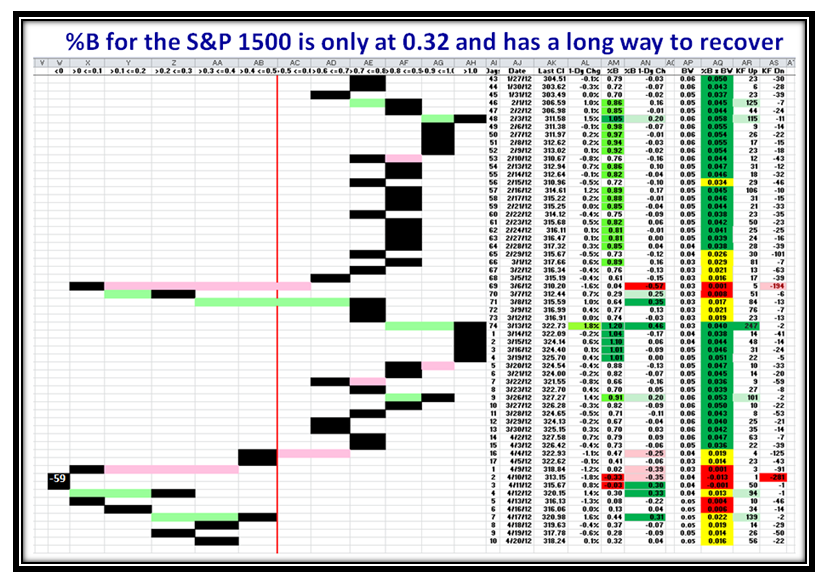

What’s new?…the Monthly Jobs Report was dismal and we finished Friday with a 3.6 Bucket down day…bad news:

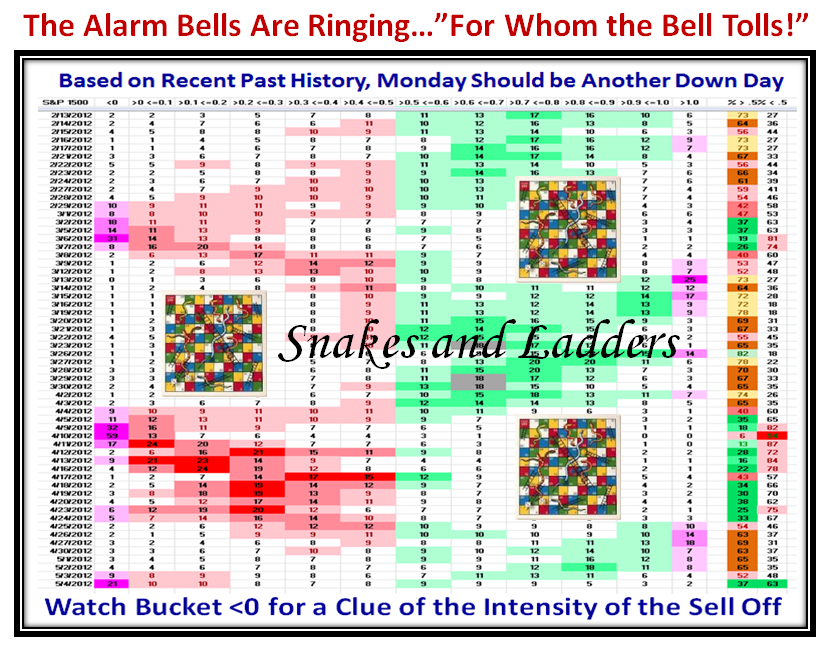

Yes, we are Playing Snakes and Ladders and we are once again in the doldrums:

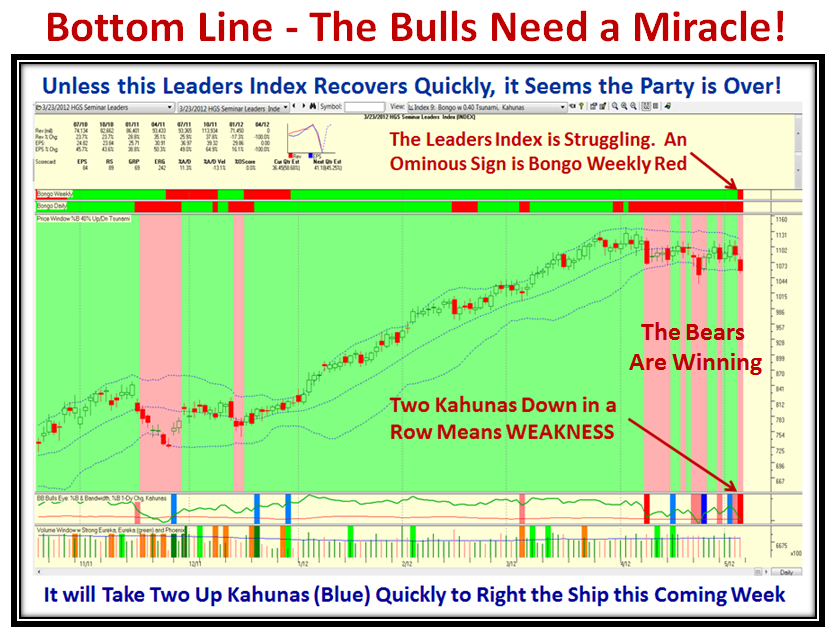

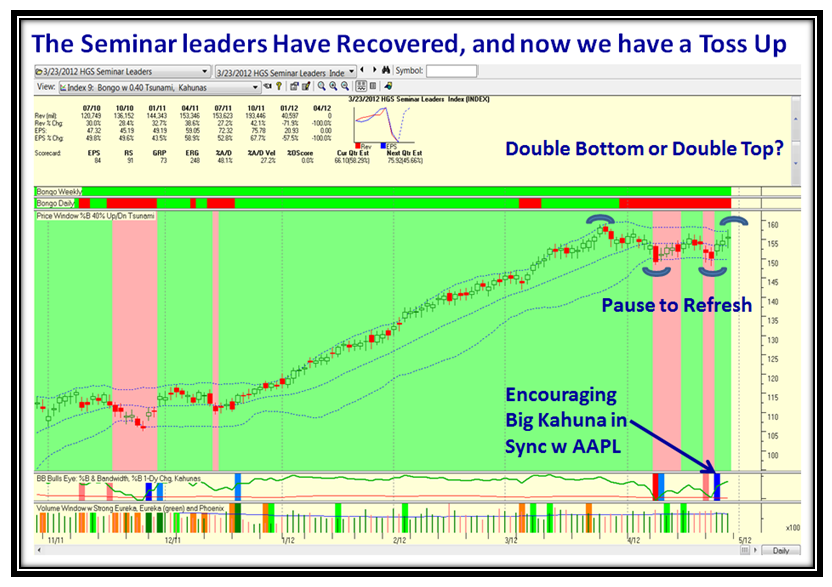

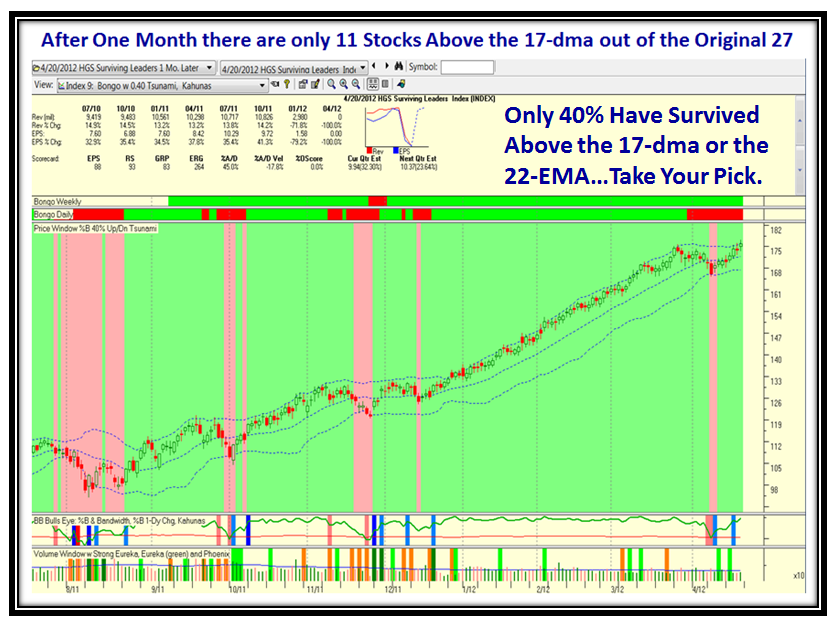

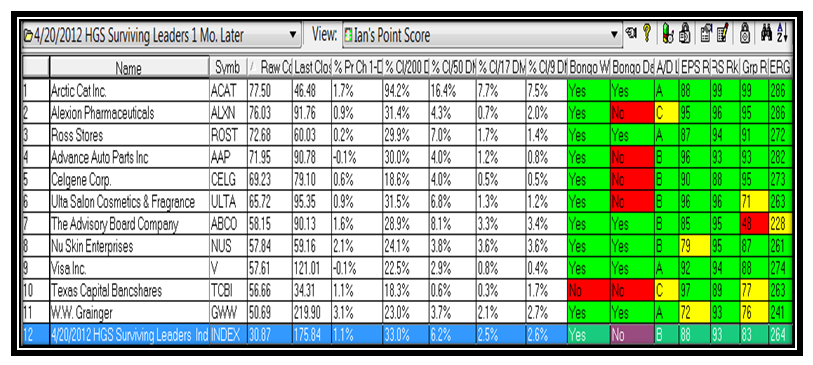

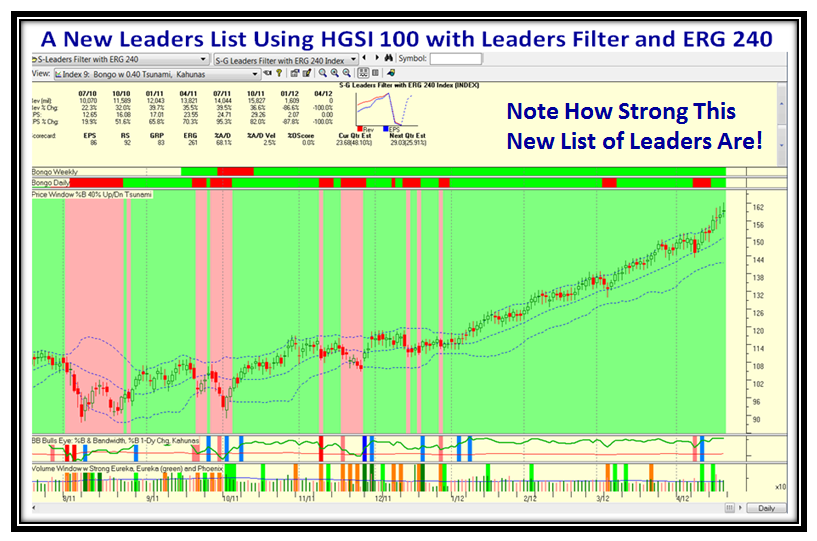

The Leaders Index looked promising a week ago, but it doesn’t take five seconds to see that this Index is Struggling:

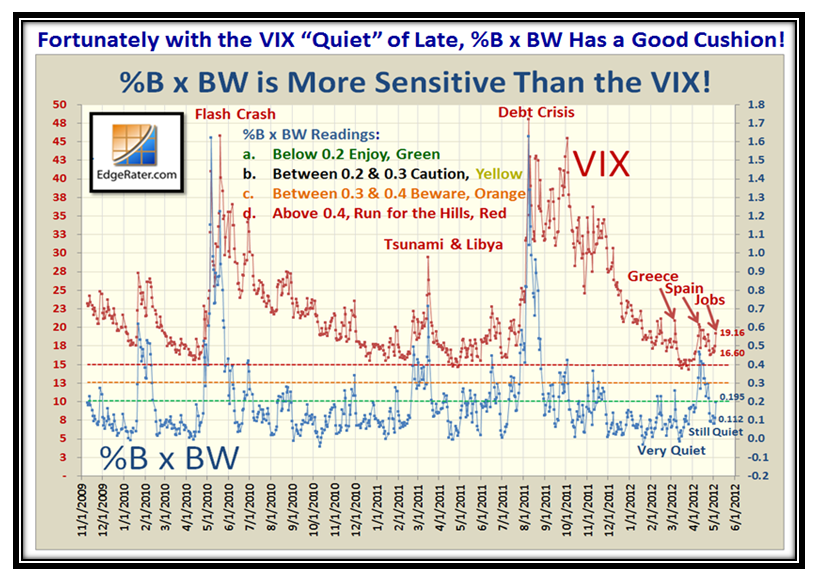

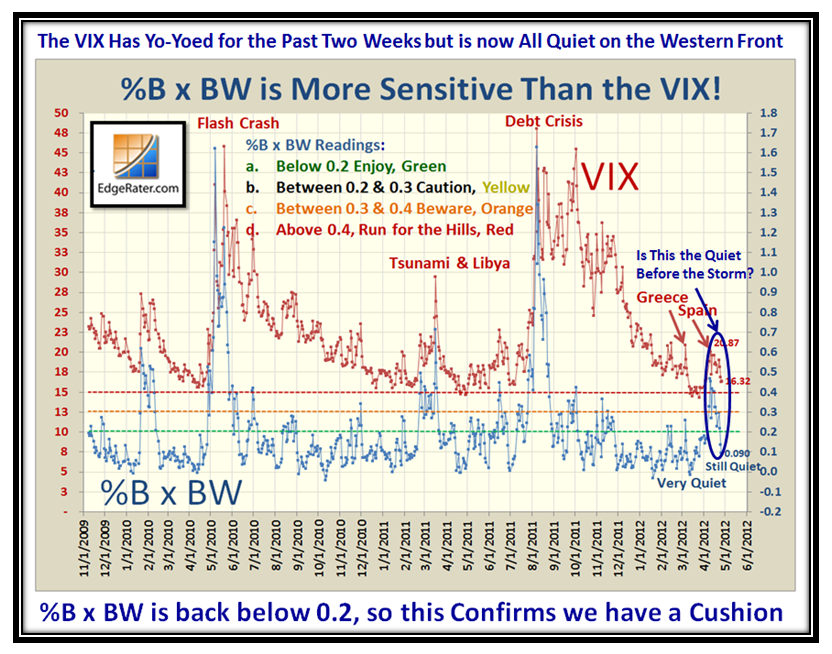

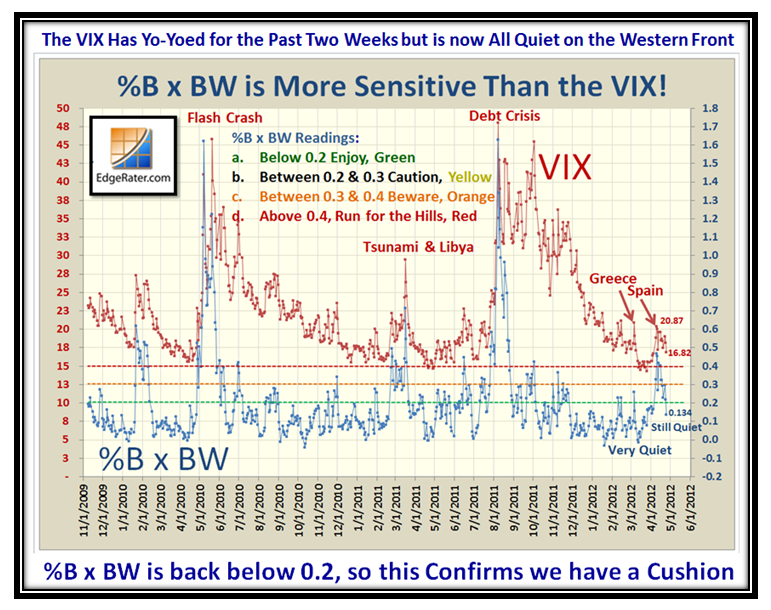

…And last but not least, the item to watch next week is the VIX as it has NOT Exploded as yet and therefore if there is a big down draft and a run for the exits, the earliest clue of Major Abnormality will come from the picture below:

Let me once again thank the Worldwide viewers of the Blog for their support…Today I had 17 hits from Thailand!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog