My friend David Steckler always signs off on Friday on the HGS Yahoo bb with “Its Milluh Time”. Today it is 401 Keg Time! I had a couple of questions from RichardB and Charlie Willey which I answered in the “Comments” section, but I told them in the note that I planned to put the answers up here. Since I mentioned the 401 Keg, I felt I should let you know that back on October 6, 2008 I had 5364 hits from around the globe on that day, the most by far ever, and I have been doing this blog for four years. So, since most of you know I am NOT a Fearmonger, I hope you will accept this reminder of what a 401 Keg is with tongue in cheek:

You all know that Ron and I teach you to be your own guru’s, so although the UNDERLYING message on my blogs may not always be obvious, those who know me well understand that I will lead you to water but you have to unravel what “that” message is when you drink. With that said, I hope the following answers to Richard and Charlie’s questions will make you think…I do not spoon feed, but I felt it important for you to know where my head is at:

RichardB Says:

June 10th, 2011 at 6:10 am edit

“Any further than this to the downside can do much damage to your 401K, so you know the drill by now”.

I’m sure the answer should be obvious, but what would the best drill be, please?

Thanks again so much for these blogs.

RB

Charlie Willey Says:

June 10th, 2011 at 7:32 am edit

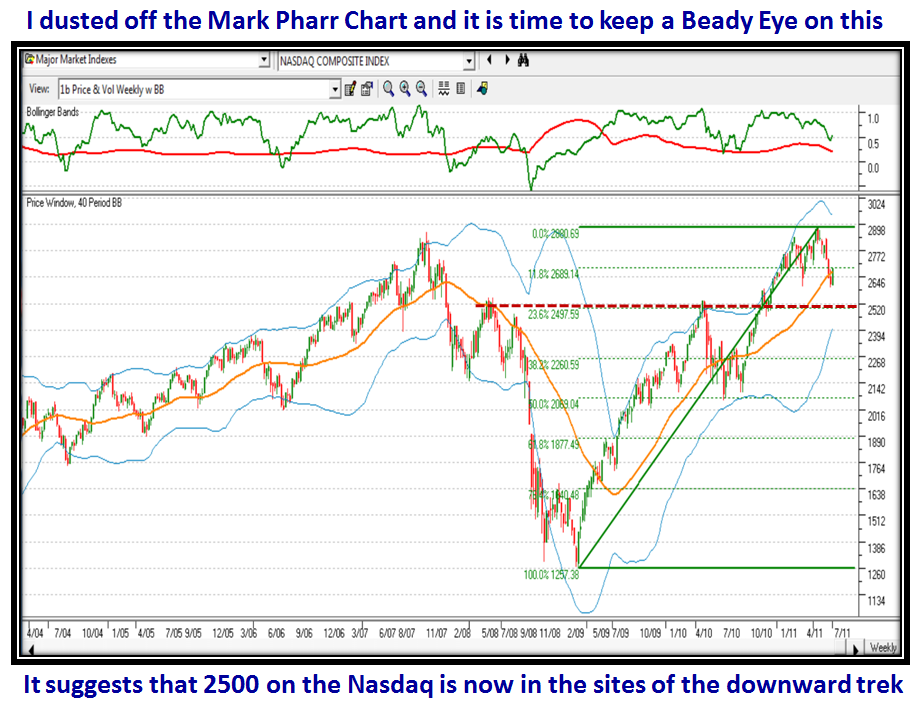

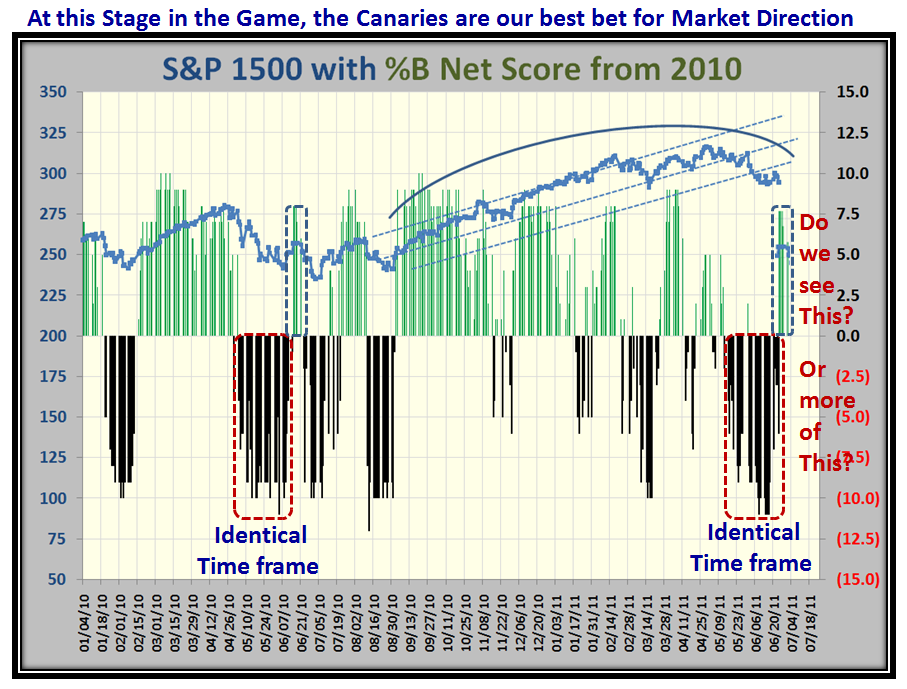

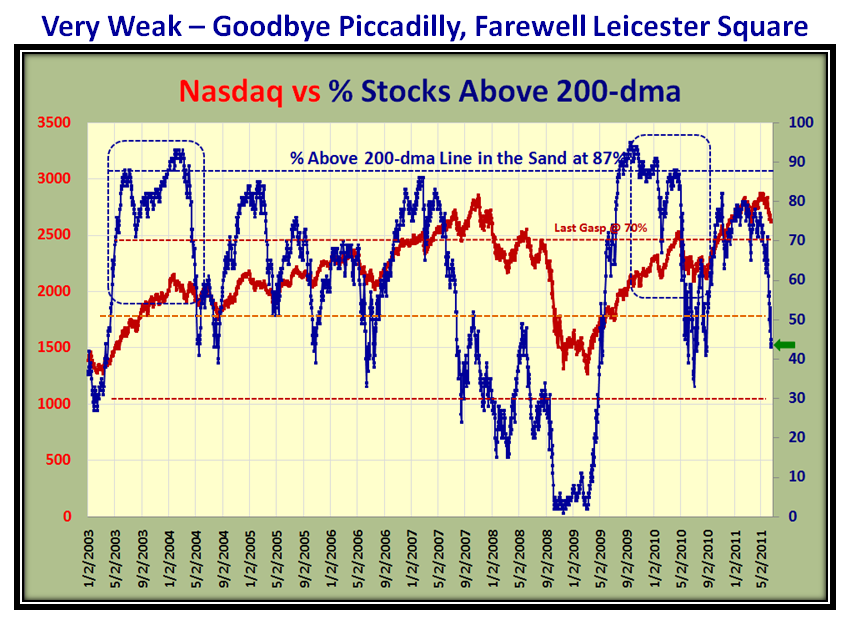

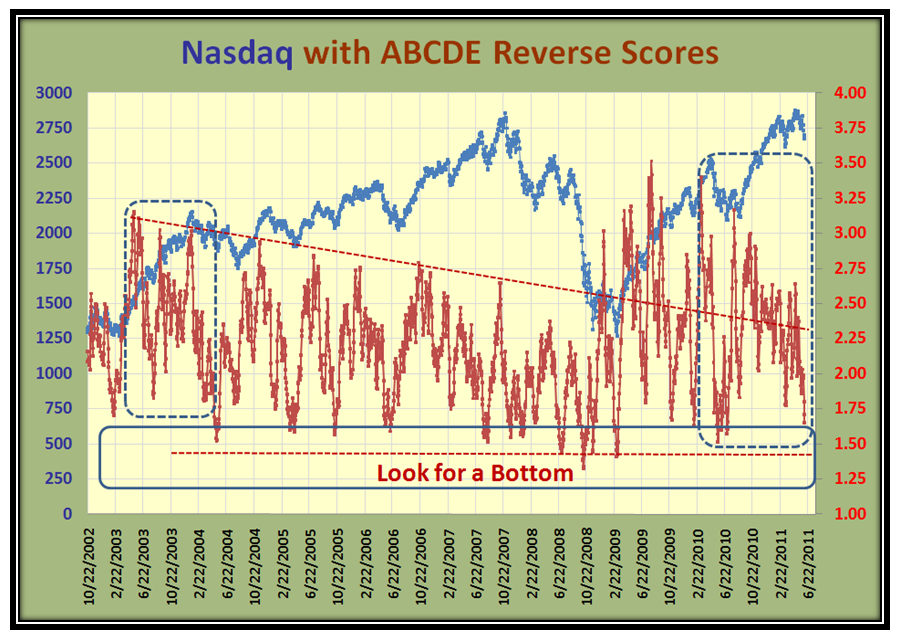

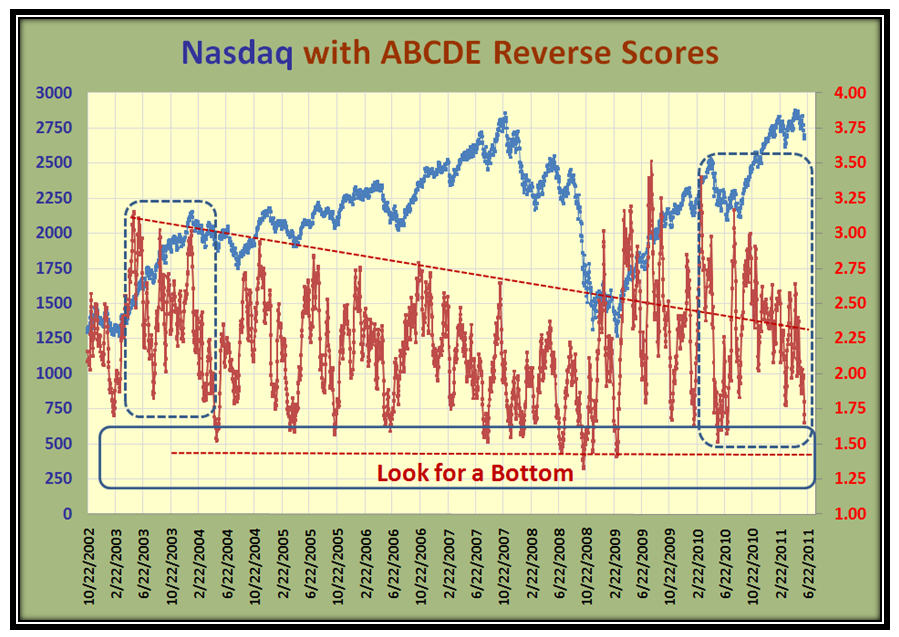

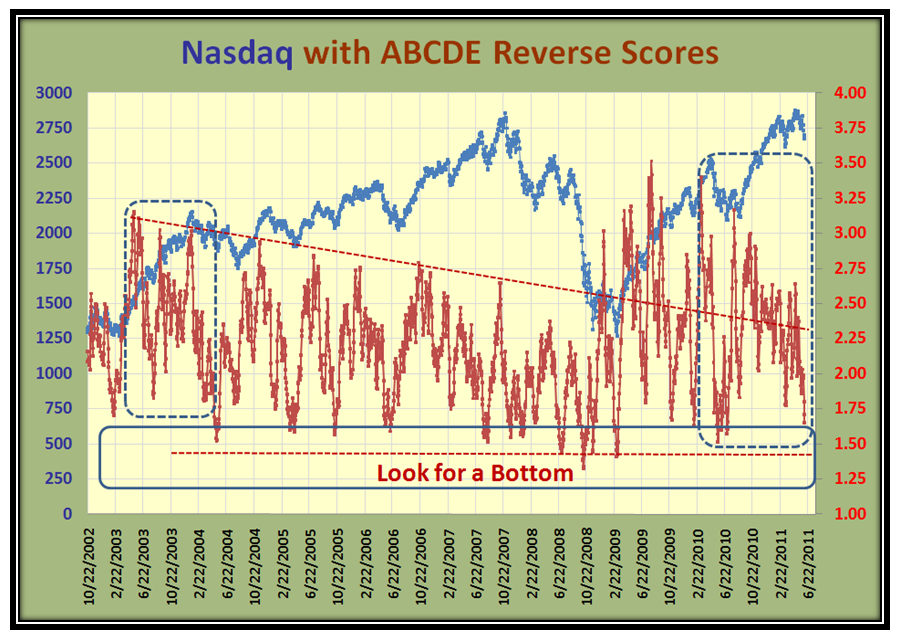

Ian – The chart NAZDAQ with ABCDE Reverse Scores is a very interesting chart. Just from a glance I am seeing a bit of Forwarned is Forarmed for anticipating bottoms as you have discussed.

You have a red dotted line drawn at about 1.40 on the Reverse Score column. Is the line drawn there to accomodate some risk value or do you think any penetration of the horizontal blue box will suffice as a warning?

Or am I off track here?

– Charlie Willey

Hi RichardB and Charlie:

As usual you are on the ball!

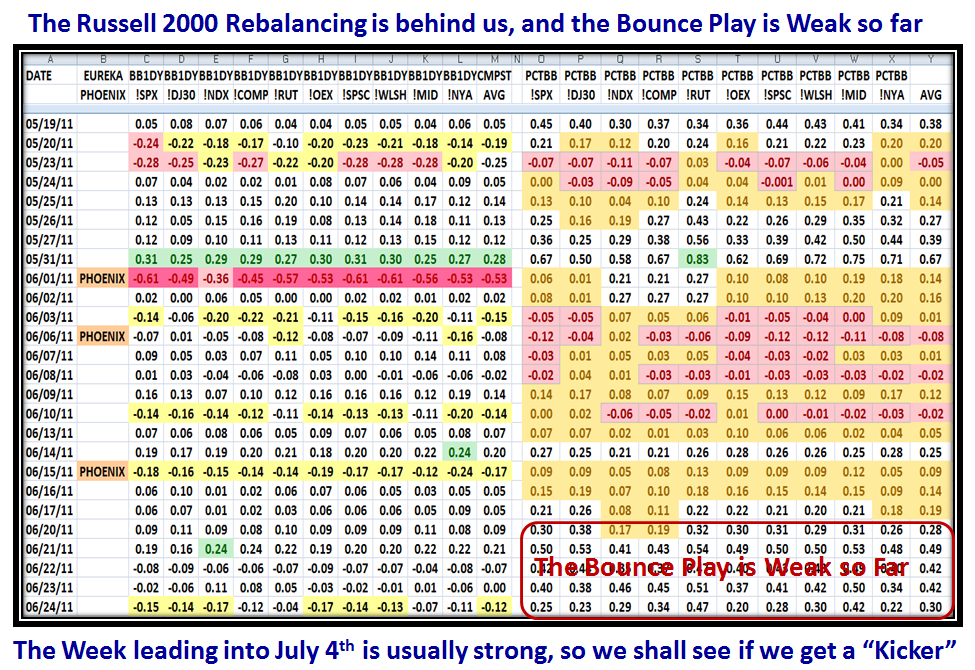

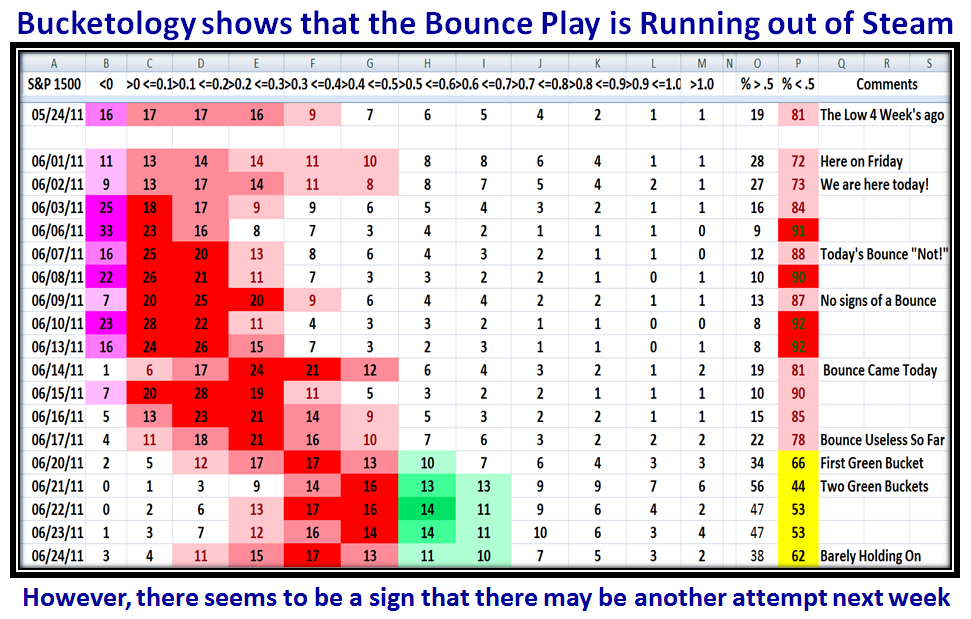

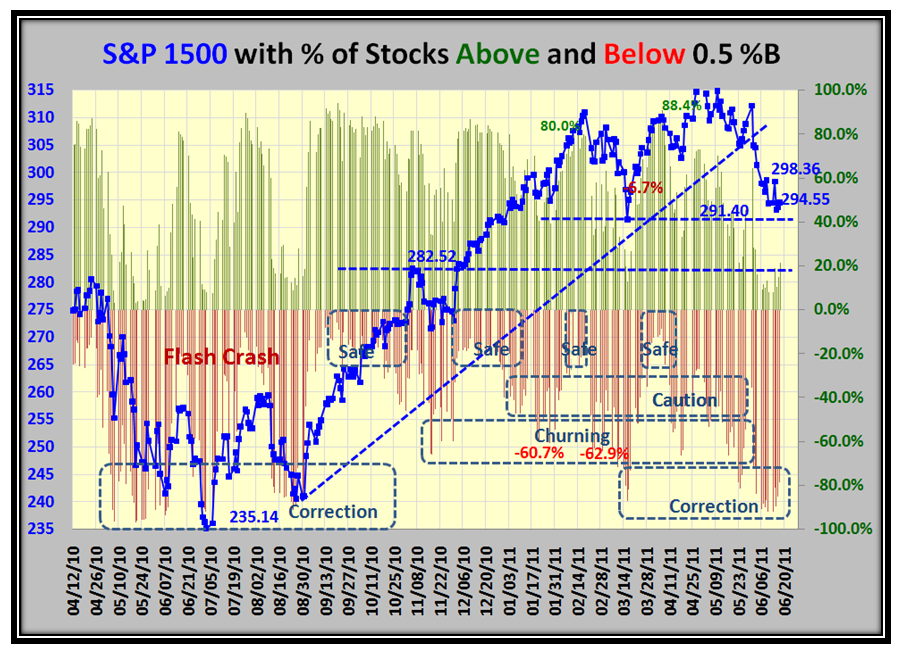

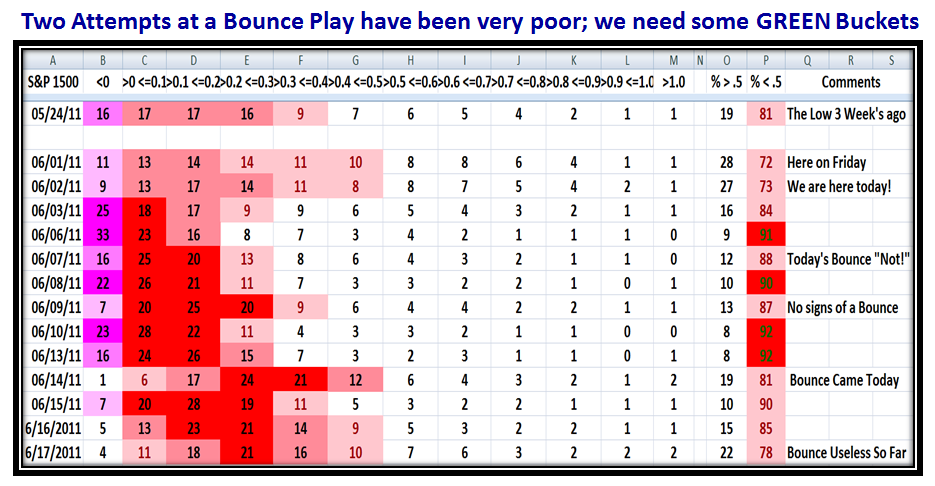

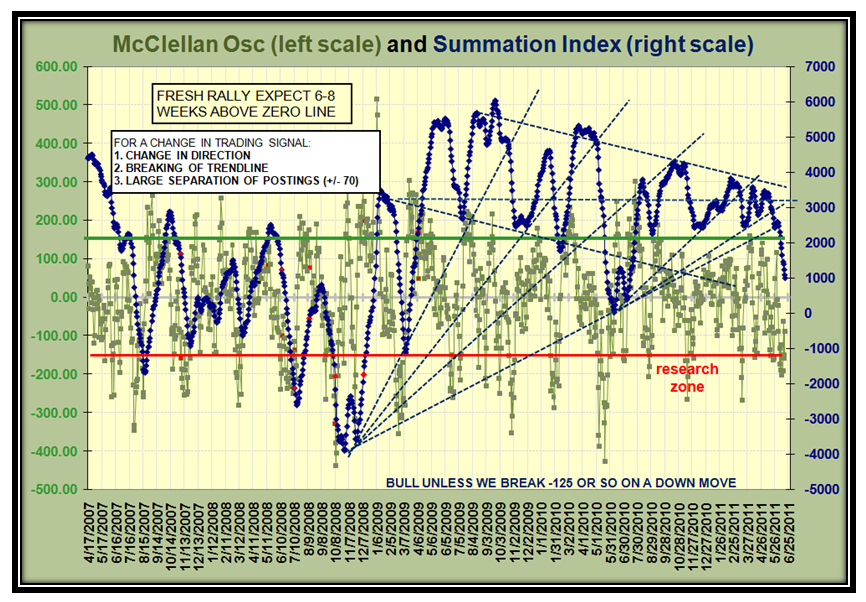

1. Red dotted line at about 1.40…Worst Case Scenario ala Black Swan Days. It suggests to me that although there should be a bounce at that level, the worst is not over, particularly if on the Bounce it can’t get above 2.25 on the score. Note that it took four tries from that level of 1.40 together with a lot of pain before the doom and gloom had worked itself off. So, the best one can do at that level is to be very nimble and essentially day trade or at most a few days to a week…Type 1 and 2 Types enjoy volatility, both long and short.

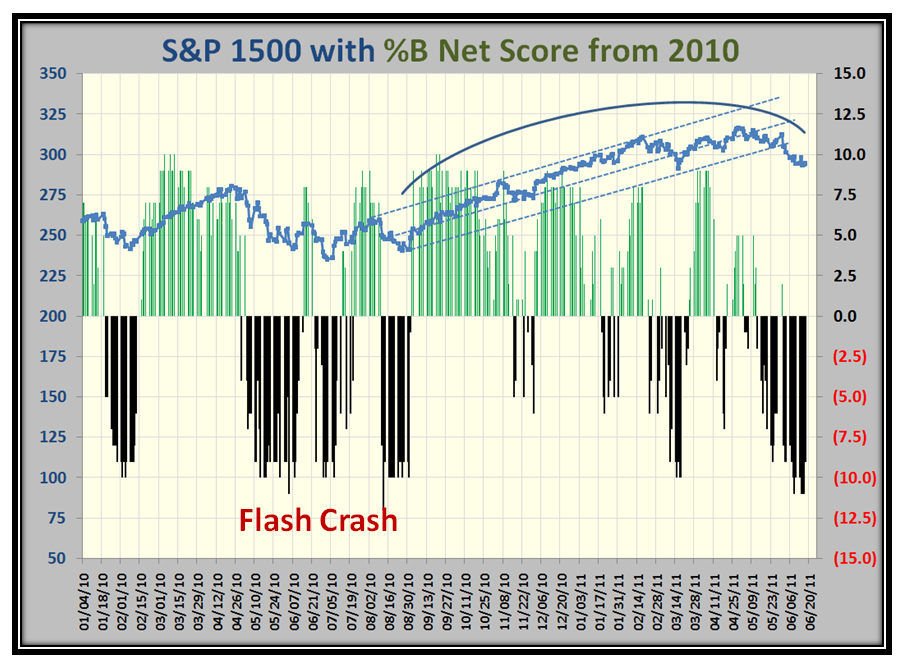

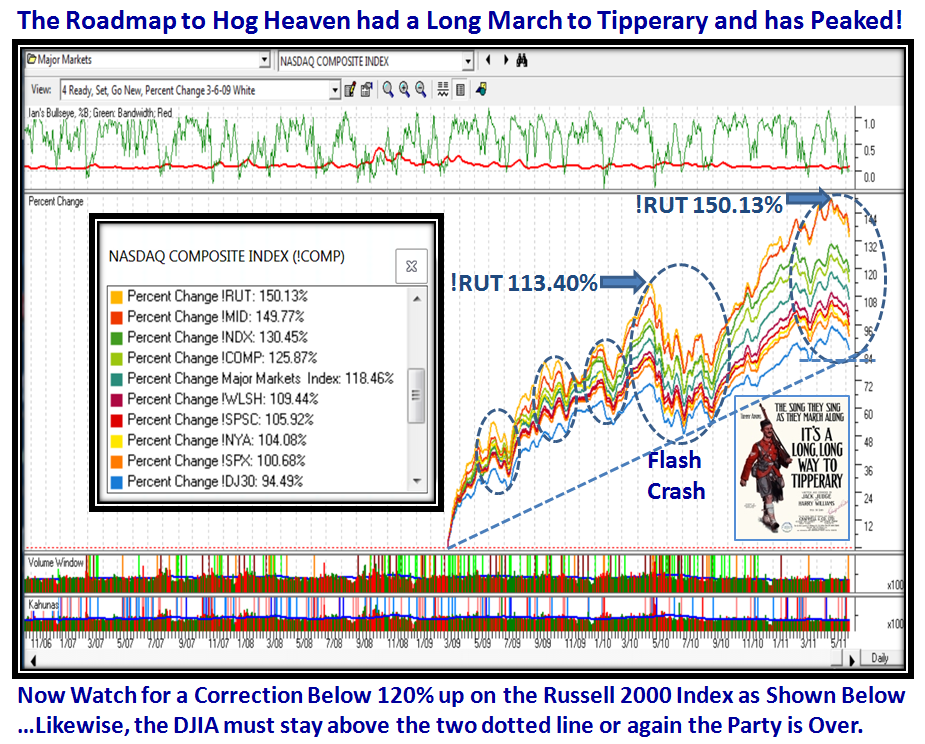

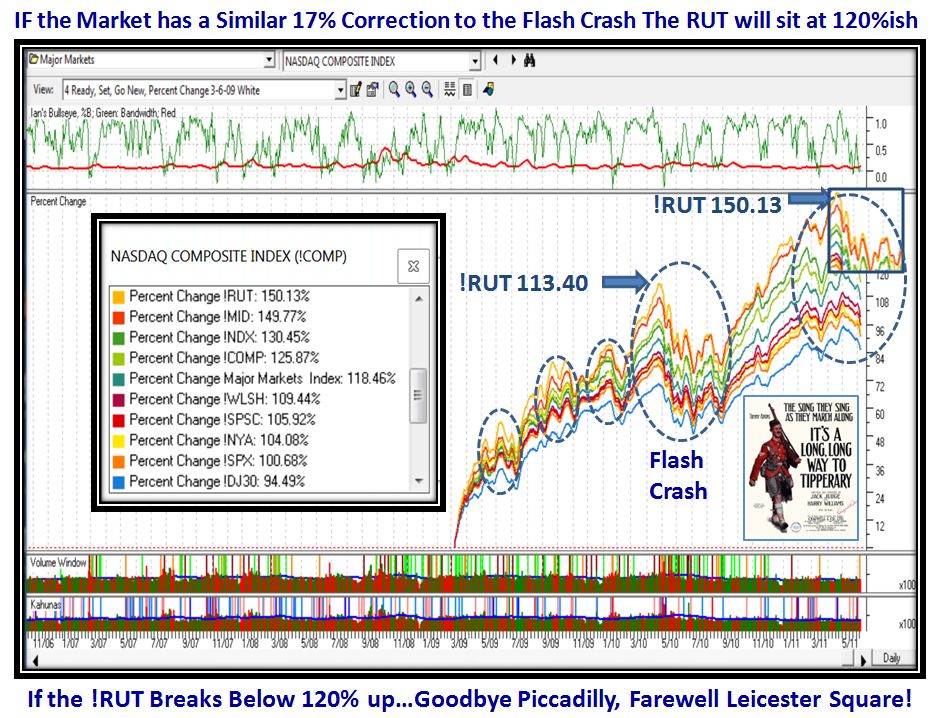

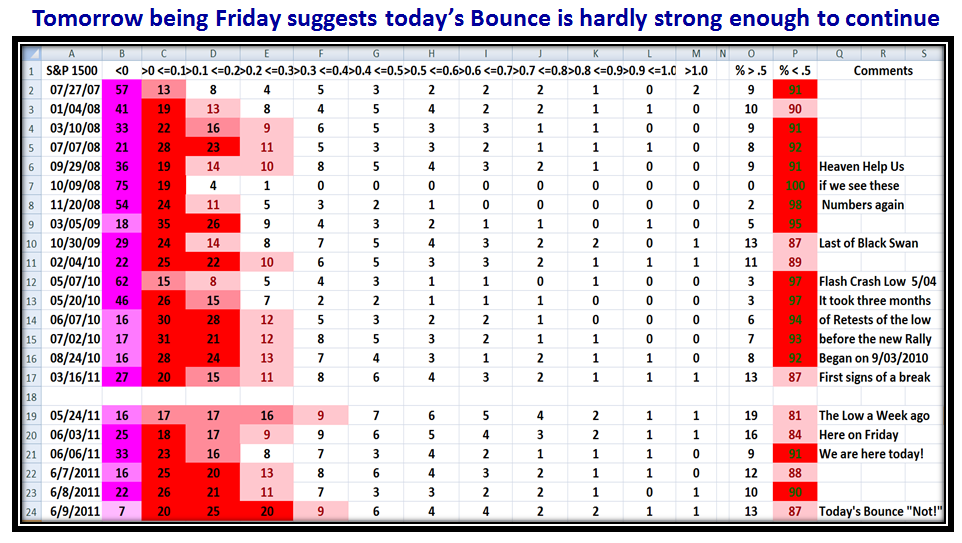

2. Penetration of the Blue Box to the level of the blue dotted portion within that box suggests that we should sharpen our pencils for a Bounce Play, and the odds are that although the correction may not be over, the likelihood is that if it retests down to the 1.50 score level the chances are that we will be spared a BEAR MARKET. The worst we should expect is a Major Correction of between 16% to 20%, similar to the finish of the Flash Crash ultimate drop of ~17%.

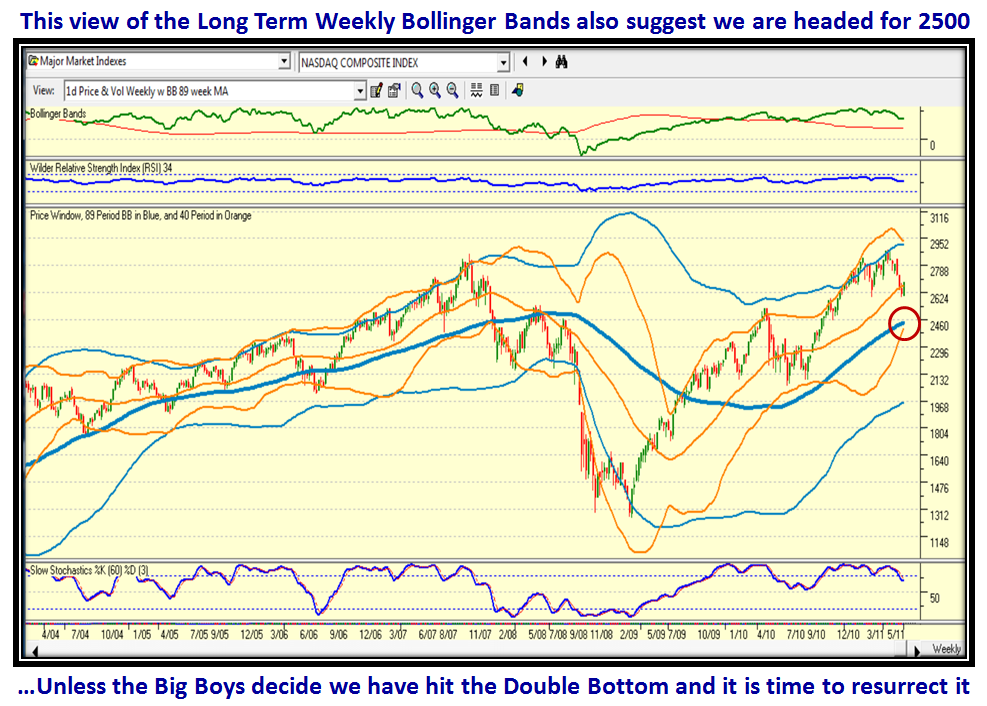

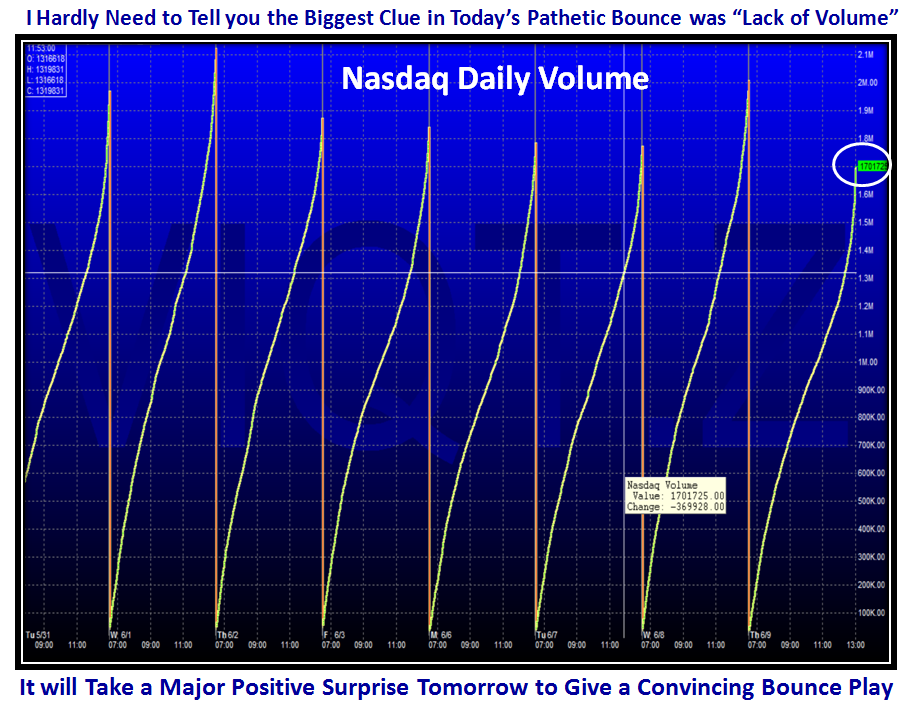

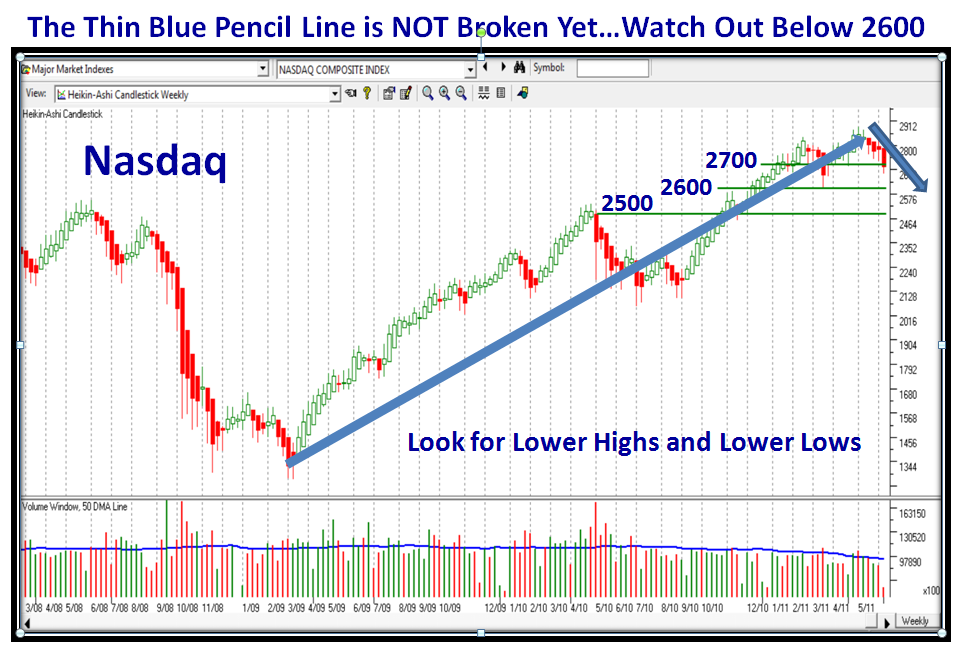

3. Today’s action should take us into the blue dotted area within the blue box. Where we go from there is in the lap of the gods and the Large Players…you and I know it is all a big game, but if it goes down further then the cushion we have is ~50 points to reach the Thin Blue Pencil Target of 2600 on the Nasdaq.

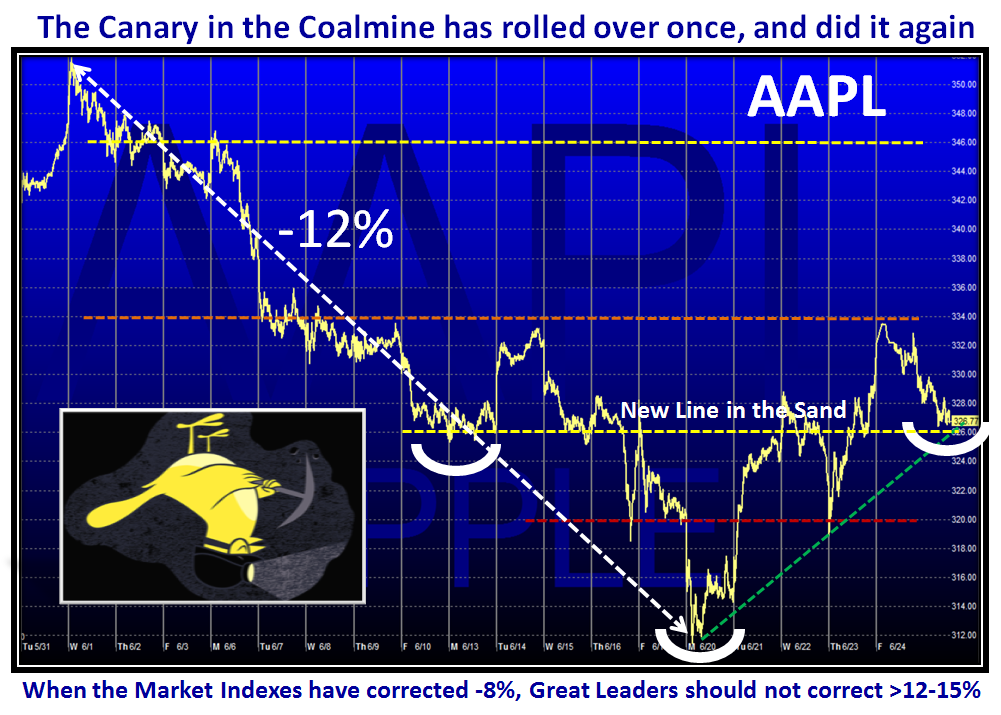

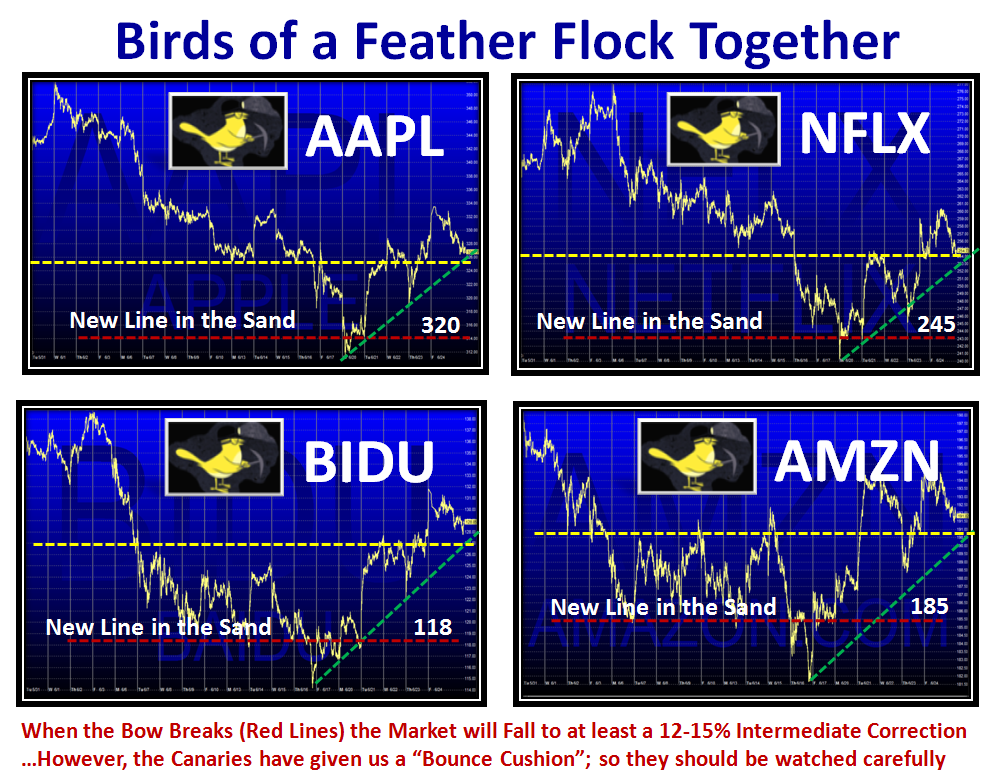

4. We then have to watch for The Thin Blue Pencil Line Chart of “Lower Lows and Lower Highs”, and if that is breached after a further tepid oversold bounce then we are headed for the red dotted line and you better take care of your 401K before it becomes a 401 Keg!

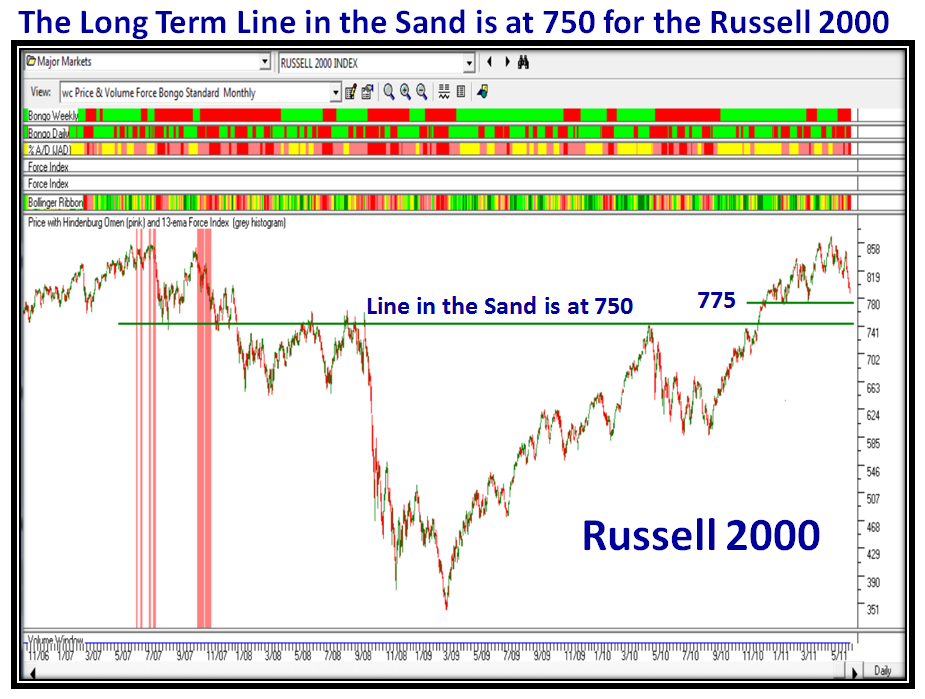

5. Last but not least, I am NOT a Fearmonger, but there comes a time when commonsense over rules the heart and it is time to take action before there is a total downdraft…in which case it is invariably too late. When is that point you ask? It is right there in the blog on the Russell 2000 chart. If that beast breaks 750 it will for sure be 401 Keg time.

I aim to put your questions and this answer up on the Blog instead of hiding it here in the Comments which may be missed.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog