Two weeks ago the Internet was abuzz with all the chatter on the Hindenburg Omen (HO), and now that everyone has weighed in, including Jim Miekka the inventor of the signal, it is time to harness the potential mystery of the ticking time bomb. I am not going to bore you with all that has been said on this blog and others during the past two weeks, but to bring out my Stakes in the Ground and Measuring Rods and give you the Low, Middle and High Road Scenarios to establish a Game Plan.

For this particular Blog Note, let me accept three critical points that are now sitting on the latest version of Wikipedia, which by the way has been through a lot of changes in these last two weeks. Please try http://en.wikipedia.org/wiki/Hindenburg_Omen for all the latest details:

1. From historical data, the probability of a move greater than 5% to the downside after a confirmed Hindenburg Omen was 77%, and usually takes place within the next forty days.

2. The probability of a panic sellout was 41%, and the probability of a major stock market crash was 24%. Though the Omen does not have a 100% success rate, every NYSE crash since 1985 has been preceded by a Hindenburg Omen. Conversely, 76% of the time no crash has occurred.

3. The Omen’s creator, Jim Miekka, considered the Omen officially triggered on August 12, 2010 and confirmed on Friday on August 20, 2010, according to the Wall Street Journal.

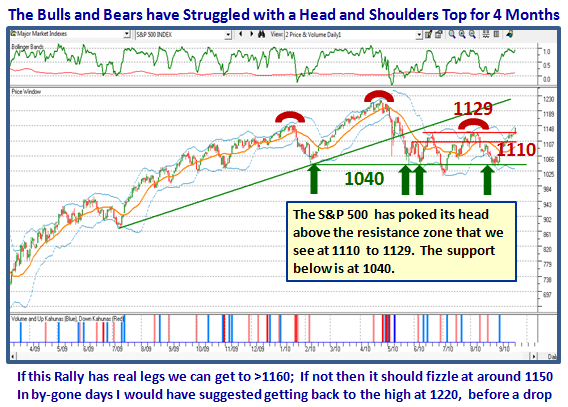

There couldn’t be a better time to put a box around these facts to establish whether we will have a Minor Correction, an Intermediate Correction or a Major Bear Market Correction within the 40 days since August 20, 2010. There are three other factors that have consumed the Emotions of the Market based on past history and the coming events in the next 60 Calendar Days, i.e., approximately 45 Trading Days:

1. The Presidential Cycle History of where the 2nd Half of the 2nd. Year is the most vulnerable

2. The fanning of the flames for the pros and cons of a Double Dip Recession

3. The Mid-Term Election which is due in about 60 Calendar Days, which fits ideally when the clock runs out on the Hindenburg Omen as mentioned in the very first item of stakes in the ground.

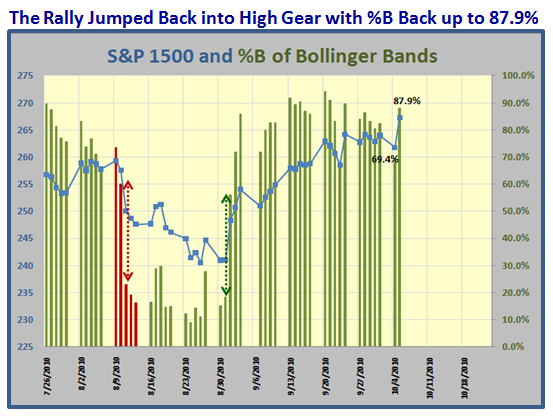

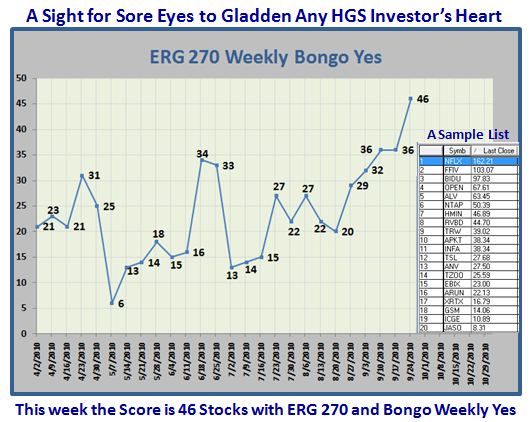

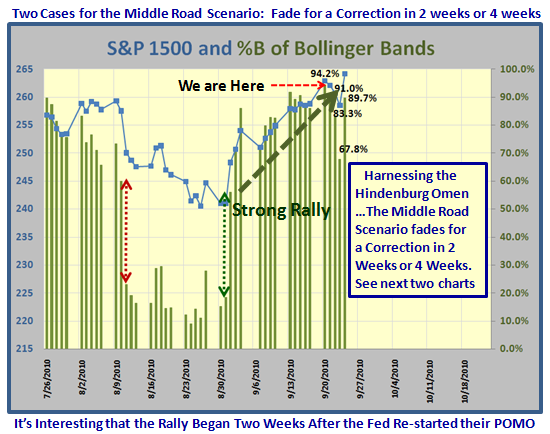

As you well know, I have been constantly raising the bar on understanding the value of using John Bollinger’s %B in mapping the ebb and flow of the Market. I felt this was an ideal opportunity to test my skills at establishing the Low, Middle and High Road Scenario using the work I have done. For those who are newbies at this stuff, here are three nuggets to take to the bank in giving you eyes in the back of your head to gauge which way the wind is blowing: “At your back, then attack…if in your face, disgrace if you don’t take defensive action.”

1. The uniform and CONSISTENT rapid movement of %B as it ebbs and flows with the Market Indexes, ETFs and Stocks alike as I have demonstrated numerous times on this blog and in the Newsletter.

2. The strong Line in the Sand between strong and weak hands as %B sits above or below 0.5…the Middle Bollinger Band assuming 20 periods and 2 standard deviations as the general rule.

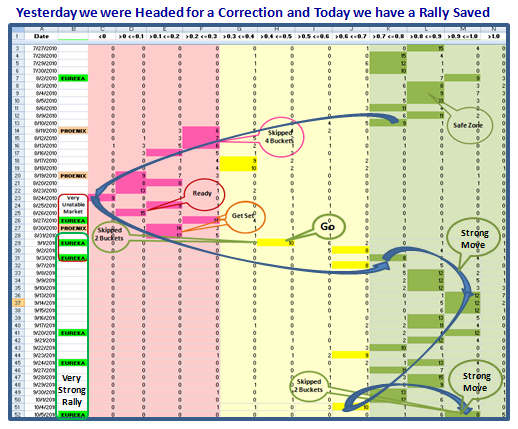

3. My latest invention of slicing %B into 12 Buckets as explained previously and the ability to immediately spot strength or weakness as % B “skips Buckets”. I will again demonstrate the value from what has transpired just this past two weeks while all this song and dance about the HO has persisted.

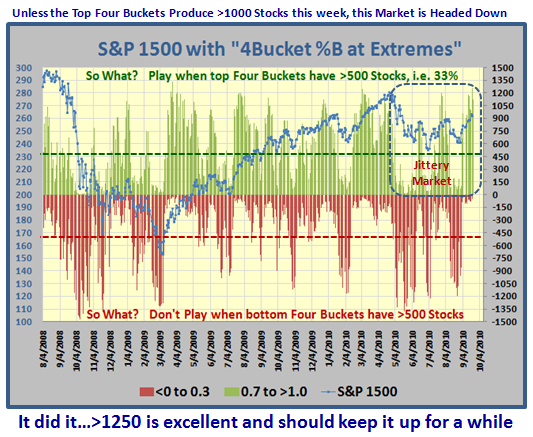

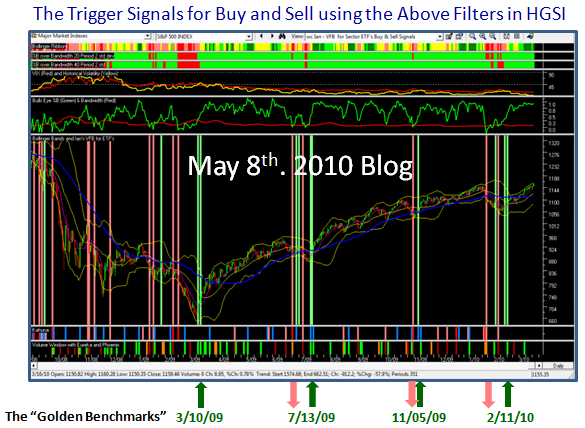

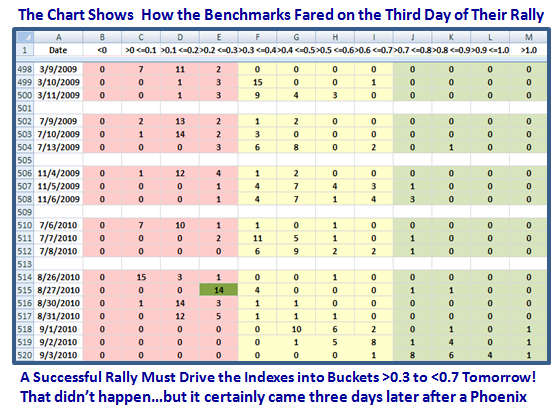

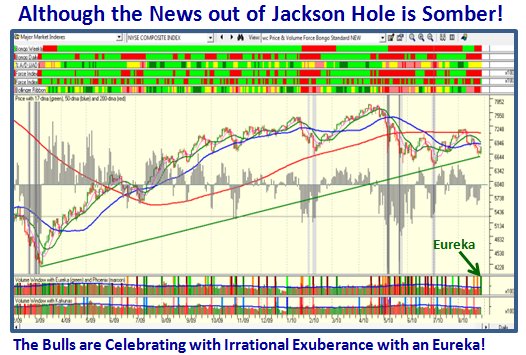

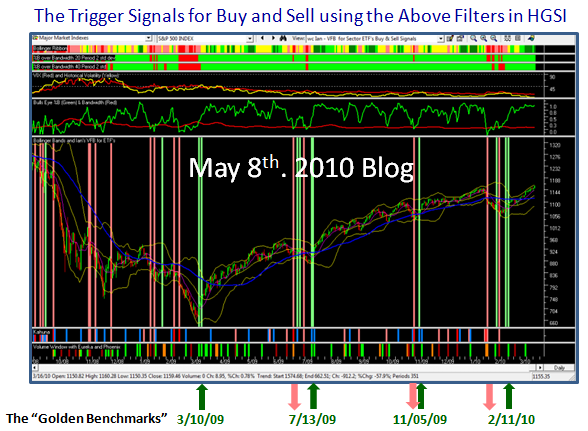

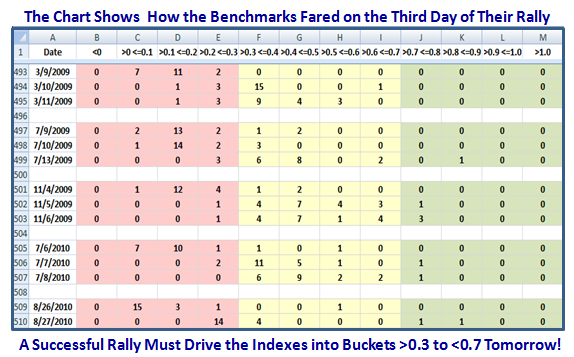

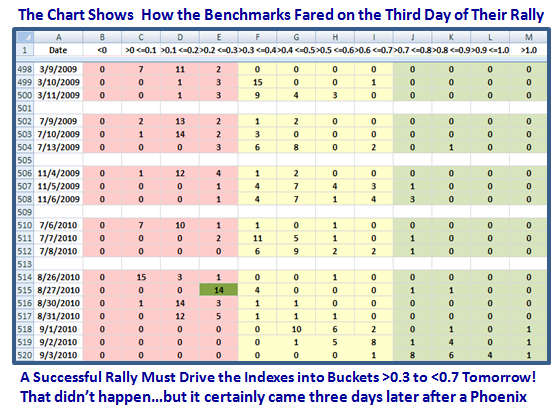

For continuity, let me start with the standard Benchmark of Golden Dates for Rallies this past 18 months:

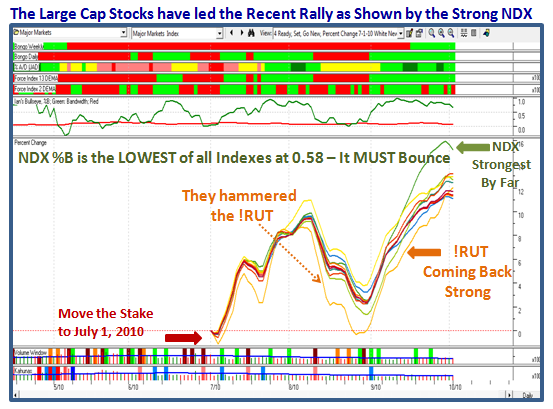

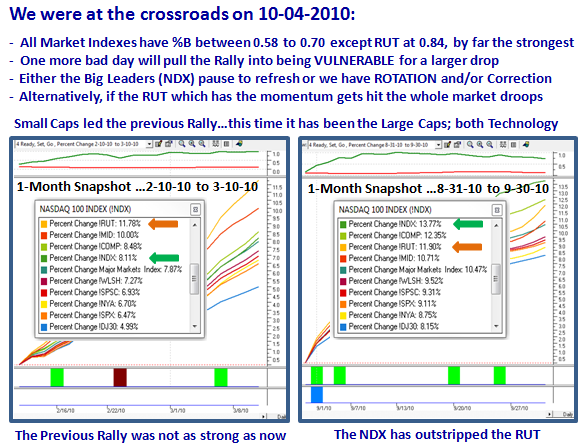

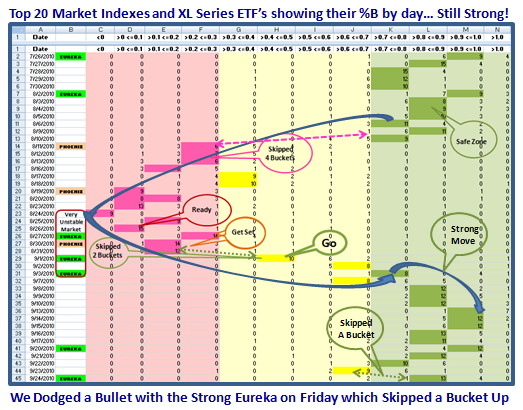

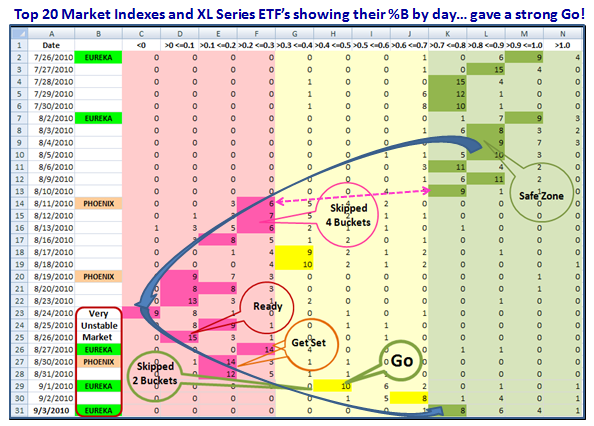

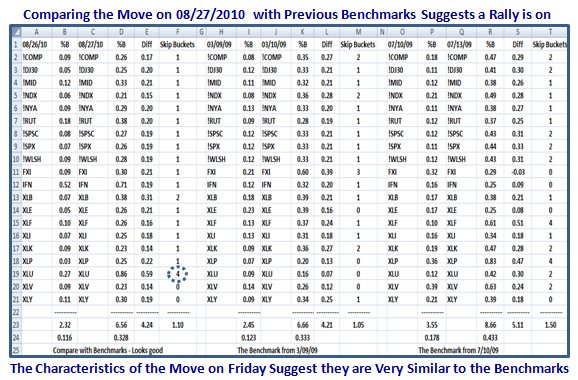

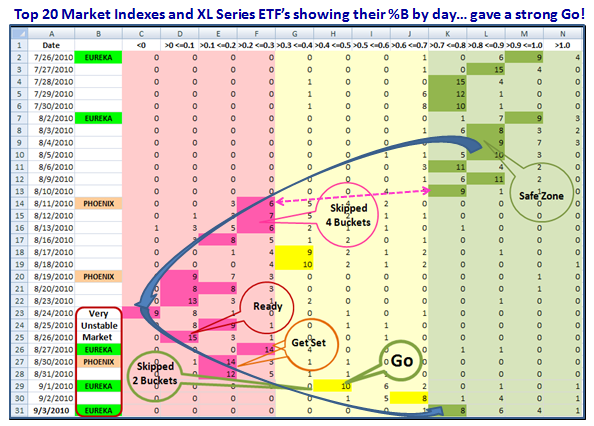

Now let me bring back the results of the 20 Standard Market Indexes and XL Series ETFs I use to gauge whether the market is moving up or down and particularly with what degree of strength or weakness. Here are the 20 Items: !COMP; !DJ30; !MID; !NDX; !NYA; !RUT; !SPSC; !SPX; !WLSH; FXI; IFB; XLB; XLE; XLF; XLI; XLK; XLP; XLU; XLV; XLY:

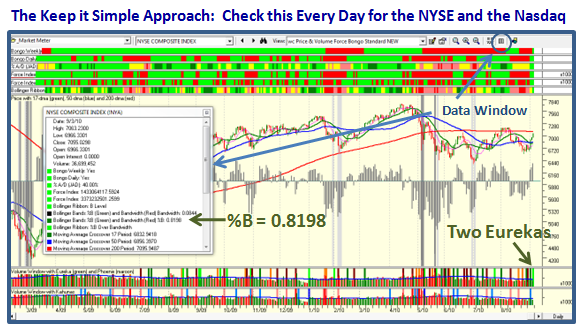

The chart may be a trifle difficult to read, but please don’t write telling me so as the message is on the top and bottom of the charts, and that is the focus, especially as you cannot reproduce all this stuff nor do I want you to. Now let’s brighten it up for you to follow exactly what the messages were this past month:

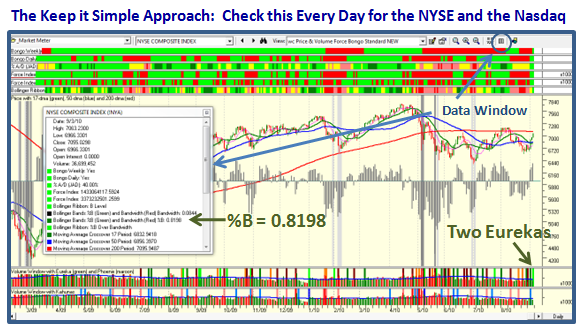

Let’s understand step by step what the messages are:

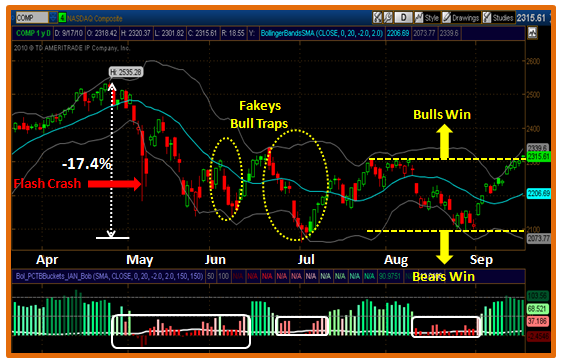

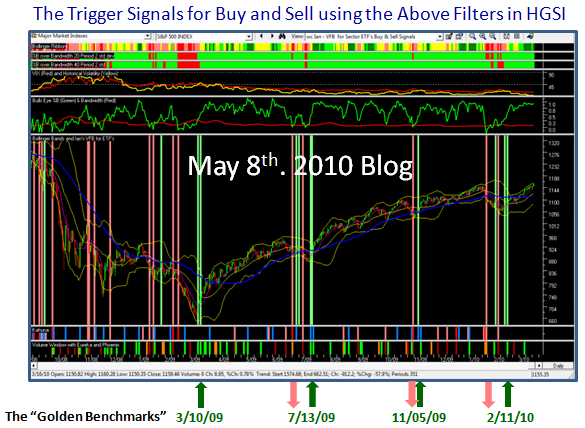

1. With two Eurekas on 7/26/10 and 8/2/10, respectively, the Indexes sat in the Safe Green Zone.

2. Then on August 11th, the cave fell in and there were rumblings of a Hindenburg Omen on that date but conceded it was close and no cigar, followed by one which most asserted occurred on August 12th, as mentioned above.

3. It wasn’t any surprise to me as the preponderence of the Indexes skipped FOUR Buckets on the 11th coupled with the Phoenix Impulse Signal as shown.

4. The Indexes tried to bounce back but then crashed with the second Phoenix signal on the 19th August, only to find we had a follow up Hindenburg Omen on the 20th, one day later. Obviously not a coincidence when the Market was now turning from Bullish to Bearish and hence New Highs kept dropping while New Lows had risen to meet the HO requirements.

5. When it hit bottom on 8/24/10, the question at that time was the party over or was the Market so oversold that a rally attempt was forthcoming, and true to form it turned out to be the latter.

6. I show the Ready, Set, Go criteria as the Indexes blossomed by skipping two buckets to the upside on 9/01/10, coupled with an Eureka, and followed up with yet another one to close out for the Labor Day Holiday this past Friday. We are now back in the Safe Zone, but do we endure another Fakey of a Bull Trap, or do we move out with gusto this time?

As my good friend Aloha Mike Scott reminds me “A few days and we have gone from gloom and doom to bloom and boom. That doesn’t feel quite right. Tip toeing in and nervous as a cat.” He was also the one to suggest we dust off the old Low, Middle and High Road Scenarios, so let’s give that a whirl:

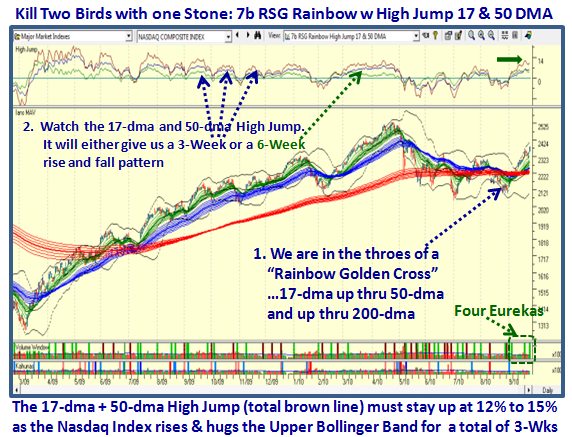

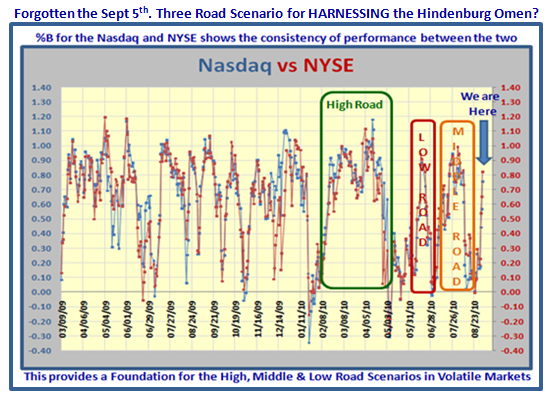

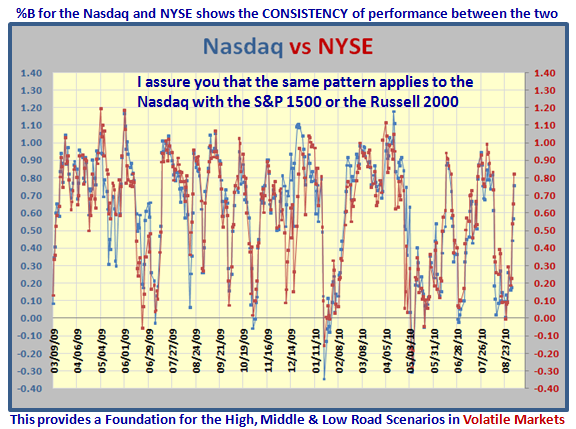

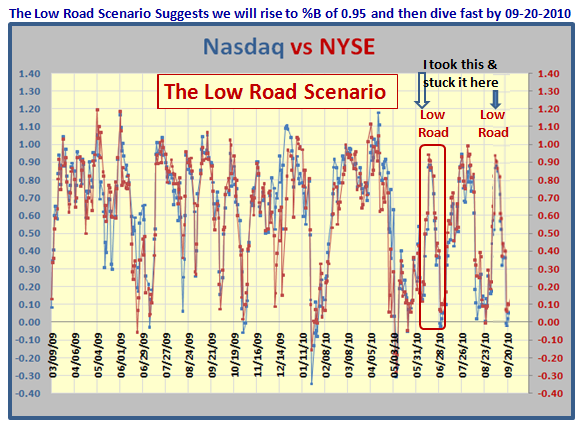

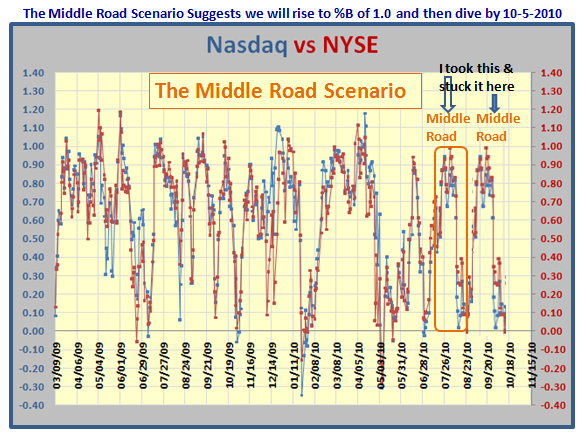

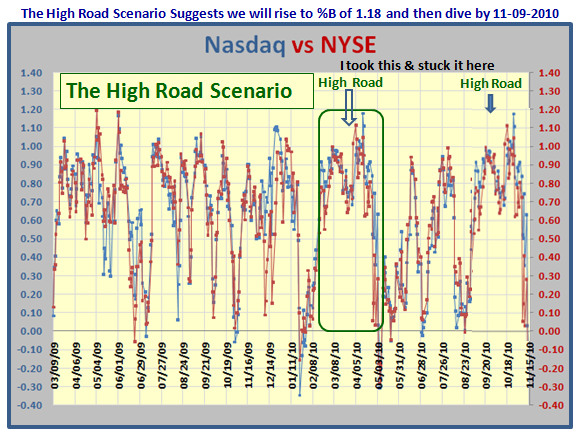

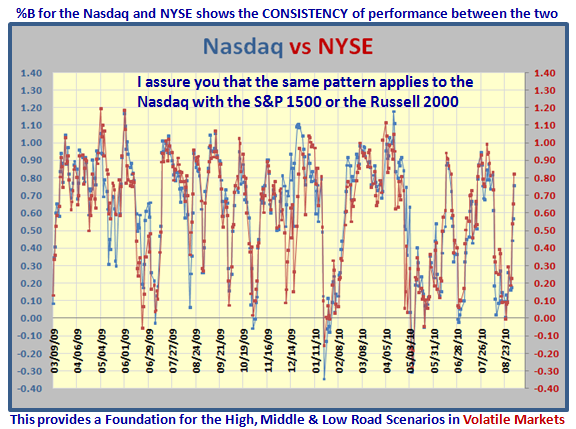

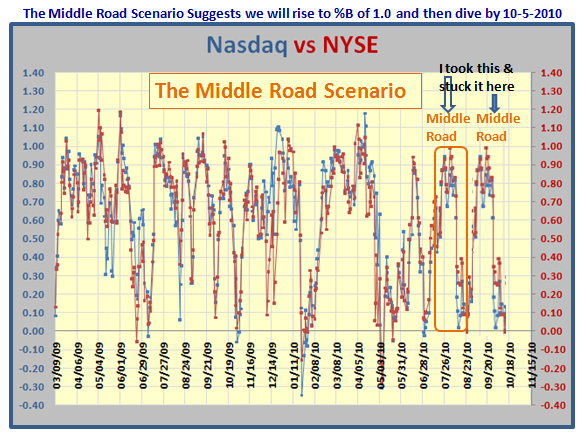

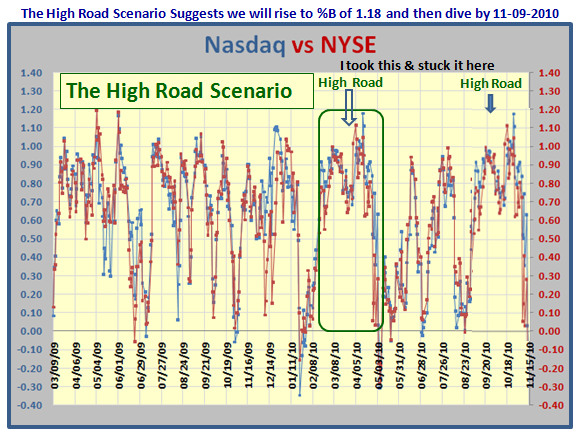

Over the course of the last 18 months, I have driven home the fact that %B is one of the most CONSISTENT Indicators across the entire database, be it Market Indexes, ETFs or Stocks. But here yet again is that picture showing the Volatility of the Market we have endured, but also I now show you the comparison between the Nasdaq and the NYSE. This is going to be a long blog note, so take it from me that the chart patterns are essentially the same whether one uses the Nasdaq, the NYSE, the S&P 1500, or the Russell 2000, or most any other Major Market Index or ETF you choose to use.

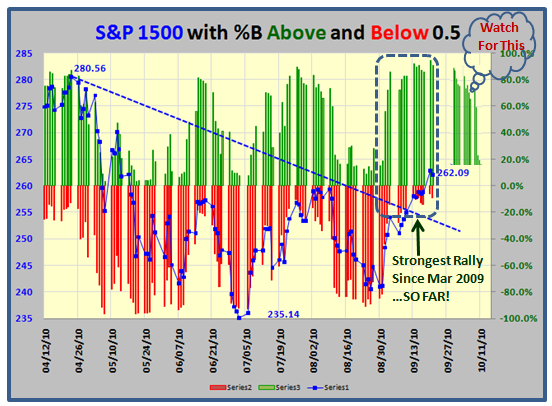

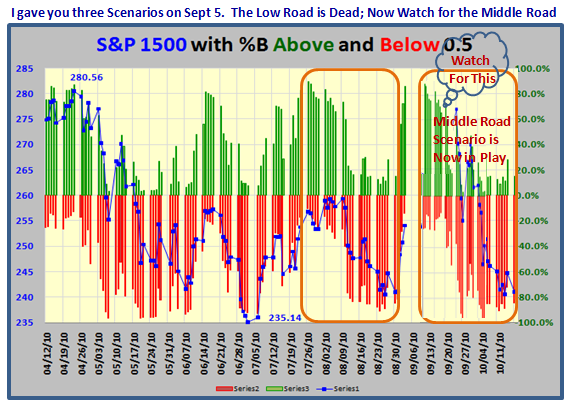

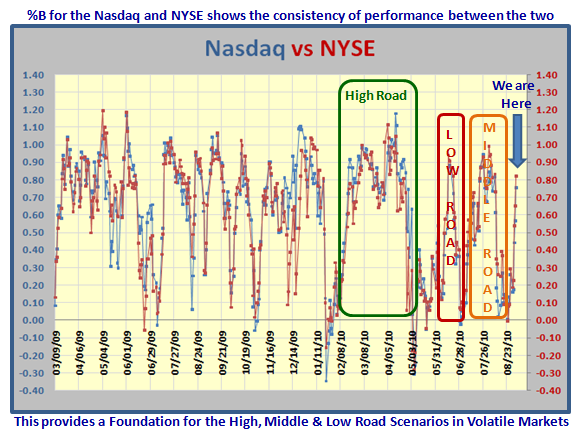

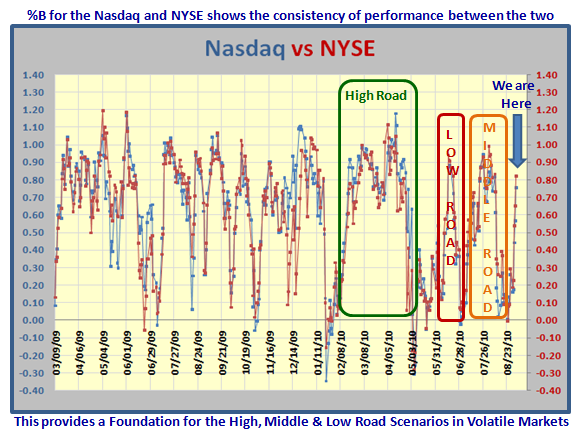

“So What, you ask?” Right before our very eyes we have experienced in the last 6 months, the High Road, The Low Road (Fakey, Bull Trap) and the Middle Road Scenarios, and here they are circled for you:

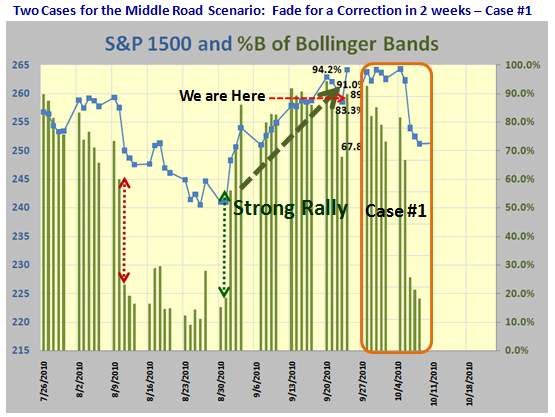

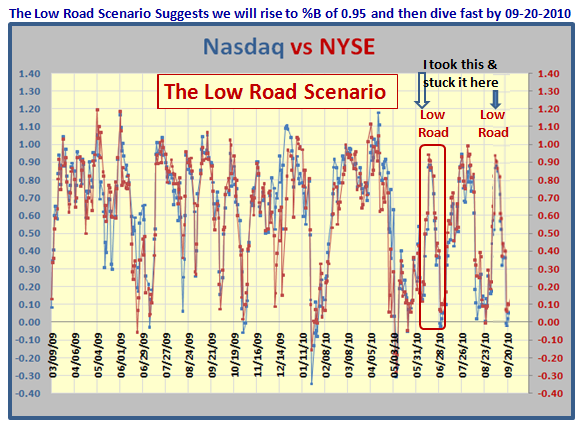

So, let’s start with the Low Road Scenario which is shown below and suggests we dive within a matter of ten trading days based on the June Fakey and Bull Trap. I have copied and pasted that phase onto the current status to show what the picture would look like for the Low Road Scenario.

The beauty of the approach is that we don’t have long to wait to prove that the market is behaving so unstable that after two Eurekas we are back in the doldrums of presumably more instability with Phoenix Impulses firing yet again. I suggest we should know before this month is out and is in keeping with September invariably being the worst month of the year, when the big boys will be back in full force from the Hamptons after the summer vacations.

If all of this is true, then expect to see us trot a little higher on the %B bandwagon for a very few days in the “Safe Zone” above 0.7, and then peak and trundle on down for the next ten days or so. Just count the red dots if you don’t believe me. In addition, the expectancy is that there will be no further Eureka signals and certainly we should see a Phoenix in this timeframe. This implies that there was no follow through by the Bulls, and we had essentially bounced from an oversold situation. Also, expect a sudden drop in %B with “Bucket Skipping” to the downside.

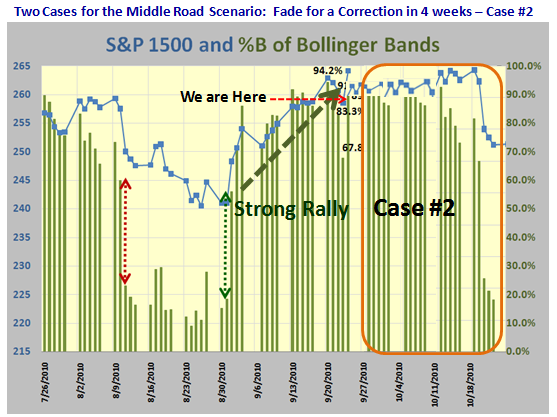

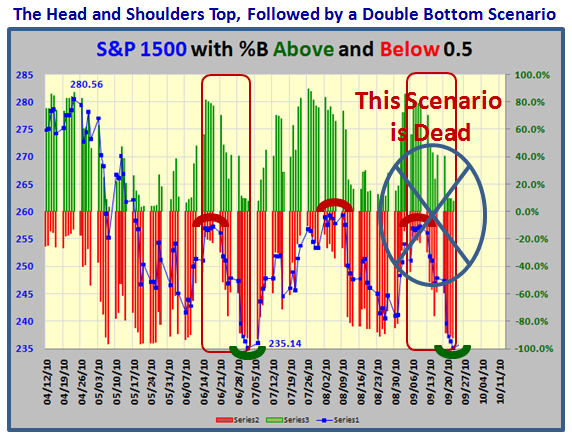

I have used the same process of copy and paste, and to cut a long story short we should dive by early October. For us to see a decent rally of at least 20 trading days we should see more confirming Eurekas to drive and hold the majority of the Indexes in the Safe Green Zone of 0.7 to >1.0. This Scenario implies an unusual Rally through most of September. Understand that this Scenario closely matches the time period for the HO to clock up a major drop as we would be well into 32 trading days by October 5. To be on the safe side add another week, and the HO mumbo jumbo is History or there will be all sorts of gloom and doom by October 12 that this is indeed a magic potion! We would be less than three weeks away from the Mid-term Elections. Note that Bucket Skipping will quickly signal the downfall.

As we see from the caption at the top we will stay above the golden 0.6 level on the %B for all of two months and then dive, (I didn’t say die) around the Mid-term Election time, which would imply that the Market did not like the results! In all we should see a powerful move with three more Eurekas in quick succession similar to that of the Benchmark of March 2009. This should sustain the Rally in the Green Zone for at least two months. Though there will be dips, the majority of the Indexes must stay well above 0.6 and certainly above 0.5.

Now, most of you cannot or do not want to do all of this detail to stay on top of what I have produced. I don’t expect you to. However, I am sure I have woken you up to at least check on a daily basis where %B sits on your HGSI Charting Module for the NYSE and the Nasdaq. I trust you like the logic of what I have shown you to stay one step ahead of the skittishness of the Market. There are no tricks up my sleeve, as you have lived through all of this for the past 18 months and survived.

Last but not least, if you don’t watch for Skipping Buckets and taken defensive action if %B falls below 0.5 then you have learned nothing out of all of this. Just use your wc chart in the Charting Module and open up your “Data Window” and you will see that the current reading for %B is a healthy 0.8198!

The message is that the Three Road Scenario I have outlined above gives us the heads up to manage the gloom and doom of the Hindenburg Omen, the 2nd half of the 2nd year of the Presidential Cycle, and all the kerfuffle of a Double Dip Recession with a Game Plan that makes sense using Bucket Skipping with %B. Now let the Market tell us which Scenario it is on within the limits of 10, 20 and 40 trading days! If we do, then chalk one up for Jim Miekka. Anything past that timeframe and the HO is history, especially if we don’t see a Major Fall in the Market.

Have a Good Labor Day, and put the Seminar high on the Things to Do List as we have only 6&1/2 weeks to go! Please don’t leave your reservations until the last minute, as the Hotel Rooms must be booked and reasonable airfares reserved by around now.

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog