Stock Market Rally – Days are Numbered

Sunday, April 18th, 2010I am a little pushed for time so I will fall back on snippets of a Running Commentary with my friend and Seminar Attendee, Hsin, and others over the last three days. We also covered this at yesterday’s Monthly HGS Investor Meeting, so all are up to speed.

Wednesday, 14th April, 2010

When you start rubbing your hands with glee, for sure that is the time when the Market is nearing a top:

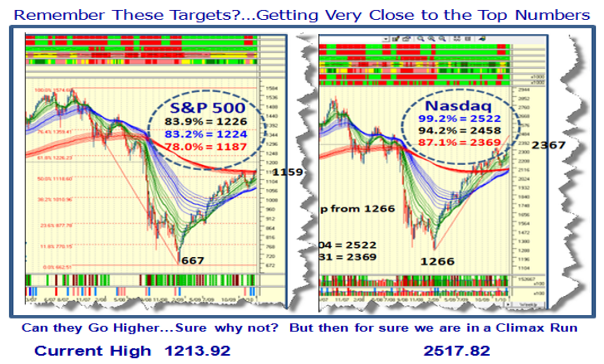

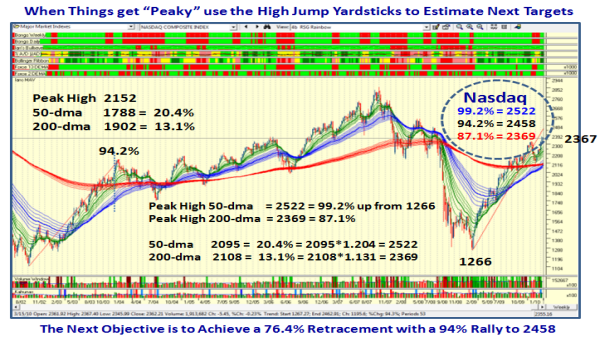

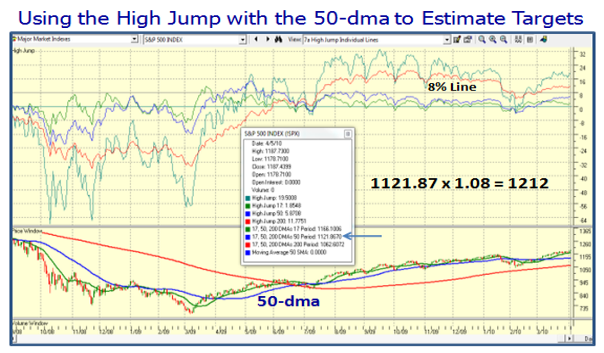

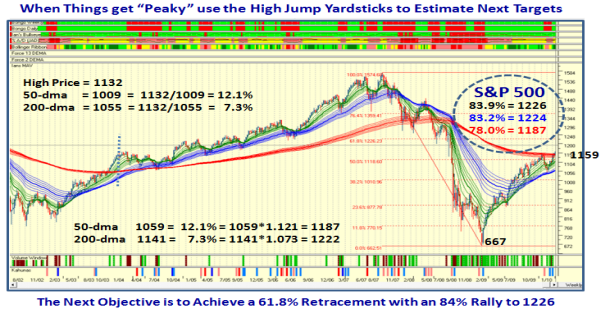

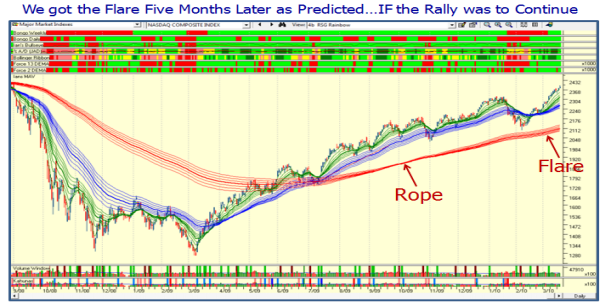

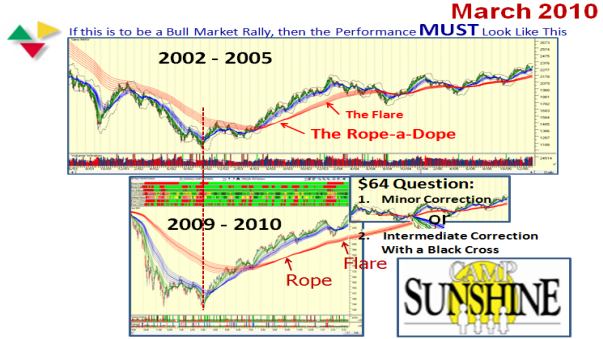

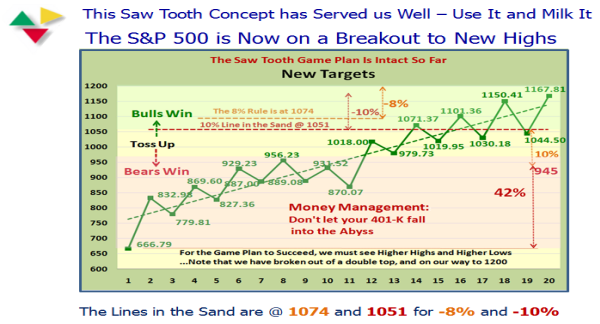

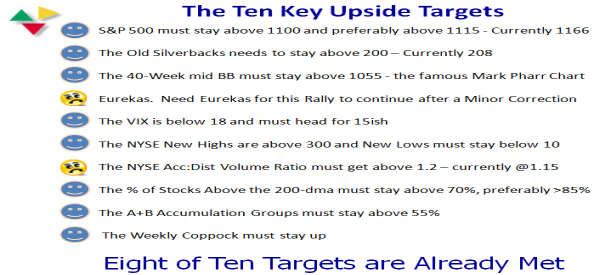

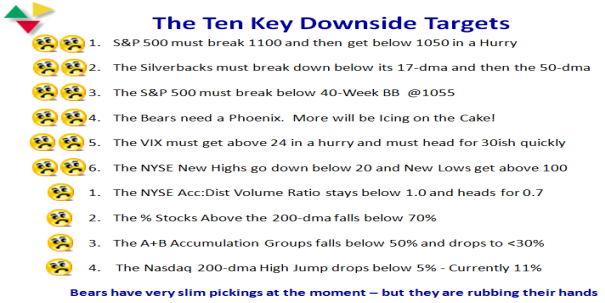

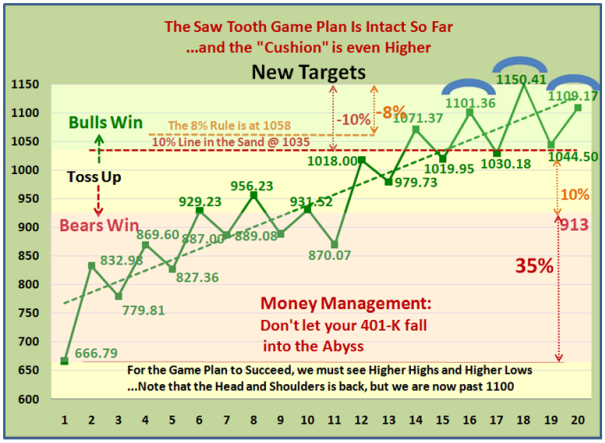

Recall the Targets I gave you at the seminar and have since posted twice on the blog…it suggests we are very close to the top for now:

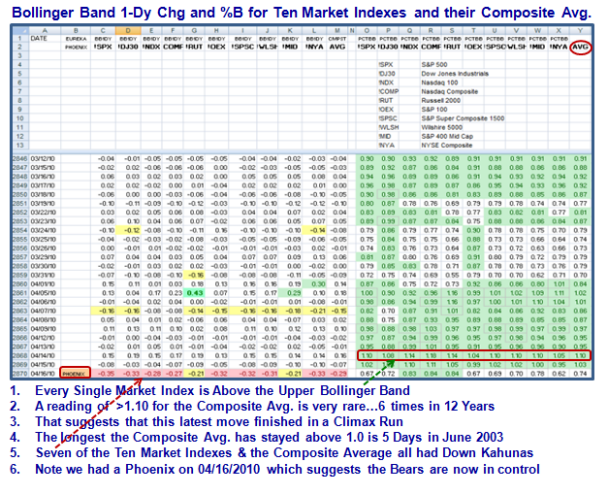

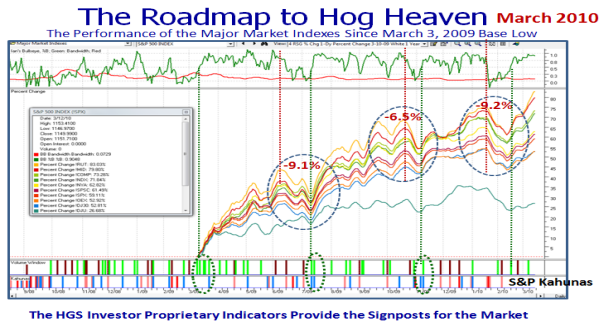

Now the $64 question is when will this beast give a Climax Run? The answer is very soon, and I am claiming that some form of correction is due within a week to ten days. We shall see, as you well know nobody knows for sure. But why do I even suggest that?

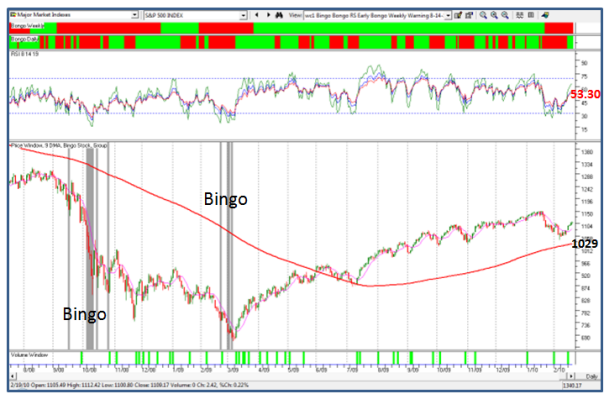

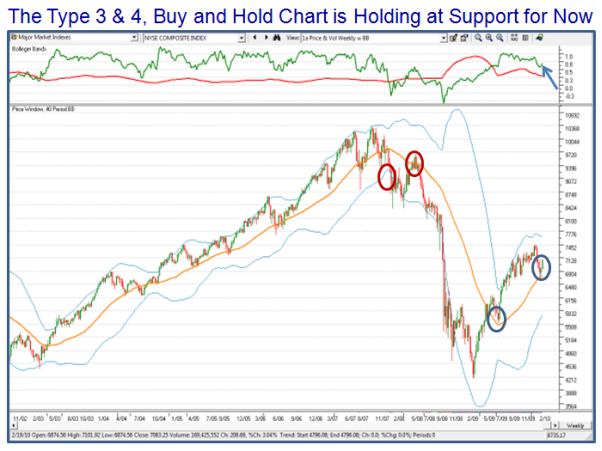

Hsin, you now have eyes in the back of your head…just look at the chart above and you will see from my notes why we are in VERY RARE Territory. There are only six other times in 12 years that the COMPOSITE AVERAGE of %B of the Bollinger Bands of all ten Market Indexes have been above 1.1. I go on to give you additional statistics on that slide so enjoy before I put up my blog hopefully this weekend. Only back in June 2003 did the Composite of these ten Mkt Indexes stay ABOVE the Upper Band for five days before they began to drop.

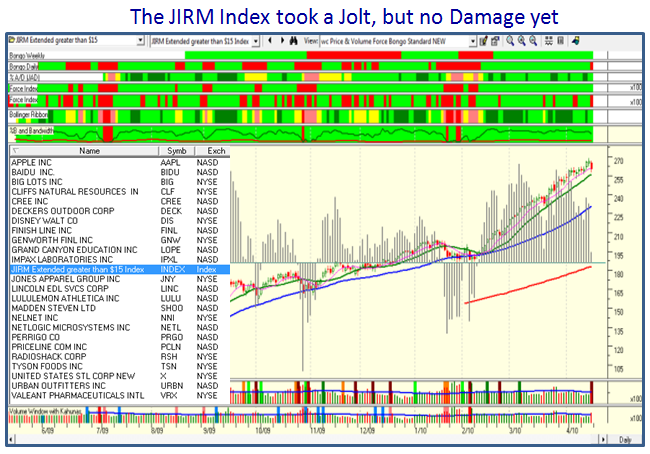

We have no way of knowing when the break will happen and there are many other things you should watch to see if they are breaking down, none the least of which is the JIRM Index…it will be one of the earliest clues.

The Three Scenarios:

1. A SURPRISE Knee Jerk down which will cause an obvious deterioration that all will see quickly

2. A Climax Run which will surpass the Targets I show on the 3rd chart…give it a few more strong UPSIDE days

3. A gradual fading of the rise with a correction that either gains steam or is minor and the rally goes again.

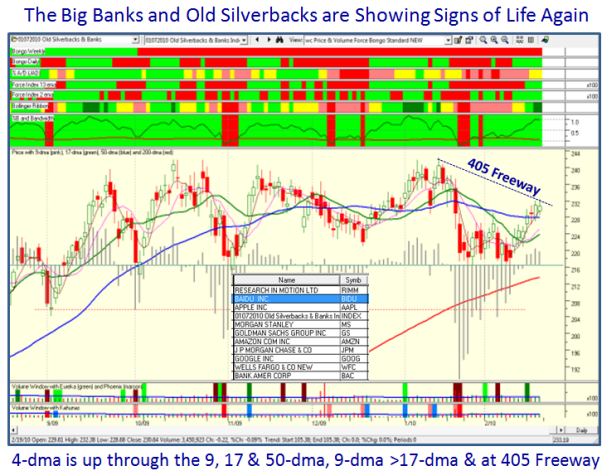

Don’t be TOO Eager to switch to the Short Side TOO FAST, is my next suggestion to you. The stock Market is not a Black or White, on-off switch, flip-flop, call it whatever fits your fancy…especially at the top. There are shades of Gray that you have to watch for very carefully. After all, what caused this sudden additional recent euphoria…INTC and JPM, Technology and Big Banks firing on the same day. Days like that don’t get turned off quickly. So make sure to keep an eye on the Old Silverbacks and Top Banks list plus the additional obvious ones you added such as CREE, NFLX, ISRG, PCLN, BUCY and PRGO, etc. etc. If you have to pick one stock of all to watch it should be CREE, why?…because it has given us >16% since the Seminar and is double all the rest. Late Breaking News: Note that they hammered GOOG after hours.

Good Luck, Ian.

Friday Night, April 16th, 2010

Well Hsin: Scenario #1 worked today so no need to look further after all that anticipation. But at least we knew we were close to the top, which again was pretty obvious, so no cigar! Since it is also Options Expiration day, we should be patient and see where they close this beast. The cigar comes with what happens next?

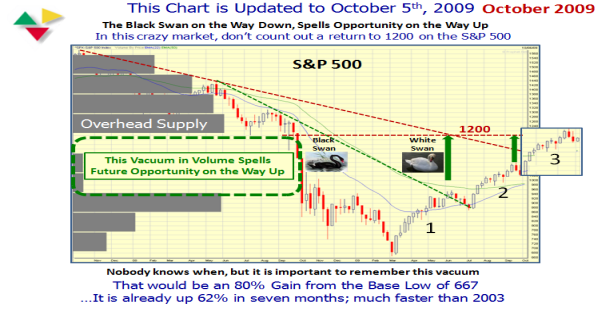

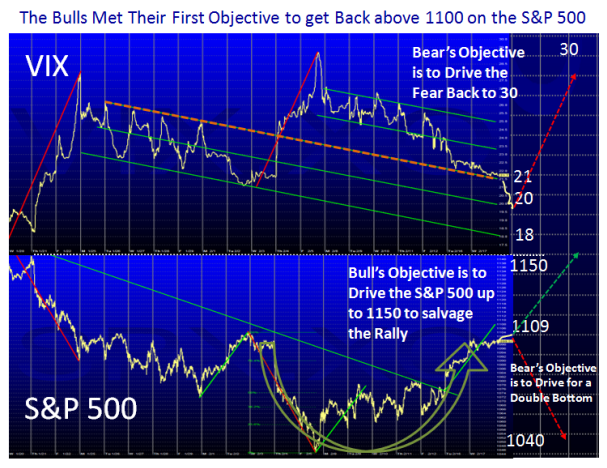

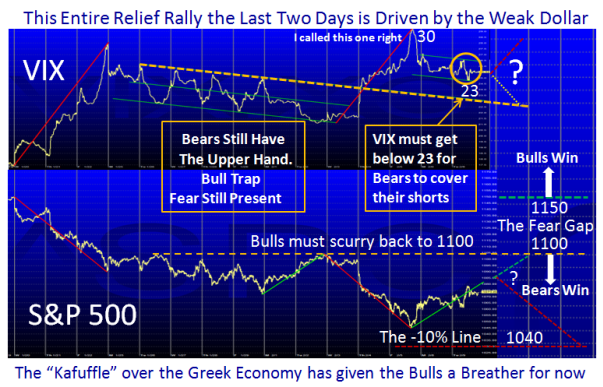

Either the VIX drives up another 3 points to 22ish and the S&P 500 goes down another 25 points (as I gave you GOLDEN Rules previously) and the party is over, or the Bulls come charging in to buy, buy, buy. With something as serious as GS Fraud charges, I suspect it will be the former. The floodgates open up below 1165 on the S&P 500, and will have wiped out the last 20 days gains.

In any event you now have the tools to tell you which way the wind is blowing…JIRM (an acronym named after four people at the seminar) is blood red today with all stocks negative at -2.37% down as I write.

Six stocks are already under water since we made the list, and another day like today will net another five or six to zero or negative gain. That spells half the leaders if that were to happen. That’s all you need to look for…period. Then the cigar comes with what happens after that. I will wait on your thesis!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog