Hey Captain – Are we Headed for a Depression?

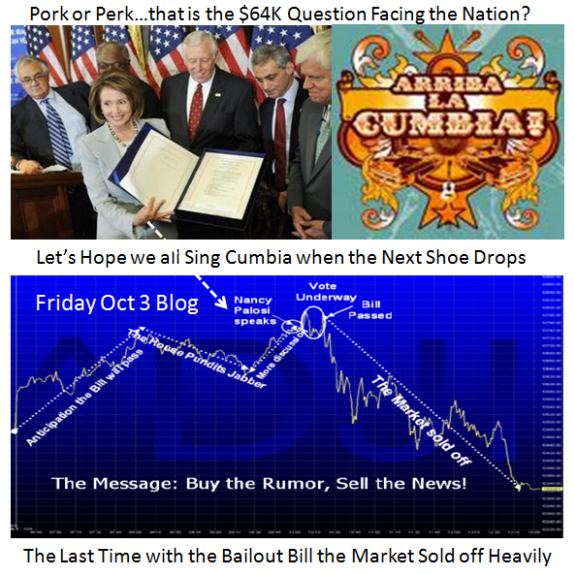

Wednesday, February 11th, 2009Sure enough…”Buy the rumor, sell the news” wins once again. It seems that Wall Street has a new Whipping Boy, so Helicopter Ben gets a respite and we have a new Sheriff in town. By the way, my blog shows that I have the most hits from this picture below which I posted many moons ago, so naturally there is a major concern as there has been new fear instilled into the rhetoric from the White House, the New Treasury Secretary and the Congress as they tell us in no uncertain terms that we are in dire straits not seen since the great depression. This is the refreshing new transparency and to be forewarned is to be forearmed. We can only hope that these three musketeers will turn the tide for the nation:

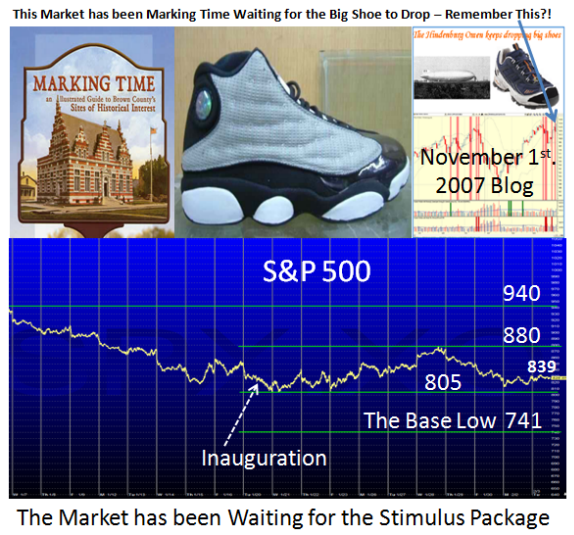

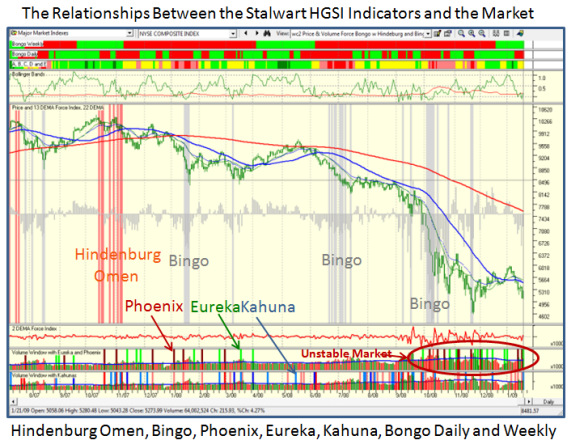

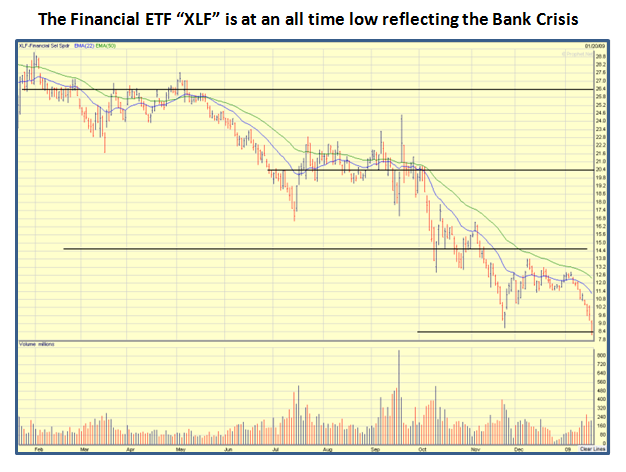

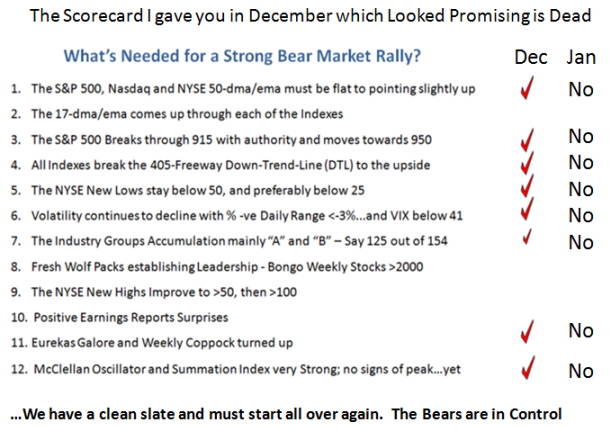

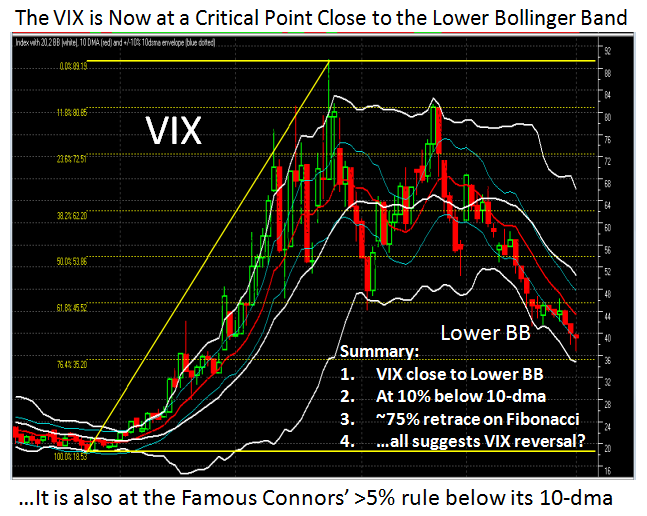

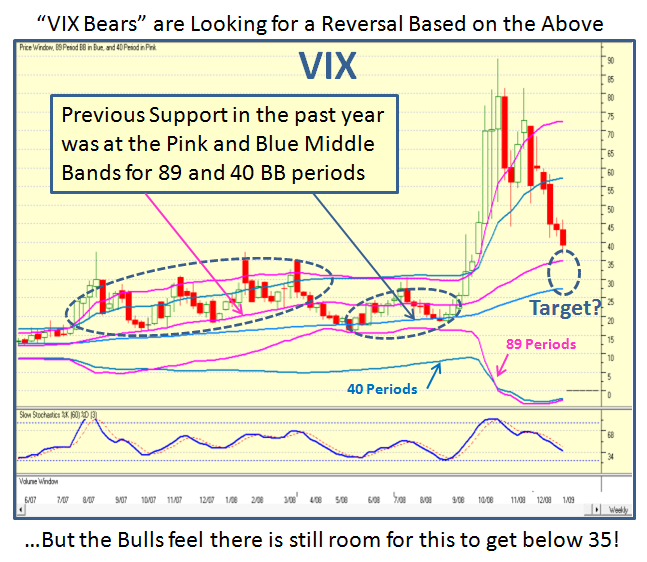

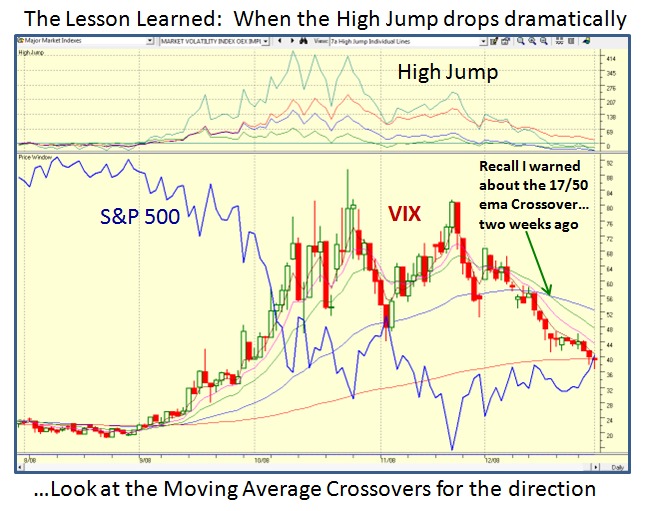

There is little point in my adding fuel to the fire…all I can tell you is what my eyes see in the reaction by the Market. It took instant heed and plummetted us into another Phoenix signal yesterday which decapitated the two Eurekas previously. So now we go on Red Alert until we see the Bulls Recoup when they were beginning to flex their muscles again, only to be driven into their cubby holes once more.

The bottom line message is that in these times it is better to be on the side of the Bears, and those who anticipated the “Buy the Rumor, Sell the News” axiom made a lot of hay yesterday.

So now who do you believe:

1. The Optomistic View: Warren Buffett and Zeall who feel the bottom is already in

2. The Pessimistic View: Maudlin and Tuttle Asset Mgmt who believe we are half way through a Secular Consolidation Phase and have another 7 to 9 years to go

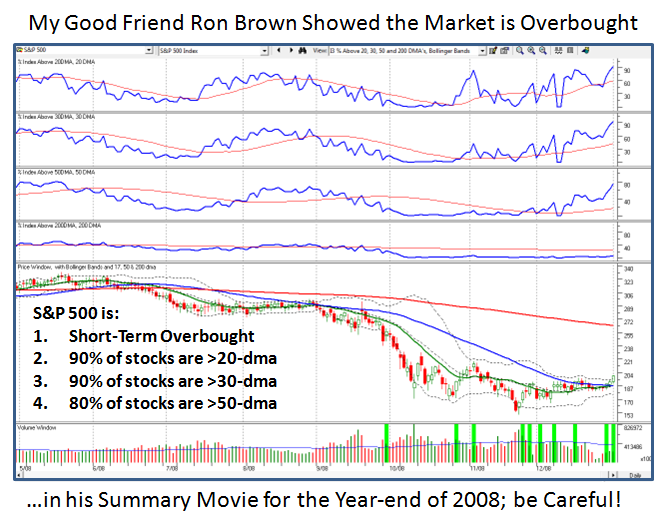

3. The Realistic View: Woodward and Brown who suggest to let the market tell you as we do in Ron’s Weekly Movies, the Newsletter and this blog. Why not try our Seminar in March 21 to 23 and you will learn how to protect and make money in these troubled times?

The brief messages as we hope to resurrect ourselves from the Phoenix ashes are:

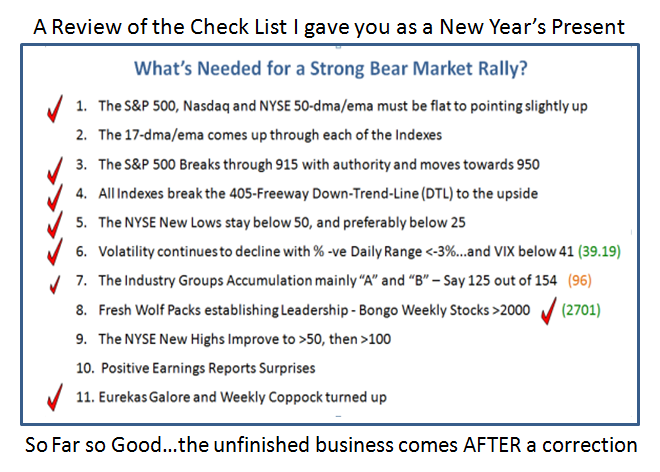

1. Use the Game Plan and Check list I have given you in several of my blog messages recently and…

2. Type 1 and 2 Traders enjoy to your heart’s content in moment and day trading…Type 3 use the check list, and Type 4 long term Buy and Hold, just be patient and wait.

Don’t waste your money trying to bottom fish. However, it is possible to make money off the bottom if you are nimble to give yourself a cushion but run for cover at the slightest sign of a mistake at the onset. I suggest you look at %Cl/52 Wk Lo, as most stocks are 50% or higher from the Base Low…you can do it if you are nimble, but make sure the Earnings are out. Understand that the difference between you and Uncle Warren is that he has deep pockets!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog