Stock Market: Fool Me Twice, Shame On Me!

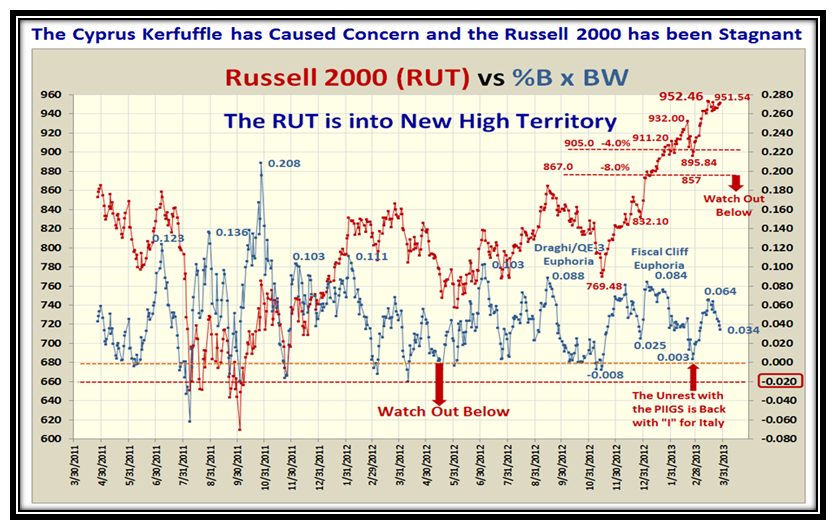

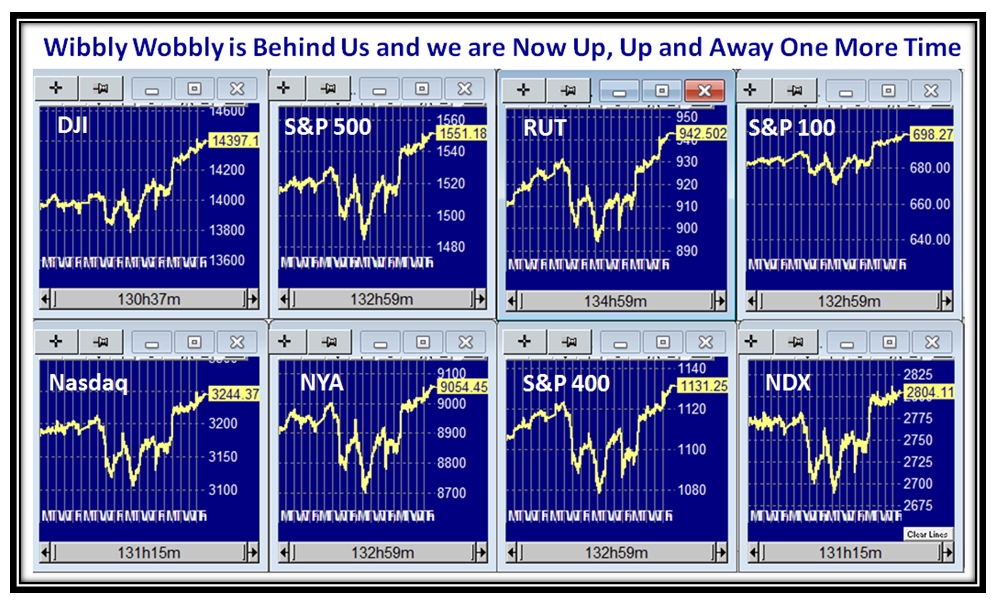

April 11th, 2013Yes, you guessed it, Uncle Ben did it again and the Bears are wondering what hit them. Their turn will come sooner or later but for now we are back to New Highs and flying high:

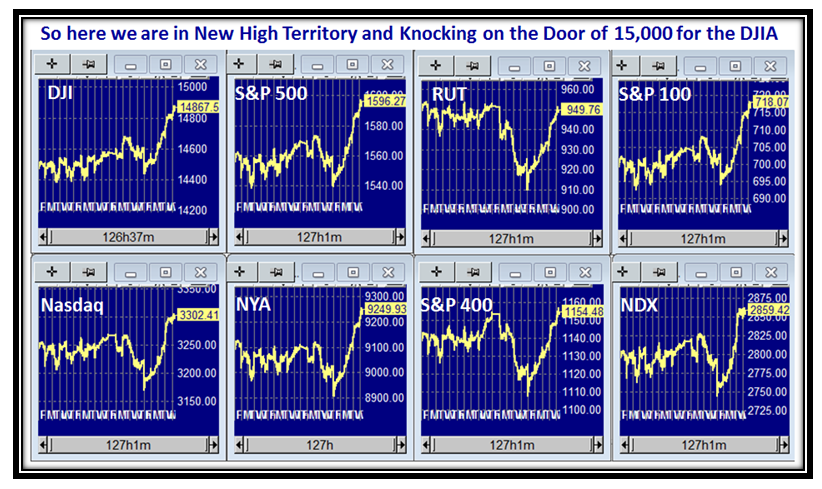

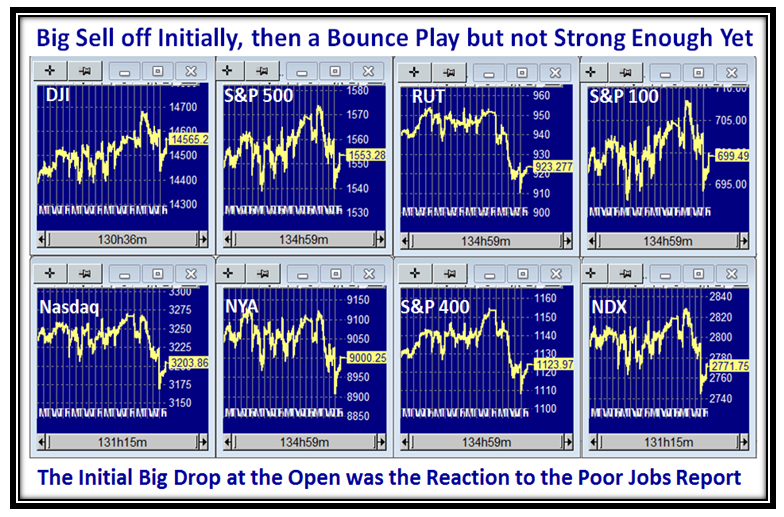

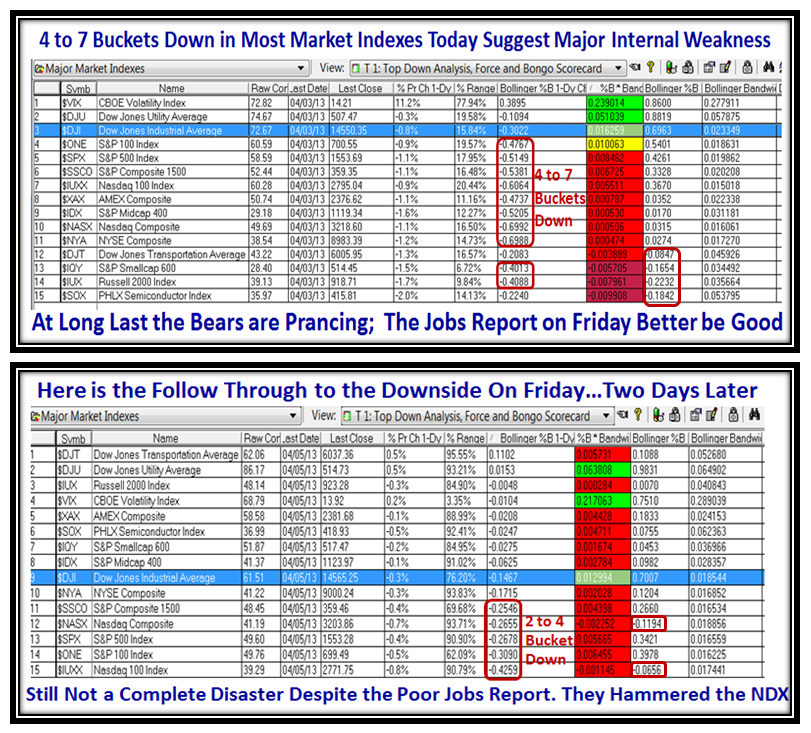

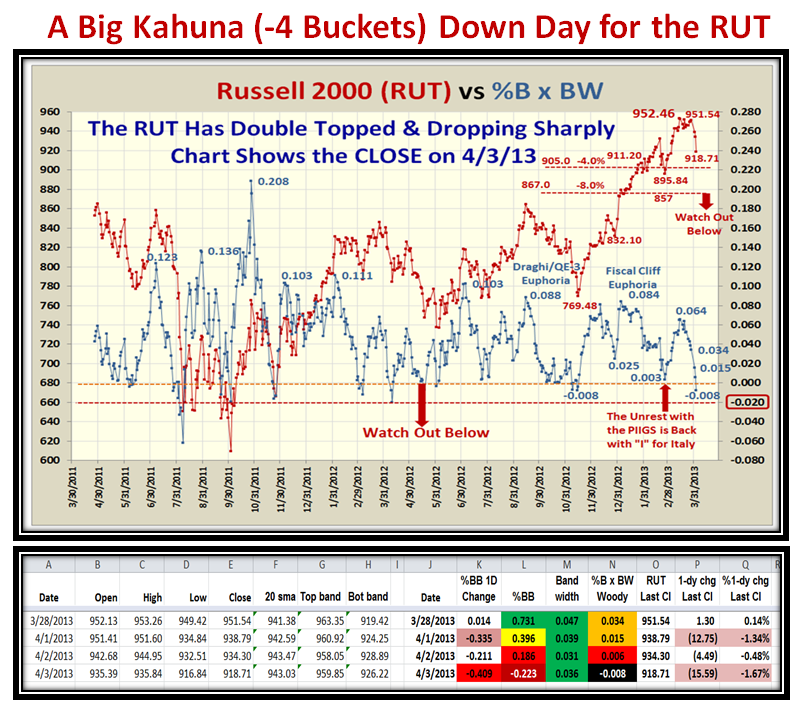

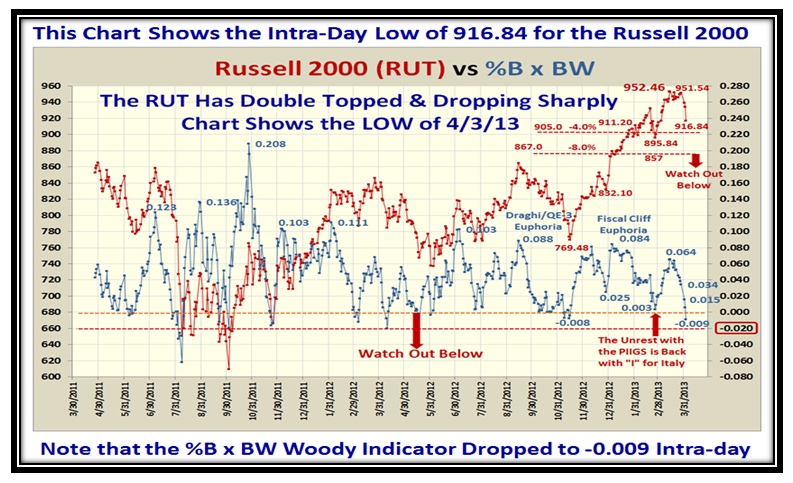

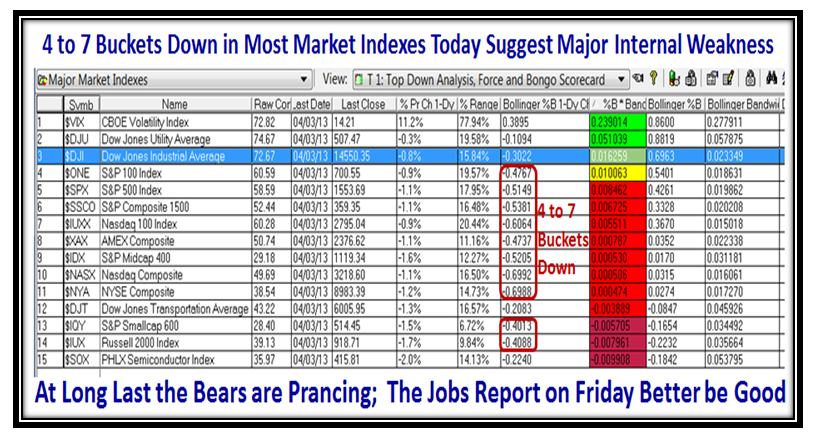

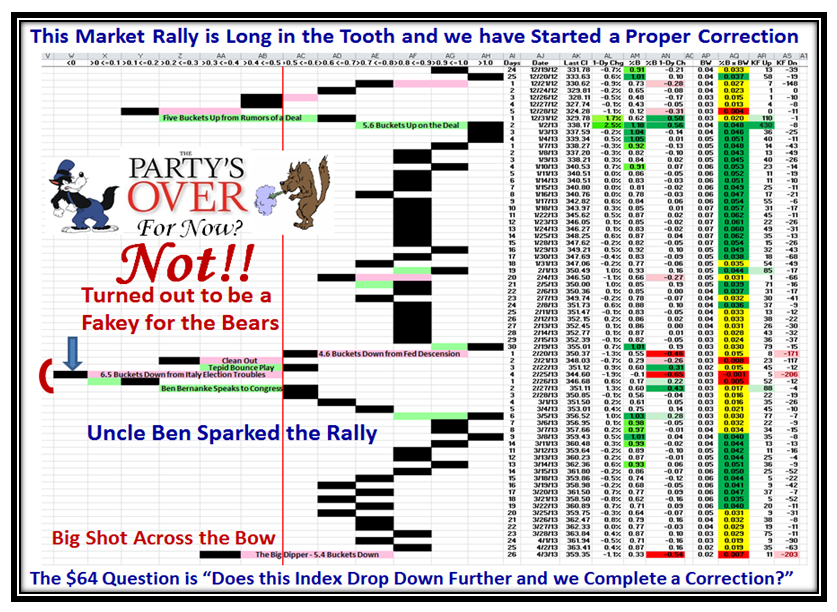

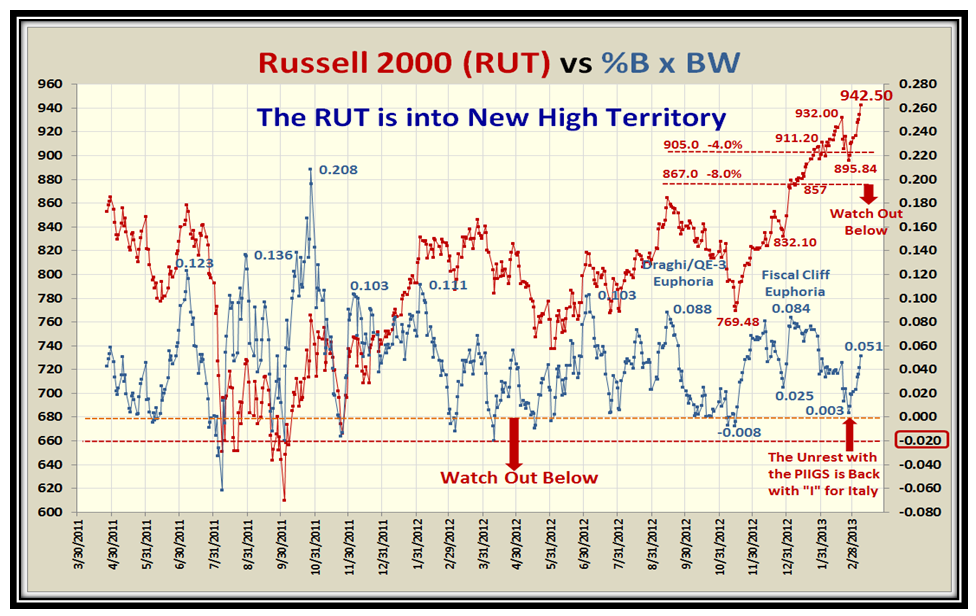

We have now had several different occasions where Big Knee Jerks are followed immediately by huge recoveries in the Market Indexes but where Volume by and large has been relatively sluggish while the Indexes trot up to New Highs:

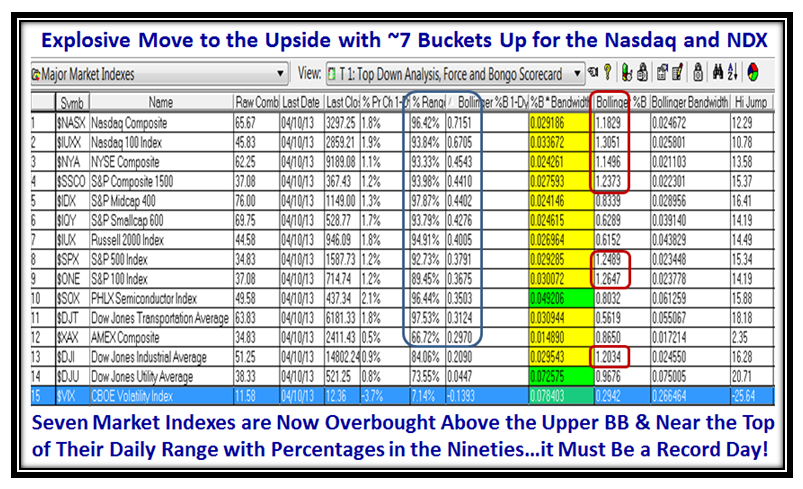

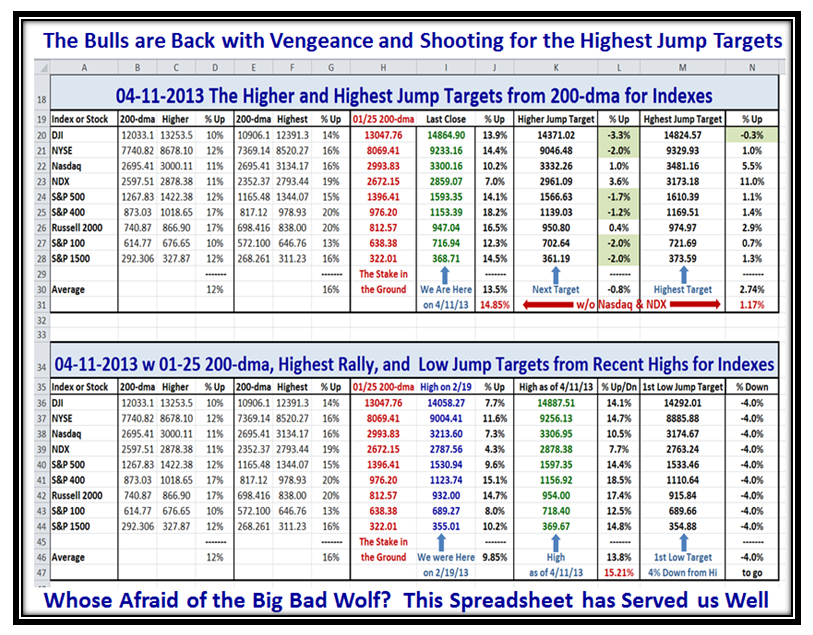

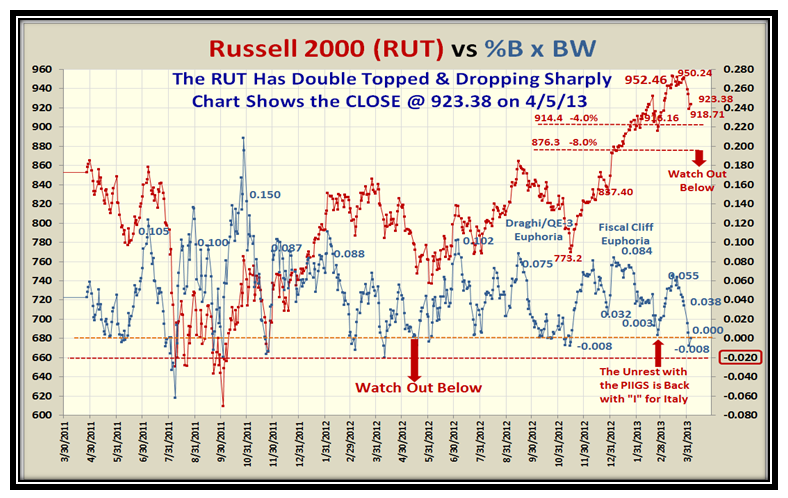

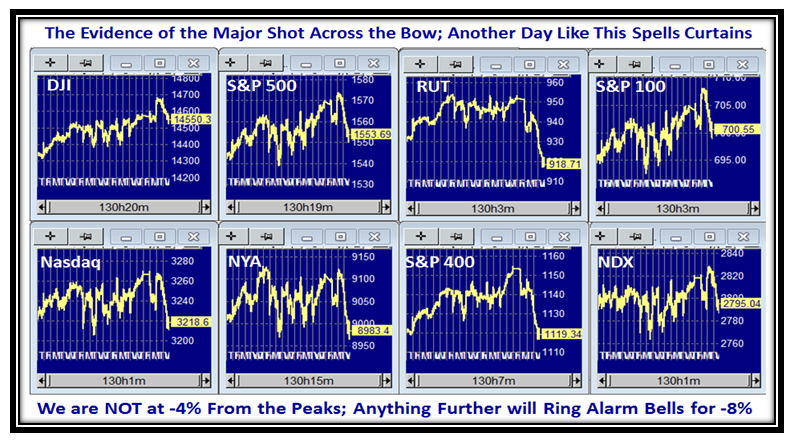

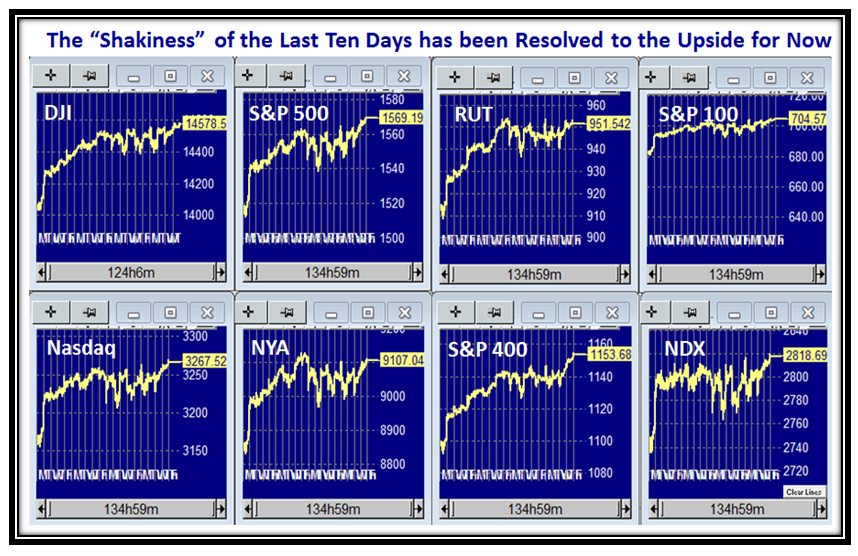

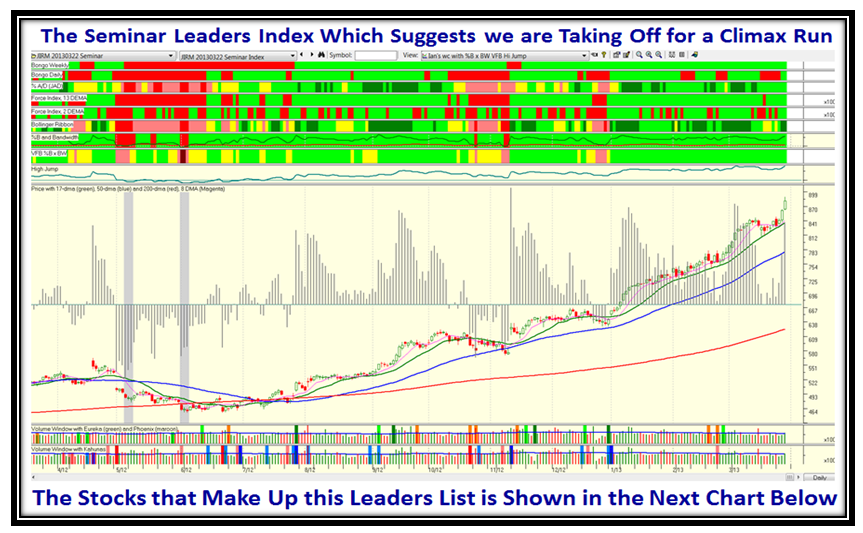

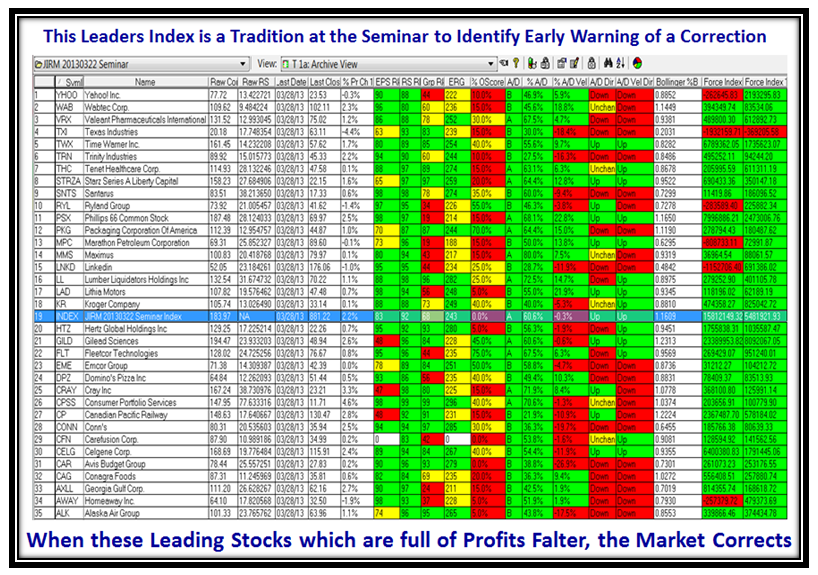

This next chart is an Eye Opener with explosive moves in all Market Indexes to the upside yesterday. There are now seven Indexes in Overbought territory, and following through again today but as one would expect not quite the same enthusiasm:

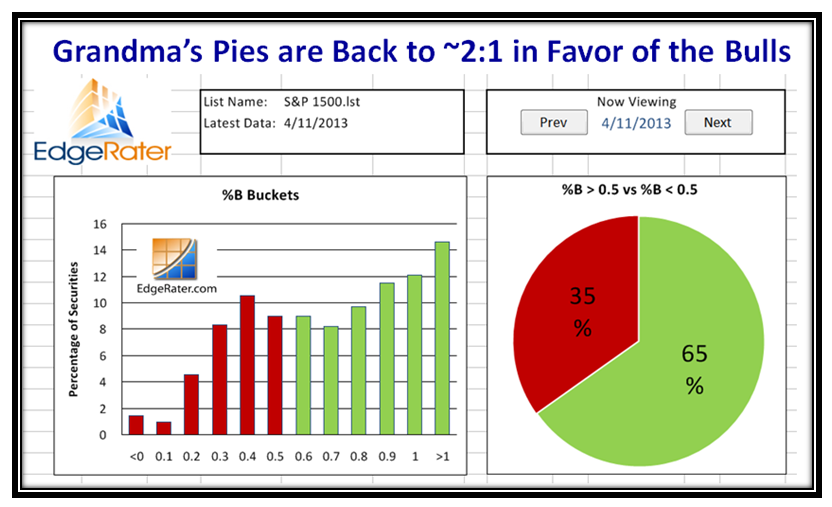

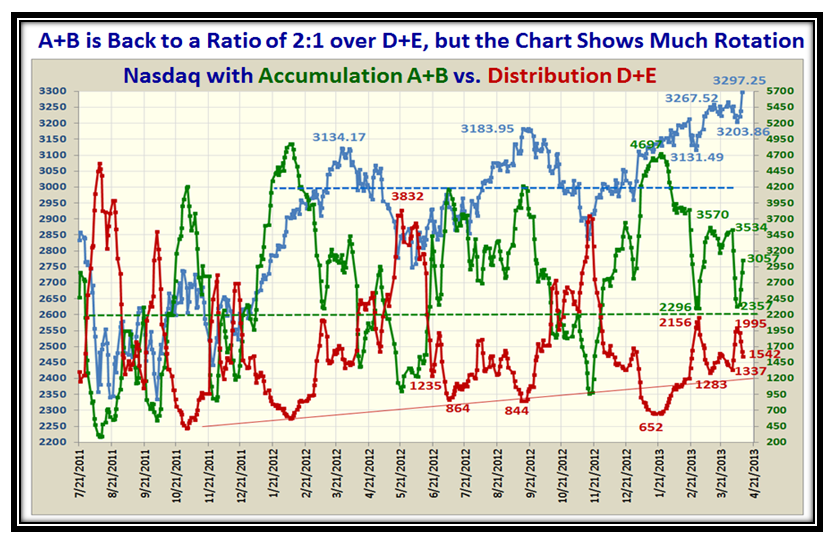

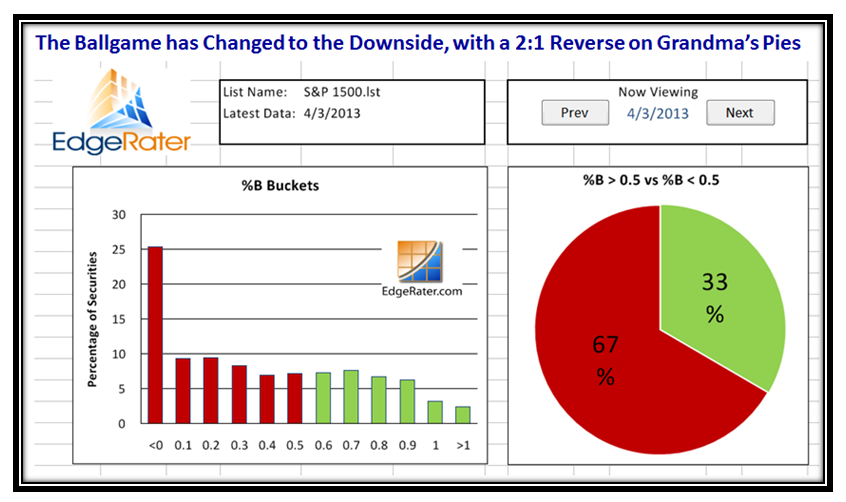

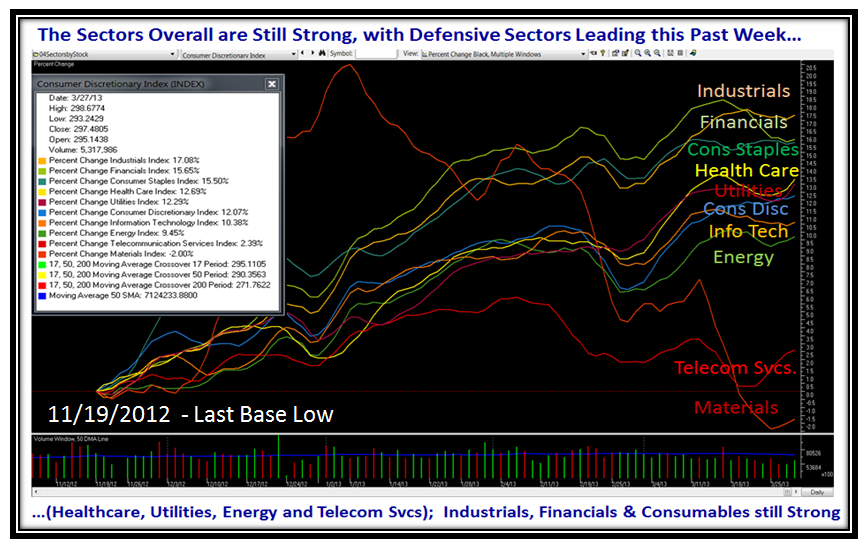

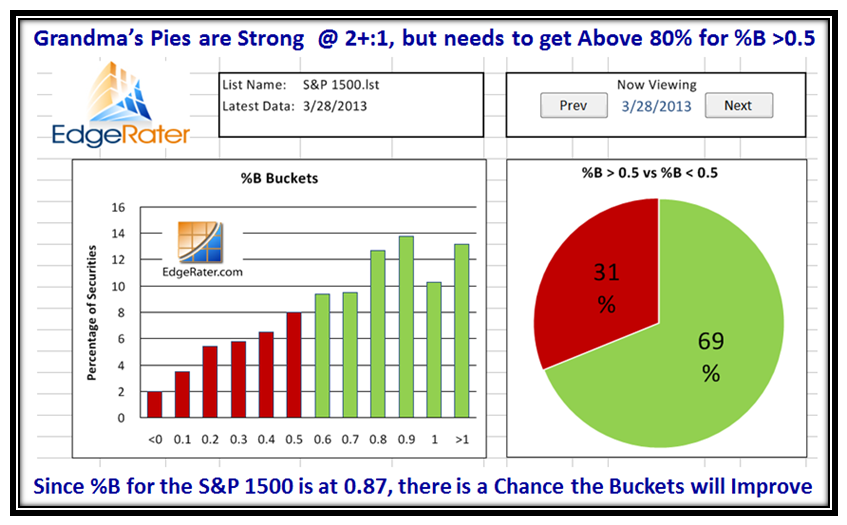

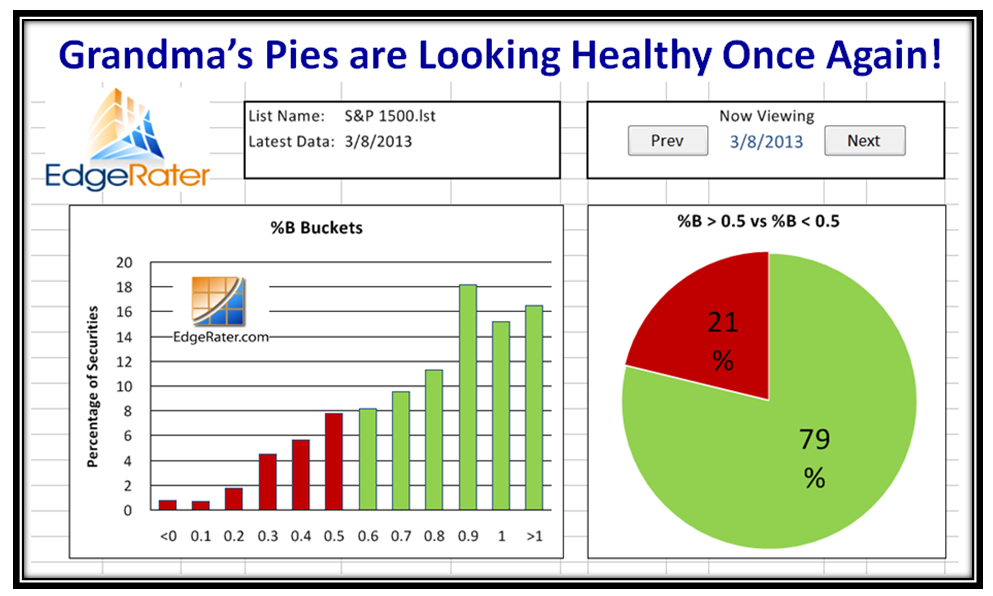

Grandma’s Pies are back to being healthy with ~ 2:1 in Favor of the Bulls:

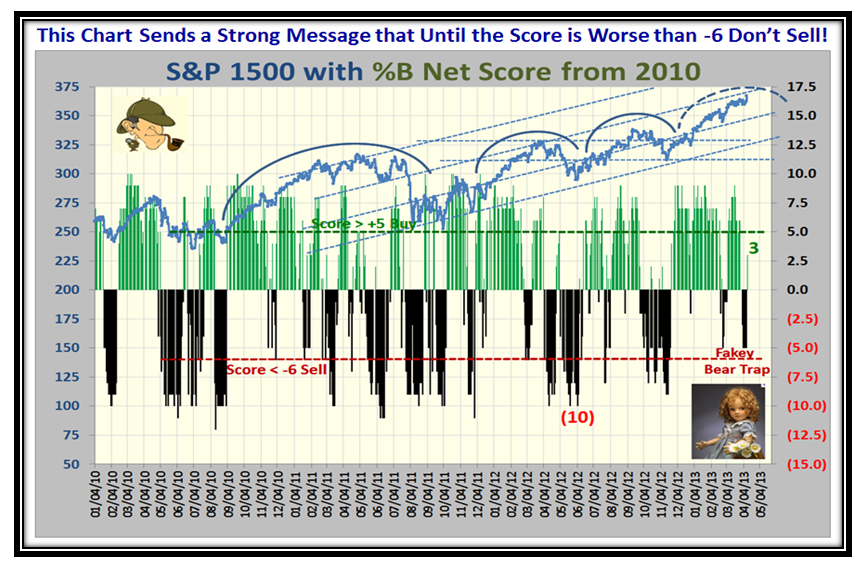

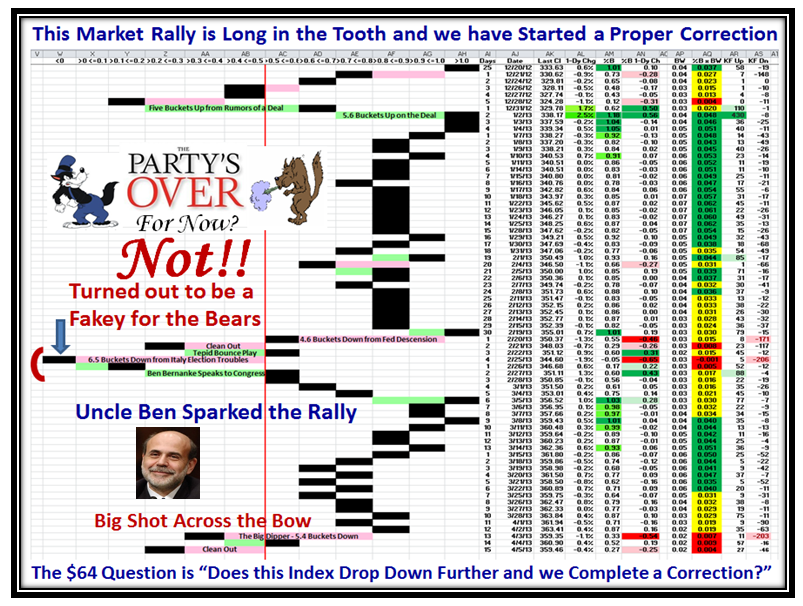

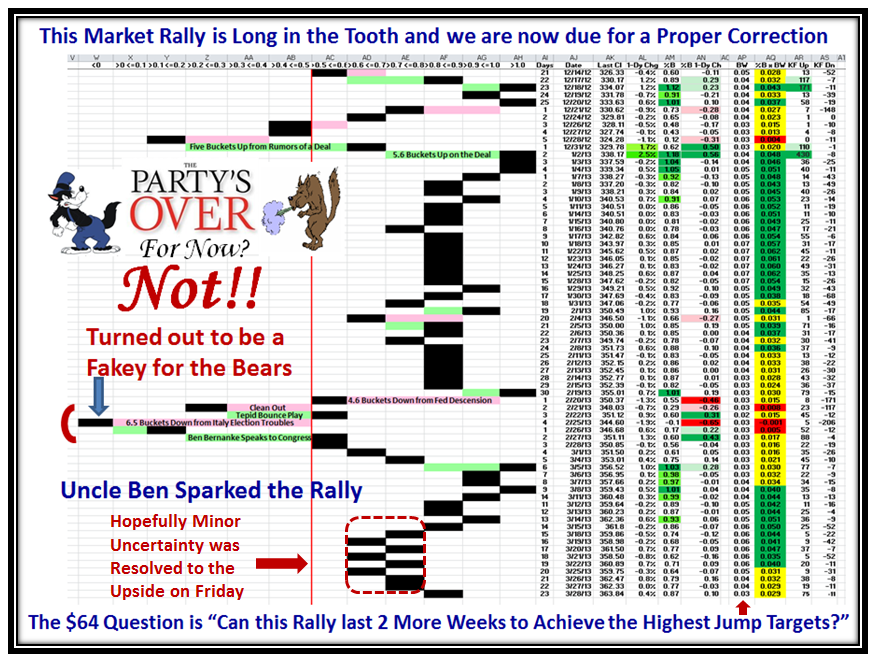

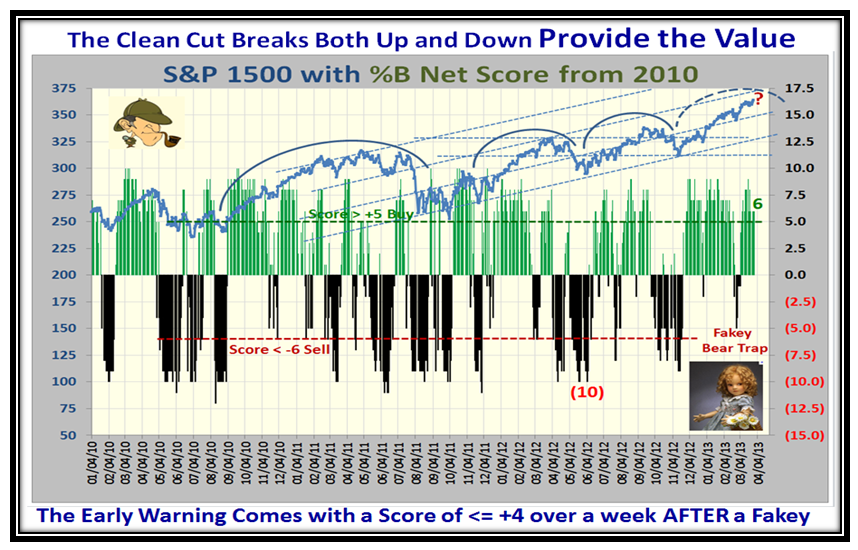

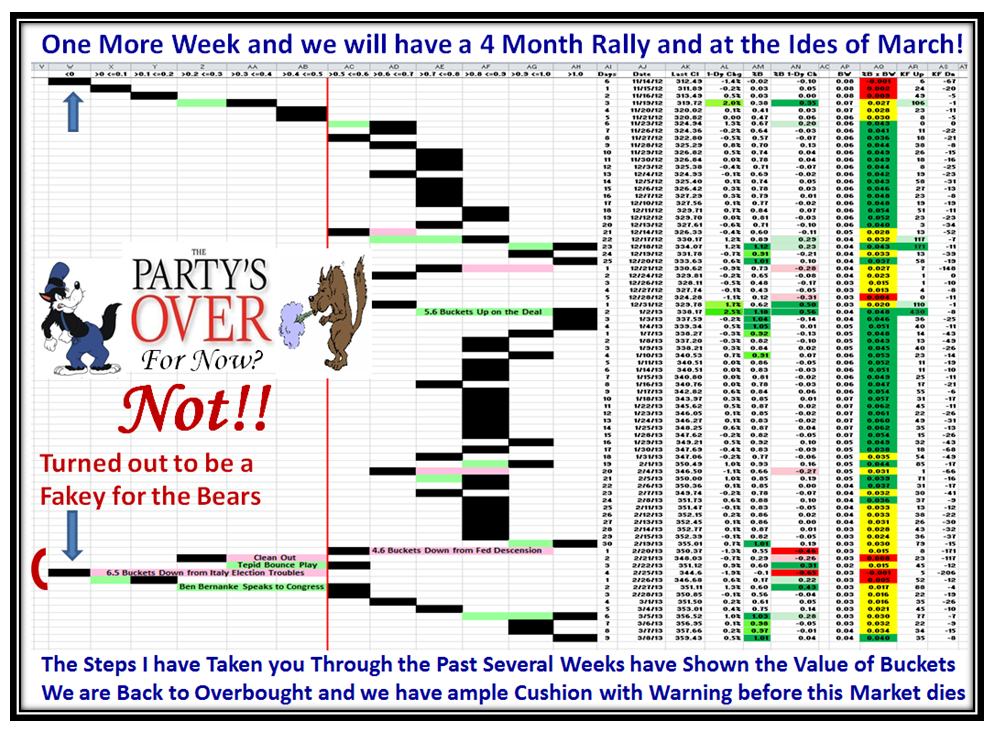

It is difficult to stay calm when we have these earth shattering days with big yo-yos in the Market Indexes, but it seems of late that when the %B Net Score is no worse the -5 it pays to wait for the next day before acting. However, this is probably a situation of the times we live in where any bit of news around the world can cause the markets to go into a tail spin or reach for the stars almost on a day to day basis:

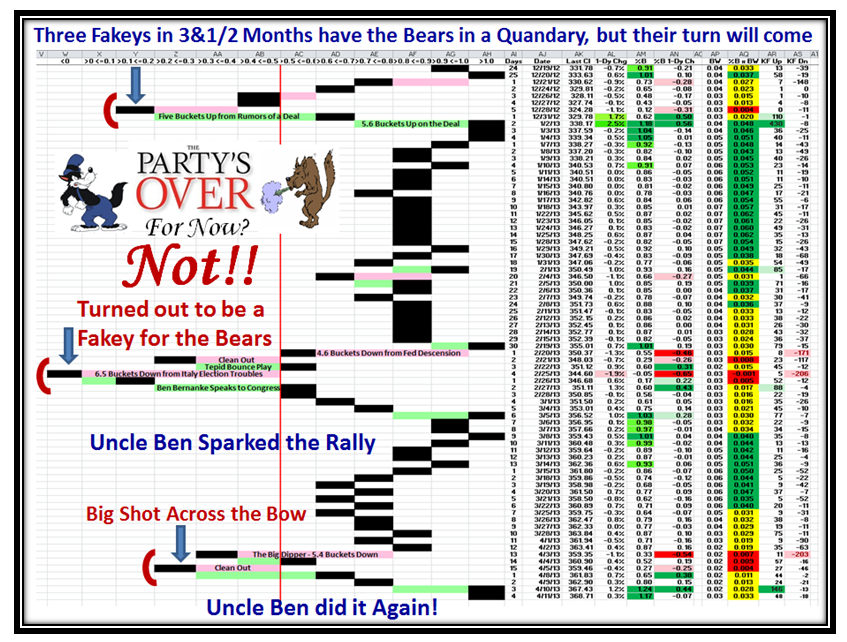

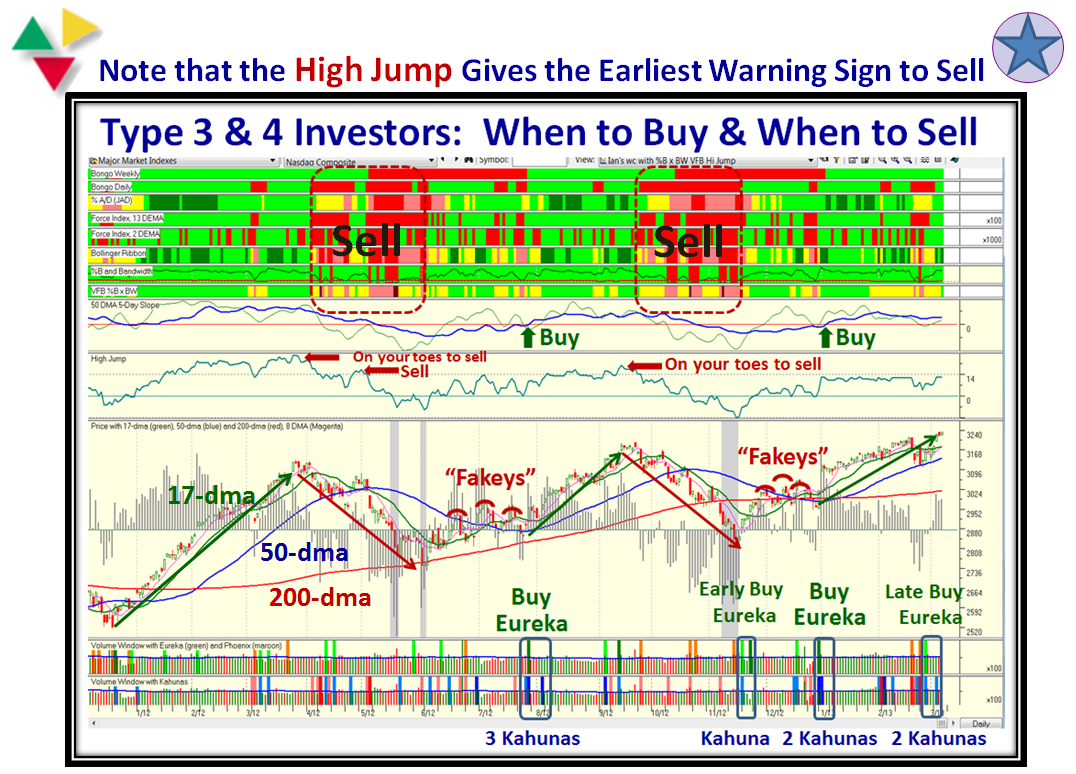

Uncle Ben used his magic wand again and drove the Market back up to Overbought in three days flat…we now show three Fakeys, all within the span of 3&1/2 months which leaves the Bears in a quandary…but one of these days their turn will come:

Naturally, with all this turmoil from day to day the Acc/Dist Ratio wobbles all over the place, but at present it shows bullish favor:

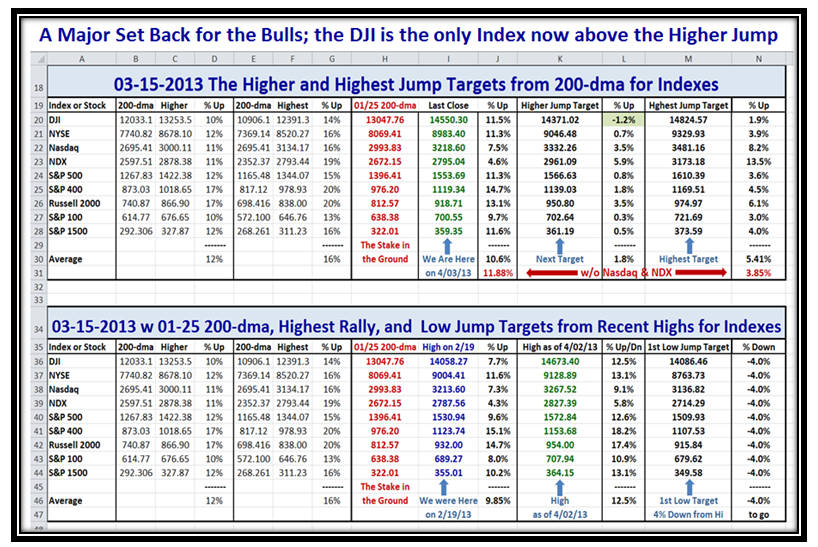

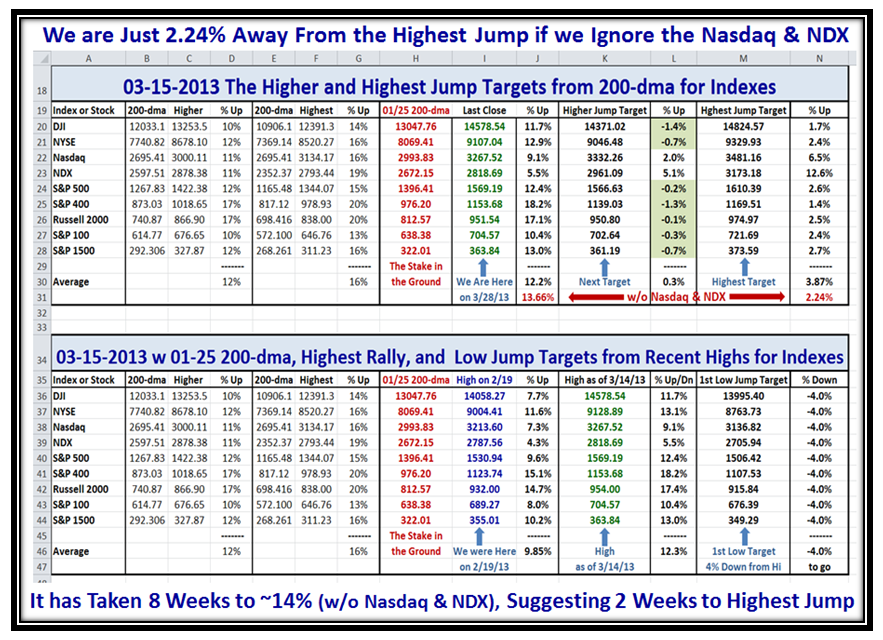

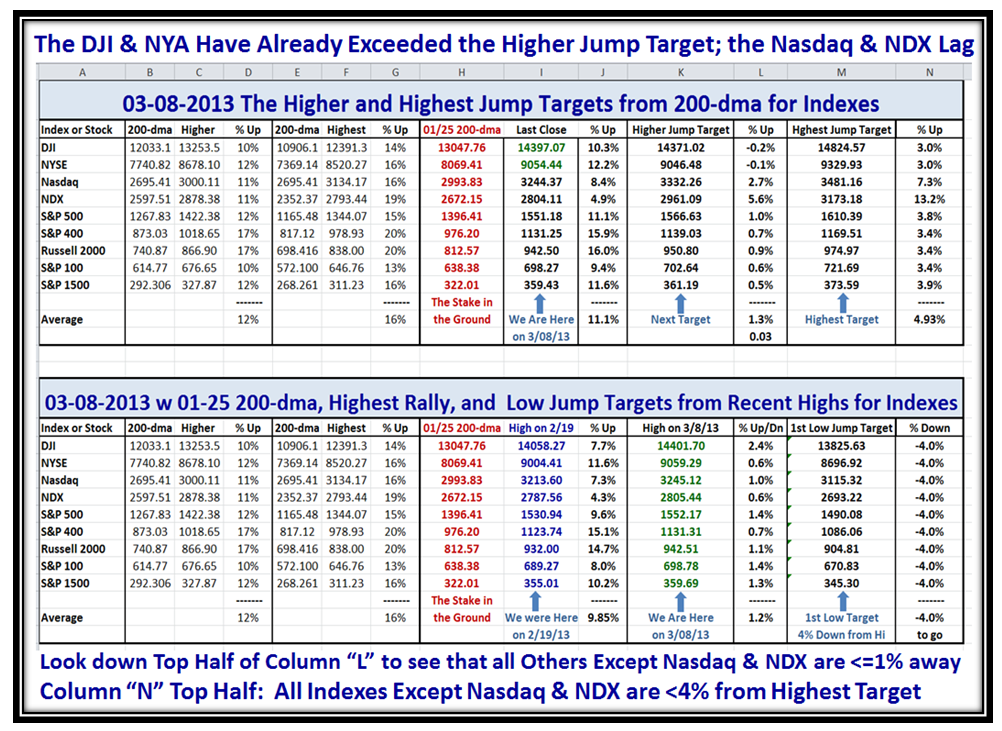

It goes without saying that the DJIA is riding highest of all the Market Indexes. We can see from the following chart that it has now surpassed the Highest Jump Targets and that five more are only <1.5% of doing the same.

Of course, all good things eventually come to an end and few would disagree that we need some form of decent correction before one should reasonably expect to continue with a rally that is now all of four years old with corrections no worse than ~17% along the way. Whether we shall see a Bear Market Correction of >20% is in the lap of the gods, but note that the Doom and Gloomsters are out in full force touting the worst is yet to come. I have added the line for a Bear Market Correction of -20% on the S&P 500 which is 1278 so we will make that a stake in the ground once the correction is underway.

Play close to your vest, and enjoy the move up while you can.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog