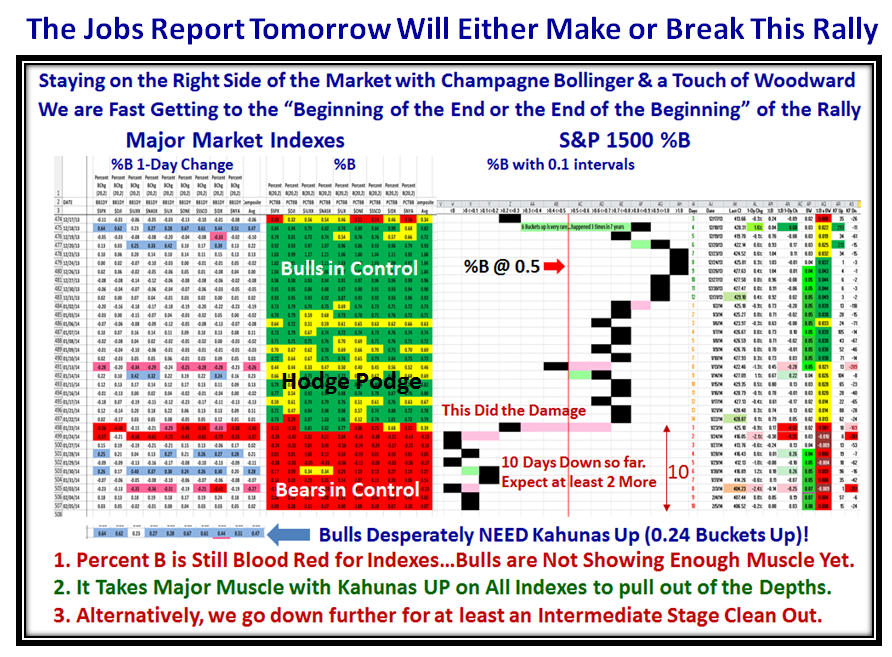

Stock Market: The Jobs Report Tomorrow is Key

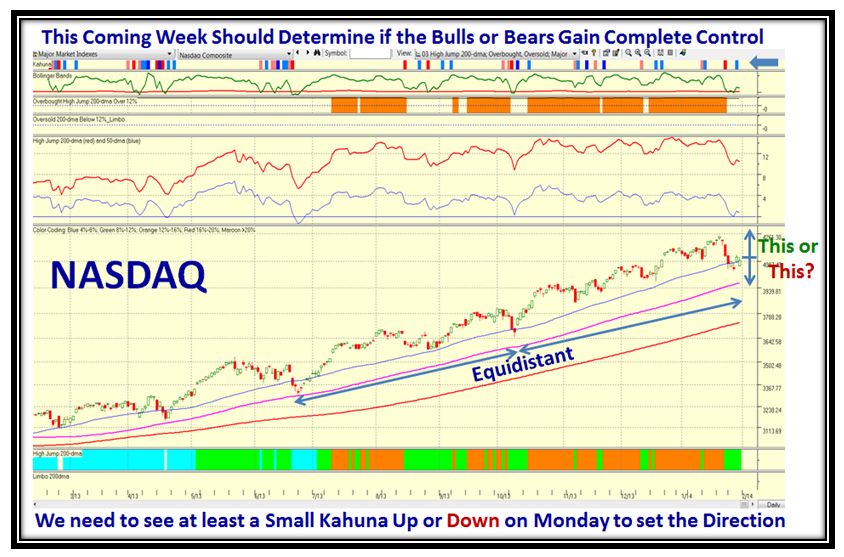

February 6th, 2014Those who know me well understand the respect I have for my good friend and neighbor John Bollinger for what I have gleaned from his Bollinger Bands over the years, and the fun I have had in using Bucketology, Grandma’s Pies and Kahunas Up and Down to keep you and me on the right side of the Market.

The last time I tipped my hat to him was on October 29, 2011 in these blog notes, so it’s time to do it again:

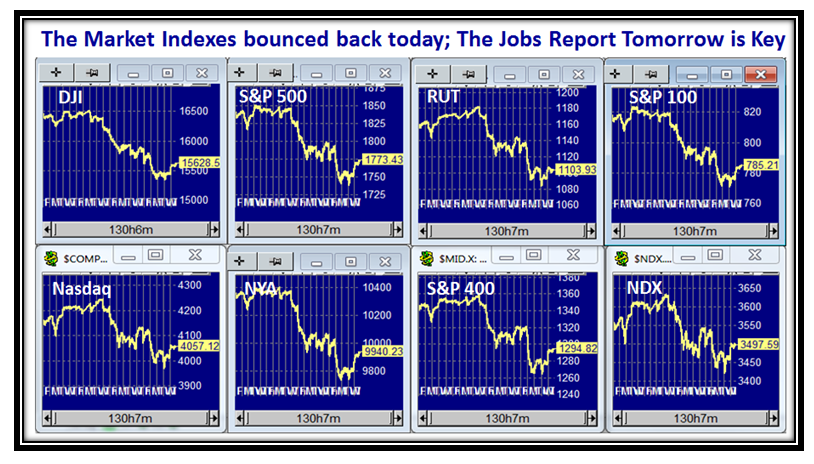

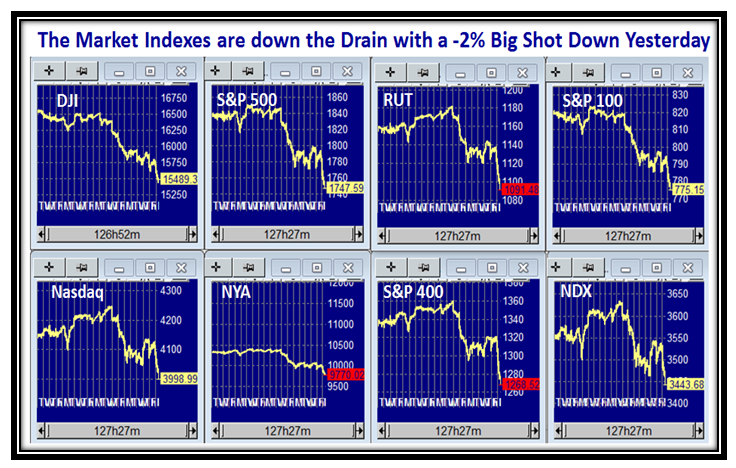

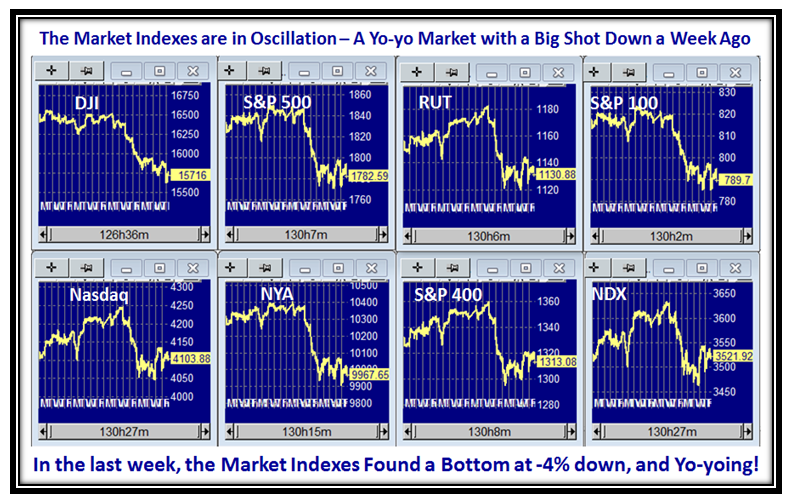

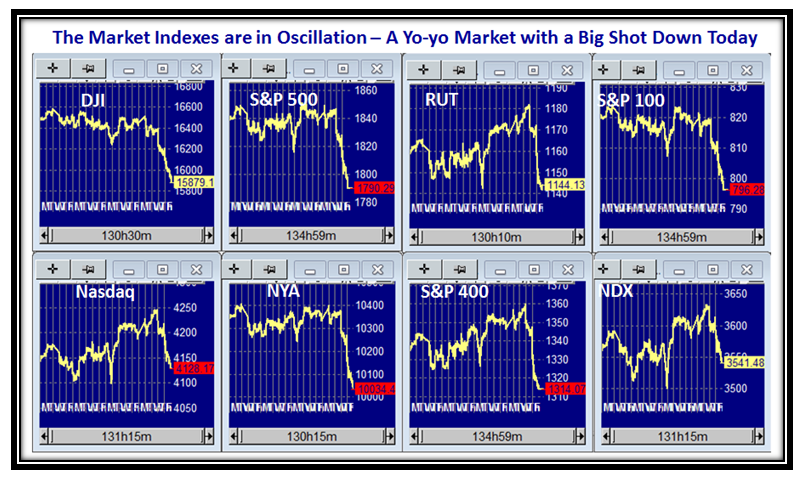

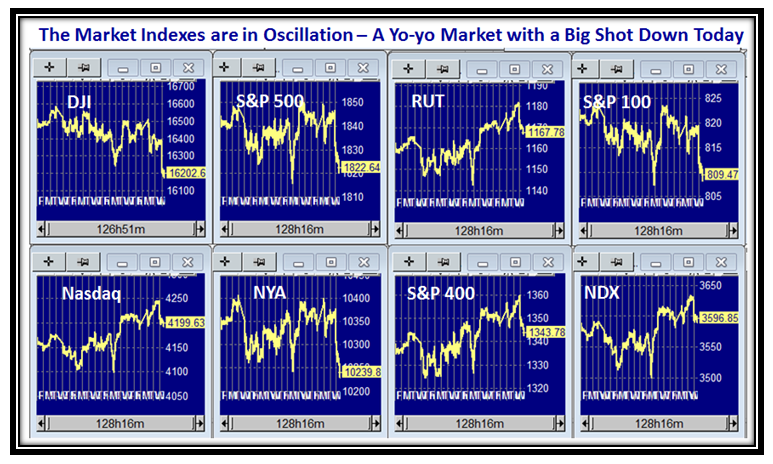

The Market Indexes all had a respectable 1% Bounce today. The Jobs Report tomorrow will determine if the Bounce continues or we fall back into the abyss:

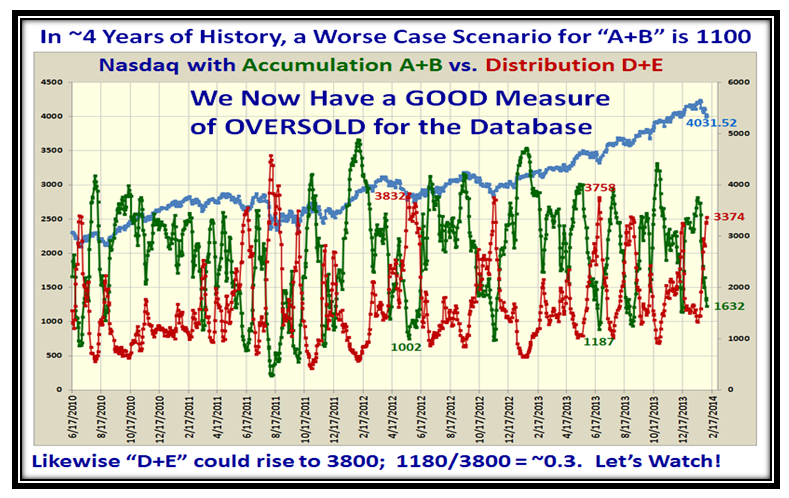

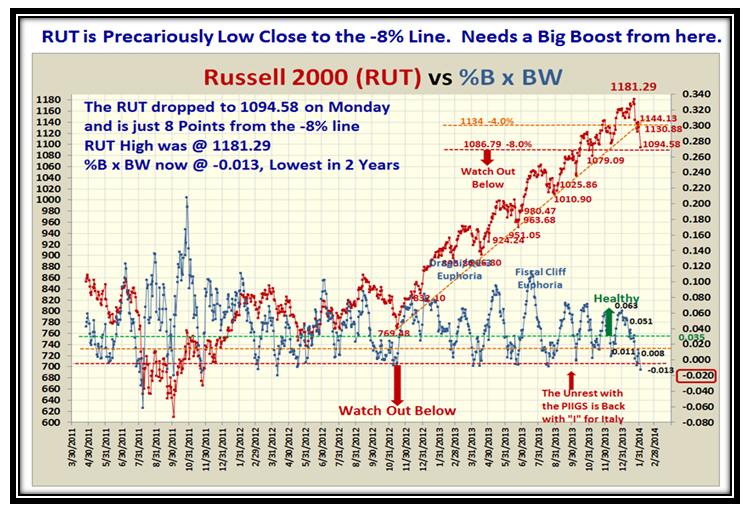

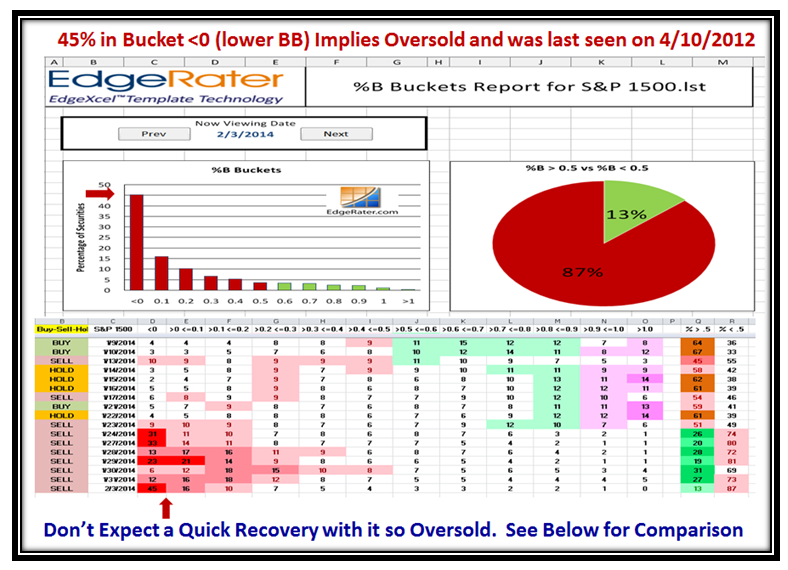

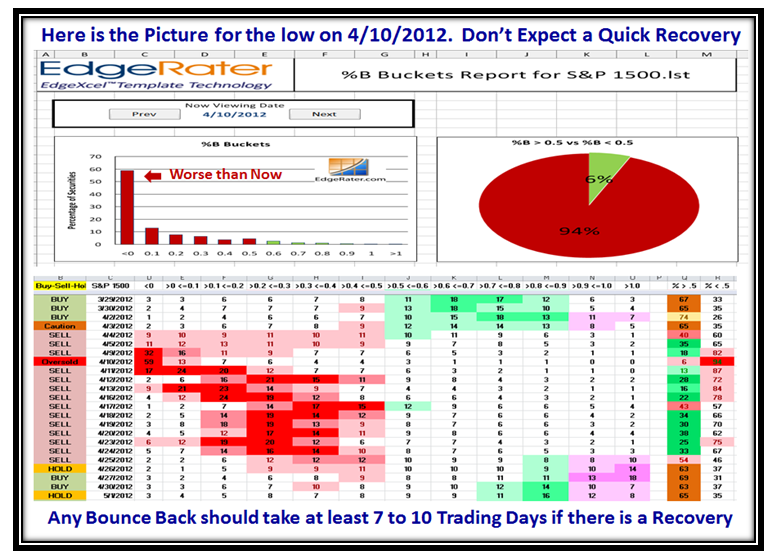

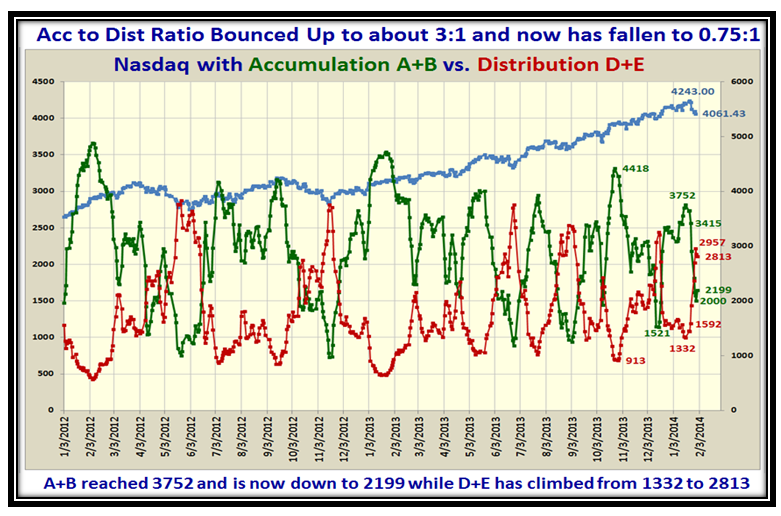

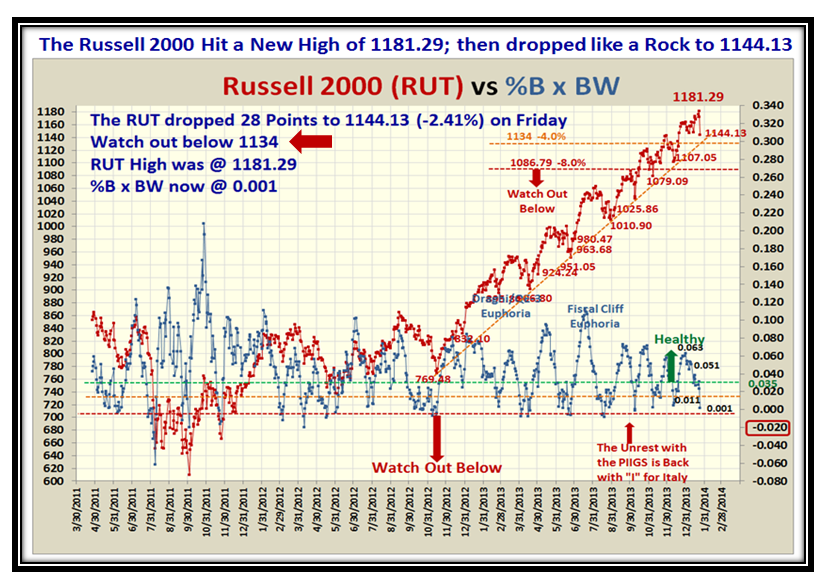

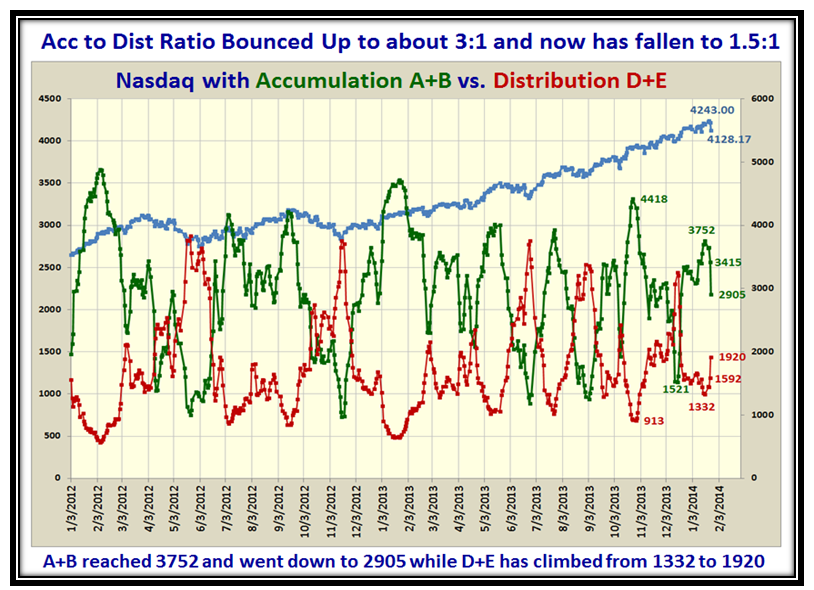

This next chart of accumulation vs. distribution shows that the Market is well oversold and gives us a measure of how much further it should go before there is a significant Rally:

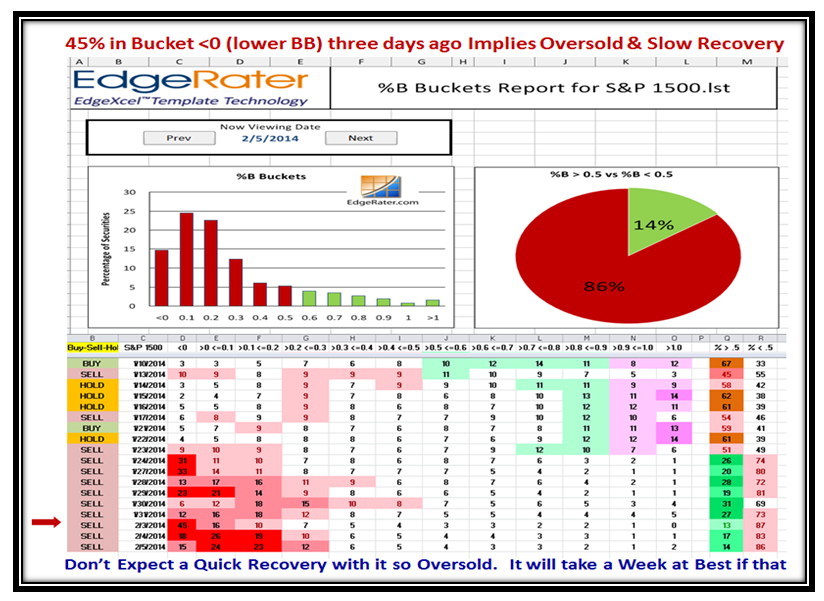

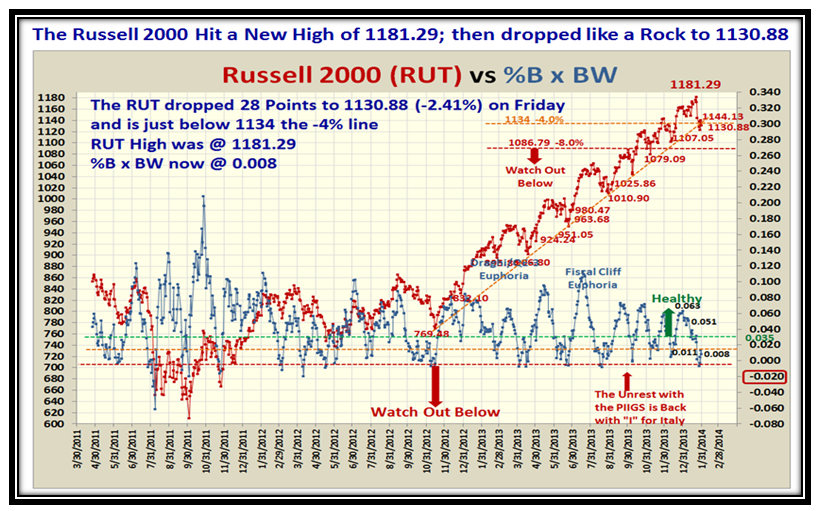

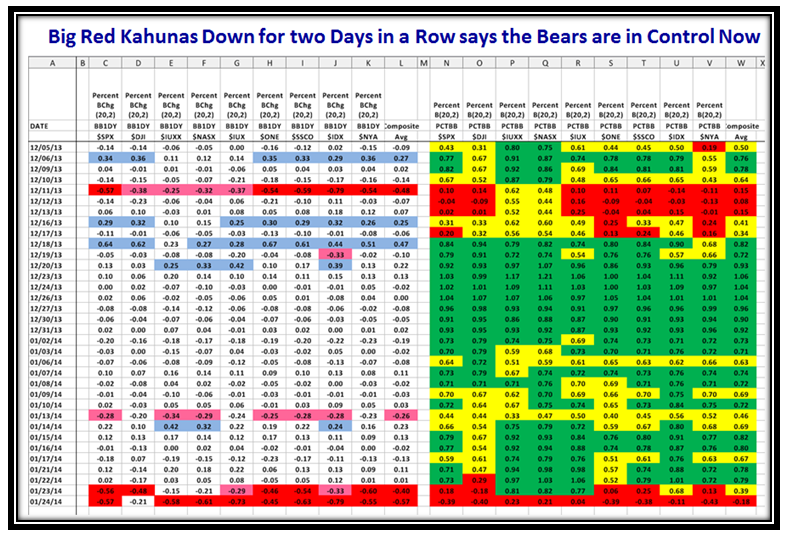

Here is the picture since we had that 45% of the S&P 1500 below the Lower BB on 2/3/2014:

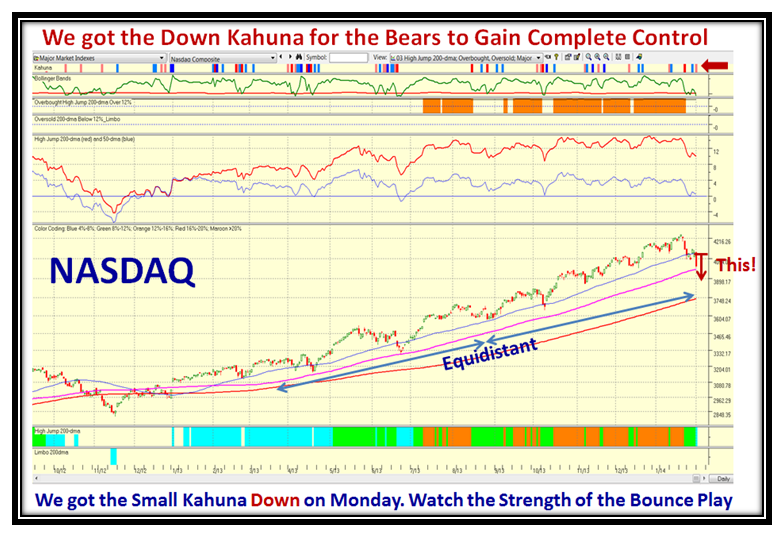

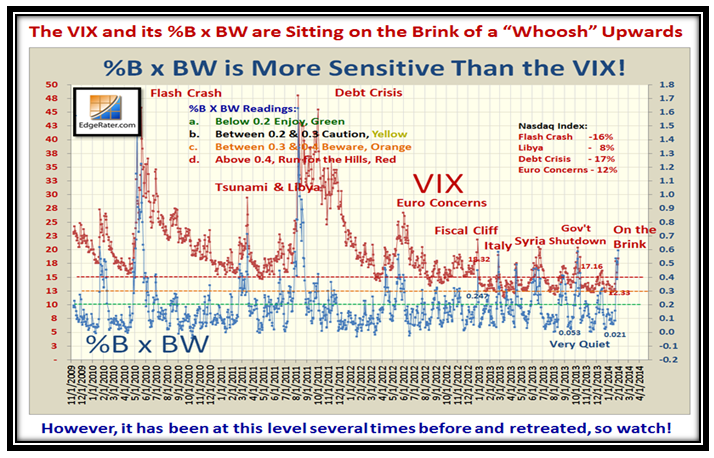

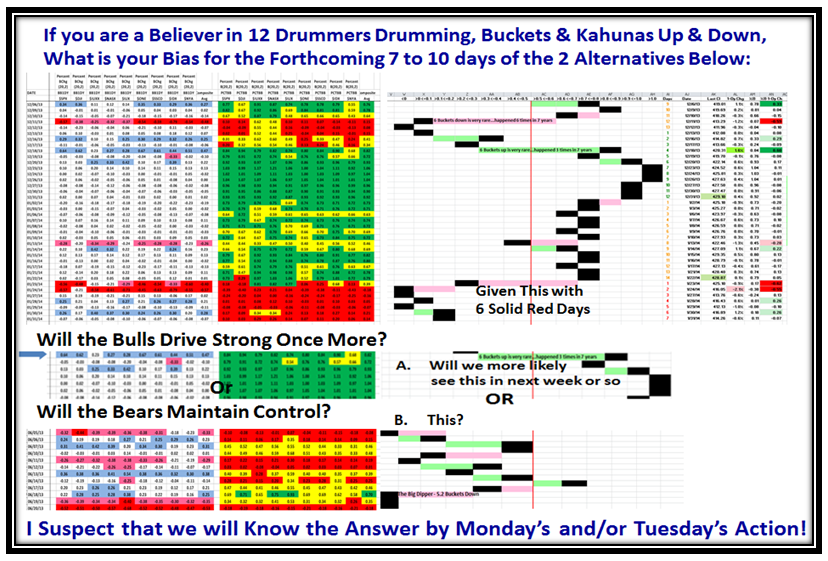

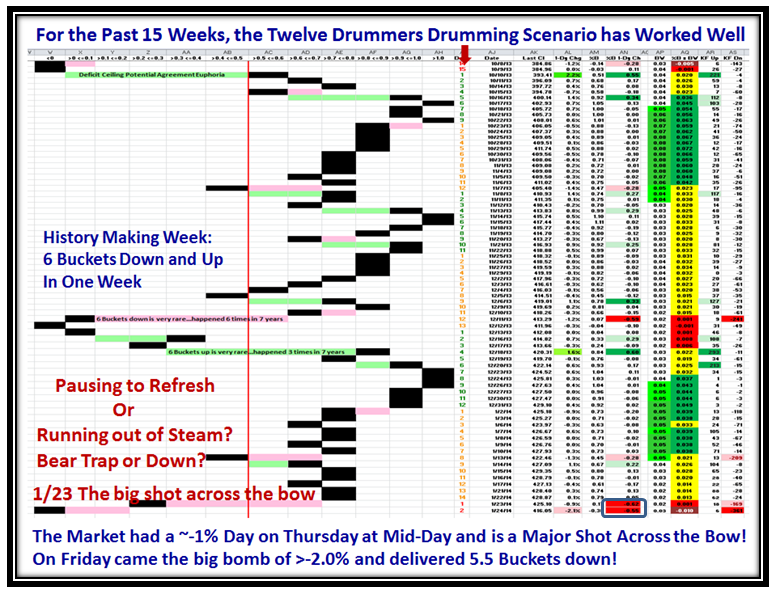

I know this next chart is a trifle busy, especially for newbies, but it sums up the current situation and tells you precisely what are the alternatives for the Bulls and the Bears going forward. Net-net, the Jobs Report tomorrow had better be excellent to drive Kahunas up on all the Indexes as shown to get the Bulls to Rally and out of the control of the Bears:

Good luck and good hunting,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog