Swim Suits On When Tide Runs Out?

Wednesday, July 25th, 2007Warren Buffet once said “You don’t know who is swimming naked until the tide goes out”.

At this very moment in time there are only two things playing tug of war in the market that matter:

1. The Earnings season is in full swing and by and large there is no question that the earnings are showing strong results especially in the technology arena. That on top of the fact that the Tech Sector has been dormant coupled with a weak dollar has given a fillip to the Large Cap stocks. However, I don’t have to tell you that the Small Cap Russell 2000 is being hammered.

2. The sub-prime fiasco is not behind us by any means. The latest casualty is Countrywide Credit. In addition, it seems that the credit market is finding difficulty in closing the Chrysler deal which suggests there is a lot more bad news which will take longer to unwind and will last a lot longer than next week when the majority of the EPS reports will be out. Let’s cut to the chase as to what matters of all the things that can affect the stock market in the next two weeks:

1. The strong Earnings Reports confirm that I was right in the July Newsletter to raise the year-end estimate for the S&P500 Growth Rate from 10% to 15% over 2006. That is the fuel that is keeping the stock market up, because the P-E is at fair market value. That is the only reason that this market keeps chugging along at this point in time. However, that swan song cannot last forever without a pause to refresh.

2. There is a major disconnect in the opinions of the gurus on the sub-prime stuff regarding the size of the potential damage:

a. The administration including Ben Bernanke implies things are under control though admits there is a problem.

b. Bill Gross who is the Bond King has turned bearish and you can read his stuff to your hearts content at pimco.com or look him up on Google. For him to turn bearish raises most eyebrows, including mine.

c. If the markets come to a grinding halt on getting the Chrysler deal together that will favor Bill Gross’ point of view, as that spills over into more than sub-prime alone. Late breaking news says “The backlog of buyout debt just got a few billion dollars bigger. Chrysler has postponed a $12 billion financing intended to help fund its pending sale to Cerberus Capital Management”.

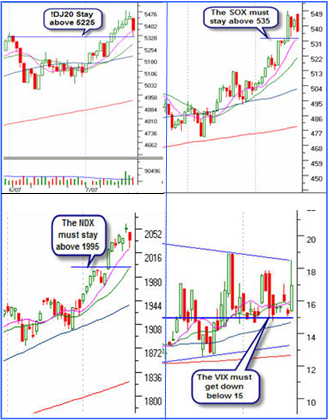

My point is that we have only about ten days of grace before we begin to see the tide go out on the former and maybe the latter. So be patient and play close to the exits and you will soon see which one or both are naked…but, make sure you have your swim suit on and protect your Capital!

Meanwhile, take great comfort that the EPS Reports are strong and play the long side with stocks that have strong earnings already out and bucking the current volatility. Or seek out those stocks that have disappointed and are vulnerable. Never short a strong stock till it is wounded. However, I note that some stocks such as GOOG, MICC, SNHY, BTJ and SPWR which have all been recent leaders are looking a trifle droopy and that is invariably the best clue that a correction is imminent if not already underway. It’s always “Your Call”.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog