Ignore the Fog and Follow the Signposts

Since it is a relatively quiet day in the Stock Market, I felt I might discuss my approach to High Growth Stock Investing to keep it simple. I am reminded by a good friend of mine, Mike Scott, who said to me “Ian, you taught me one thing that has improved my Investing Habits and Success enormously and that is to follow the signposts.”

I realize that Blogs are places where people go to get ideas and with Investing Blogs one is looking for “tips”. That’s not my style. I teach you how to fish “My Way”, but seldom if ever catch a fish for you. Rather, I prefer to show you where the fishpond is and show you by example where the liveliest and biggest fish are waiting to be caught. Hopefully in the course of the last eight weeks you have begun to see my approach to solving complex problems by dissecting them in threes. It has worked all my life and it is not too late for you to use the underlying Principles of High Growth Stock Investing. Here are the pieces of the approach that are most pertinent given that you have been following along in how I tackle problem solving relevant to the stock market:

- The Plan must always consist of three Scenarios, the High Road, the Low Road and the Middle Road. The worst thing one can do is to have a single plan based on your bias, as the market will either surprise you or fool you or both. Assessing three alternatives eliminates the element of surprise to a large extent.

- The Targets one sets for the three roads must be challenging but reasonable based on past experience. They become the Stakes in the Ground from which you measure progress over time. History seldom repeats itself in precisely the same way, but I find that the folklore of the past will set one’s level of expectations to being achievable rather than too optimistic or too pessimistic.

- Let the Market tell you which road we are on. Yes, I know you want to be contrarian and you don’t want to be sheep that follow the herd, but being contrarian when the herd is heading for the exits is a sure way to get trampled to death. There is a balance between being the early bird and waiting too long before you act. Be patient and prudent…but pounce. Ready, aim, aim, aim and never firing just will not work, especially in this volatile market.

- Return to those stakes in the ground and take measurements. Then of course make an assessment…Too high, too low, and not high enough, etc. It is important to cut through the fog of all the items one can list for the Case for the Bulls and the Bears and to pick just one from all the chitter chatter that seems most prevalent at the time, as I showed you in my Tug of War note. That way you cut to the chase on what matters at that time instead of worrying about every bit of news or nuance. At this stage of the game the run on the British Bank Northern Rock and the swift move by the Bank of England to shore them up put the immediate focus by the FED that at all cost they did not want to see a run on the banks in this country. Therefore, despite the ever looming problem they face regarding the impending inflation had to take a back seat for the time being. Whether they overdid it by the generous 50 basis point cut on both fronts remains to be seen, and we can certainly see that there are many who feel that way as both Gold and the Ten Year Note went up appreciably today. So that is the change in the Tug of War at this time.

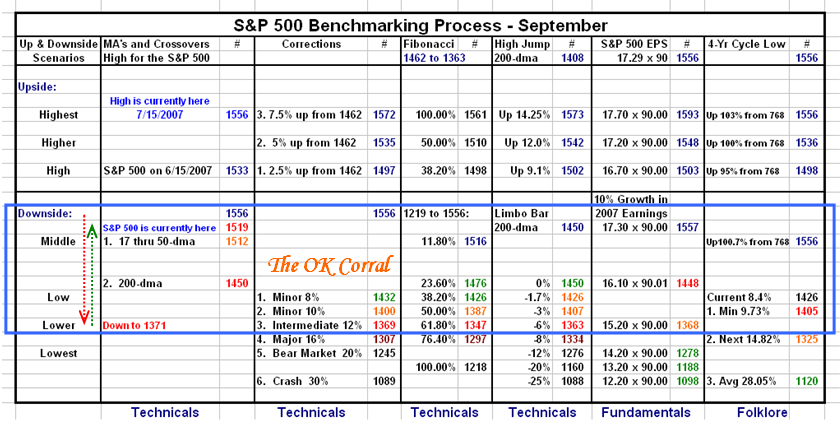

- Change Management is a part of Risk Management. Having done the homework, assess if it is time to change the targets you previously set, WITHIN the framework of what was previously done. If the Stakes in the Ground have served their purpose or are now meaningless chuck them out, but invariably I find that I can still keep the original targets but move on up or down to the next level from there. I’m sure you saw that in my assessment yesterday of the progress that has been made in the Gunfight at the OK Corral. The upshot was that the Bulls won the first round. Now we move on from there.

- Finally, find a way to serve up the meal of all of this in a simple form, hopefully in a sentence or a paragraph or a chart or a diagram, and keep it by your side as your own Game Plan. I know; I know…you are saying “Ian, we know all that, but don’t leave us with platitudes. Where’s the Beef?” I say you will be making a big mistake if you just skim over what might seem like platitudes…it’s called discipline. Study them and see how many of those items you follow in establishing your own discipline in addressing the market. If you buzz around like a blue bottle fly, you are never going to make it…in my humble opinion. So here’s the beef:

Here is a one page plan that slices and dices the market six different ways, four of which are Technical, one Fundamental and one Folklore, all of which are self evident to the reader. It is in essence a ready-reckoner that gives you insight to the different Road Scenarios, and shows where the recent Gun Fight between the Bulls and the Bears took place. Your job is to know which side is winning and act accordingly. Enjoy!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog