Archive for October, 2007

HGSI October Seminar – The Goose that Laid the Golden Eggs

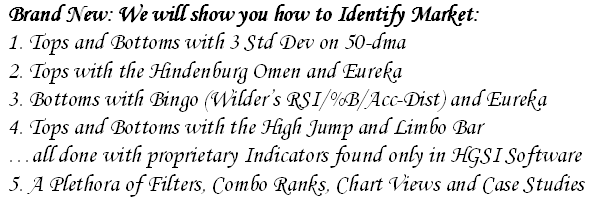

Thursday, October 4th, 2007We not only show you how to identify changing market trends, we give you suggestions on how to factor these trends into your investing style for capital preservation (market tops) and capital growth (market bottoms)…we show you how to connect the dots, so to speak, which Ron makes come alive as he does in his Weekly Movies.

Hurry, Hurry, Hurry: Besides all this “good stuff” you will get to meet our associates George Roberts and Matt Sorrels who are the architects of the Software. A few seats are still available. For Information and to Register, please go to this site by clicking on the Go To sign at the top of this blog at www.highgrowthstock.com and select Seminars in the Table of Contents or try this to get there directly: http://www.highgrowthstock.com/Seminars

Best Regards, Ian.

Bulls and Bears Make Money, but Pigs get Slaughtered!

Tuesday, October 2nd, 2007Mail-bag Question: Started a position in early August in GLNG. Great pick. Nice dividend in September and expect them to continue. The High Jump is saying “get out now”. I didn’t expect it go to so high so fast, so now it’s hold for the long term and expect the pull back, as opposed to sell now and buy back in later. And the answer is……….

Answer: Earl (on the High Growth Stock bb) gave you great advice and told you what he did which was to sell into today’s high. Net-net, never let a great profit turn into a rotten one. I also see that Robert gave you further insight going back to 2003 on the High Jump which I didn’t go back that far, and he suggested that you should consider placing a trailing stop below the prior day’s close, raising it each day until you stop out. Today’s low is 25.01. He usually uses 0.6% below so 24.86.

Here is more fodder for you to chew on. Here is the long answer…And the answer is never simple. But if you have been reading my blog, take a problem like this and break it down three ways. The Highest High to date from the 200-dma is 75.1725% up (I show you all four decimal places so that you can cast your beady eyes on 1/14/2004 and see the number). (Editor’s Note! A beady eyed customer caught an error…it is Jan 14, 2004 and not 11/14/2004…Thanks Steve and his wife). So the 200-dma is currently at 16.0904. Therefore the highest you can expect TO DATE is $28.19. The stock has produced a double top so far at $26.25, so you have $2 more to go between friends. Let’s assume you were really lucky and bought this beast at $17.00, which would be a handy $9 or a gain of 53% on your investment right now, not counting the handsome dividend.

Note that the decision of whether to sell into the high of the day or let it ride for another day is bounded by Earl’s and Robert’s points to you. Watching the action at 11.45 Pacific Coast Time on a 1 day 5-min chart shows a beautiful cup and handle and a desire to try to break through that top. So read on and you can make up your mind according to the next hour’s action.

-

If you are conservative, one rule is to take 70% off and play with the remaining 30%, when a stock delivers >50%. You will have taken your Capital off the table and will be playing with profits. Let’s assume you invested $10,000…that has grown to $15,000, between friends. So if you take 2/3rds off or 66.7% off that means you recouped your $10,000 capital outlay and have $5000 PROFIT to play with. So decide how much profit you want to give up and act accordingly.

-

The bird in the hand is worth two in the bush. As I write, it is trying one more time to get up to $26.25, and is currently sitting at $25.57. It has also shown you that today’s support is at $25.25 so you can place a stop there and either take it all off or 70% off or do nothing. If it can’t get through $26.25 then that may be all the ride you will get for now until it cools off a bit, so I have narrowed that decision down to giving up $1000 of your $5000 profit.

-

Bulls make money, Bears make money and Pigs get slaughtered…but that only happens after the event. So you sit tight and ride it through for now to see if you can get to $28ish and at least you know when your stomach says I was a pig and “shoulda, coulda, woulda”. Your ONLY reason for saying that is that Transport-Shipping is the hot area to be in and since Stocks are like wolves and hunt in packs, you will keep a beady eye on DRYS, and EXM and when you see those stocks and your own GLNG getting hit, it is time to kiss it good-bye. All of these got trashed recently and of course they are going again, and more importantly are setting NEW record High Jumps. The bottom line is that the Ian High Jump Indicator defines when a stock is extended based on its past history. Always look back to the Highest Jump it has recorded as a guide. If it breaks that highest level, the stock is into new high territory. Confirm that others in the Wolf Pack are also doing the same thing, and that might give you a clue of how long to hold onto the stock. If they are, there is a fighting chance the stock can go higher. There also needs to be momentum in the Market and of course the Industry Group, which there is right now. Decide how much profit you are prepared to give up and act accordingly. Never let a great profit turn into a miserable one

Editors Note: All three stocks, GLNG, DRYS and EXM set up Cup and Handles today based on a 5-Min 1-Day chart. They all sold off early in the morning having made highs for the day and then formed cups and handles. So the answer is…if you didn’t sell early into the high of today, hold for another day! The lesson learnt is to always look for the action in leading stocks in the Wolf Pack. Best regards, Ian.

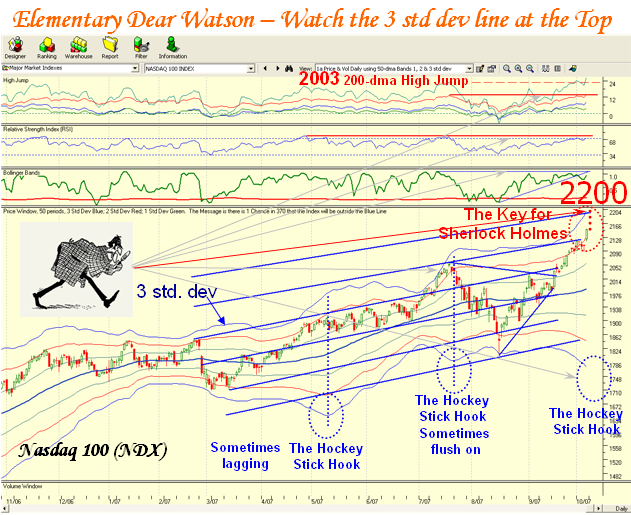

Up, Up and Away in My Beautiful Balloon

Monday, October 1st, 2007You may have noticed that apart from last night’s late breaking news about the Hindenburg as a top notch Indicator for Market Tops, it was not intended to dampen my enthusiasm of the previous couple of captions. They were up beat with “My Blue Heaven – Market’s Up, Surf’s Up and “I’m Sitting on Top of the World…Just Rolling Along”. The gloom and doom of six weeks ago is currently behind us and although I warned that we should not count our chickens before they are hatched, we have now hit a new market high on the Dow, the Nasdaq, and the Nasdaq 100, with the S&P 500, S&P 100 and NYSE all close to their old highs of just three months ago. So enjoy the ride up that the Fed has garnered for us having plucked us out of the jaws of the abyss!

Today’s gift seems to have come in part from what Bob Pisani of CNBC calls “Perverse Logic” in that the major announcements of the bad news by both Citigroup and UBS in taking heavy hits in ANTICIPATION of further Loan losses; the bulls turned this bad news around to in fact spin it that the worst is behind us and now we can look ahead. We have only to look at the bottom fishing in the Home Builders today to see that the exuberance is there to yet once again find a bottom on this sector of the market…along with the strong movement in the beaten down financial stocks.

Couple all of that with this being the 1st day of the 4th qtr when stocks are usually up, that insider selling is down and insider buying is up, that Company buy backs are up, and that there are fewer IPO’s to compete with the current shares outstanding all suggests longer legs to this current bull rally. It goes without saying that Short Covering is still prevalent and short-term traders are now reversing their positions over the near term. Also, one can’t help see that as we head for bed at night and look at “World Markets” the global stocks and markets are showing substantial gains.

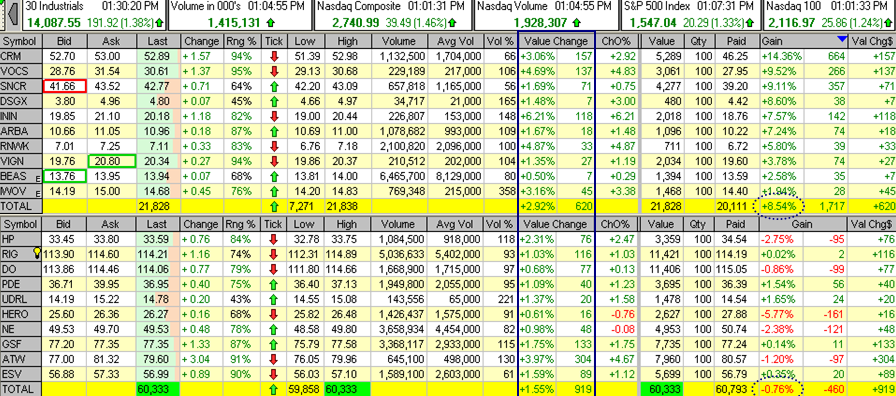

If we bring things down to our little world, we note that stock leaders with RS >95 and strong ERG is where the action is at, coupled with Technology stocks particularly related to the Internet Software and Telecommunications. Transport-Shipping, Chemicals Specialty are still providing stellar gains. The Chemicals Specialty Wolf Pack I gave you five weeks ago on August 26th, 2007 is now up 25%. The Internet Software group of ten stocks I suggested just a week ago is up 8.54% as shown below, and in the interest of full disclosure, the Energy Drilling group pulled back last week, but showed signs of life today with all ten stocks up but the group is down 0.76% for the week. Keep an eye on this group as I warned you that Wolf Packs don’t necessarily all fire straight out of the chute. Below I show the results of the two groups, with Internet Software on top above Energy Drilling. Naturally every stock in the two groups was green today:

It is only natural that at this stage of events where we have had a powerful drive back from the Base Low and are now above or nearly at new highs in the Market Indexes, that the Technical Analysis aspects come into play, but I believe that we still have a chance to test the recent highs on the High Jumps for all the Major Indexes. I said that I felt we were on the second leg of a high tight flag and today has shown that in spades. Naturally, October also looms in our minds as one of the worst months for gains so we need to be cautious and not sit with irrational exuberance.

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog