After a Historic Inauguration, Whither Goes the Market?

Wednesday, January 21st, 2009After an historic Inauguration which had “Hope” and “Openness” as the main themes going forward, the country shared a time of unity as we watched the pomp and circumstance of the traditional ceremony which we have come to expect and enjoy.

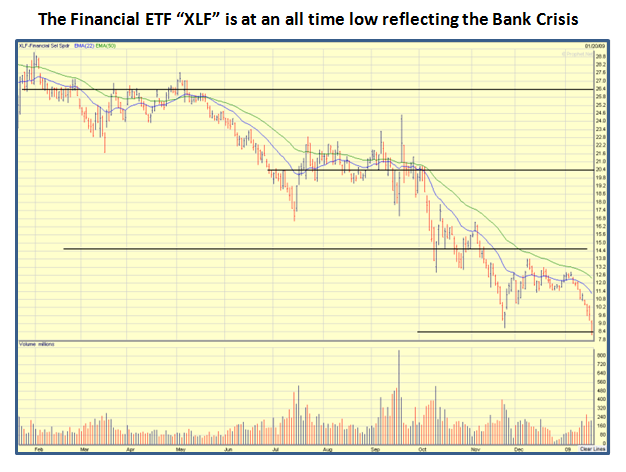

Today we come back down to earth as we listen to Tim Geithner testifying at Congress, and we realize the enormity of the task ahead when he said “When Trust and Confidence is lost, it is difficult to get it back”. Dead Banks walking is another catchy phrase in vogue at this time and yesterday’s 300+ drop on the Dow and over 5% drops in most of the Indexes show the major concerns in the Stock Market, exemplified by the XLF falling to its lowest level at around $8.10.

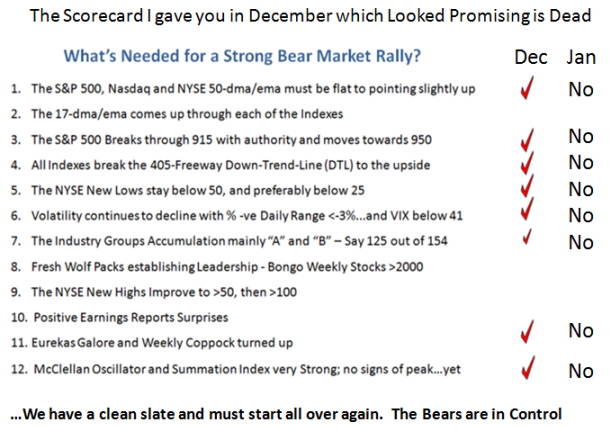

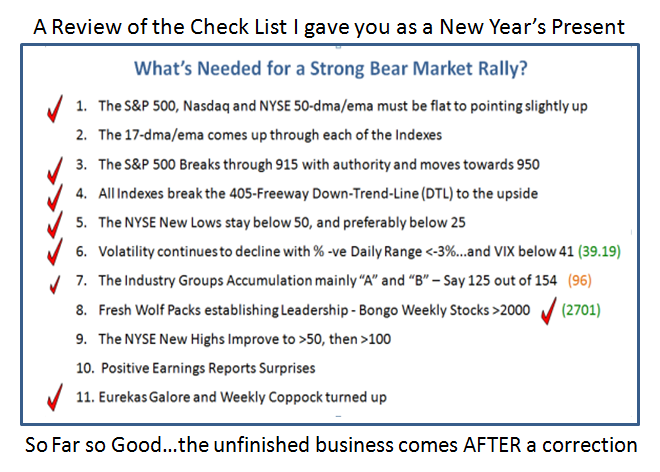

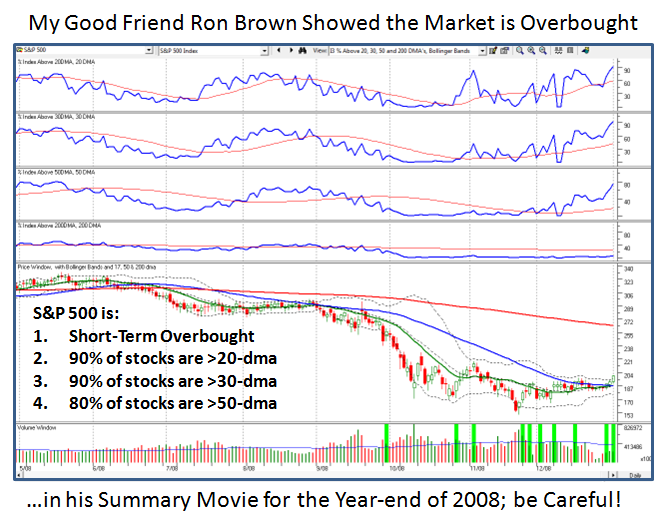

But that is all water over the dam and we can only Hope the new Government will find efficient ways to get out of this Financial Crisis, to renew the nation’s trust and confidence, and eliminate the Fear and Greed. To come down to our level, the Hope of a decent Bear Market Rally is over and now we are back down to the Fear of testing and then undercutting the recent Low of 741 on the S&P 500. Heaven help us if we do! As you can see from the Chart below all the criteria that looked promising have now been destroyed and we must pick ourselves up, dust ourselves off and start all over again:

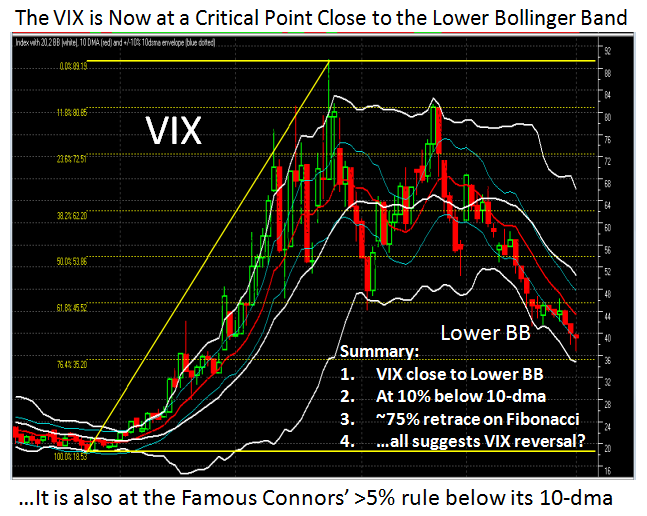

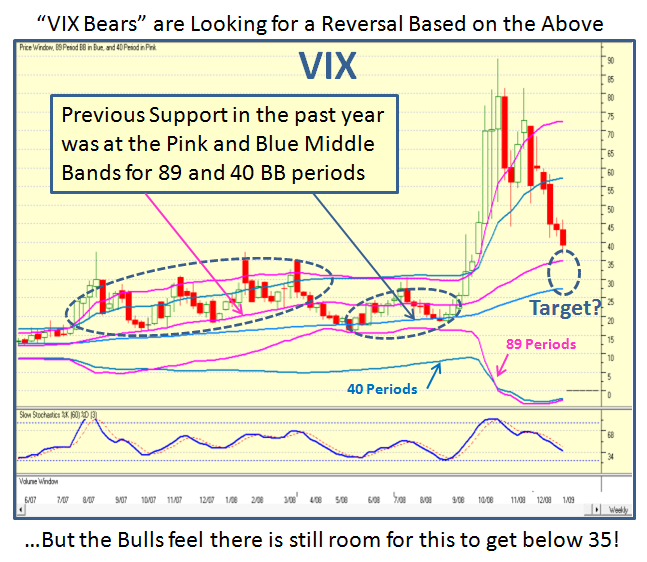

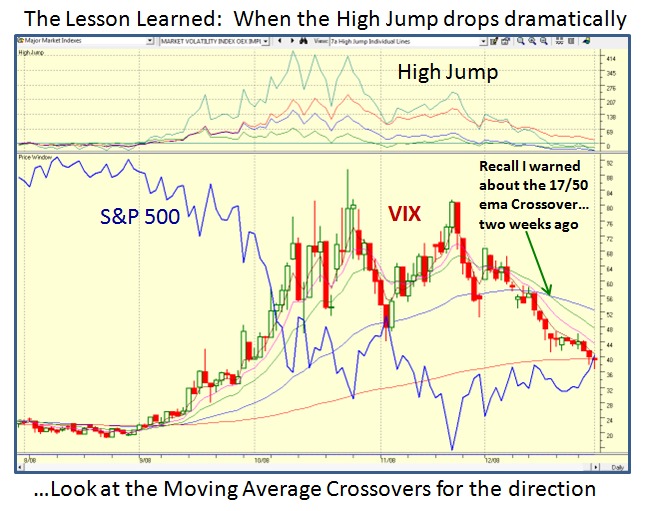

Those of you who follow Ron’s and my work closely have seen the Research I have done to introduce us to a new Indicator called “Phoenix”, which in conjunction with Eureka will hopefully show when we transition from coming out of the ashes to a new beginning. We began to see that promise as we dropped to a New Base Low of 741 on the S&P 500 and the meager Bear Market Rally we eked out into the first week of January. Sad to say that we have witnessed two Phoenix signals on the 14th January and again yesterday, the 20th of Jan…indicating that the Fear is back and the least line of resistance is down. The VIX hit a peak of 57 yesterday so we have a long ways to go to see it drop below 40 which is where it was at just two weeks ago. So the Bears are in control once again, and until the VIX drops below 40 there is little hope of a new full blown Bear Market Rally. It was good to see it close weak at 46.42 to give some signs that the Fear was abating, and that the shorts were presumably covering their positions. The chart below was recorded an hour earlier, so there was a dramatic drop since then when it was at 49+.

At least the market is up strong today but I don’t have to tell you that it will take more than 280 points up on the Dow to get us out of the hole we are in from this past two weeks. Still, beggars can’t be choosers, and it is a good start. Tomorrow, the S&P 500 will need to break 840 to the upside with authority and follow through quickly above 870 before there will be any new signs of HOPE for a Fresh Start! That would set the “Re-test” Low so far at 805, which is much healthier than trotting all the way back to 741.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog