As you have gathered by now the lead off picture invariably tells the theme of the story line, but this time you will forgive me for using two pictures.

The first one is a continuation of the last blog where I left you with the thought that the Fed Chairman, Ben Bernanke was due to speak to Congress the next day and to expect him to vigorously deny any cover up, and true to form, they gruelled him for 3 hours and 15 minutes and he outfoxed them all. The Market remained strong all day on Thursday, but in fairness it was not only due to his solid testimony but also the Bond Market had a roaring $104 Billion auction on that day. In my opinion and I don’t often take sides on this mumbo jumbo…if they replace him at the end of his term, heaven help us all. He has been the most trustworthy of the whole bunch.

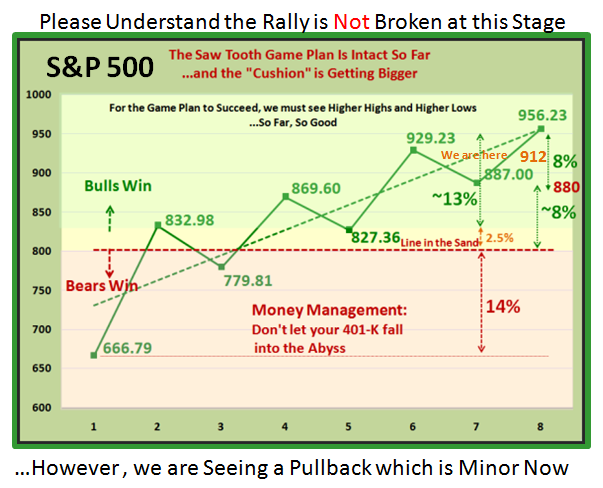

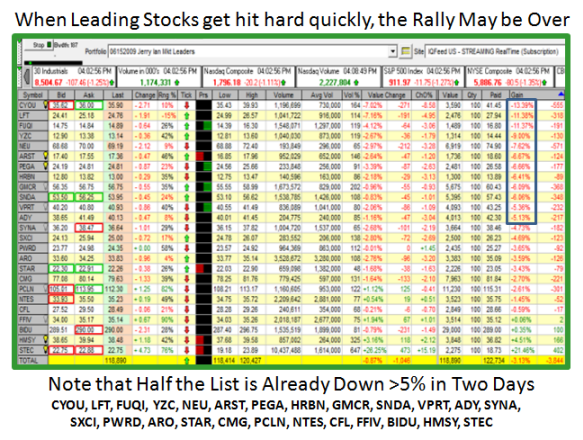

The second picture shows the tricky state of affairs on this market and we are literally again at the crossroads of the decisions we all have to make. I gave you the early warning signs all of seven weeks ago, but I am getting ahead of myself, so let me introduce the latest theme:

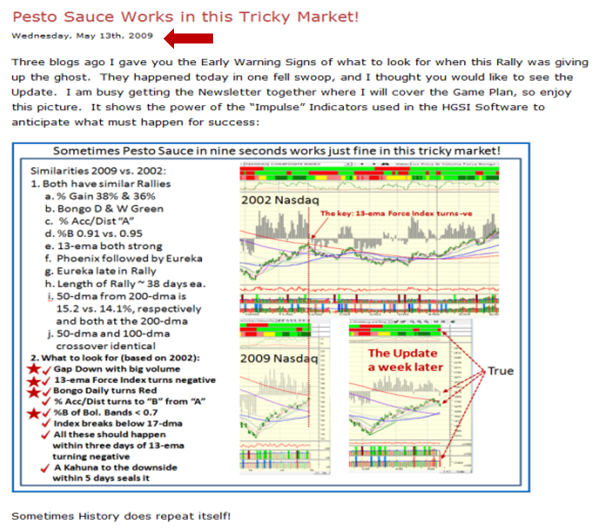

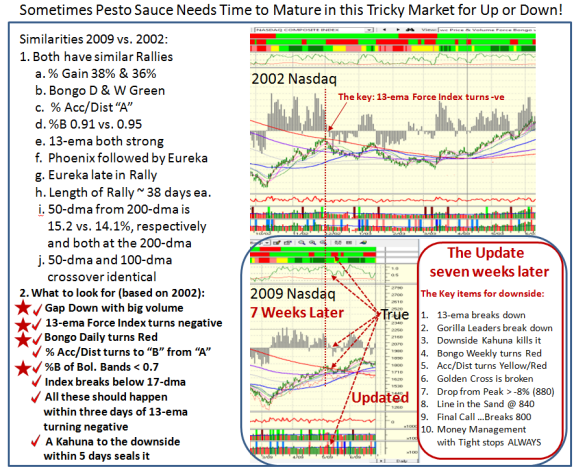

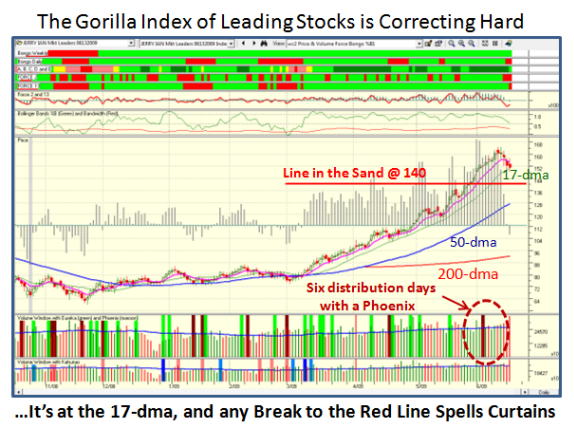

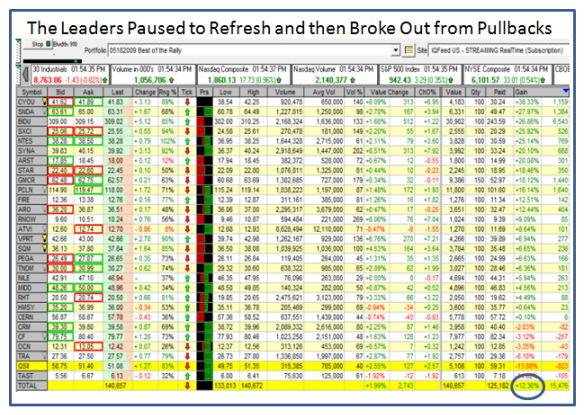

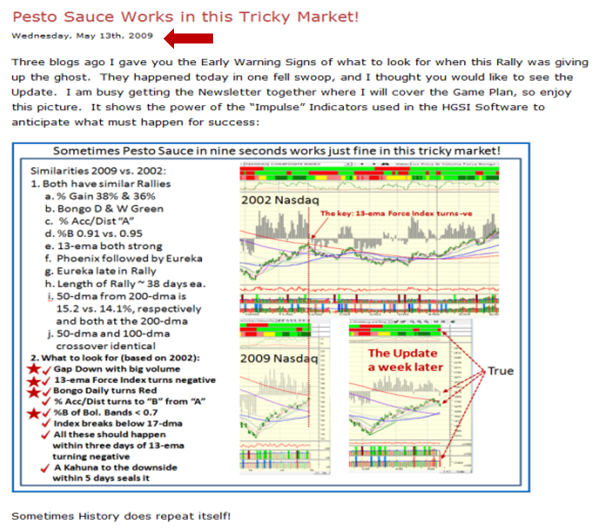

Now let me come back to the Pesto Sauce Picture I put up seven weeks ago on the blog note of May 13th, in which I showed you the signposts to watch for and then occurred, using the HGSI software to guide you. I am sure those who follow my blog will recall the following chart and we had a good laugh on the Pesto Sauce cooking theme which “mk” introduced and I chewed on at the time. Unfortunately in this day and age people skim so here it is again to remind you:

The moral of that story at that time is that indeed the market did correct, but NOBODY, nobody knows when and for how long. I try to be fair and give you both sides of the coin, but it is “Always Your Call”. The market will invariably fool you and I, and do the opposite. However, the rest of the story is to always have an up, down or sideways plan and let the market tell you which way it is headed. Never fall in love with one scenario.

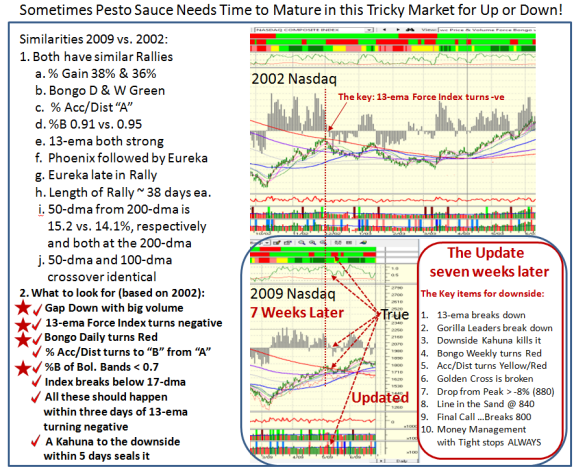

Given all of that, I offer you a new line on the Maturing of the Pesto Sauce Theme, in which I have UPDATED that chart of May 13 in the Bottom RIGHT HAND SIDE of the Chart, with the ten items that need to happen SHOULD this Market start to crater around Independence Day. I don’t have a crystal ball and I am not suggesting there is something magical about after July 4th. However, with all the Russell 2000 re-balancing that took place on Friday that shot the Volume up and the fact that we are now nearing the end of the month, the quarter and the half-year mark, window dressing will be the focus next week. It seems to me the serious business will come after they have had their fill of Hot Dogs, Hamburgers and Pesto Sauce!

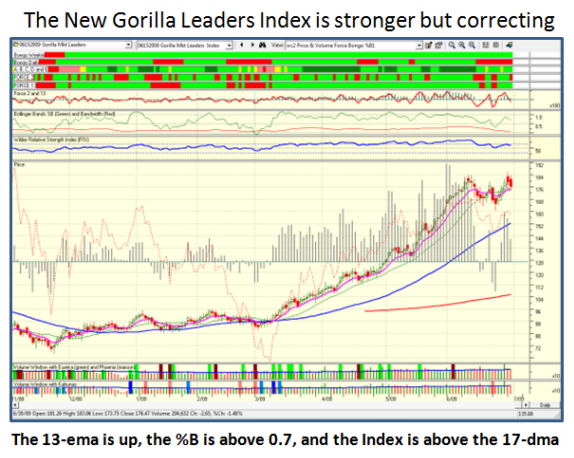

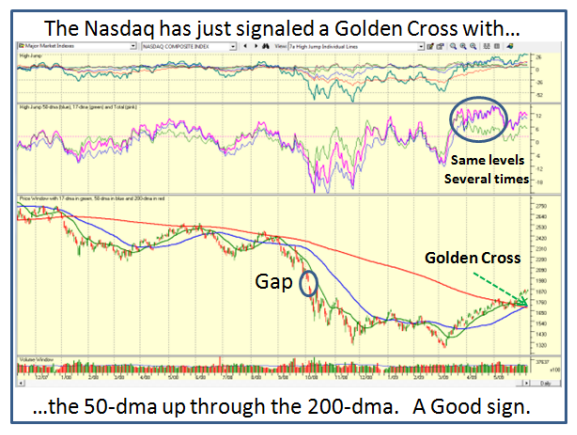

Note how the Chart shows that after declining for about 7% for a couple of weeks, it finally got enough oomph to break through the 200-dma with gusto and then dragged the 50-dma up to achieve the much-looked-for Golden Cross. If you look above and below at the ribbons and “stakes” you can see that they were all positive. Then the first signs of once again starting to droop was the Bongo Daily going red and we saw the 13-ema breakdown, as shown. If you look at the very last day we see the 13-ema is up again with a Light Blue Kahuna at the bottom, suggesting some momentum to the upside, but remember it was re-balancing day.

To the right of the bottom chart, I show the steps in the process for the Market to give up the ghost. Don’t read anything into that, as I show below the items to watch for the upside:

1. 13-ema stays up and shows continued momentum by the growing size of the black bars

2. The %B moves up again above 0.7 and heads for >1.0 along the way and stays up

3. The Bongo Daily turns Green and stays that way along with the Accum/Distrib

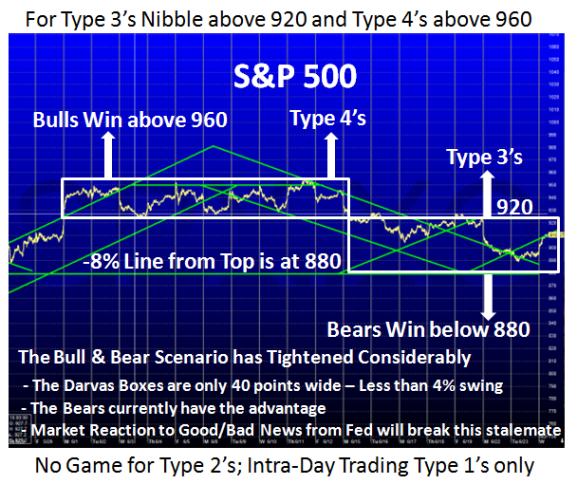

4. The S&P 500 rises above 920 as shown in the last blog where Type 3’s nibble

5. The market surprises the Bears,heads up through 960 or stumbles there

6. It won’t hurt to see an Eureka or two to show some irrational exuberance by the institutions

7. It would be even better if they are accompanied by a Kahuna along the way

8. Wonders never cease when the S&P 500 hits 1000, and the pundits will say “I told you so”

9. All Golden Crosses would chalk up by then, be they measured in dma or ema

10. Type 4’s who didn’t enter will say “Shoulda, coulda, woulda”

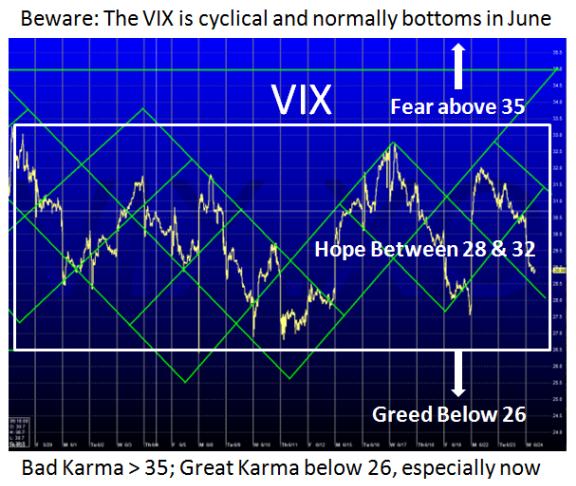

And…so the cycle will continue and the HGSI signposts will continue to guide us as to which way the wind is blowing. The one constant in all of this is that Money Management is key and keep tight stops until you have a big cushion. Then decide how much profit you are prepared to give up to play for the long haul. Just when you start to rub your hands and think you can do no wrong is when you should take some profits.

Now let me bring you down to earth – this market has only been playable by Type 1’s, the intra-day players. Type 2’s have been frustrated, Type 3’s the swing traders know better not to gamble, and Type 4’s are on vacation.

�

Technical Analysis is a windsock, not a crystal ball [Carl Swenlin].

However, I offer you some Pesto Sauce to go with the July 4th celebrations.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog