Can the Bull Market Survive?

Saturday, October 3rd, 2009Gene: As I understand, all the conditions of an early warning signal for a correction have been met as specified in Ian’s blog of May 3rd, 2009. Am I correct?

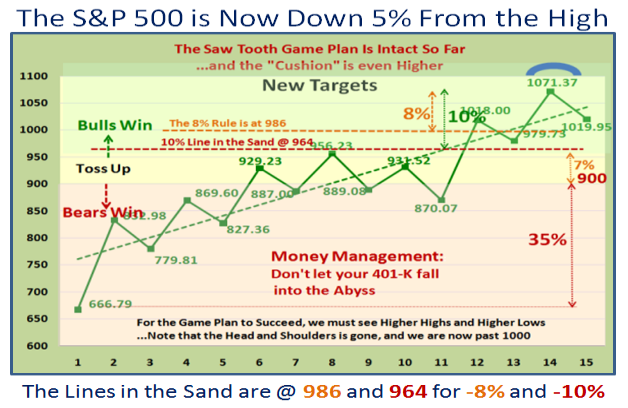

Hi Gene: You are correct about the Early Warning characteristics being met, but now everyone is wondering how severe it might be if confirmed to the downside; nobody knows for sure. However, I can add to your observation and mine from last May as to what to look for, if the market is to go down further:

The Current Status

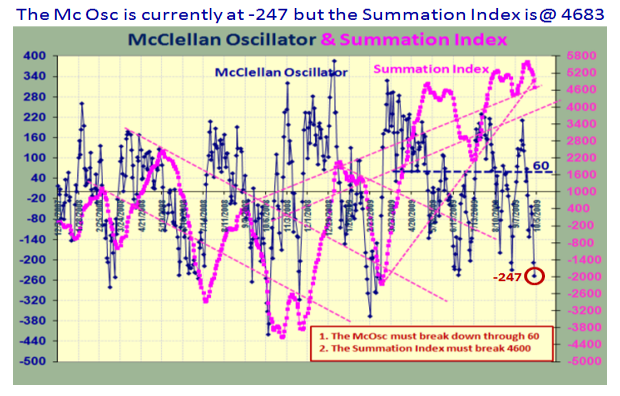

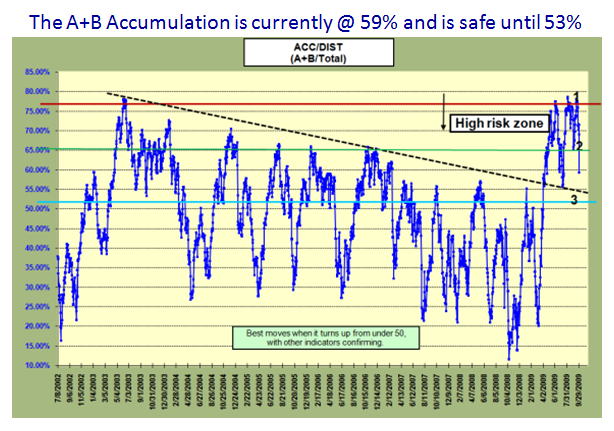

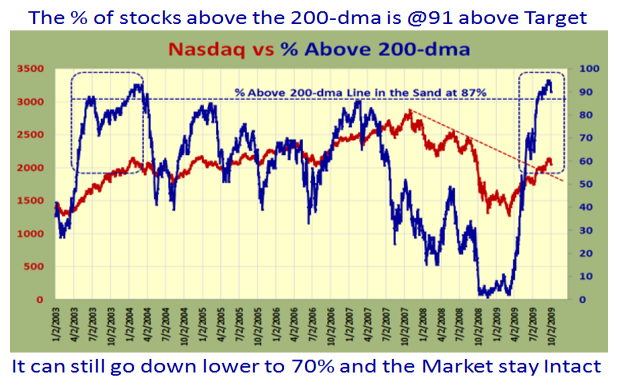

Please understand that the Market Internal Indicators we watch are still intact, though they have deteriorated considerably this past week. Items such as the McClellan Oscillator is in deep negative territory at -247, while the Summation Index is holding at its trendline, the ABCDE statistics have also fallen off sharply, but have not broken down below required levels, and the % of stocks above the 200-dma is still at a healthy 91%, where its Line in the sand is at 87%.

The Immediate Future – Next Week

Given that context:

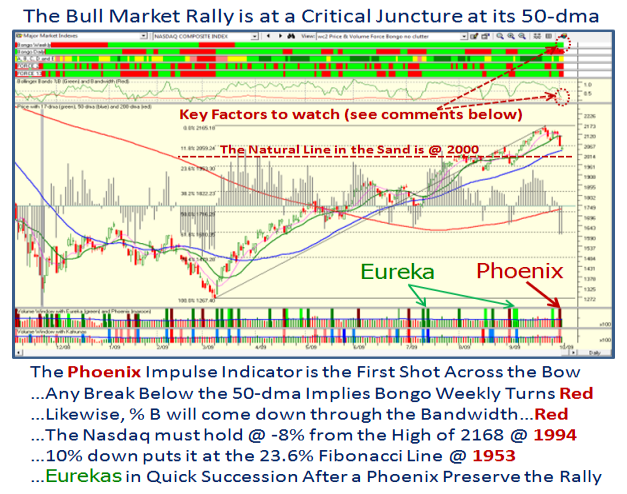

1. The Phoenix we had on Thursday was THE Major shot across the bow. It signifies that the Bears are gaining Control.

2. We must NOT see a subsequent EUREKA as that would temporarily negate that the Bears are in control. Alternatively, the Bulls are praying for a Eureka to stem the tide one more time.

3. The 50-dma must be broken, but since it is the last vestige of support, the last hope for the Bulls is that the Nasdaq finds support at or near that level.

4. Since the 50-dma is at 2032 and 6.3% below the recent high of 2167.7, we can tolerate a drop of 8% and not have too much damage done. That would put us at 1994, so don’t be too alarmed if there is a slight break down below the 50-dma.

The Deterioration Signposts to Capitulation

5. However, by then, we should expect the %B to breakdown below the Bandwidth.

6. Last but not least, the true sign that things have turned for the worse is that the BONGO Weekly will have given up the ghost and turned from a solid green during this entire rally to RED. At that point the inventors of Bongo, who include Robert Minkowsky, Dave Steckler, Jeffrey Scott, Lou Powers and David Galardi, will be whooping it up and saying “You see it does work and we made a valuable contribution to HGSI.”

7. If we see another Phoenix by then together with a Kahuna (Pink or Red) to the downside, and no immediate response from an Eureka, the Party is really over and the Saw Tooth Plan will have lost a tooth or teeth!

8. By this point in time, it pays to watch the RSI Indicator. It is currently at the 43 level for RSI 14 and it will need to get down to below 30 to signal a Bingo. I need hardly tell you that the Market will be in poor shape if and when that happens. The Indexes will be headed for their 200-dma.

9. The VIX would have shot through 30 to the upside and the Bears will be in full control.

The Upside Scenario:

We get an immediate snap-back Eureka signaling the Bulls see an Oversold opportunity and are not prepared to hand-over control to the Bears just yet. If we get two Eurekas in a row or within a day or two of each other, the Bulls are back in Control!

I repeat again, the Signposts, Stakes in the Ground and Measuring Rods we now have in place keep us on the right side of the market. They tell us what to look for in the expected severity of the decline and the potential steps to recovery.

Thanks to many of you who have responded to my note on the change of venue…please reply immediately if you have not already done so; it does help me to help you.

…And that’s My Story for Today!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog