Market Tug-O-War…Something’s Got to Give!

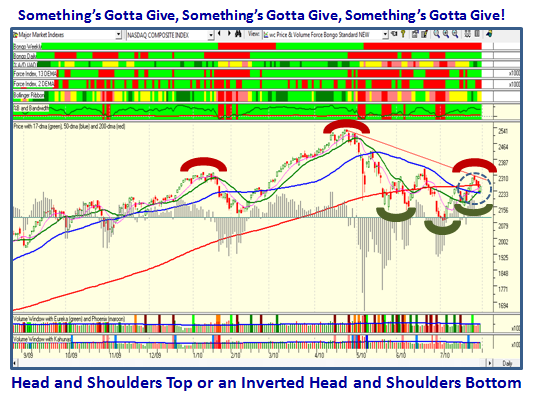

Each week we get closer and closer to seeing if Golden Crosses prevail over Death Crosses or vice versa, or Head and Shoulders Tops win out over Inverse Head and Shoulders Bottoms!

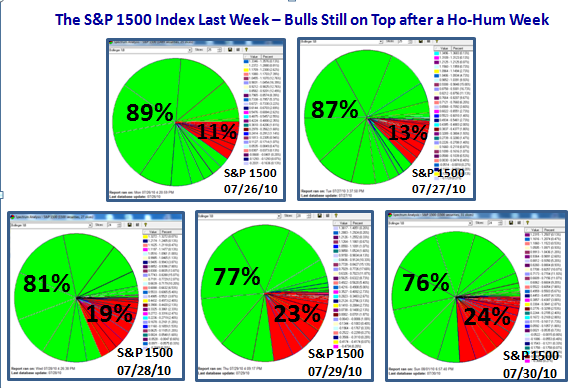

We are now at the point where “Something’s Gotta Give”. Last week was a ho-hum week, and the results of %B above and below 0.5 is shown for each day last week, below:

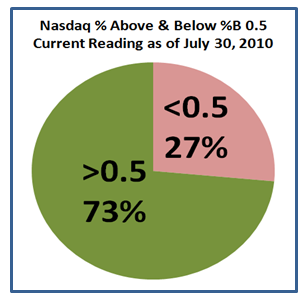

I’m sure you would like to know how the Nasdaq finished the week with the Bulls and Bears tug-o-war, so here it is for Friday:

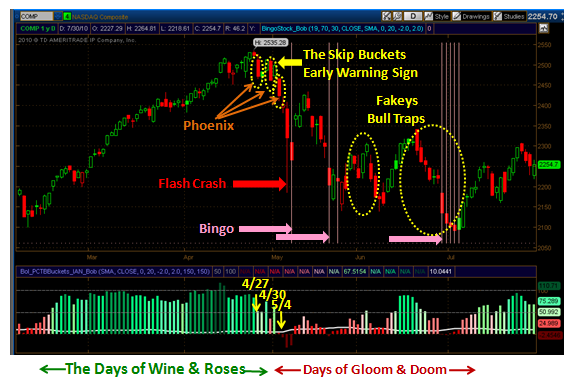

We had a Bad Spell with a couple of Fakey’s where the %B came back down through the Bandwidth, causing yet another Bull Trap a couple of week’s ago. As you can see we have now weathered the storm and the Bull’s have control at present with the Eureka on 7/26/2010 and the %B ratio as mentioned above:

My good friend Bob Meager came up with a way to show the %B and Bandwidth on the Think or Swim Software product, which allows me to display all that I have taught you about Phoenix, Bingo, together with Fakey’s (Bull Traps) and how to spy Early Warning Signs of weakness when the Index Skips Buckets on particular days. A Bucket is defined in this instance as a %B Spread of 0.1, i.e., 0 to 0.1, 0.1 to 0.2, etc. Note how the Phoenix Signals and the %B Skipping Buckets as shown below gave early warning and could help the alert trader that it was time to change from Bullish to Bearish before the big fall:

…And so we come to our favorite “wc” chart which clearly shows the congestion around the various moving averages, and so we wait to see which way it will break out or down this week:

Good Luck this week, with Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog