The Hindenburg Omen did NOT Volley & Thunder

Thursday, August 12th, 2010Those who follow my musings, including the large number of Hindenburg Omen followers I have as a result of my early warnings back in November 2007 of potential Market Tops, will strike a chord with this Blog Note today. I value the mention in Wikipedia of one of the Blog Notes I wrote back then which has attracted a lot of attention from those followers over the years and especially of late. It’s called “The Hindenburg Omen Signals between 2005 and 2007.” I knew something was astir yesterday when I noticed a large number of “hits” on the blog from the Hindenburg contingent, including four inquiries regarding the possibility of a Hindenburg sighting!

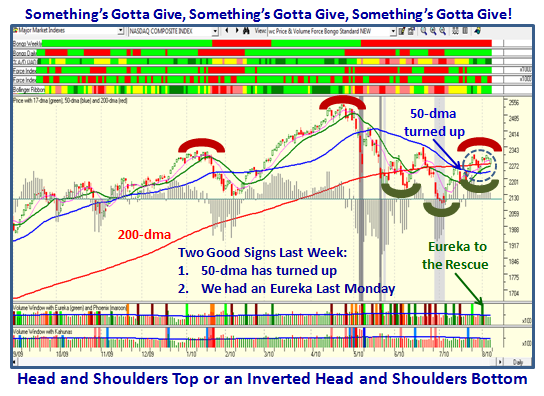

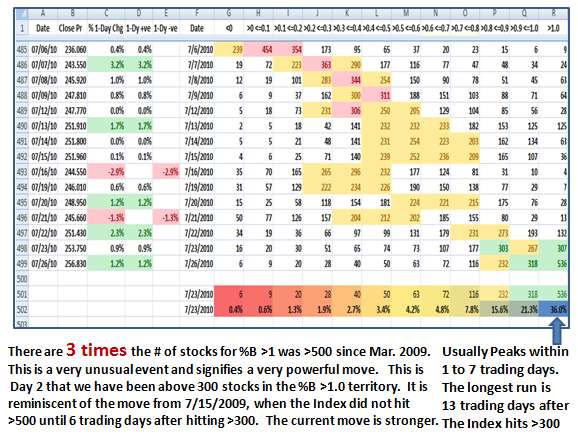

As you are well aware, my work looks for the extremes in Market Internals or as John Bollinger would say “The Fat Tails” ends of the Equation, i.e., the unusual Impulse Signals that the Internals of the Market give from time to time. I realize that to some of you that the “mish-mash” of terms you have had to learn may have little meaning, but I also believe that over time these very signals have been a god-send to us who now see their value. That’s part of the fun. Terms like Bingo, Bango, Bongo, Eureka, Phoenix, Kahuna, and Hindenburg Omen are now part of the vernacular and can only be found to help you by using the HGSI Software. They help in understanding the moods and emotions that rule the Market from Euphoria to Fear, Capitulation, Hope and Optimism to name a few.

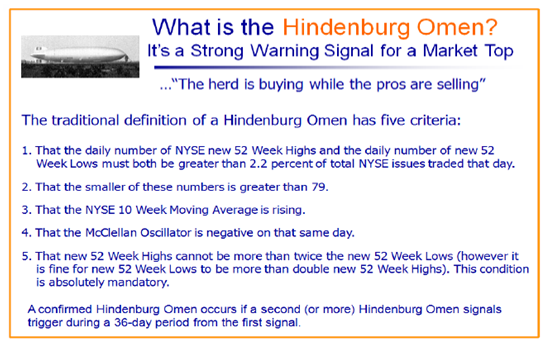

So, let’s start with the Definition of the Hindenburg Omen:

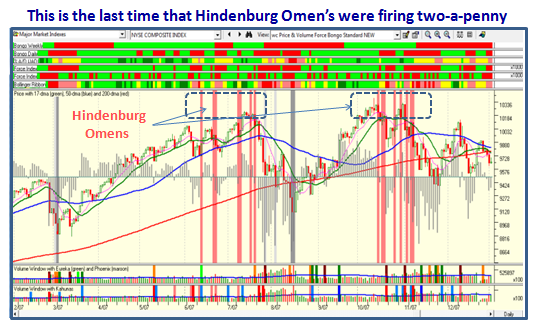

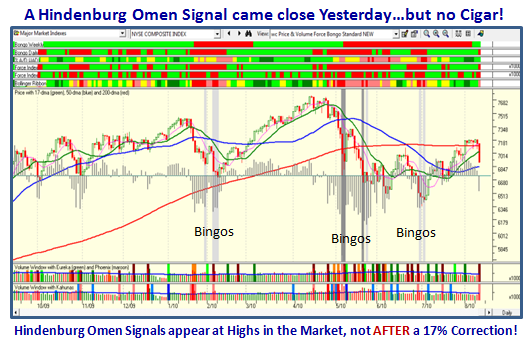

Please understand that a single Hindenburg Omen (HO) “firing” does not constitute a confirmed condition…it requires a minimum of two within 36 days, so even if we were to have a spurious signal it is highly unlikely that we will see another one given what has just transpired yesterday. Furthermore, these signals come in bunches at tops in the market usually after Long Rallies of at least a couple of years or more. In addition, it would be extremely unusual for one to get such a signal after having just tolerated a >17% Correction in the market only a couple of months ago. Yes, of course, we have seen a spurious Hindenburg Omen fire but they are to be ignored. Here for the record was the last time we saw such signals in droves, despite what you might read elsewhere on the Internet:

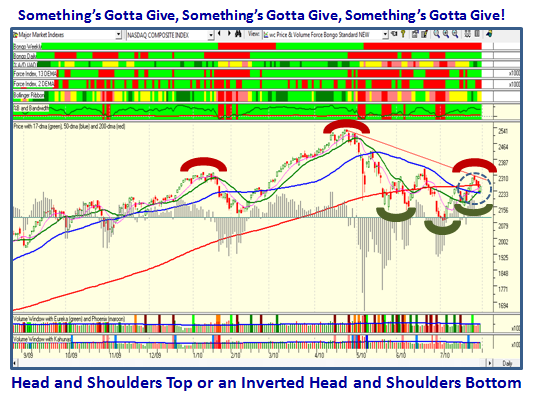

Now as for yesterday, you can see we have a clean slate. The 52 Week Lows were not quite enough to meet the criteria, and the 52 Week Highs were more than double the 52 Week Lows, thereby violating Rule #5. Of course times have changed since these rules were made several years ago, especially with the High Frequency Trading (HFTs), doing their stint…or should I say stunt?! If the market continues to deteriorate, then the chances of the NYSE 10 Week Moving Average continuing upwards is mighty slim to nil, and will also negate any chance of us seeing multiple HO’s any time soon:

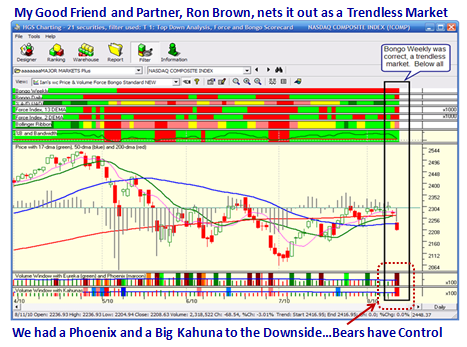

My Good friend and partner, Ron Brown, who does a Weekly Report which you can get at

http://www.highgrowthstock.com/WeeklyReports/default.asp nets out the current situation as a Trendless Market:

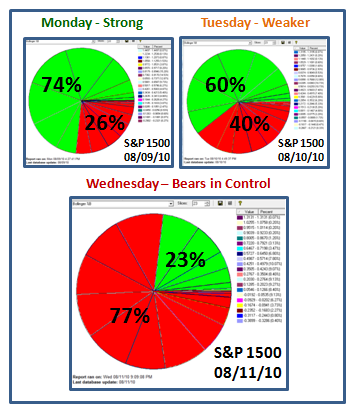

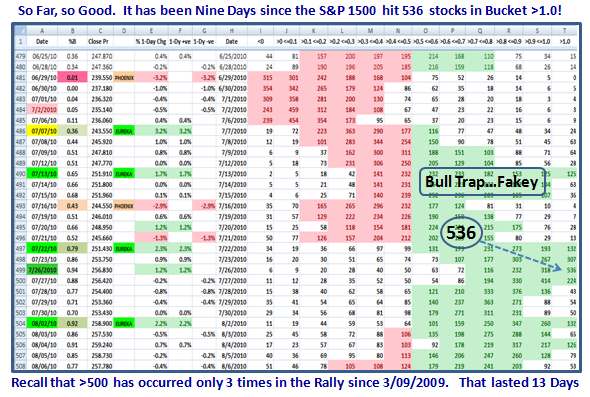

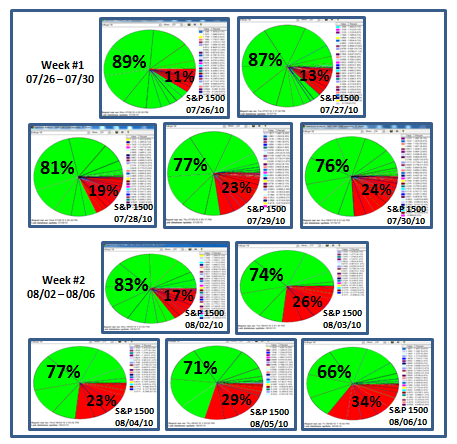

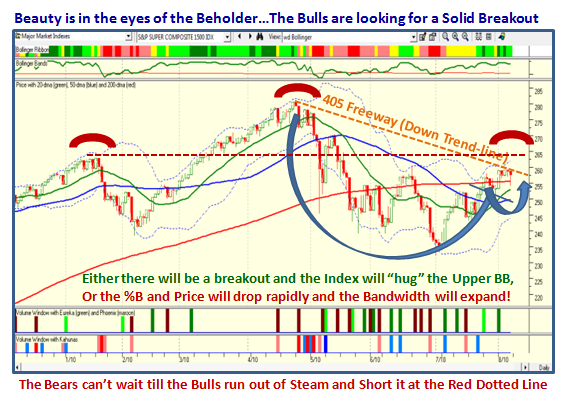

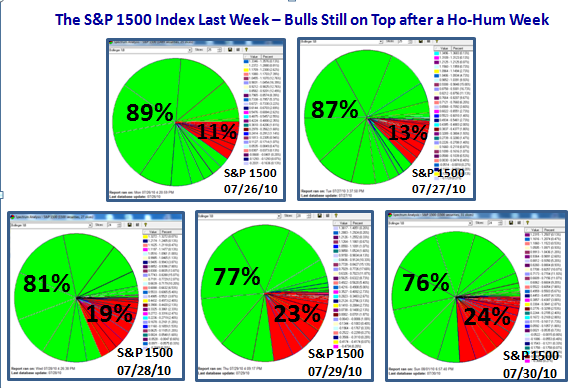

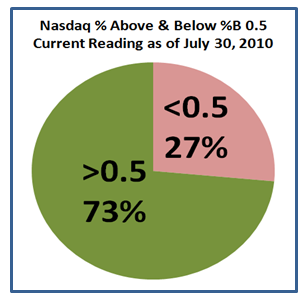

However, that said, I do have a new “Fat Tail” Measurement of Euphoria using %B Buckets to Identify Early Warning Signs of a Correction in my Newsletter which will be out this weekend. I will leave you with the following status of the tug-o-war which the Bears are winning hands down. Remember that what you are seeing is the Percentage of S&P 1500 Stocks which are Above (green) and Below (red) the Middle Bollinger Band of %B = 0.5. The Bears have it by a whopping 77% to 23% as of yesterday:

Be very cautious how you play this market until you see which way the wind is blowing, but for the moment it is in your face.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog