Stock Market: Bounce Play on Stellar Earnings

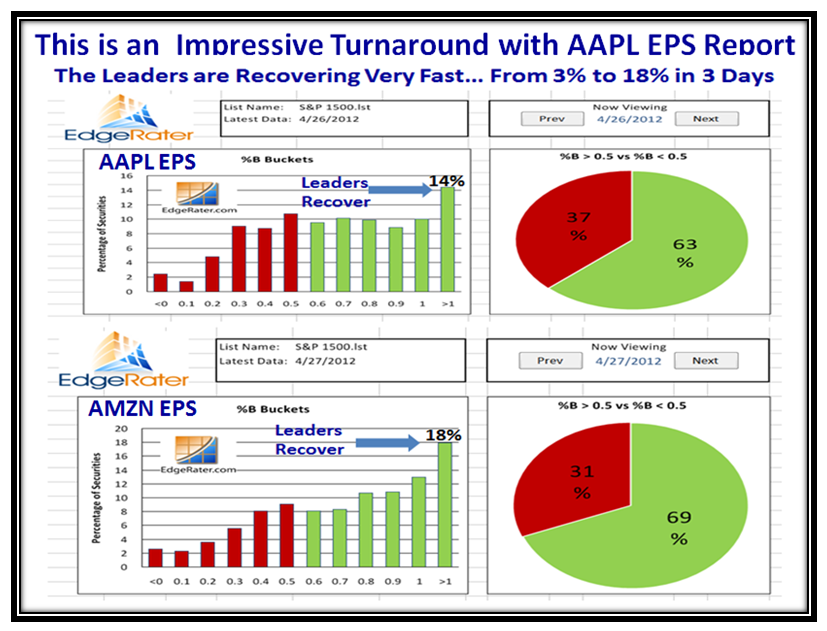

The Stock Market bounced back with excellent Earnings reports from AAPL and AMZN to mention two and now we are in a quandry as to whether this is the start of something big or we fall back into the doldrums and head down once more:

Although the Market Indexes are a stone’s throw from their recent highs, we also see ominous signs of Head and Shoulders Tops, so we shall see if the bounce of the last three days will continue or fizzle out:

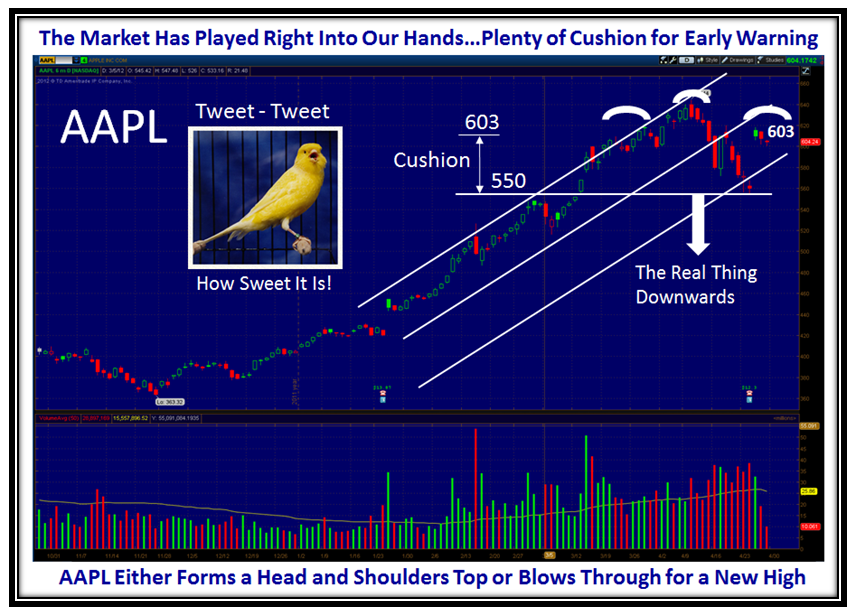

The extent of the Focus on AAPL is unprecedented, so it is a natural “Go To” for the Market direction:

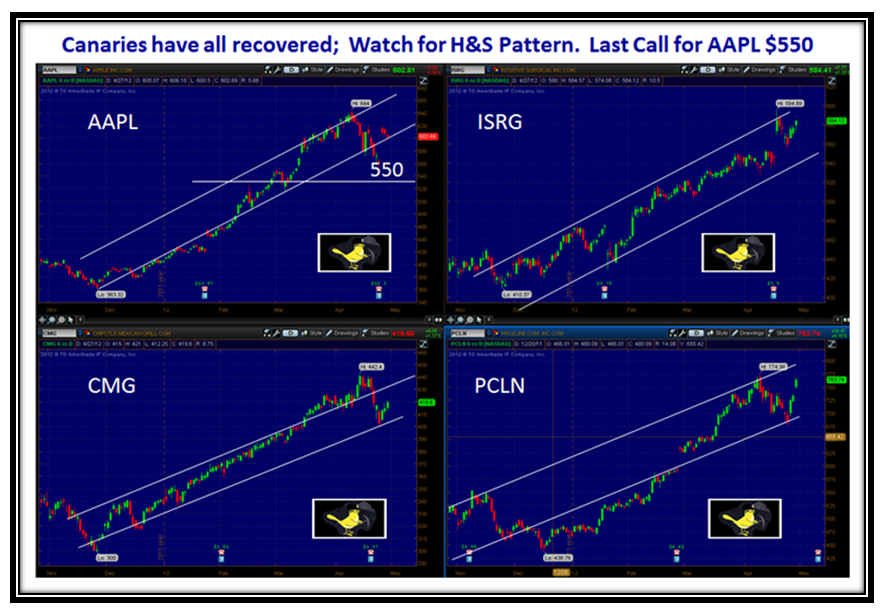

The Canaries are all chirping again, so we have another yardstick by which to judge the Market direction:

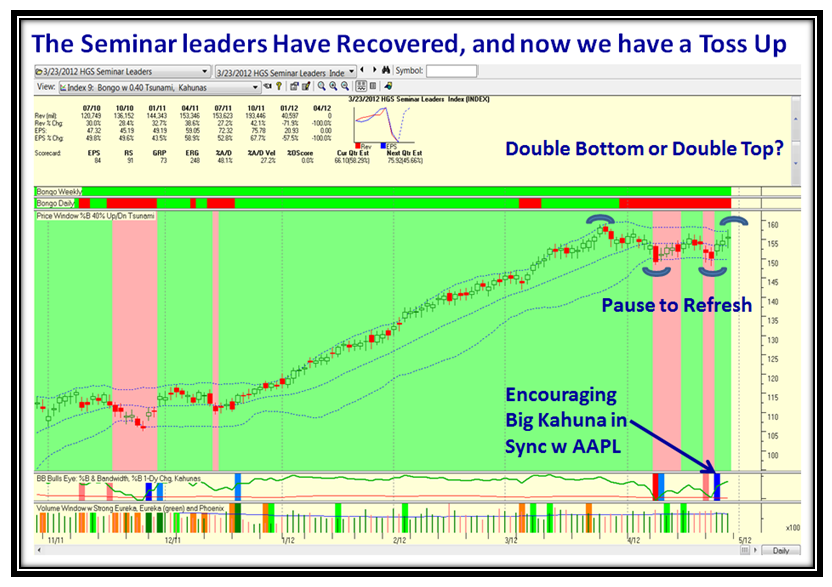

The Seminar Leaders are back in business and again we are faced with a Double Bottom or a Double Top:

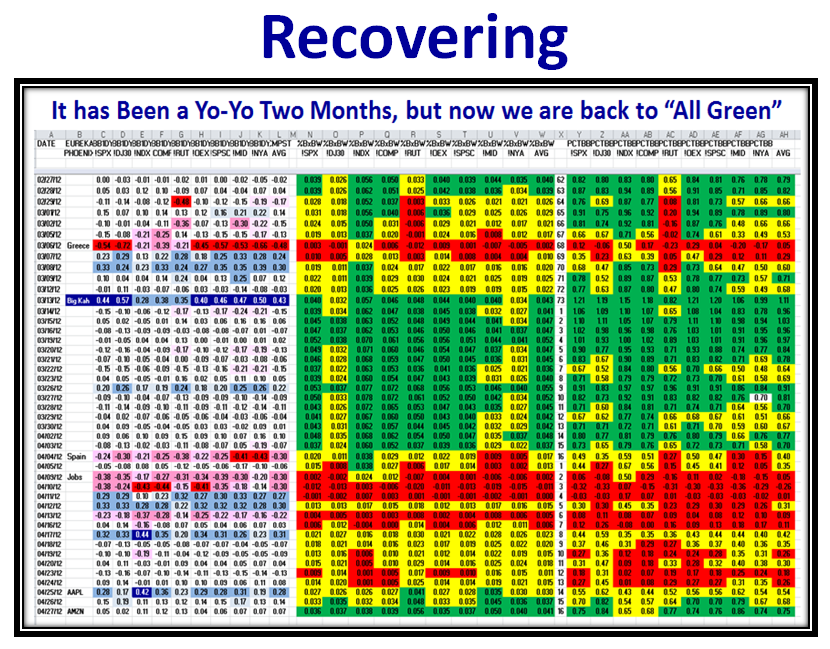

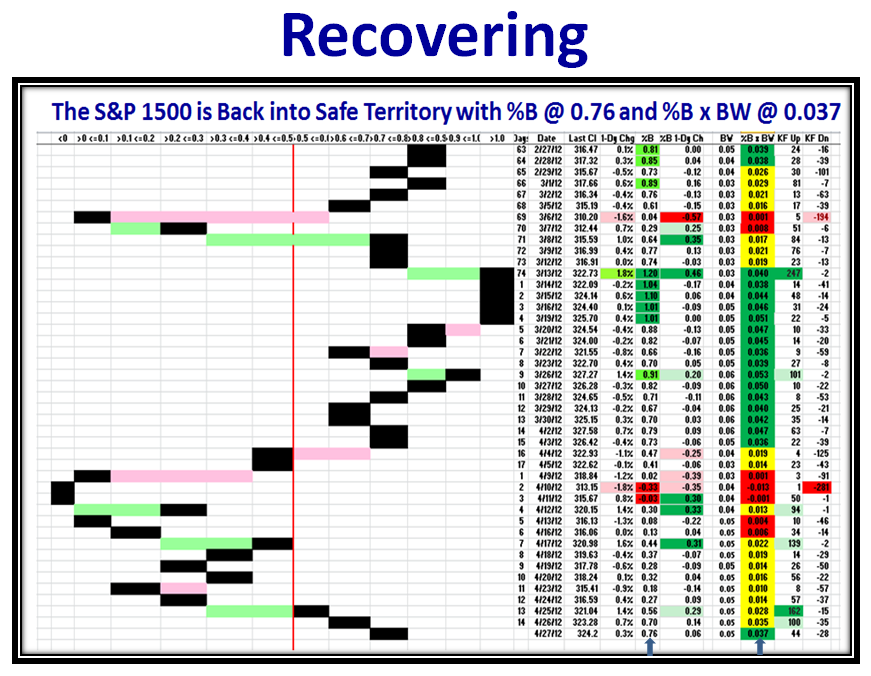

Let’s look at other signs of Recovery… Back to green on the Indexes:

…And more of the same, Recovering:

…And one more to confirm that we can stiffen our backbones:

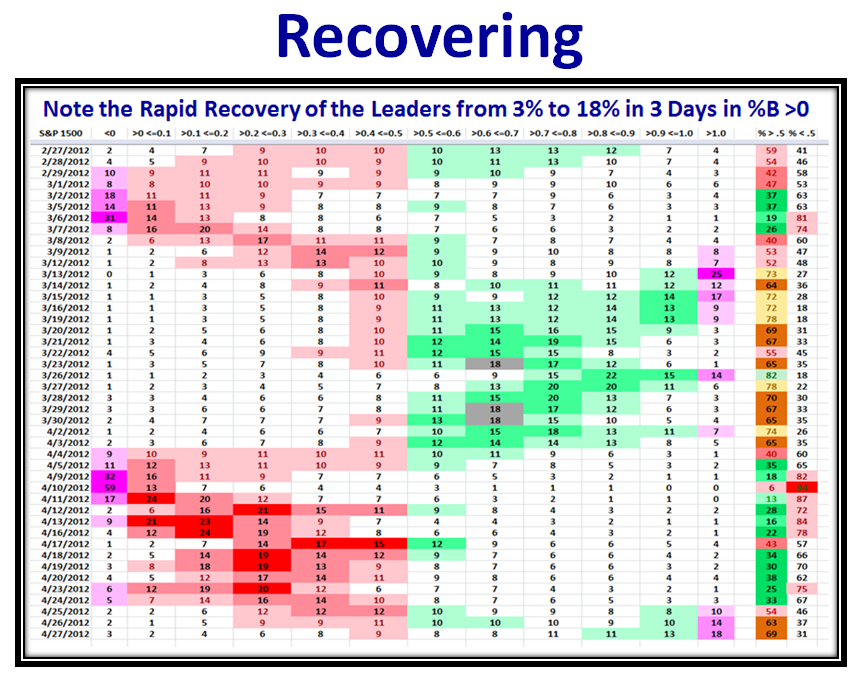

Look at the big move from 3% to 18% in %B >0 in three days as a result of the pull from AAPL & AMZN:

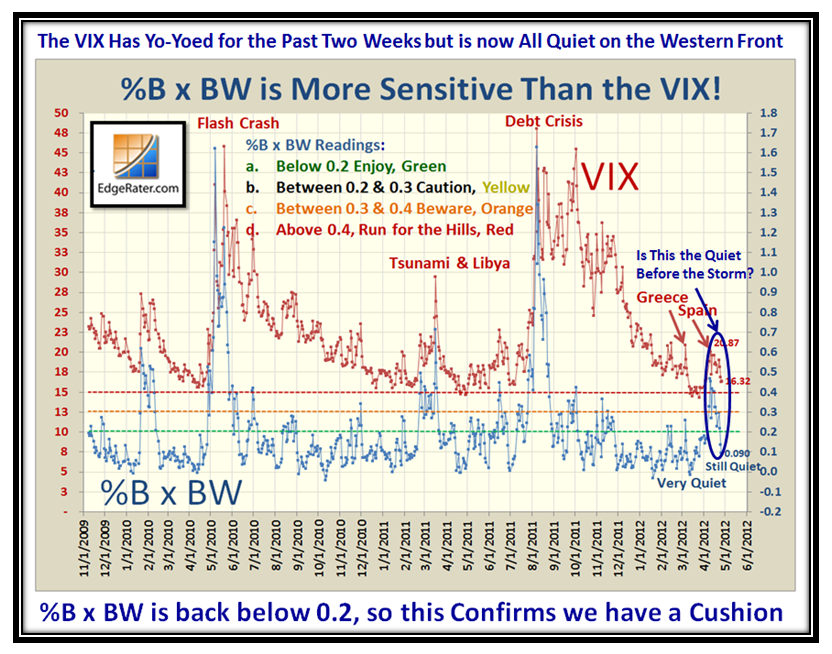

Likewise, after a couple of shots across the bow from the VIX, it is back down to “Quiet” Territory:

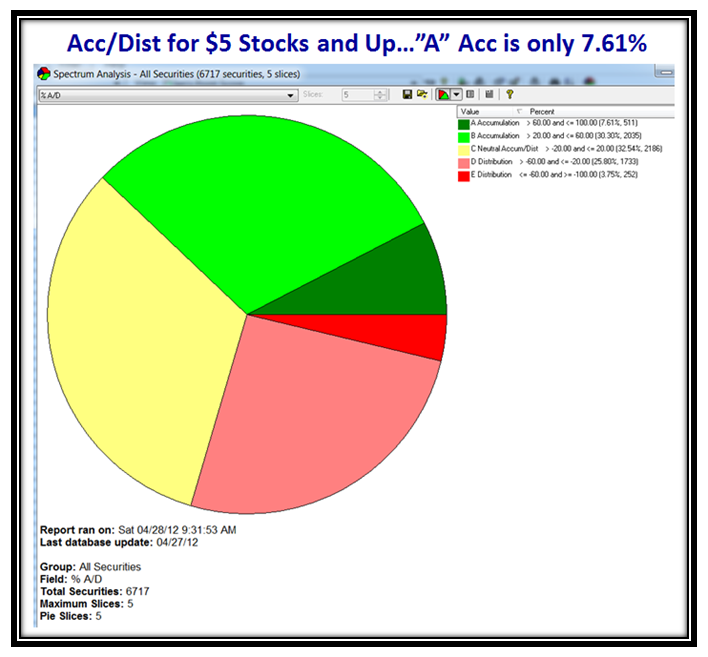

So much for the good news resulting from the positive moves in the last three days. The $64 question is “How do we establish the INTENSITY of the Positive or Negative Move this coming week to decide whether this is the Real Thing Upwards or another ‘Fakey’, and we head down?” At this stage of events the best clue will come from the Movement in Accumulation or Distribution of the stocks in the Database above $5. Let’s first see where we stand as of Friday:

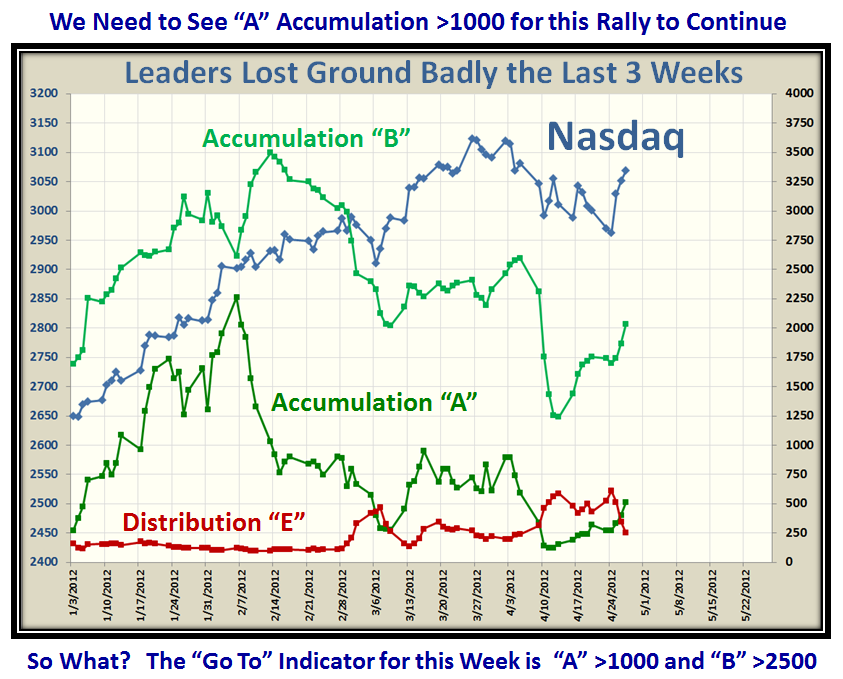

If we look at the recent History of segments “A”, “B” and “E” we can quickly arrive at targets for next week:

Let me repeat that so that it is emblazoned in your memory. At times like these focus on one thing that will help you the most to understand which way the wind is blowing and with what Intensity. It won’t change overnight but it better be strong to the upside this week or the market will fizzle again:

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog