Stock Market: Santa Claus High Road?

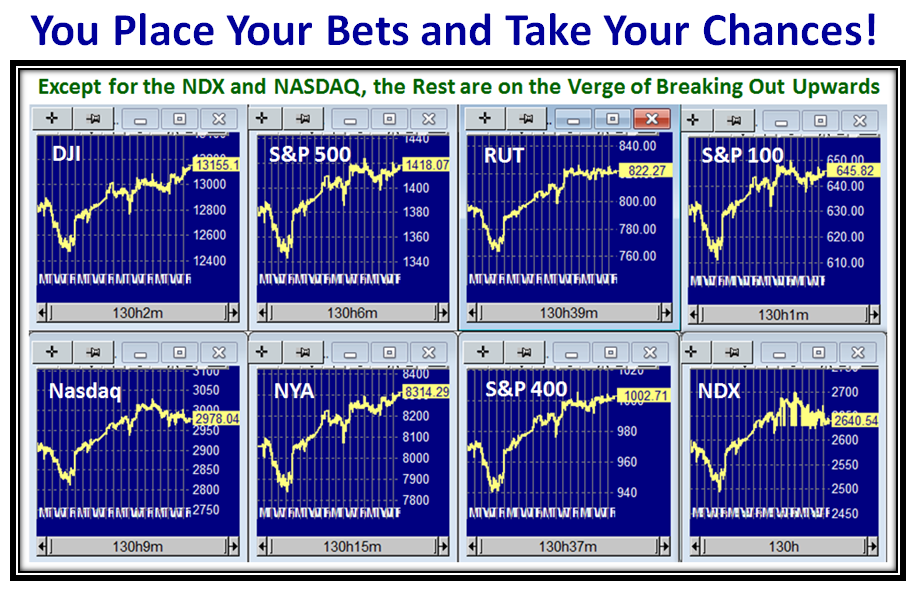

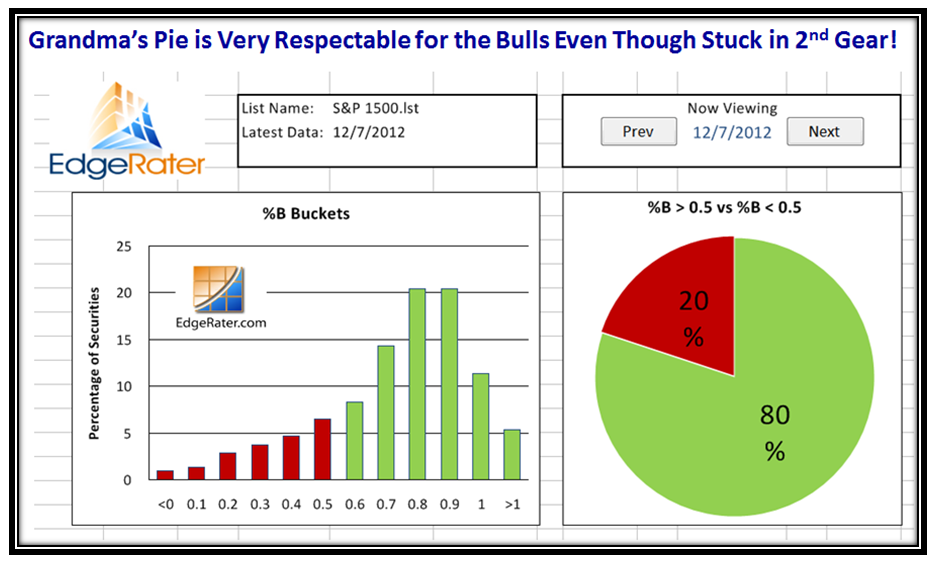

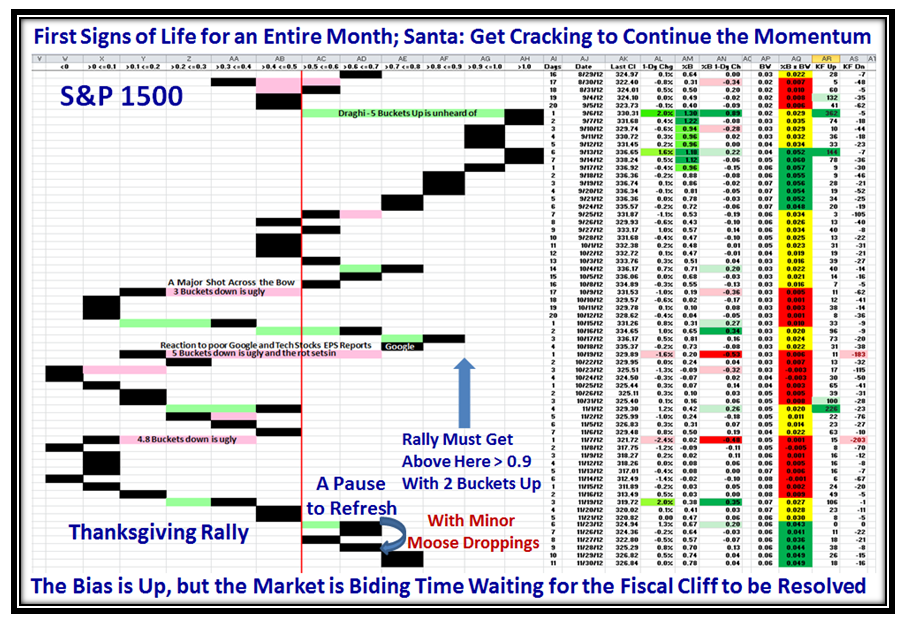

Monday, December 10th, 2012I’m sure some of you are itching to buy the Santa Claus Rally now that the Market Indexes are showing signs of life. On the heels of the Blog Note I put up on Saturday, my good friend Dr. Robert Minkowsky noted that I had shown the Mid Cap S&P 400 Market Index leading the charge. He gave me some ideas that will at least give a perspective of what are the challenges for both the S&P 400 and the Russell 2000 to take the High Road from here:

Let’s start where I left off on Saturday, and you will accept that the first Hurdle is for the S&P 400 to get above 1030.

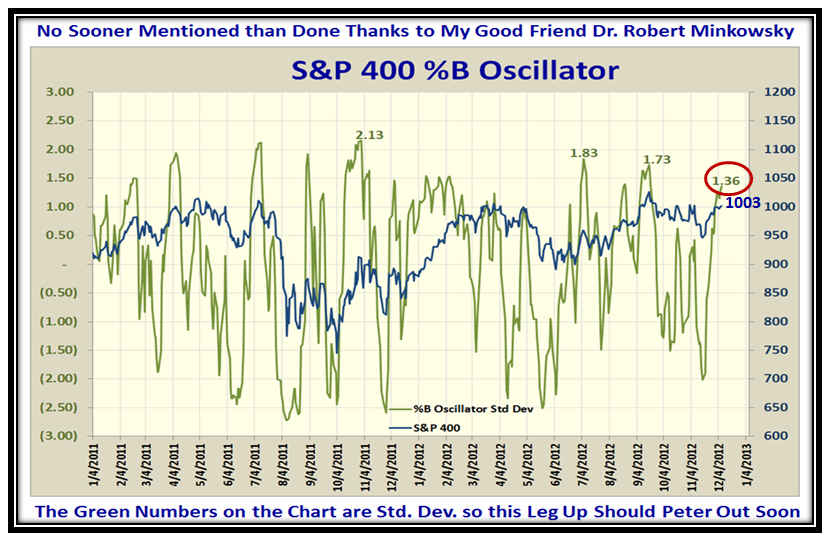

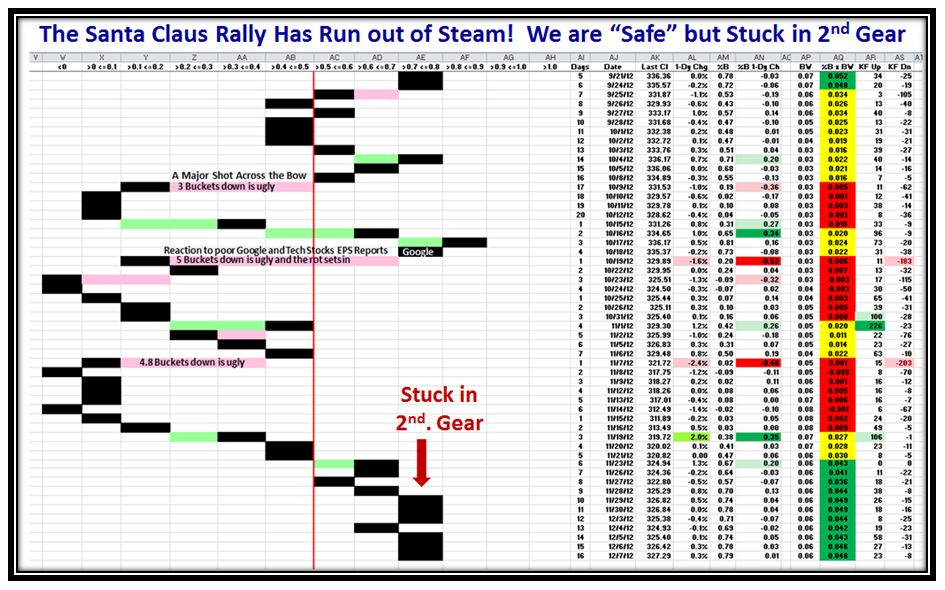

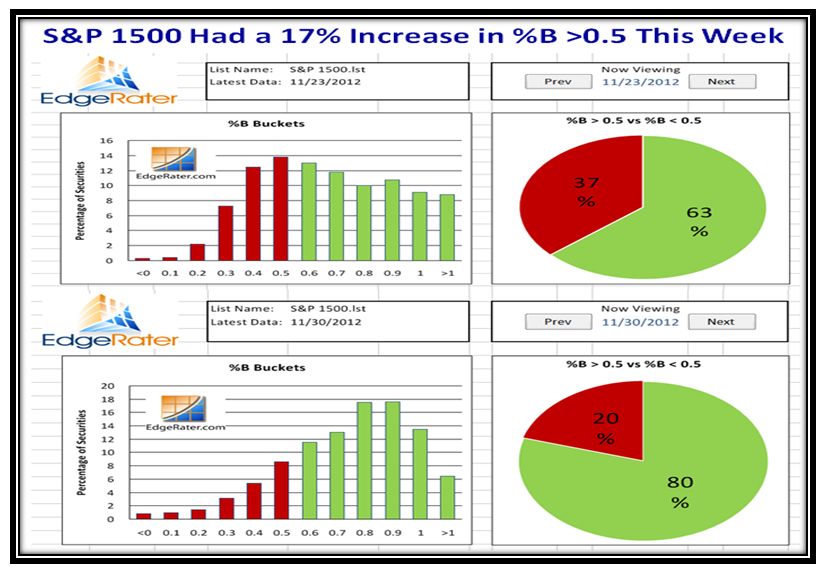

Since the intention is to buy into this Rally at this stage with the 17-dma about to break through the 50-dma to the upside, the question is where does %B stand relative to past history and how much cushion do we have? Robert has used an approach where he has “Normalized %B” using its Standard Deviation with about 23 Years of past history. He calls it the %B Oscillator, which is shown below for the S&P400:

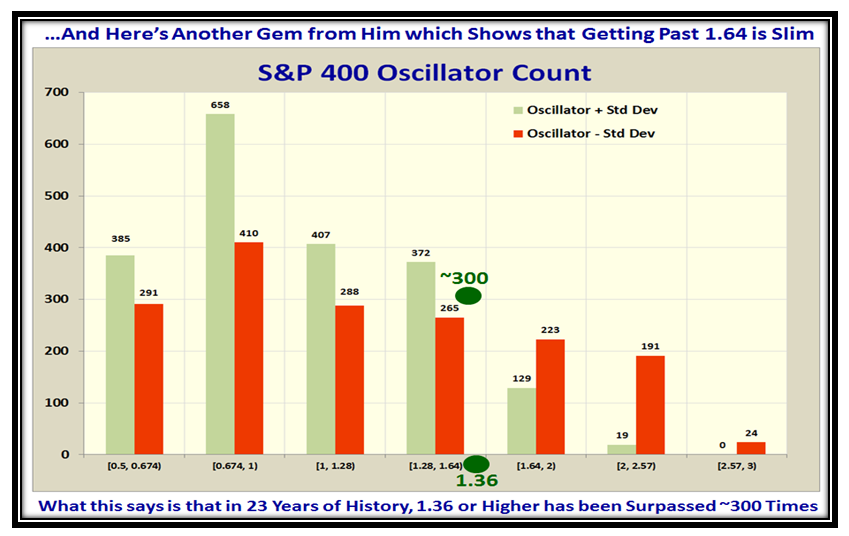

2 Std. Devs. is the Yardstick so we see that we still have some cushion with the reading in green at 1.36, and we can compare it to recent past history. The second picture shows the statistics for the “Oscillator Count” over the 23 Years of History, and as I highlight in Green, 1.36 has occurred about 300 times:

However, if we look at the next yardstick of 1.64 Std. Dev. it has occurred only 129 times, so although the Mid Cap Index has surpassed that twice before this year, it suggests that is about as far as we can expect it to go on this Rally.

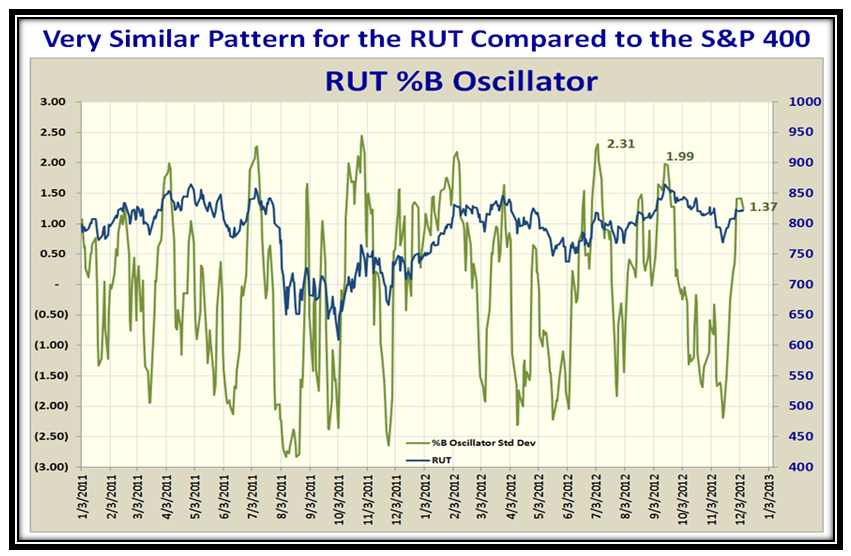

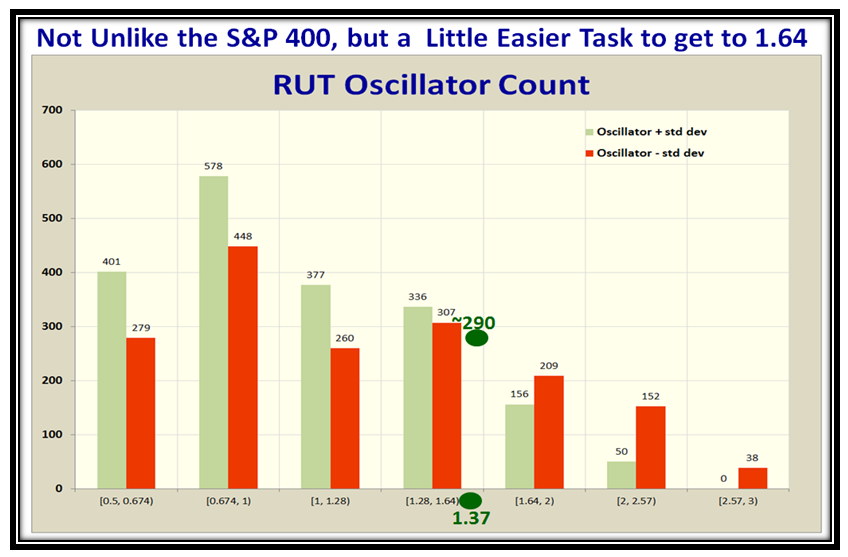

I’m sure you are asking “What about the Russell 2000 (RUT), since small caps get a boost at this time of the year with the so called “January Effect”? No sooner said than done:

The results are very similar, but the RUT has a bit more cushion since it shows 156 readings at 1.64 Std. Devs. compared to 129. The net bottom line is to be on your toes with tight stops if you are entering the Market at this stage where you are certain there are big things to come when the Fiscal Cliff kerfuffle is behind us before the New Year. Thank you Robert for a new perspective of how to use “Normalized” %B with Std. Deviations and Historical Count.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog