My good friend, Mike Scott used this very apt term to describe the current state of the Market, so that is my heading for today.

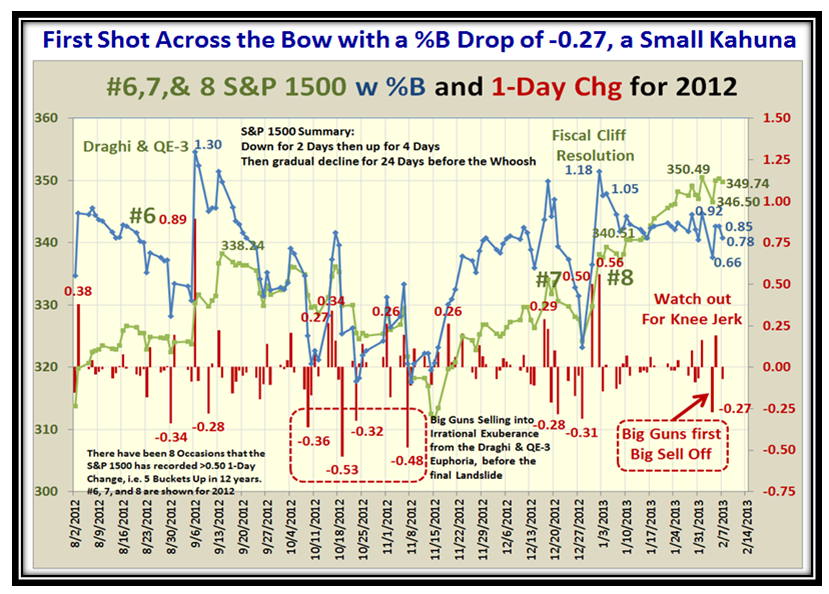

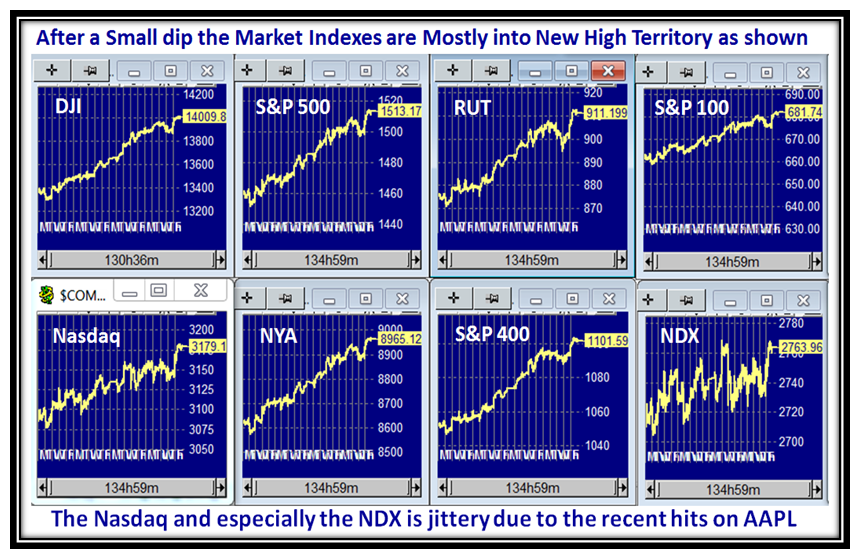

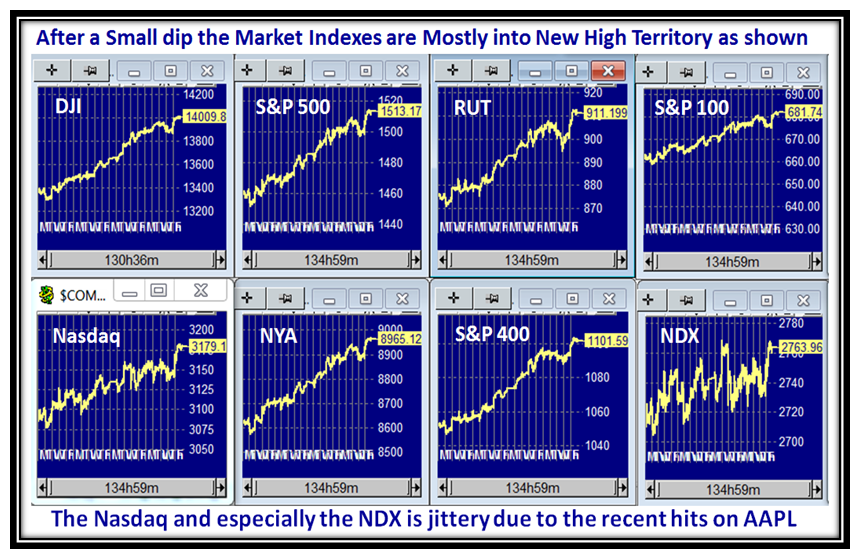

We had a whiff of the Middle Road Scenario with a very small knee jerk last week, but that was all eradicated on Friday which took the DJI into 14,000 territory and most of the Market Indexes still heading up into new Highs:

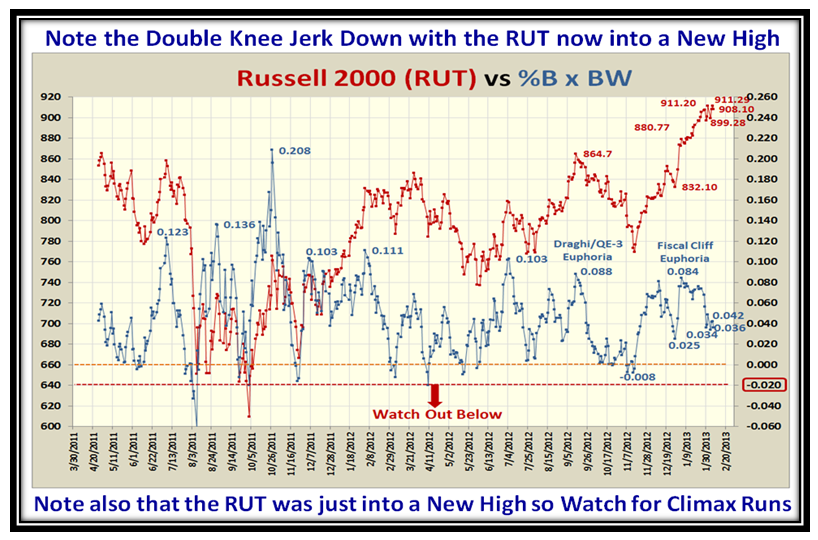

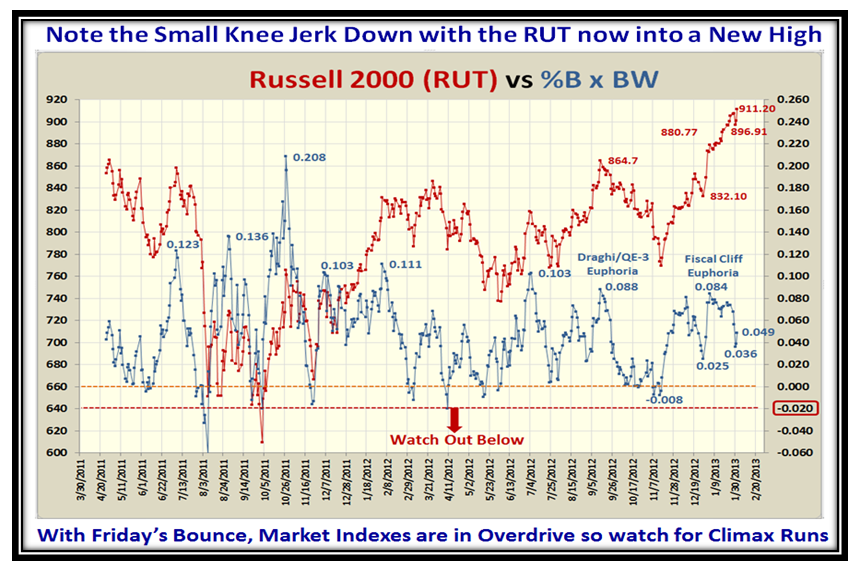

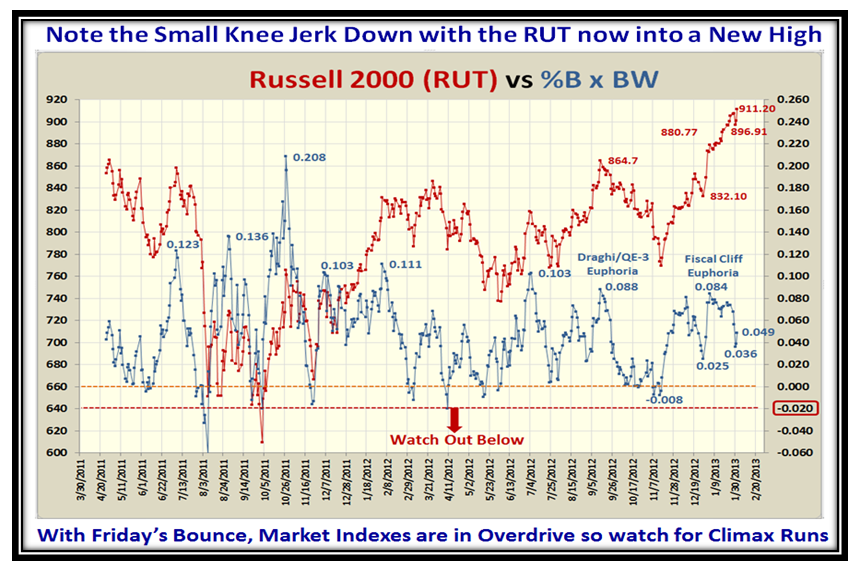

…And here is the Russell 2000 (RUT) to show that small knee jerk, followed by the powerful move on Friday, kept the cushion intact for a possible big bucket down day. Now the Bulls have their cake and can eat it too should the Big Guns start to unload:

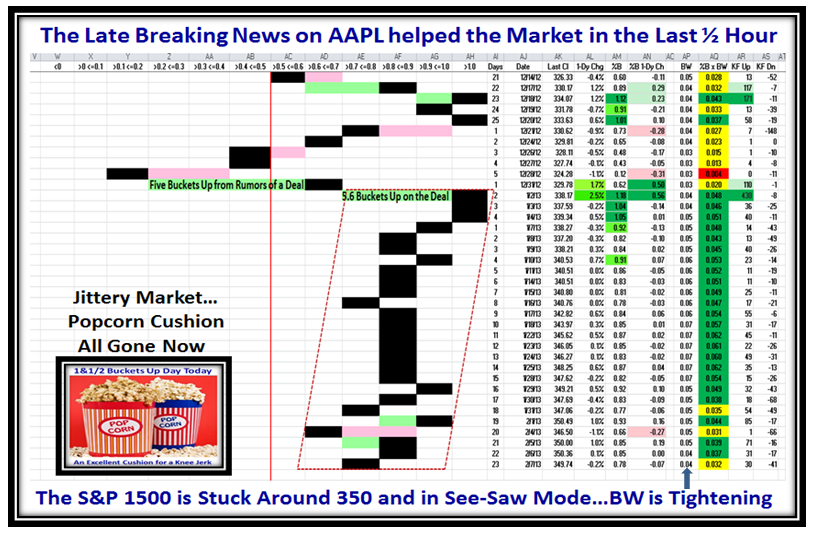

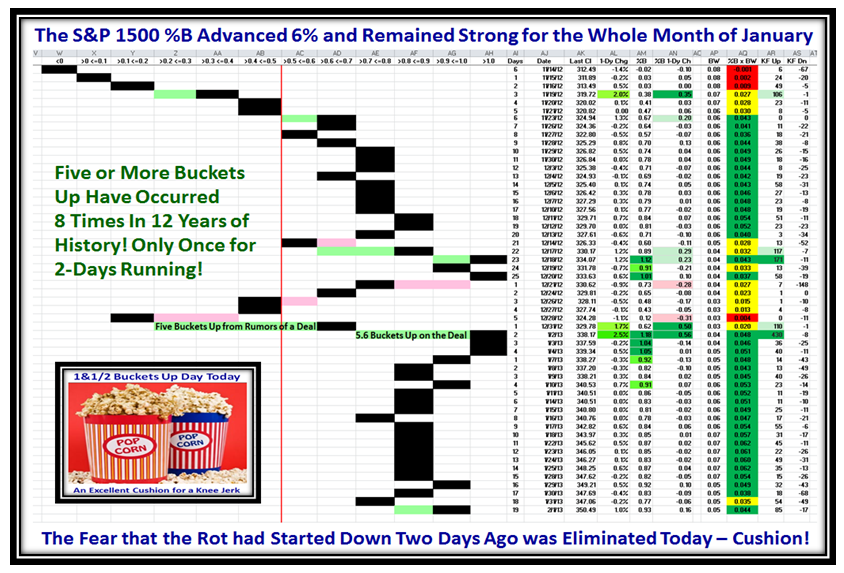

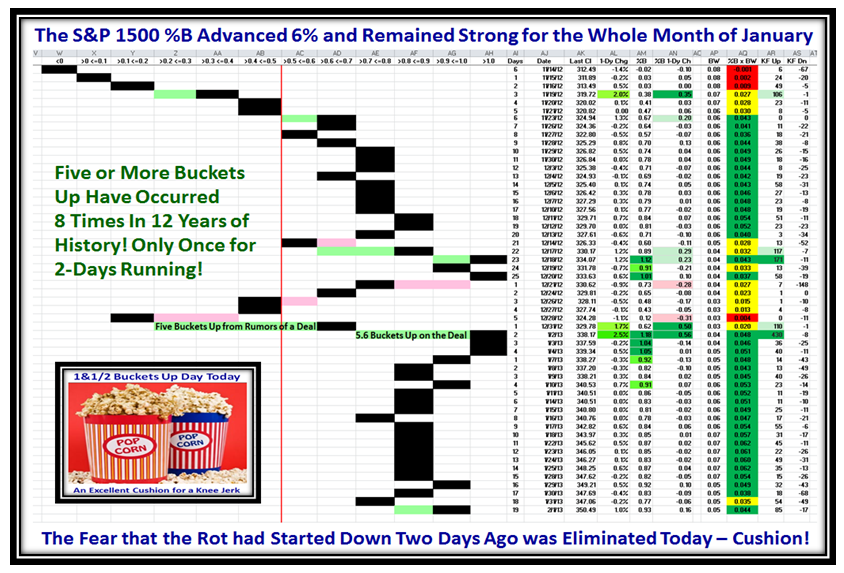

…Right on time, we got close to 2 Buckets up of pop-corn, so the previous two days downward action are negated:

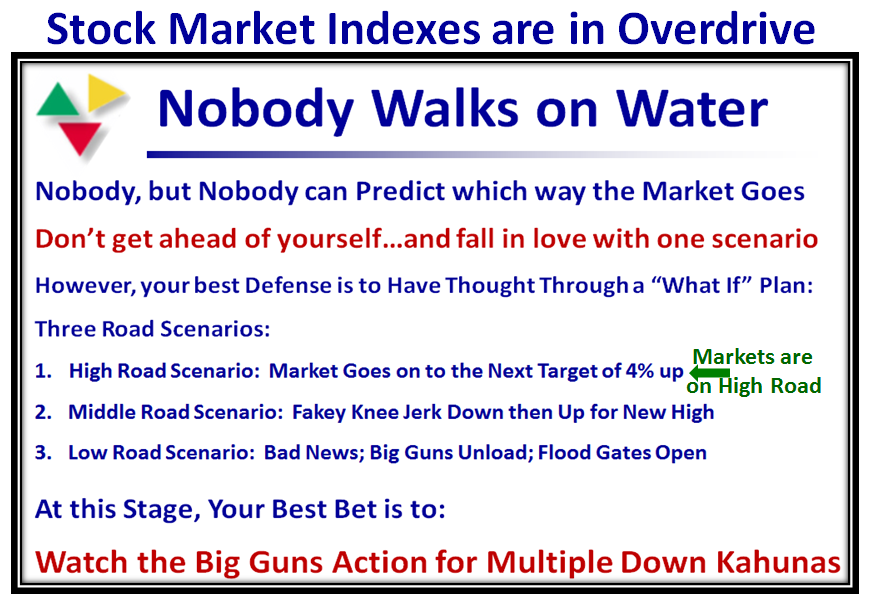

So the beat goes on and we are now back on the High Road Scenario, where many were shaken out but we stood firm and tall:

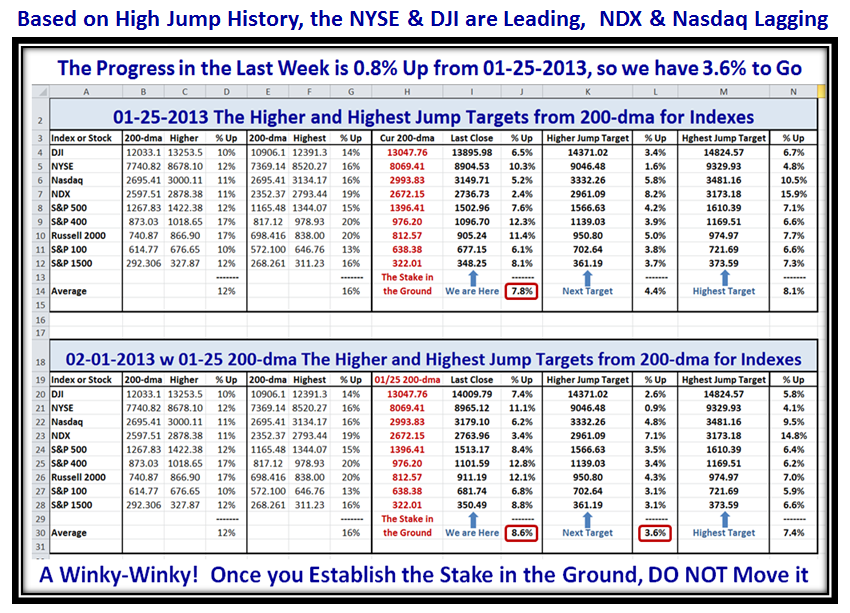

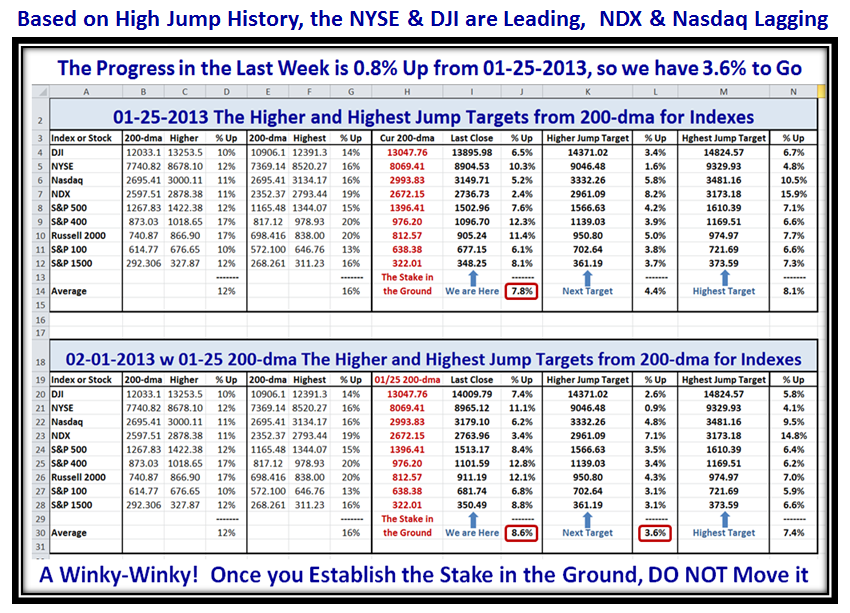

Nobody knows whether we will be on the High Road Scenario for a day, two days, a week or a month, but now the job is to measure from “whence we came” and where our next targets sit. You’ve got it, ALWAYS turn to the High Jump at this stage. We can see that we have progressed 0.8% of the 4% I said over a week ago for the Indexes to hit a 4% rise from 1/25/2013 for the High Road Scenario. If you have become a believer in this approach, then my Winky-Winky for today is unlike the Super Bowl which will start in another hour and a half, DO NOT move the STAKE! This following picture kills several birds with one stone. It not only shows which Indexes are leading or lagging, but also what the progress has been since the last measurement and how much further to go to reach the next rung up the ladder. If you keep moving the Stake each week, then you don’t have a feel for progress. More importantly, since the 200-dma will also move up, the Targets move up somewhat with it, and therefore it’s in effect exagerating the catch up required from when you first took the measurement.

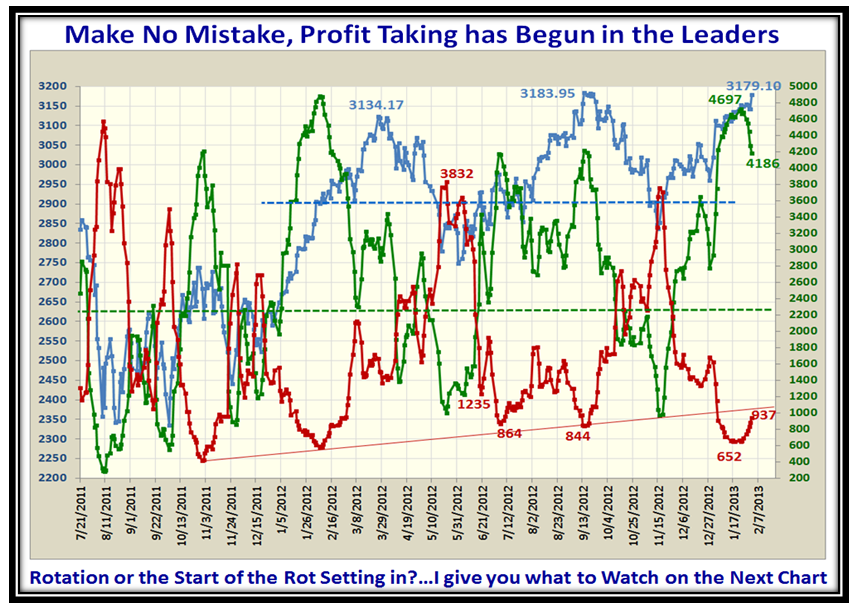

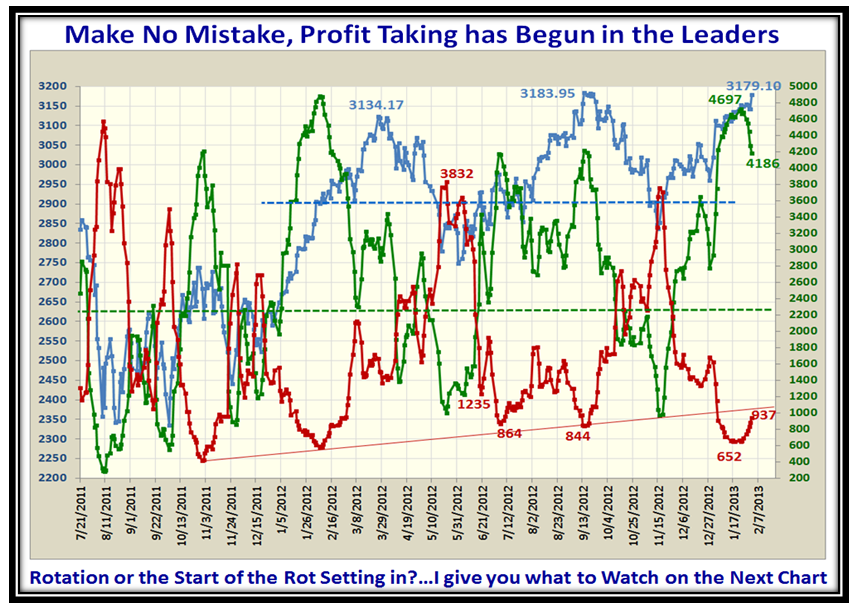

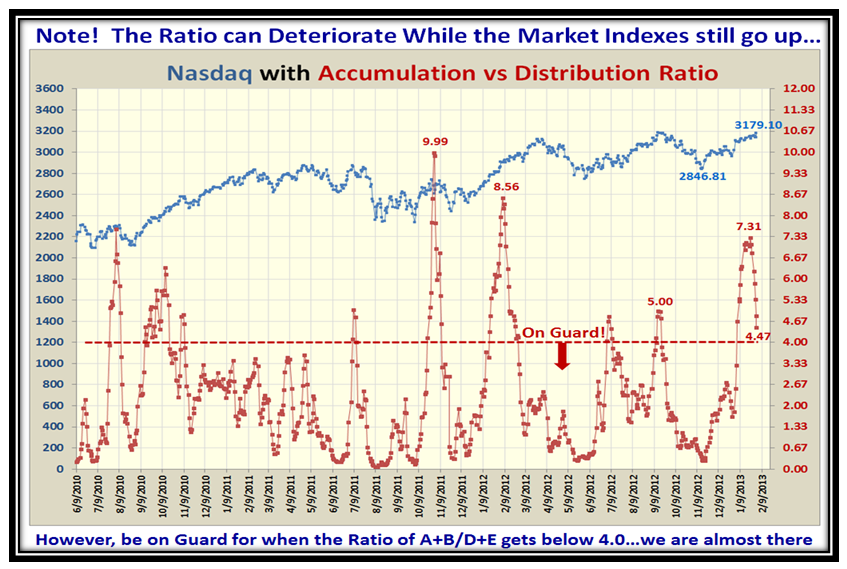

Your homework is not done. We have only worked the positive side of the equation. Now we must spot the divergencies. The first one is to watch the Accumulation vs. Distribution situation and as one would begin to expect there are now the first signs of deterioration in the ratio. The Accumulation has begun to turn down and naturally the Distribution has started to curl up:

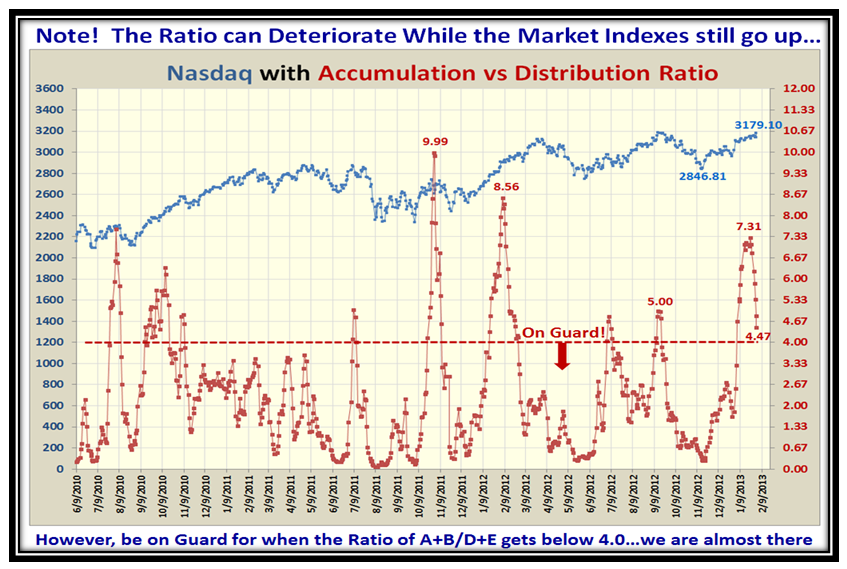

Now note the Ratio…Close to the On Guard Line, but this can still go down further before the Nasdaq corrects:

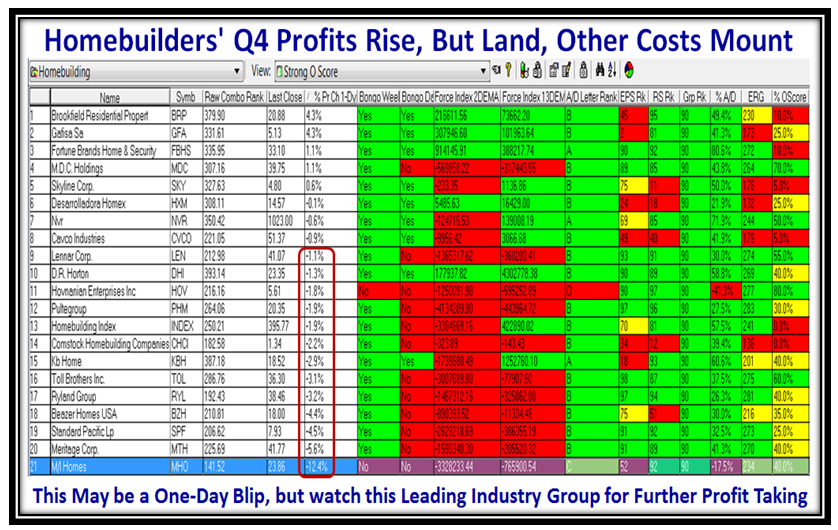

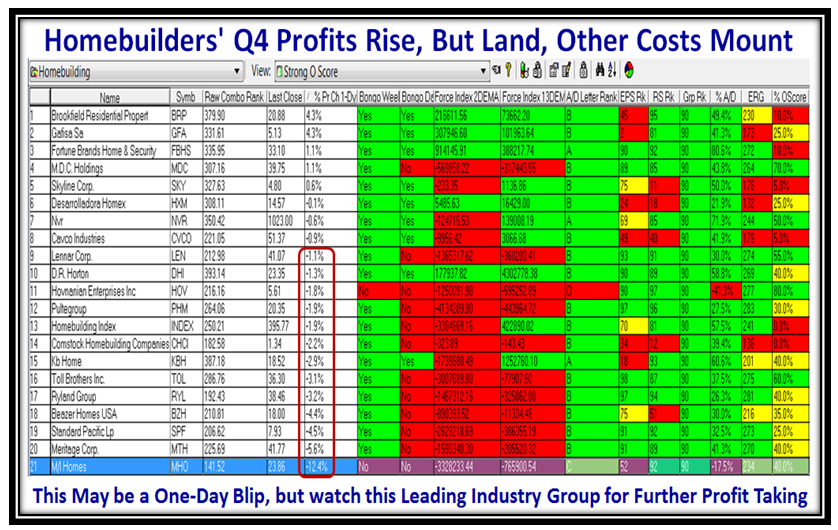

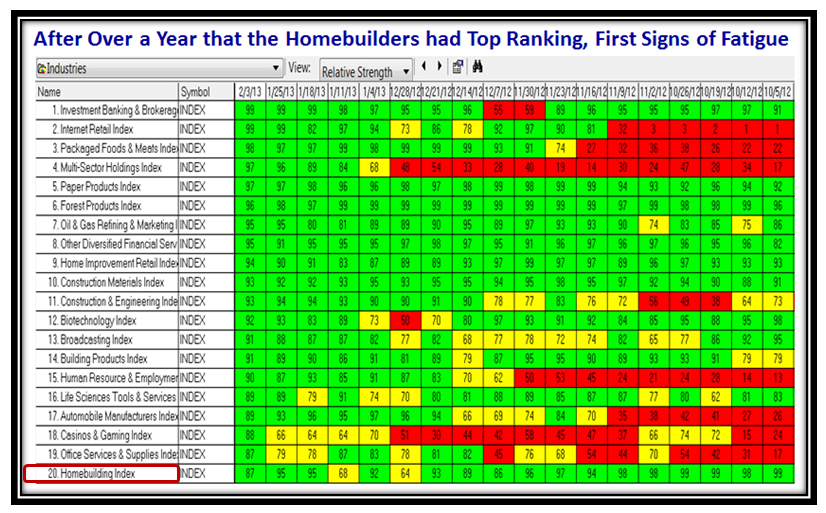

Now. let’s look for other possible deterioration, and bring the power of the HGSI Software into Play. Friday was an unusual day for the Homebuilder Industry Group. The Industry Group was down 1.9%, the second worst on the day with Leisure Facilities at the bottom with -4.8%. PulteGroup (PHM), Meritage Homes (MTH), MDC (MDC) and MI Homes (MHO) reported fourth-quarter earnings early, with Standard Pacific (SPF) out after the closing bell. All are benefiting from a gradually improving economy, low interest rates and a constrained supply of new homes.

Rising land prices, costs associated with buy-back reserves for bad loans from the housing boom and other costs pose a challenge.

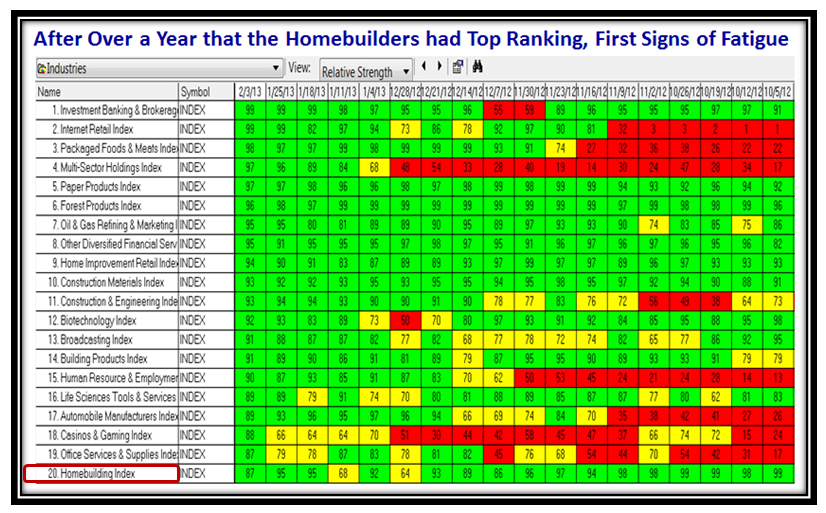

…And now let’s look at the Ranking Module and we begin to see some deterioration…it’s only natural as this Group has been top ranked for all of 13 months with colossal Price gains. The question is whether this was a one day hiccup or rotation out to come?

Now the homework is done and it’s time to settle back, put my feet up and enjoy the Super Bowl!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog