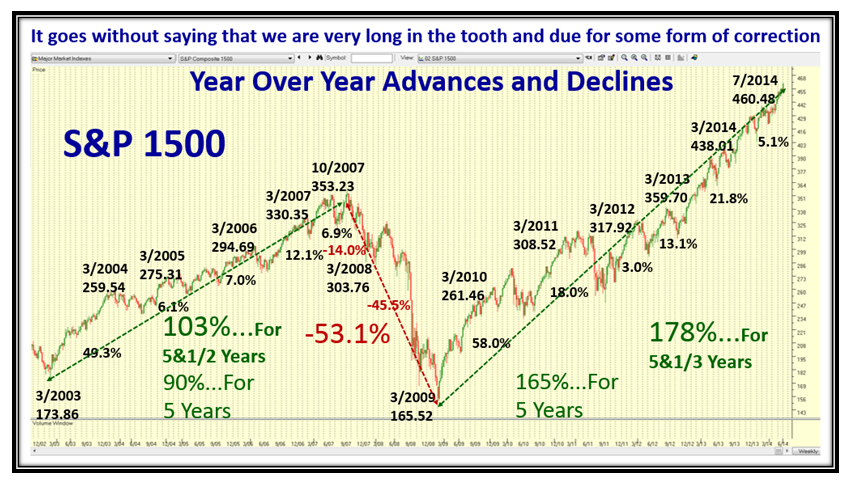

Stock Market: Bubble Continues Upwards with Hiccups

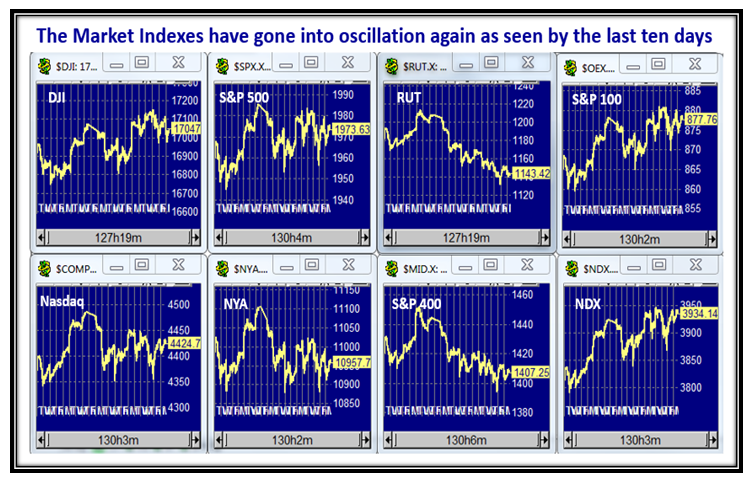

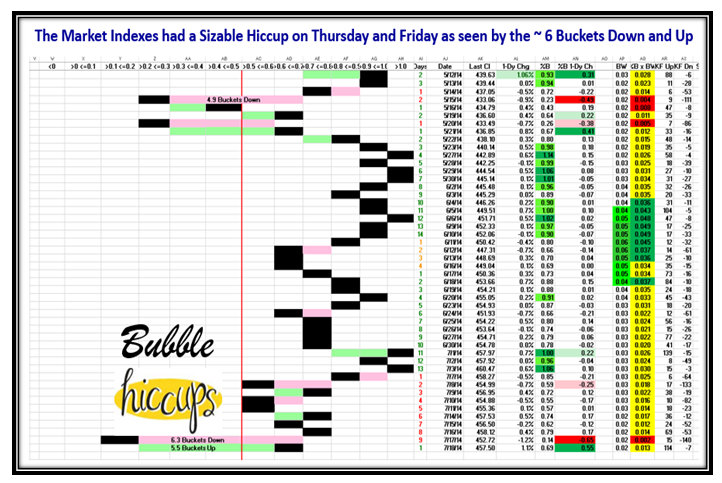

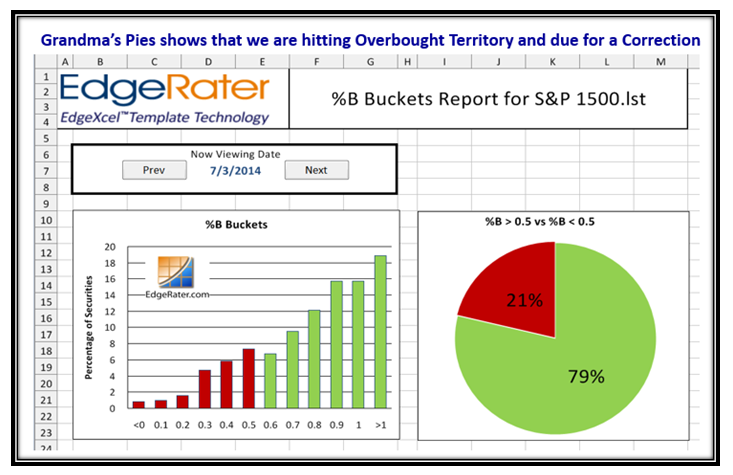

Tuesday, July 22nd, 2014The big guns are playing games with usuns yanking the Market Indexes around. Most have decided to stay this round out unless they are very adept at very short term plays both upwards and downwards. Look what just happened a few days ago when the S&P 1500 dropped 6.3 buckets down in one day only to go up 5.5 the very next day…net result is game playing.

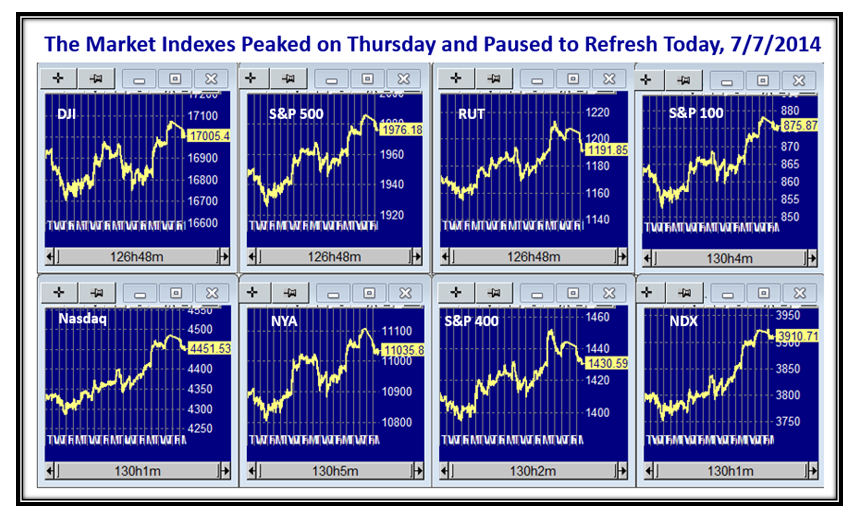

The RUT, Midcap, and Small Cap stocks have taken the brunt of the hit and are the laggards, but the DJIA, S&P 500 and NASDAQ are still near new highs, i.e., we continue to have a biforcated market:

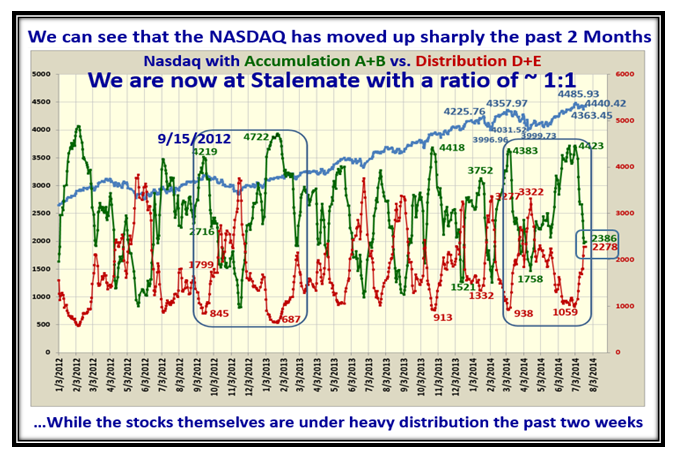

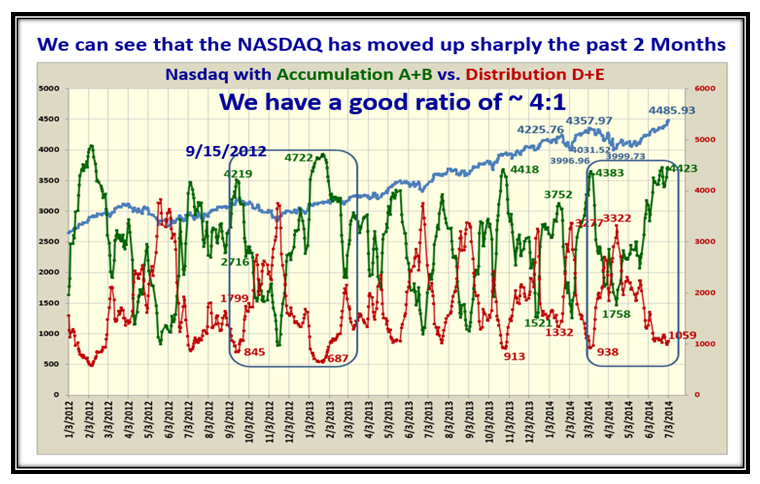

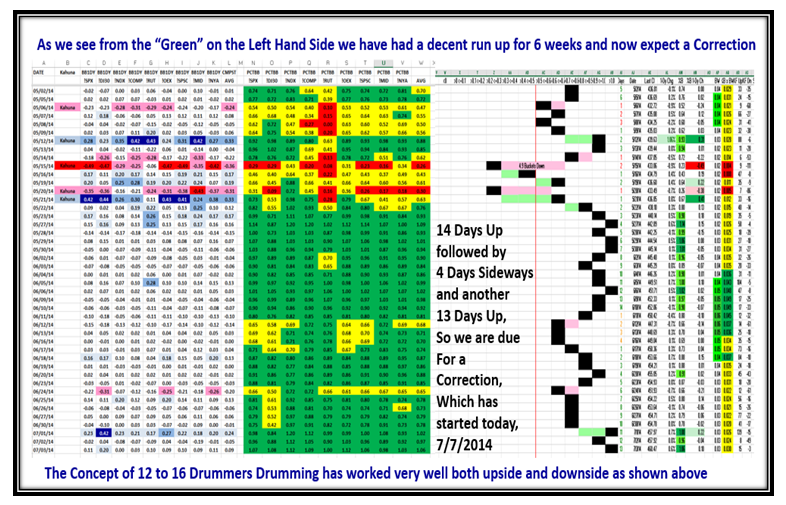

However, the tell-tale news is that the Accumulation : Distribution Ratio A+B:D+E has deteriorated to Stalemate:

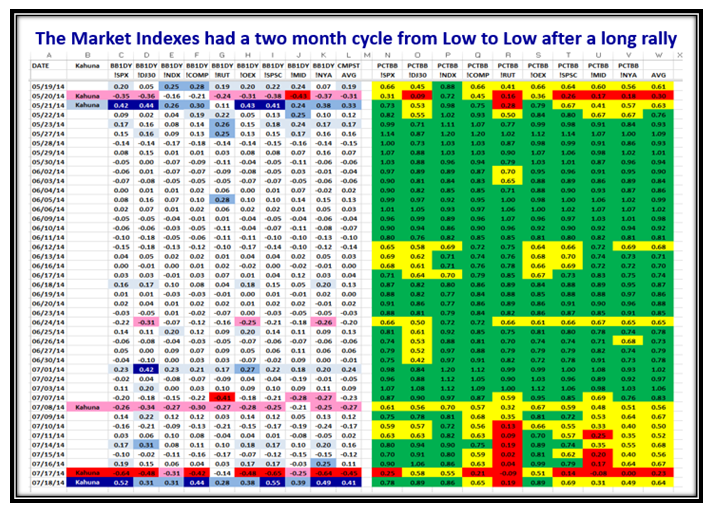

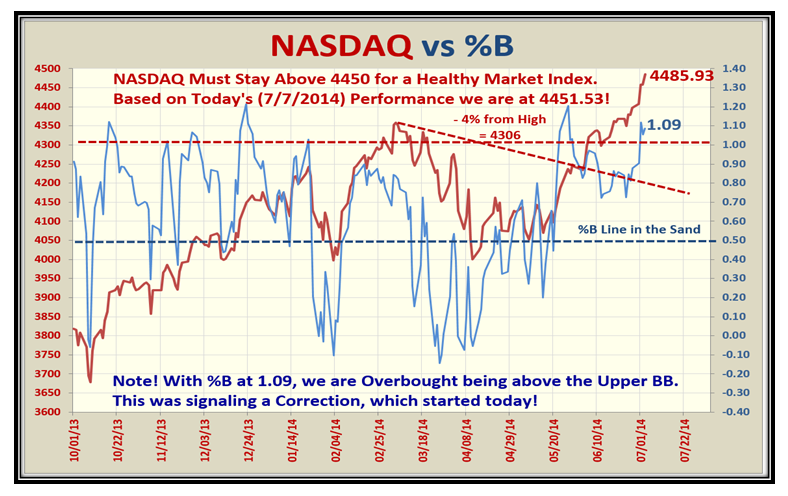

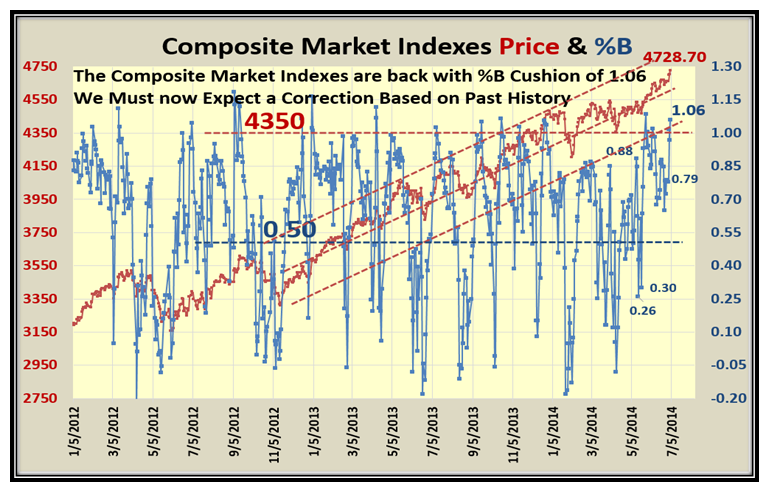

Our Favorite picture shows the Bubble Hiccup very well and it has been two months since we had a similar fracas:

…And the twin picture to the above also shows the long rally of close to two months before the Knee-Jerk occured:

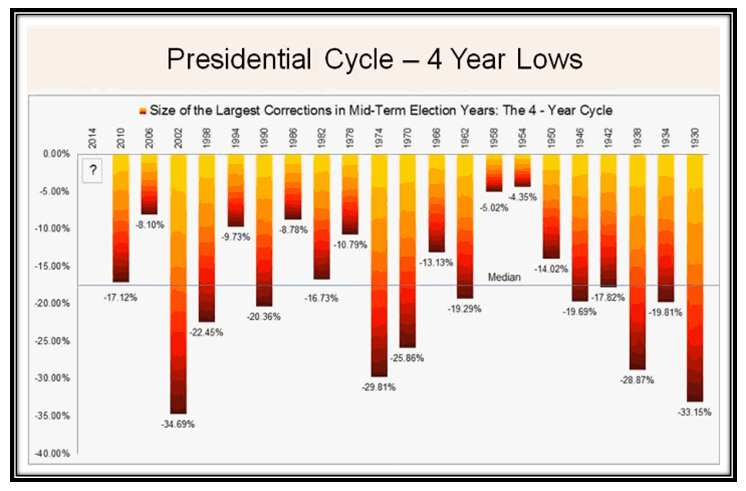

Now for some “New Good Stuff” relating to the Mid Term Presidential Cycle. Here is a neat picture of the Largest Corrections from 1930 onwards for the Mid-Term Election Years…the 4 Year Cycle, which my good friend Bob Meagher unearthed for me. It shows that the Median Correction is -17.12% and no wonder the pundits make a song and dance everytime this rolls around. There have been nine times when the number has been less and 12 times where it has been greater, with the heaviest damage in 2002 of -34.69% after the bubble:

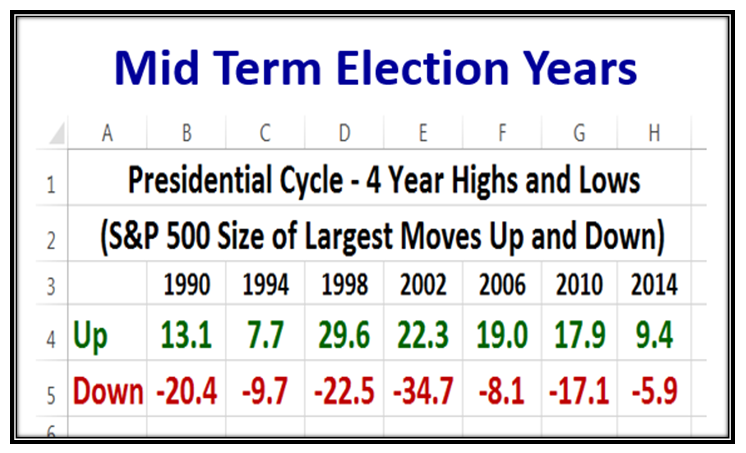

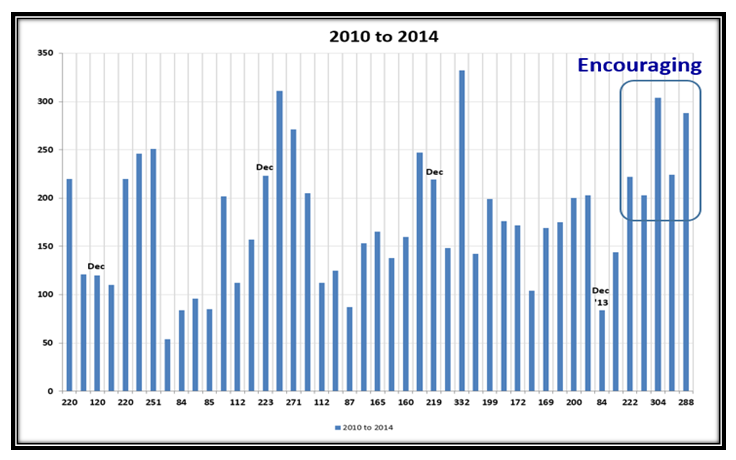

Now let’s look at the last 24 years for both Largest Ups and Downs of more than 4% in each of those years:

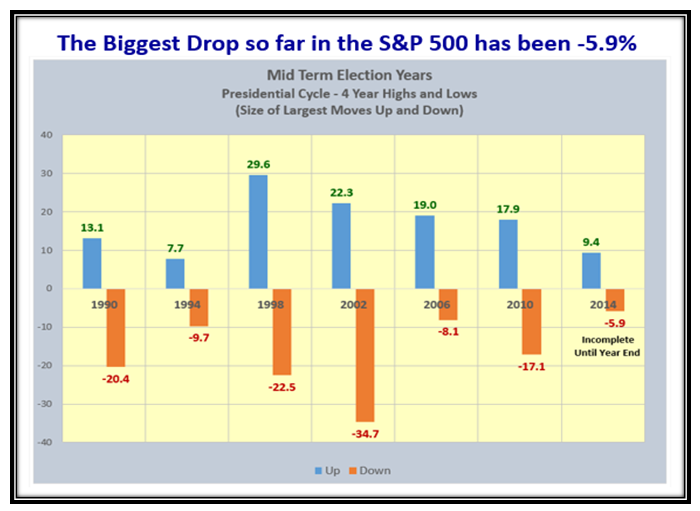

…And here is a plot of that same picture to give you a feel for what the chart looks like:

I’m sure you are scratching your heads and saying “So What, Ian, is there a pony in here?” Well, you know me in that my first answer is that the result is in the lap of the gods. But I never shy away from a challenge so my next answer is that we should certainly see a -8% correction for all of the reasons I have given you in the past. Then what? Unfortunately, that answer depends on the state of the world in the next 3 months or so…Wars, Mexican Border, Economy and Jobs, Healthcare…the usual stuff on our plate these days. My short response is that if it is worse than -12% who cares, as for sure most of us would have prudently hunkered down and protected our nest eggs long before then.

Chew on this fodder and if you have any bright ideas let me know what you think.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog