The First Shot Across the Bow

We have enjoyed a Bear Market Rally for 49 calendar days since the last big

down day when we had the last Phoenix signal, and we reached the High

Target of 875 as I suggested in my last couple of blog notes. As one would

expect with a -4% down day on the S&P 500, we had another Phoenix signal

today along with a small Kahuna. This suggests that the Rally may be over

for now, but one down day does not establish a confirmed change in direction.

Unfortunately the S&P 500 broke 840 which was a critical line in the sand on

the way up, but as I have said in previous notes the cushion we have is 8%,

so we have used up half of the reserve we had to preserve the Game Plan

of Higher Highs and Higher Lows. That will truly be broken when we reach

below 780, and those type 3 swing trader’s who nibbled should certainly have

taken some action to lighten up and preserve capital by then:

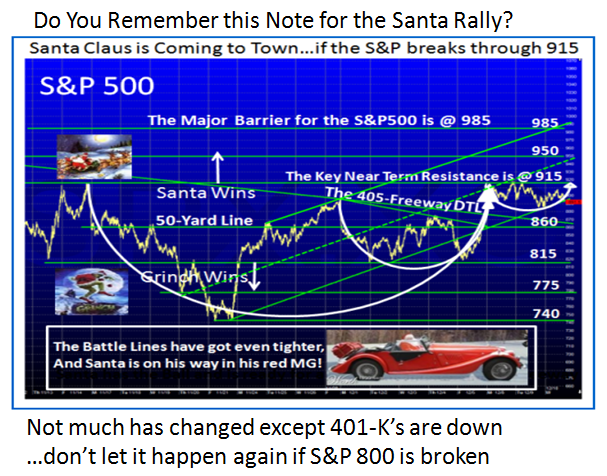

I’m sure most of you will recall a similar chart I provided four months ago

showing the critical lines in the sand. The message is that we are back to

square one. However, I am sure you will find that your 401-K is less now than

then, so this should be a lesson in Money Management that if we break 780

again, you are playing snakes and ladders with your hard earned money.

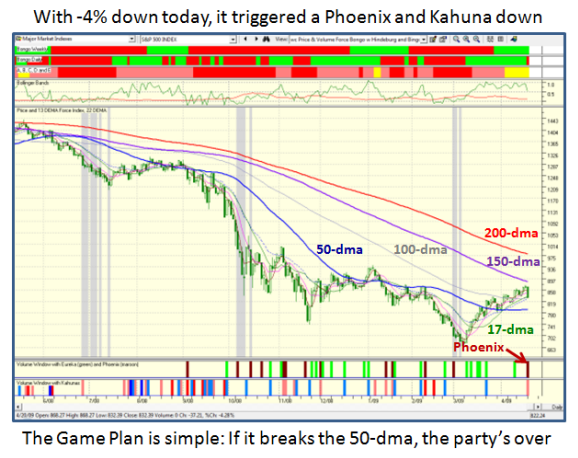

All is not gloom and doom as yet…after all we have had only one bad day, and

the following chart gives you the perspective. As you can see we show a

Phoenix and a Little Kahuna to the downside based on today’s action, and the

S&P 500 Index is sitting right at the 100-dma and 17-dma averages for support.

If it breaks that support in follow through action, we head down for the 50-dma

blue line as shown on the chart. The challenge for the Bulls is to stop the

bleeding and hopefully produce an Inverse head and shoulders pattern that

then gives a chance for another run up on the Bear Market Rally. This week’s

action should unfold where we stand for the future health of this rally.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog