Question: I read that book “Trading for a Living” that someone recommended and it was good. He recommends a 2% stop, but someone on the board said to use a 6-7% stop… with 2% I keep getting stopped out same day, and with 6% it goes up a bit, but crashes back and I end up losing a bit. What kind of strategy can I use to overcome this problem?

Answer: You are not alone…the setting of stops in a Volatile Market as this is, leaves one frustrated more often than not. It has been a while since I read Elder’s Book, but you need to look at page 260 again. He was referring to risking no more than 2% of your ACCOUNT equity. If you have a $100,000 account, then the most you should risk is $2000 on a trade. If it is $20,000 then you can only risk $400 on the trade. Let’s suppose you have 10 stocks of $10,000 each for a $100,000 account. Now let’s suppose you have 500 shares of a $20 stock you can afford to set your stop at $16, lose $4/share and therefore $2000 total. This is still only 2% of your total account of $100,000. However, if you hit a bad patch and lose three or four of your trades in a row, and lose $8,000, then stop trading for the rest of the month.

Now I am not suggesting for one minute you should lose 25% of your hard earned money on a trade. You certainly should not sit around and let a 6%-8% loss turn into a 25% one before you act. I’m sure Elder never meant that as a standard rule for all trades. The crafty Market Makers will invariably employ the spidery leg syndrome and swoop down and grab stocks with stop losses that are at around 6% down from the current price and then as quickly as you can say “Jack Rabbit”, they will trot back up again and cause those spidery legs you see (tails) on the end of daily stock prices. That invariably happens at the start of the day. The first tip is to try and stay away from such volatile stocks.

The next point is that any stock that has lost 3% or more in a day is likely to go down further the next day, before it trots back up. Of course you need to watch the volume traded on that day. if it is light then it may be that the stock is correcting in concert with a poor day in the market. If on the other hand, it is a high volume day, then for sure you need to think about taking a stock off that is down >3% at the end of the day, and certainly if it is down 6%.

There is generally two rules people use:

1. Support and Resistance Lines: I’m sure you have watched Ron Brown’s movies on the HGSI Website, and how he always draws horizontal lines showing support and resistance. Measure the distance from your expected entry point and either set your stop loss at just below that support or pass on the trade if it is too big a percentage to that support level. In other words, you need to look for tight stocks and be very careful of loose stock patterns.

2. The second way is to use Average True Range (ATR): You can do this on HGSI. Most look to no more than 2ATR as the limit of their stop loss tolerance. This then makes allowances for the volatility of the stock and therefore sets different levels for tight or loose stocks. A tight stock by our definition is one that flies like the geese, straight along the 17-dma from lower left to upper right or an LLUR as we call it for short. Try to find such beasts. They are the best long term winners.

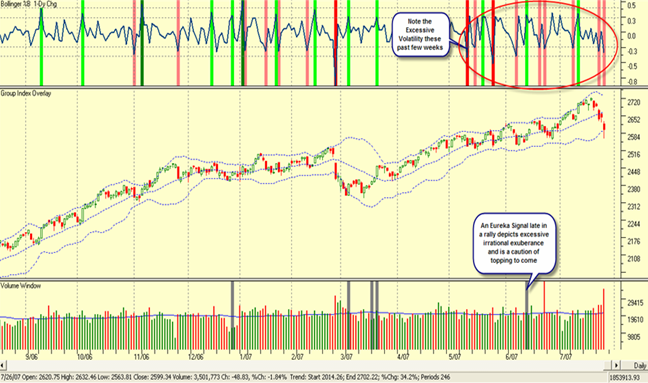

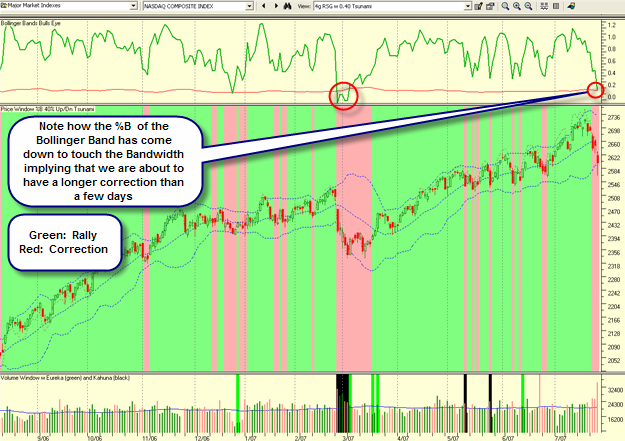

Of course, if you have made 10% or more say in a matter of a few days to a week, and especially these days, then you should make sure to raise your stop loss to ensure that you don’t let a reasonable gain turn into a losing trade. Again, you may play snakes and ladders with your money (see a note below for what I mean), but that is a caution that we are currently in a highly volatile market. In the days of wine and roses, I used to say that each base was worth 25% and if you hit a home run you make 100% or a “hundy” as I call it. Those days are gone for now…the market won’t let you make more than 10%/base for a home run of 40 to 50% maximum unless you are on a huge winner. I switched thoughts to a Baseball analogy, but I’m sure you get the point.

One last thought, if you made a little money on a good stock and it ends up taking some back to virtually a very minor gain, wait for the pullback to finish and then take it again. Most of us fail to take another ride and on the second chance, it will invariably trot off into the sunset, leaving you behind waving feverishly to let you on. Then like an unruly dog chasing fast cars you buy it far too extended and get whacked.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog