Stock Market: Bite Your Finger Nails

Tuesday, July 23rd, 2013We are at a point where its time to bite your finger nails, as this Market can go either way:

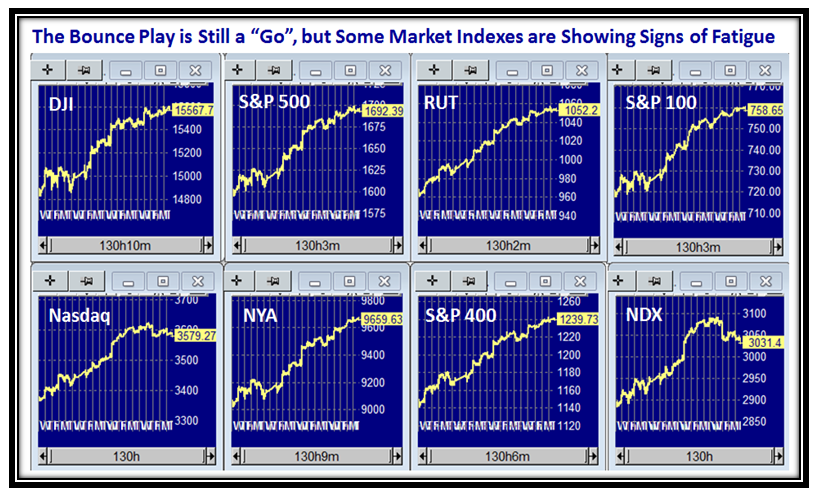

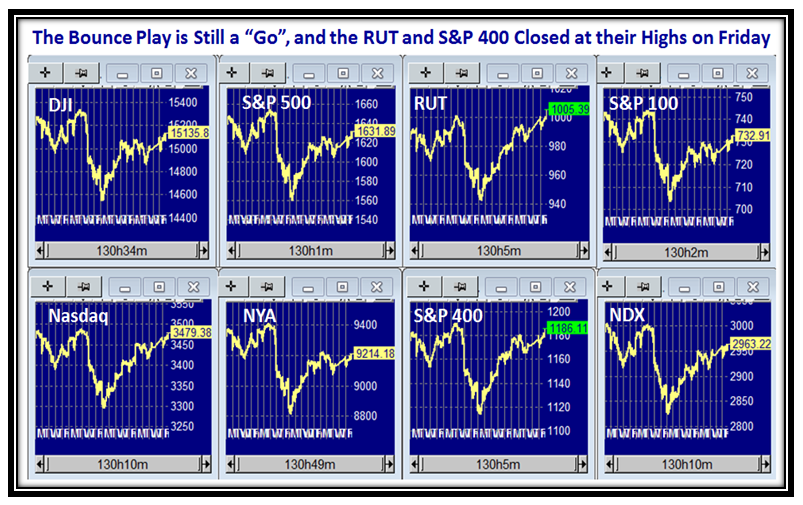

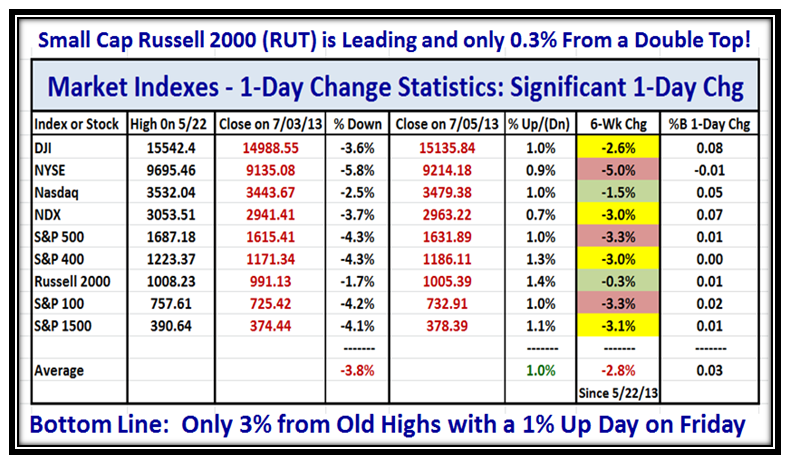

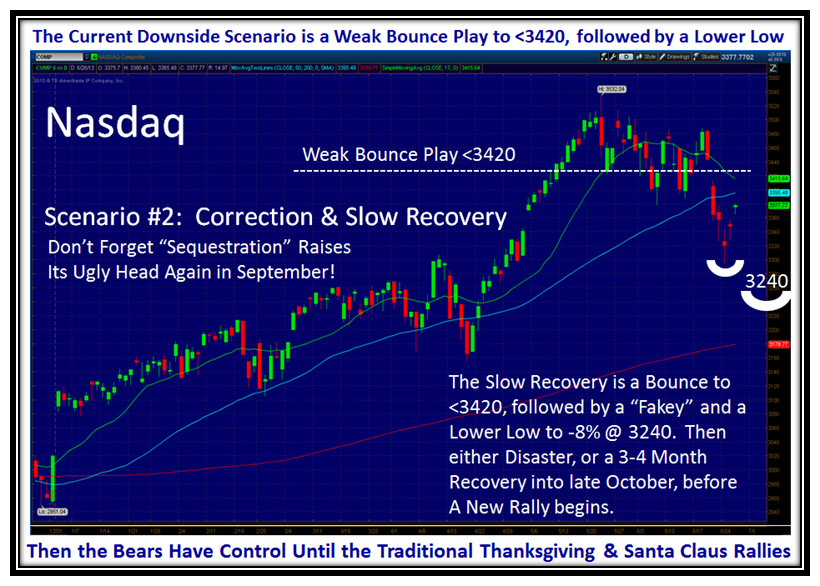

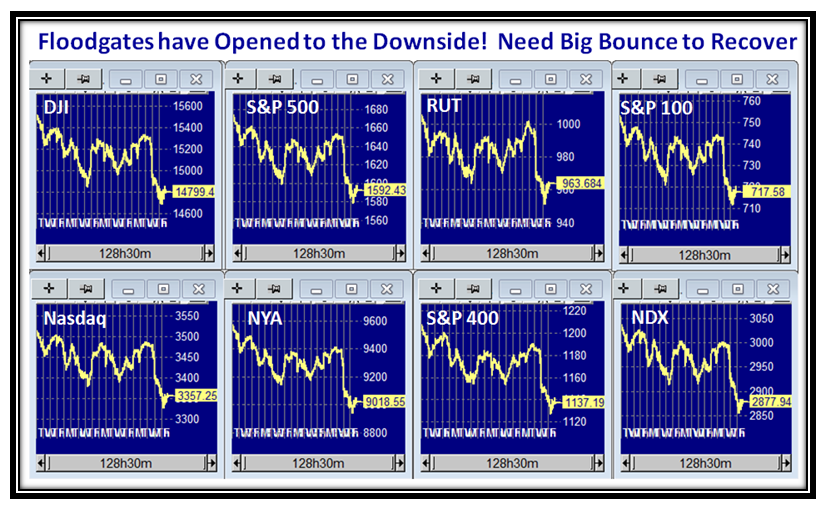

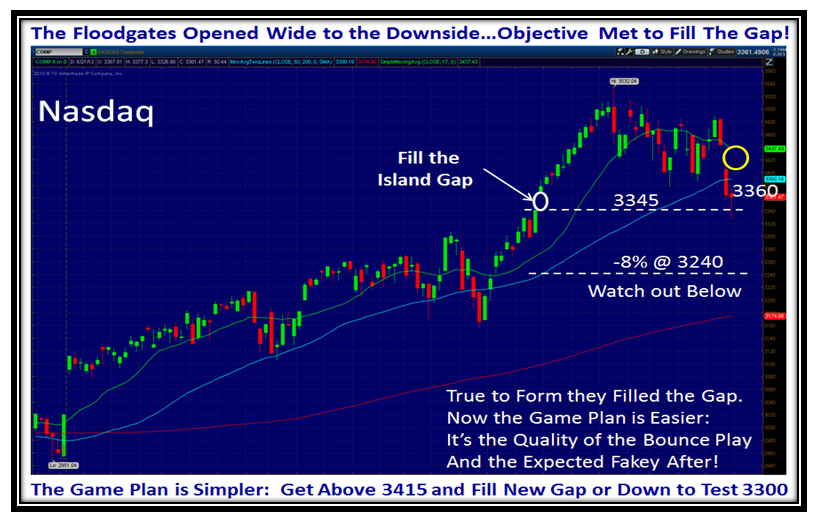

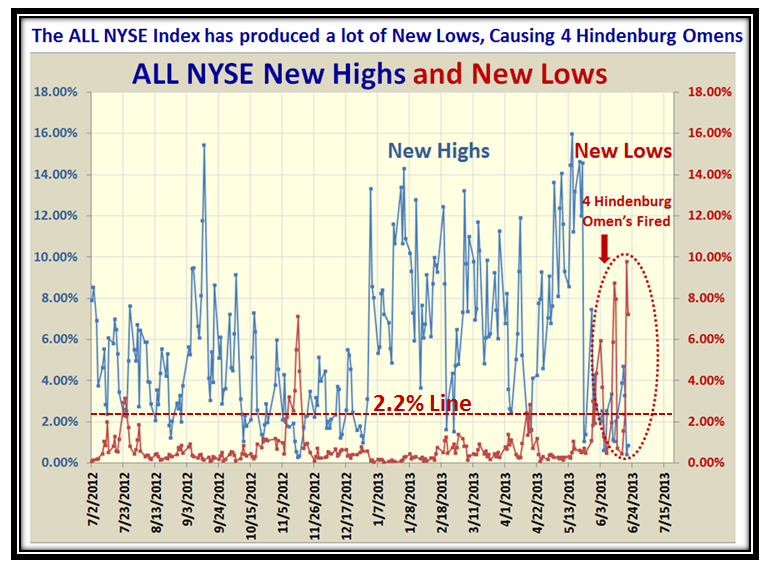

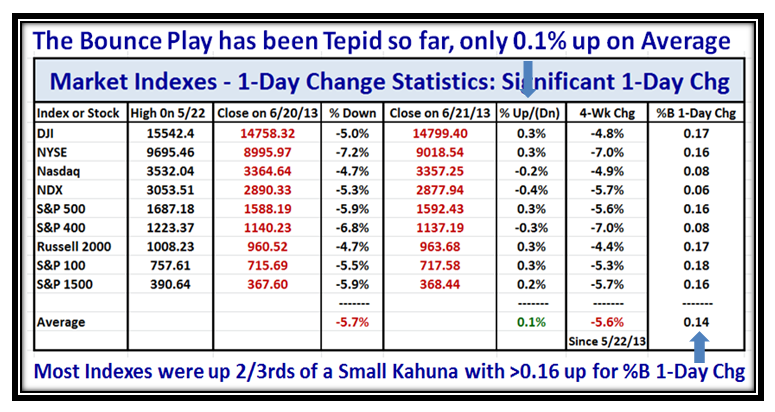

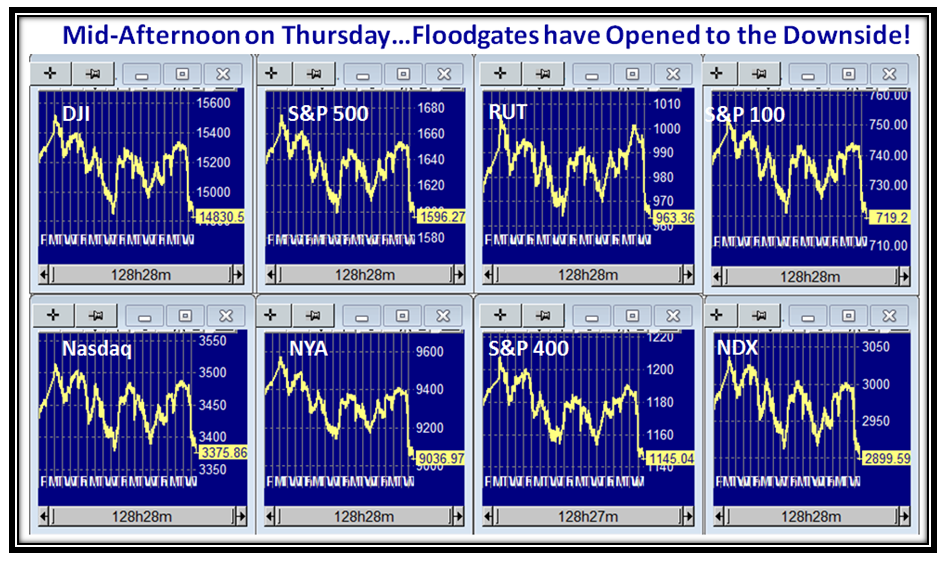

The NASDAQ and NDX are already showing signs of Fatigue, and the others are running out of steam:

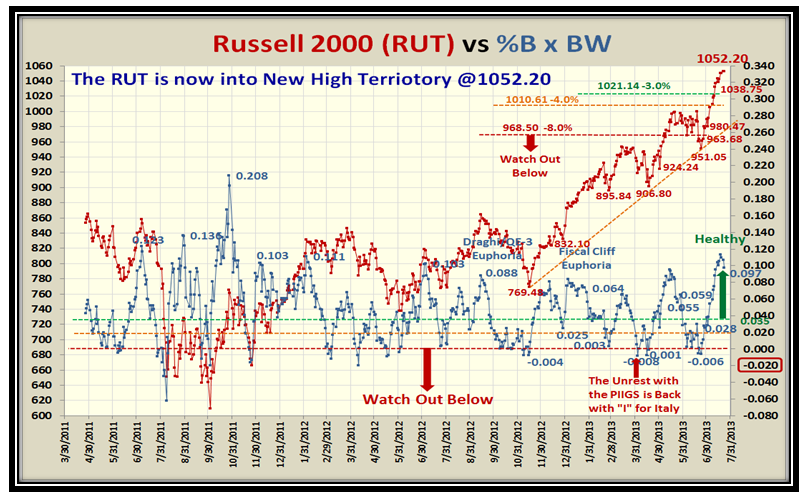

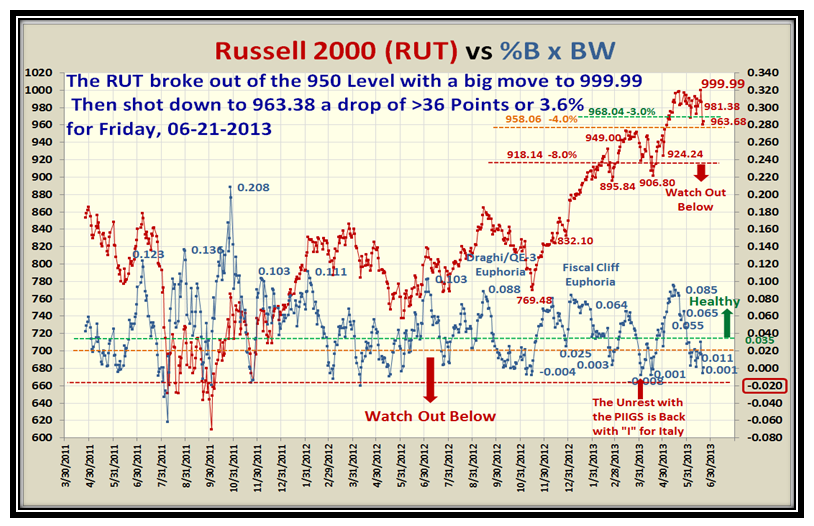

The RUT is still the strongest and now provides plenty of cushion:

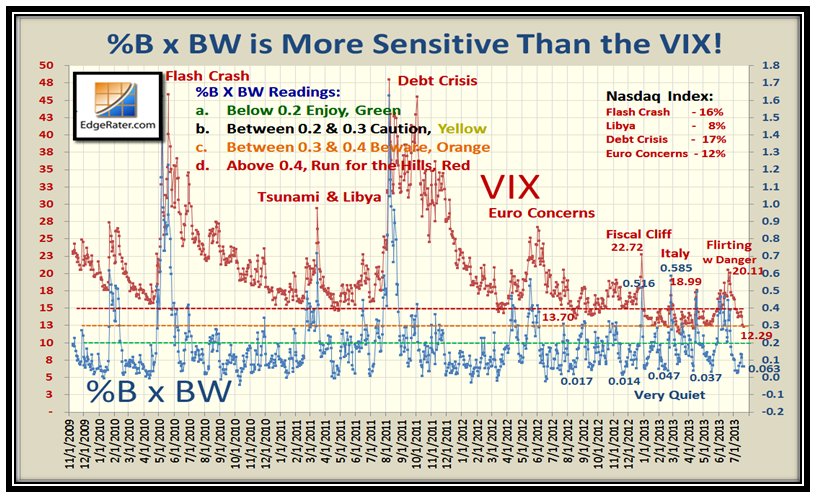

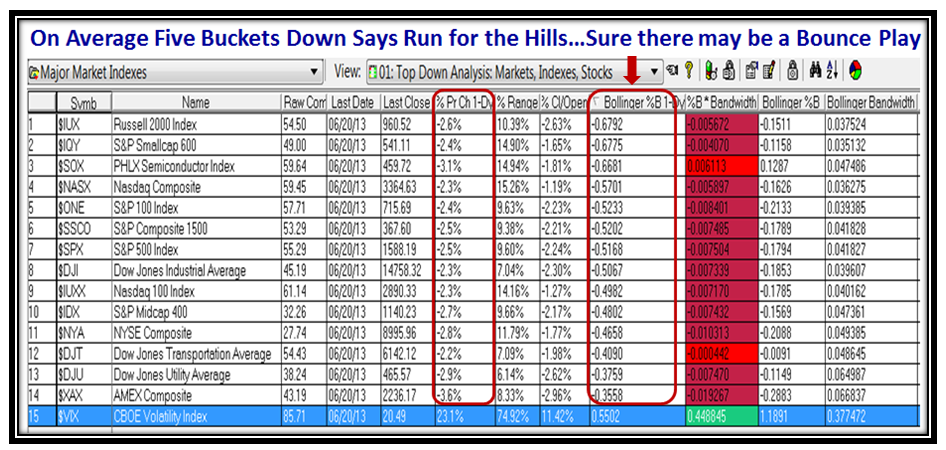

What helps the Bulls is the complacency on the VIX at the moment:

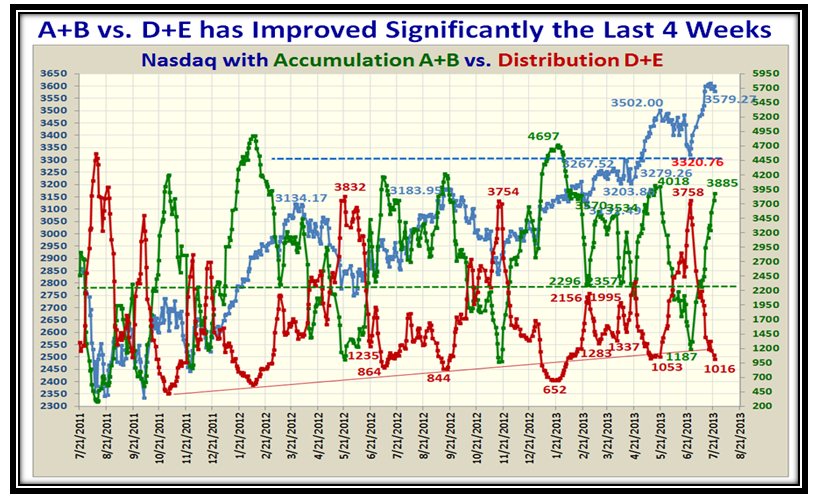

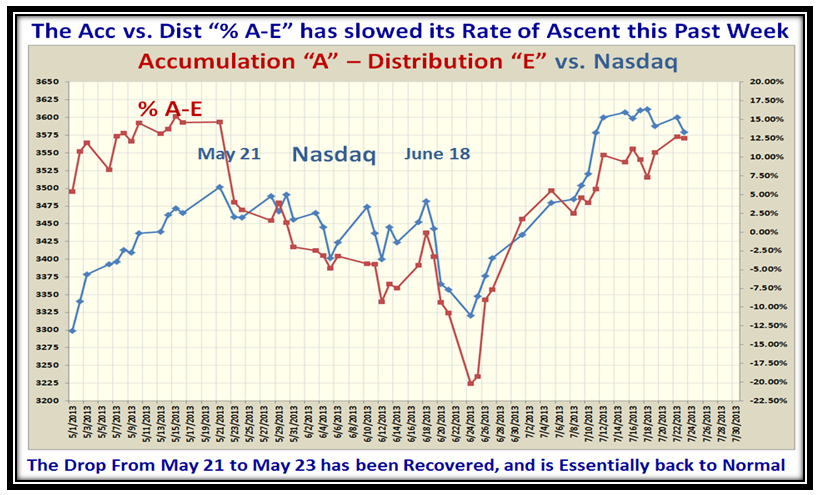

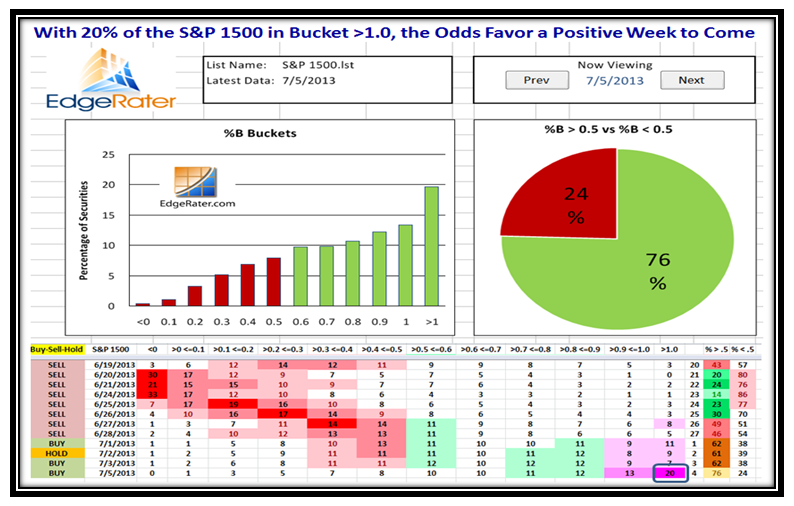

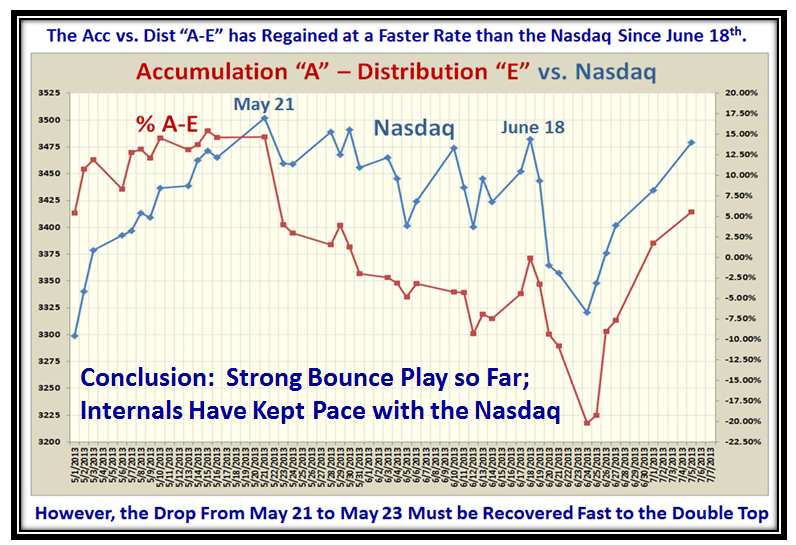

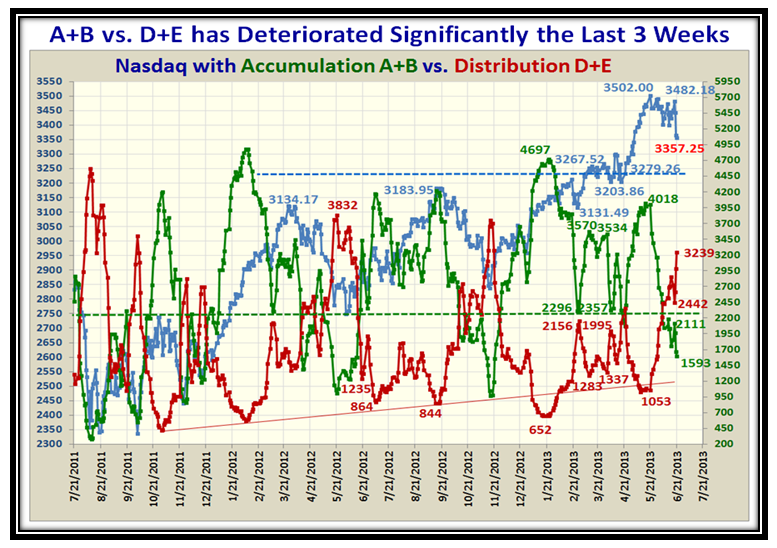

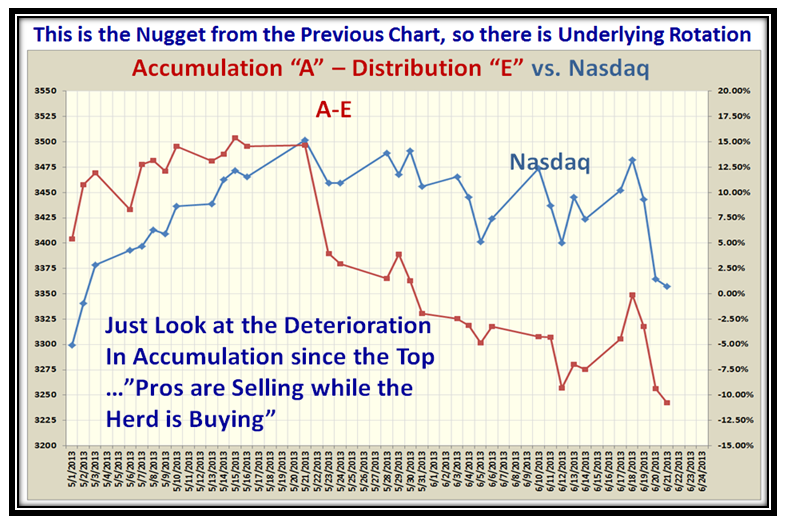

Accumulation vs. Distribution Ratio has improved significantly over the last month and reaching the point to turn around:

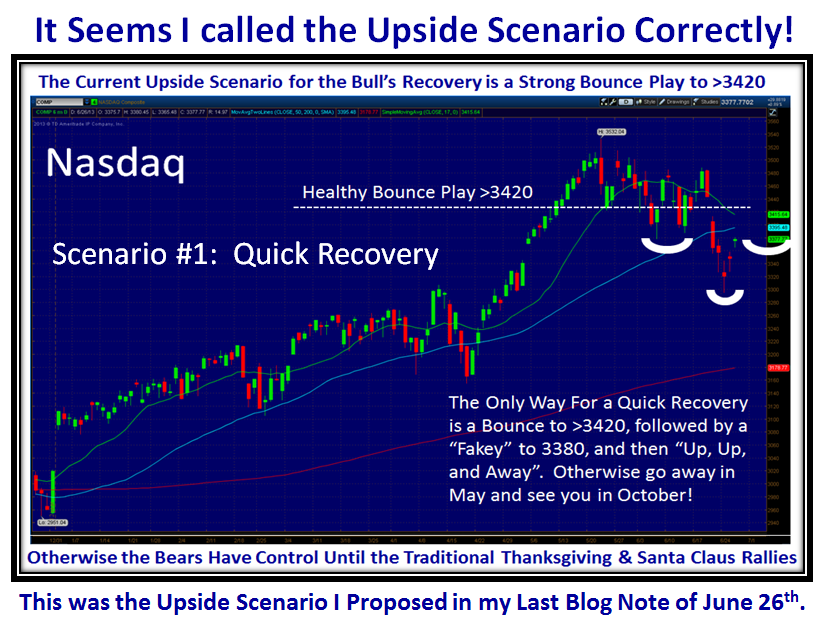

We cannot complain about the strength of the Rally over the last month, which shows that we have recovered:

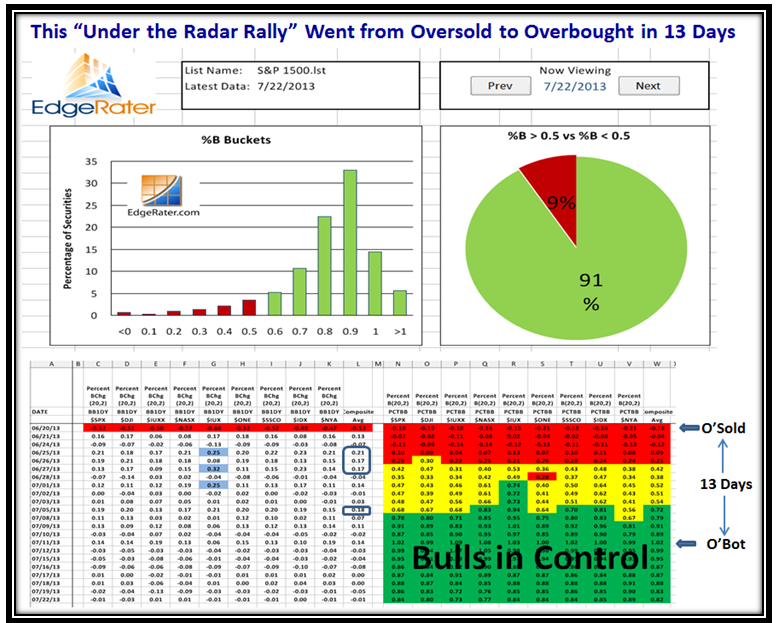

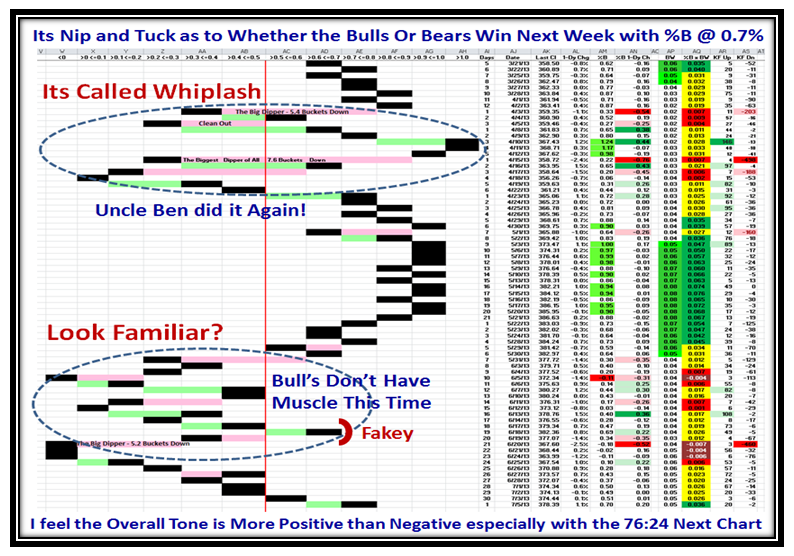

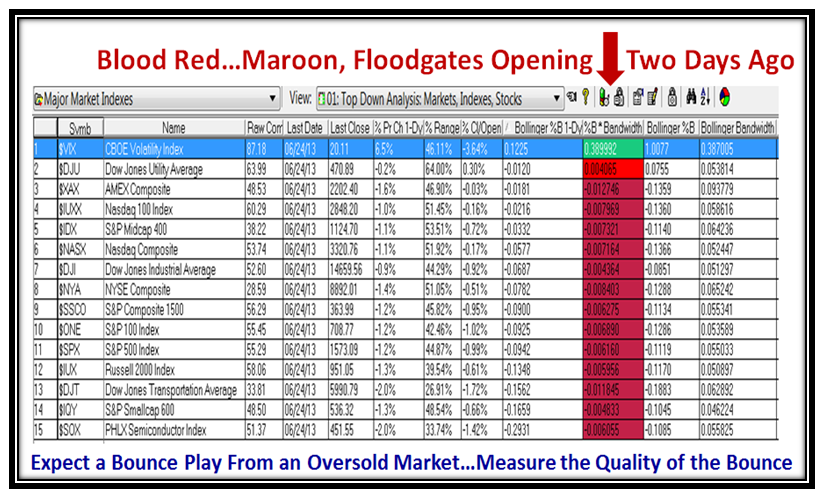

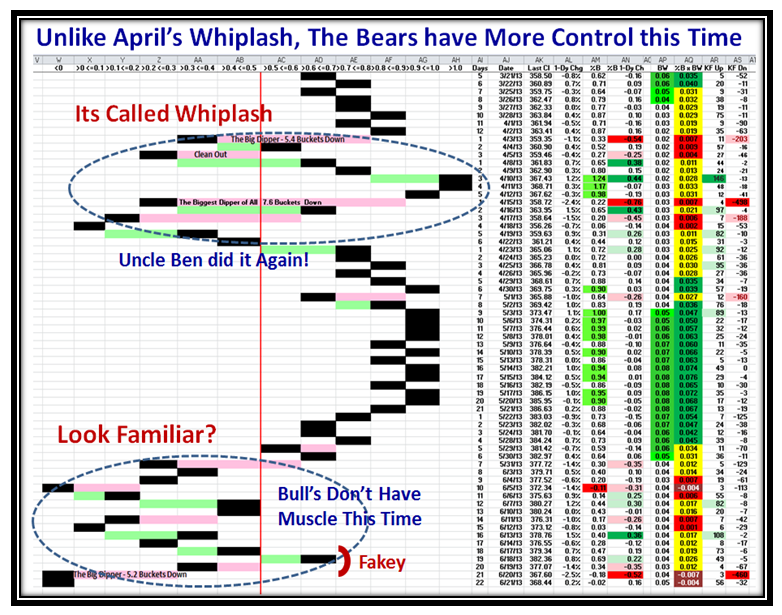

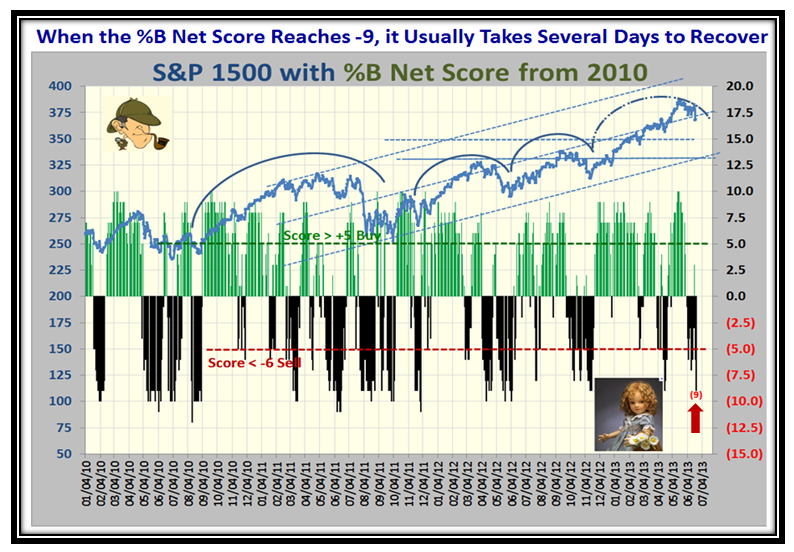

…And to prove this was no ordinary rally, it went from oversold to overbought in just 13 Days:

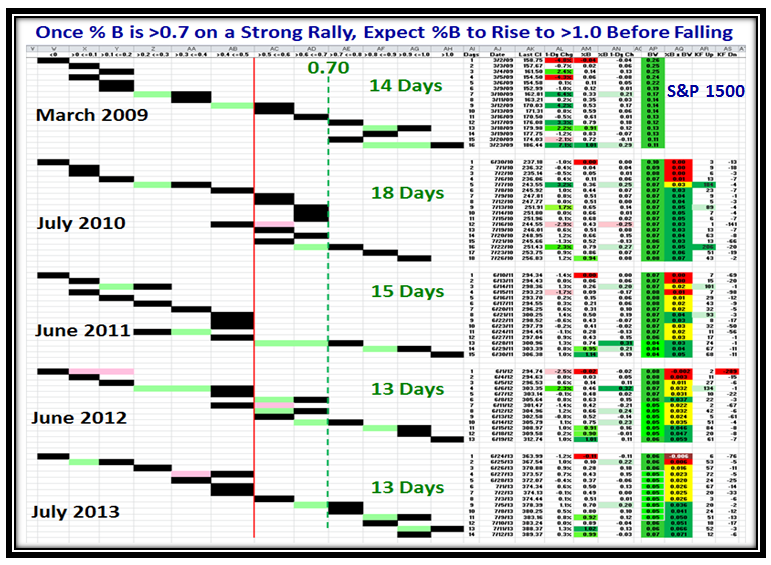

The natural next question is how often has this happened before over the past five years since the start of the Rally in 2009? The answer is that the range is 13 to 18 Days for the best Rallies over five years. Once past %B of 0.7, expect the move to continue up:

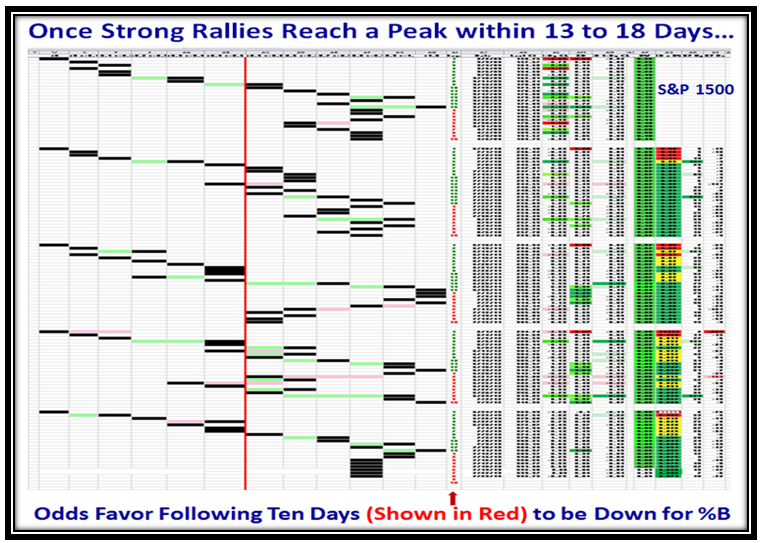

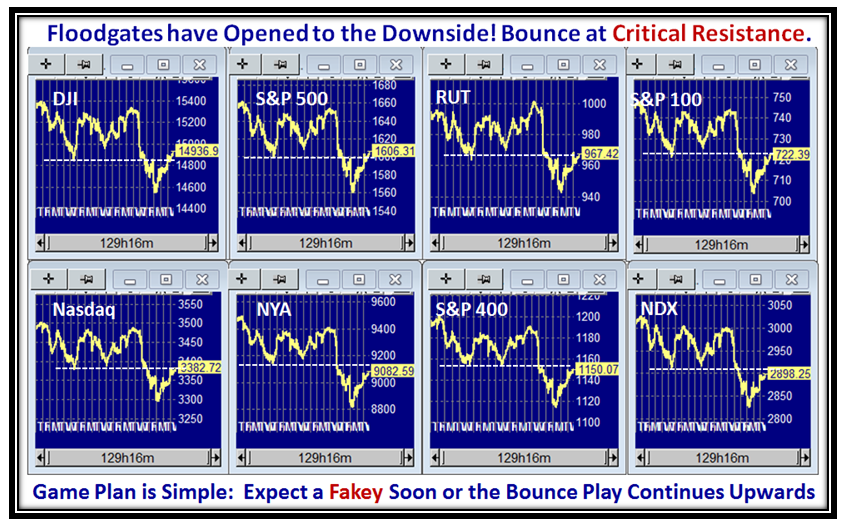

Then inquiring minds would like to know what are the odds for up or down of %B over the next ten trading days? Down. However, the Market Indexes can usually hold up for at least five days, and then trot down or sideways:

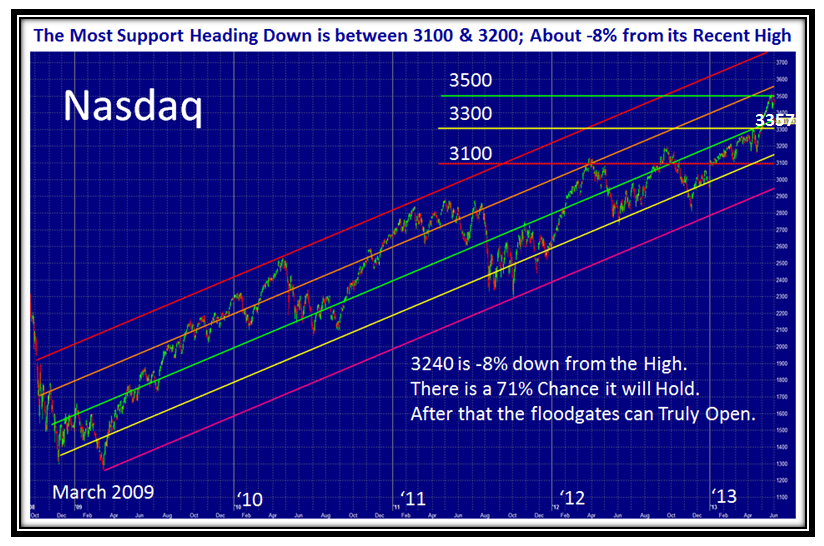

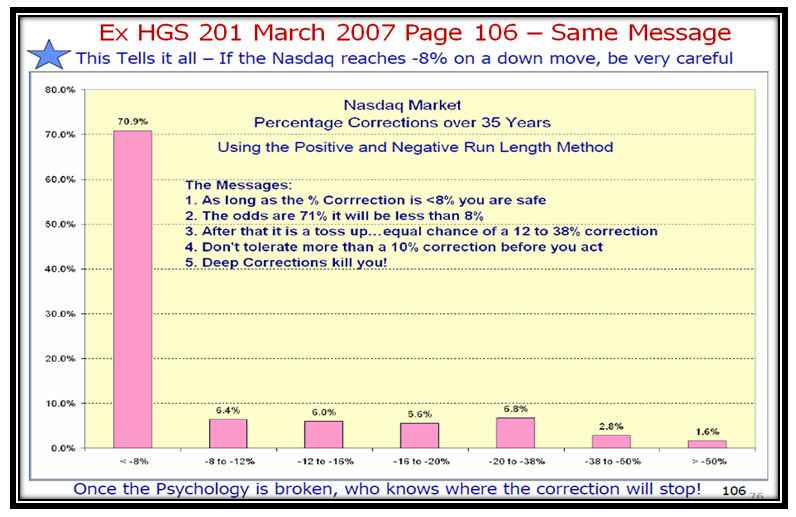

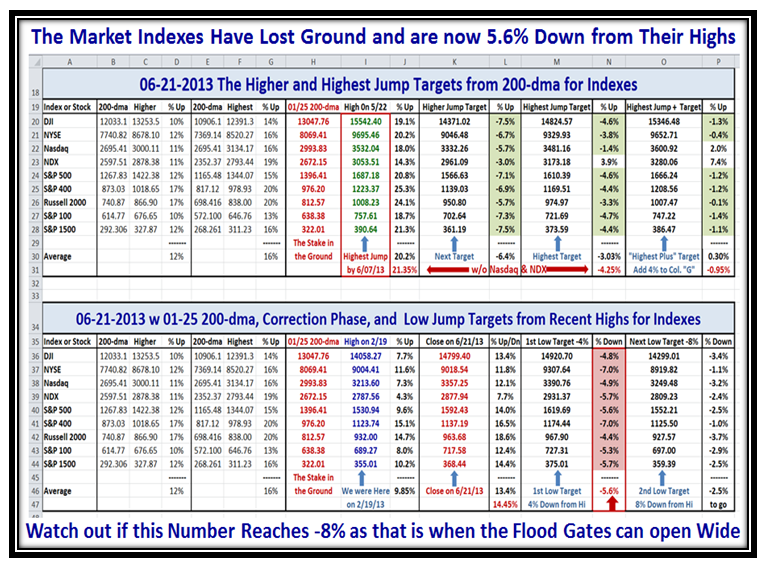

Stay on your toes, and watch the signs I have taught you of 4% down at a time with -8% from the high to think about vacating.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog