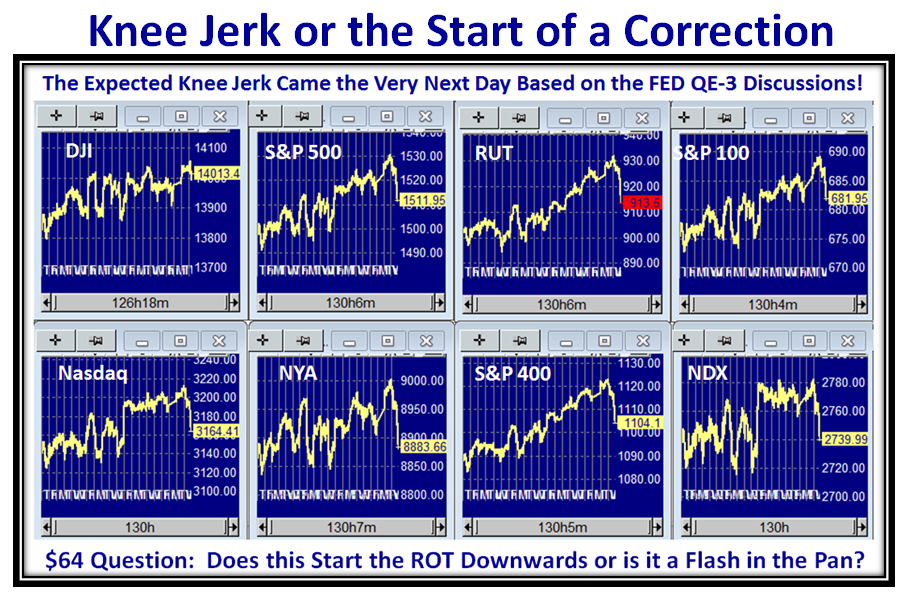

Stock Market: Knee Jerk or the Real Thing?

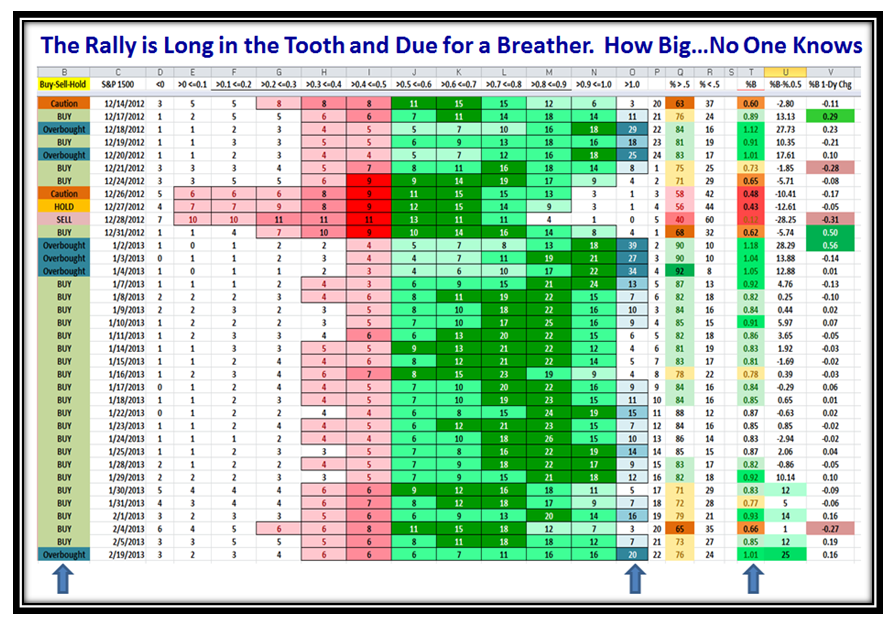

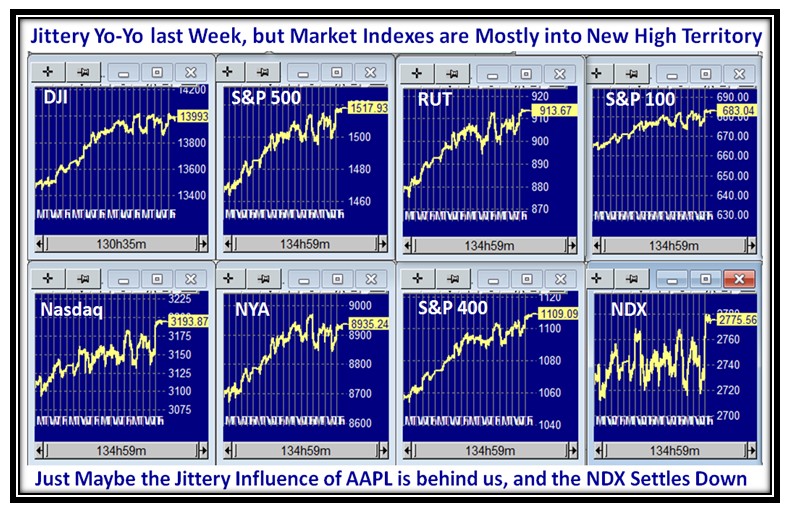

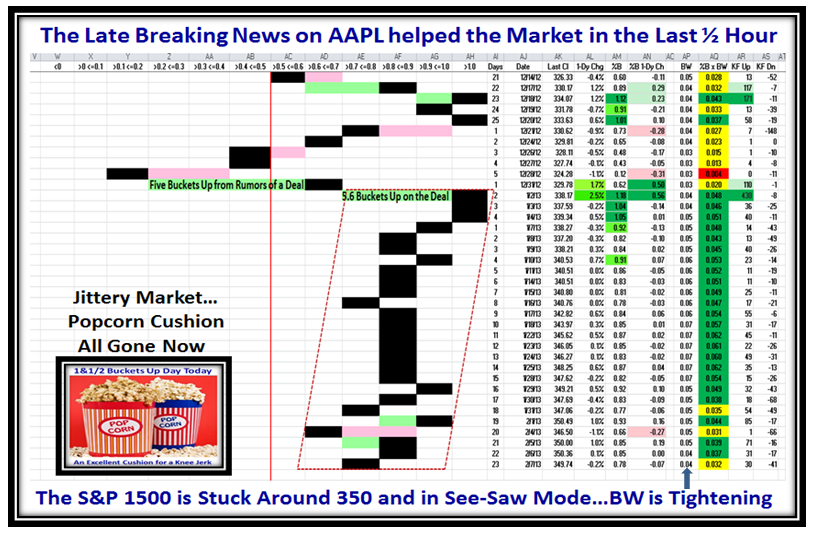

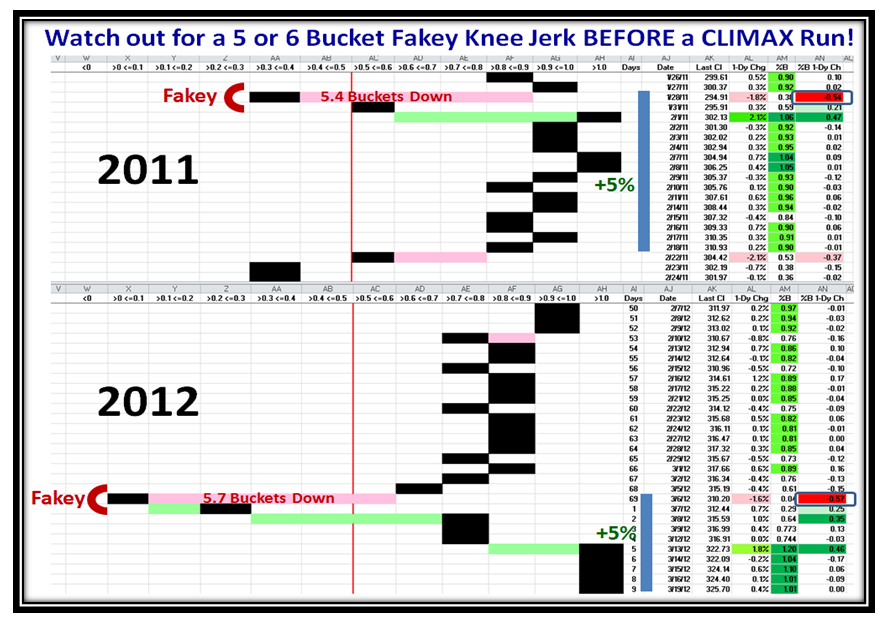

Wednesday, February 20th, 2013After a strong move yesterday which took the Market Indexes into New Highs, would you believe that wonder lasted just one day as we had a Five Bucket Down day on average for the Market Indexes? The $64 question is whether it is a knee jerk or the real thing by way of the much anticipated correction? The Bad news was there was consternation in the FED Minutes on their Monetary Policy:

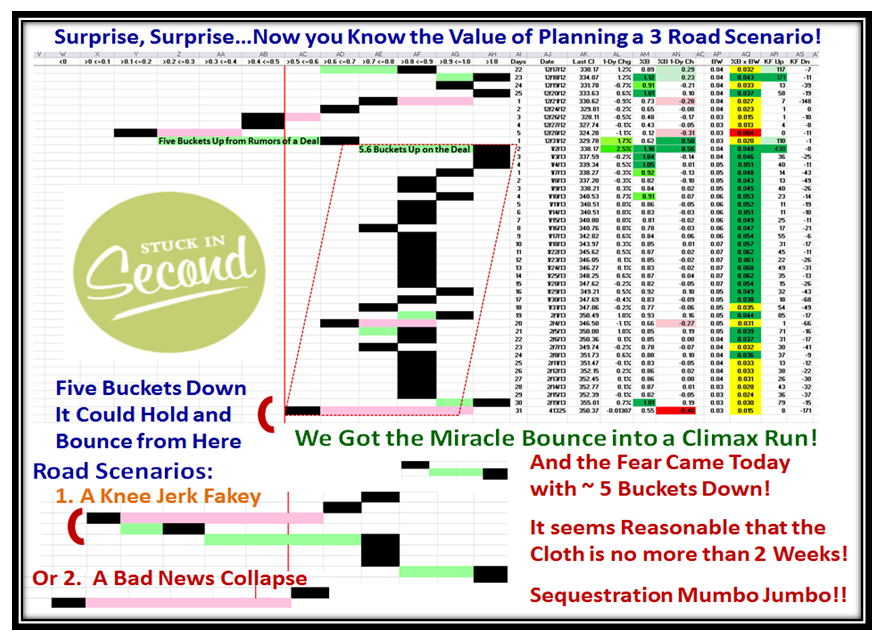

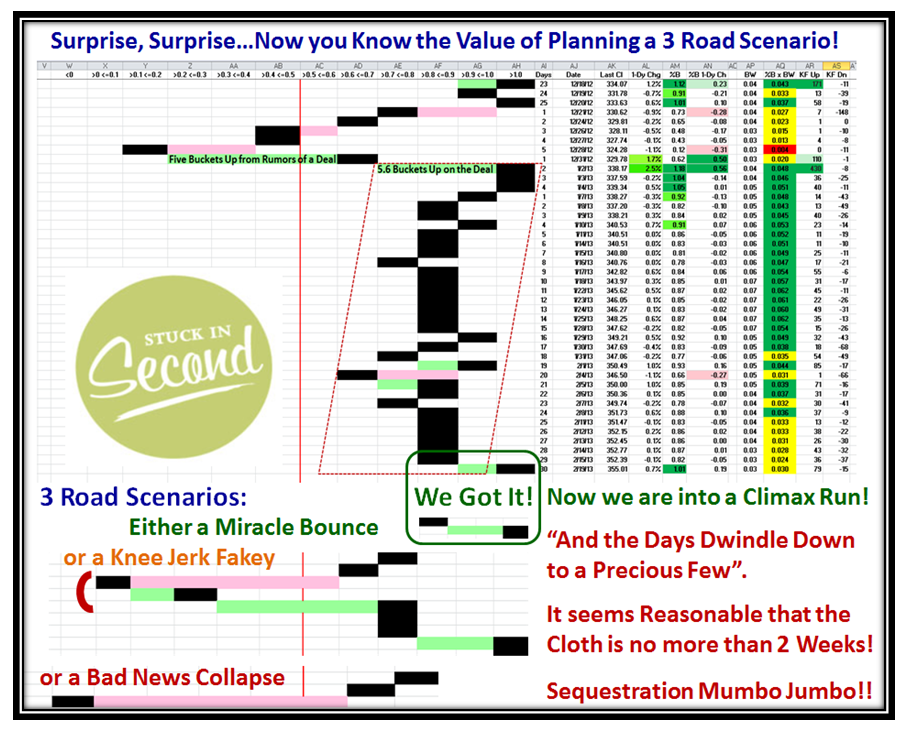

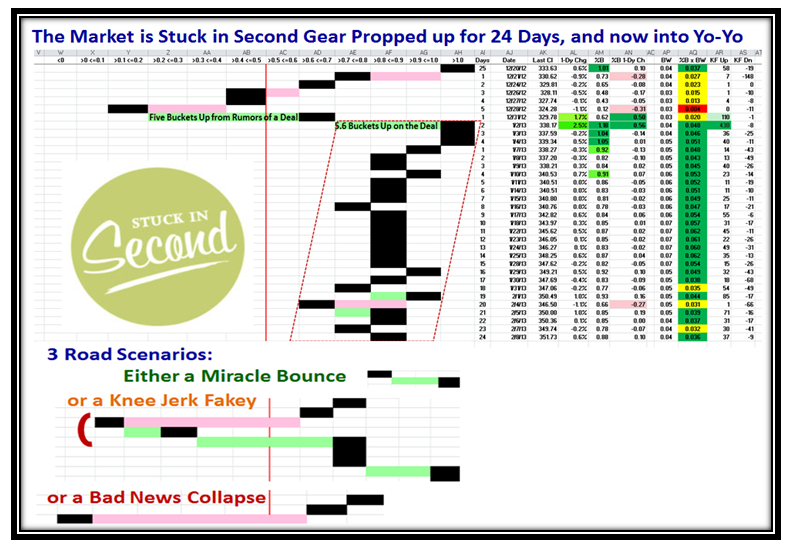

If I may say so, it seems that the Market is on the Three Road Scenario I had postulated…the first one was a complete surprise with the Miracle Bounce Up, and now we see if this 5 Bucket Down Day produces a Knee Jerk Fakey or we head on down for a Correction of the Rally which has gone all of four months, and certainly with the big breakout right out of the barrel at News Year’s time.

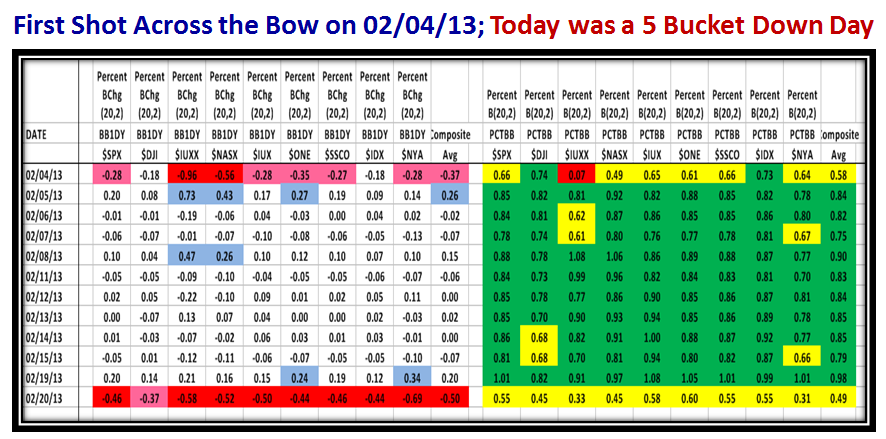

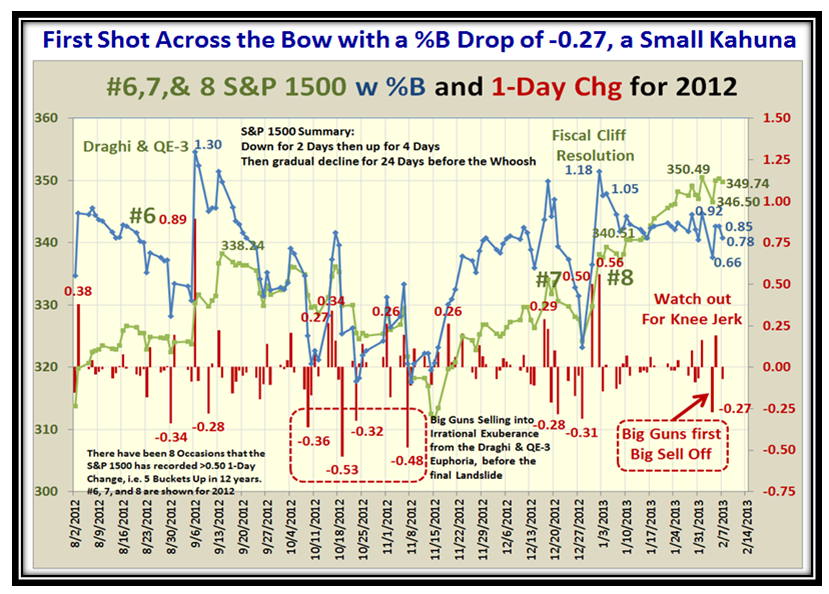

You will recall that we had the first shot across the bow on 02/04/13, and two weeks later we had the big Knee Jerk down:

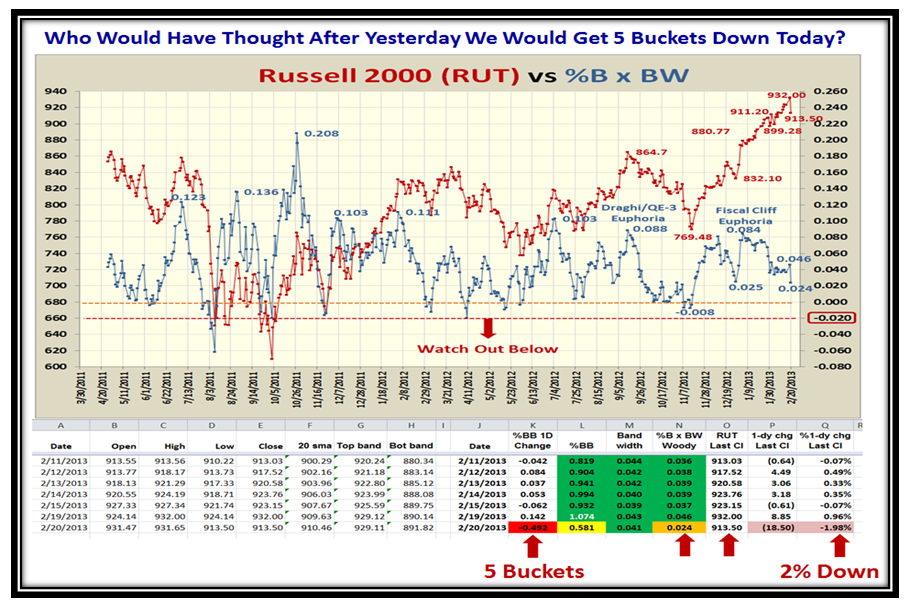

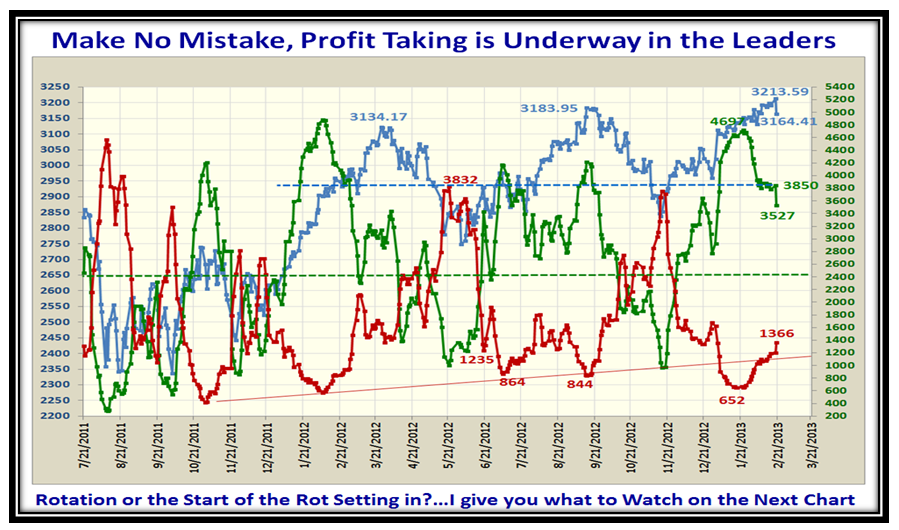

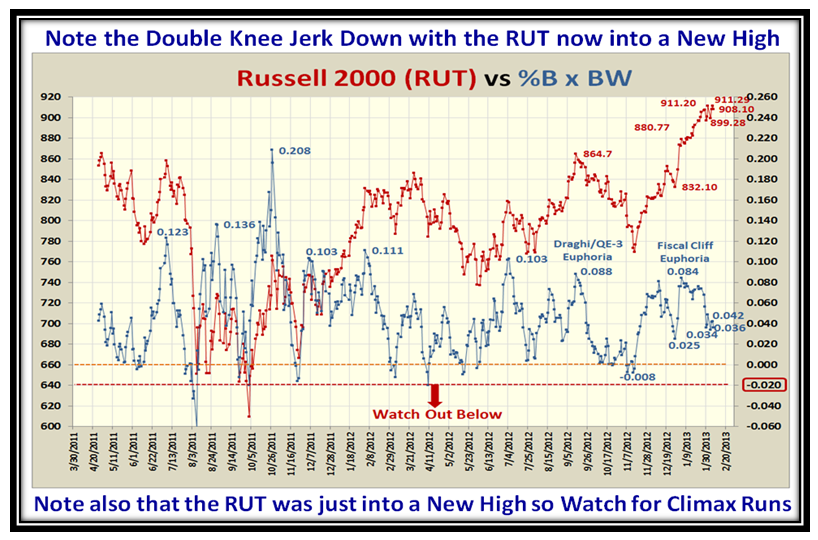

We have followed the Russell 2000 (RUT) as it has been one of the leaders, but today we got the dreaded hit of 5 Buckets Down:

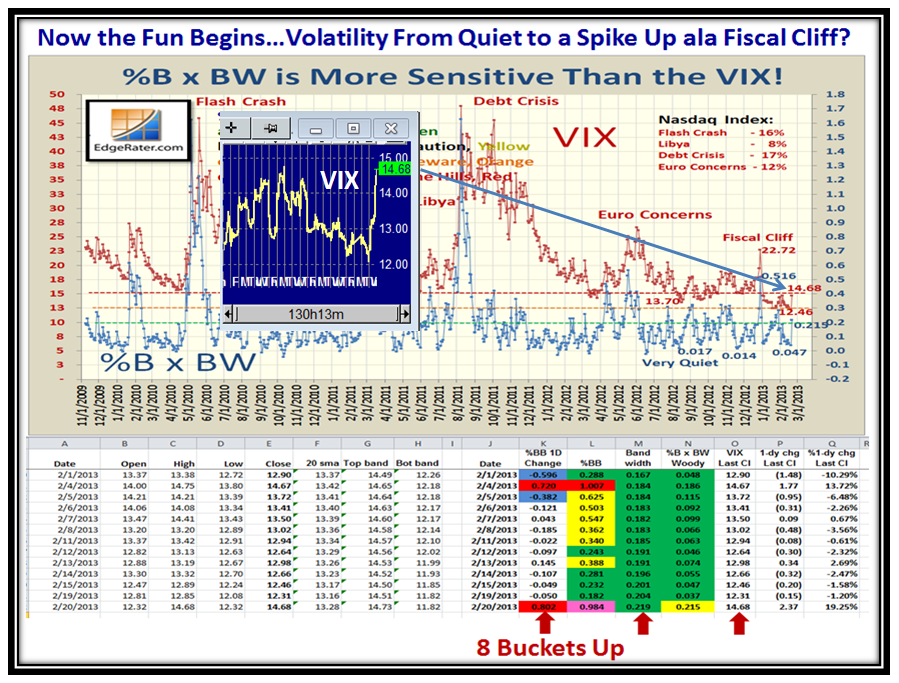

The VIX had a Field Day today shooting up 8 Buckets after being dormant and now we wait to see if it spikes up further or falls back:

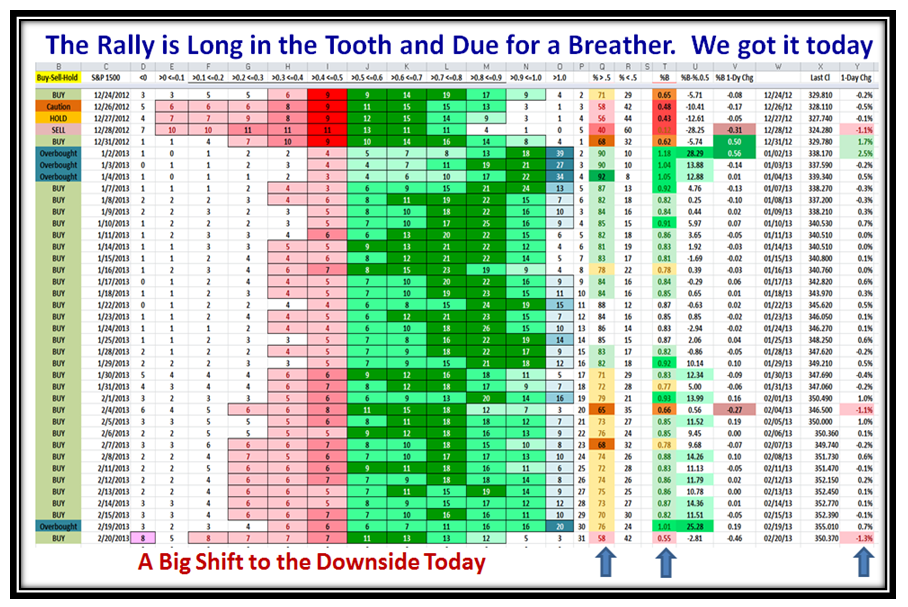

The Leaders took a big hit today with A+B losing over 300 stocks from that group and the lot continues down:

I have updated this next chart to show the High Road Bounce Play is behind us and we are now on the way down between ending with a Knee Jerk which could turn out to be a Fakey or it is the real thing in a further correction which has long been expected:

…And here is the twin picture which shows the deterioration today in the %B and the percentages in the Buckets:

I feel the next two days are critical, so watch carefully and make your call of Bull or Bear depending on how they play out. If there is no let up tomorrow to the downside with heavy volume then it would seem the call is to the downside, but understand that the Game Playing has begun and you call it as you see it.

Best regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog