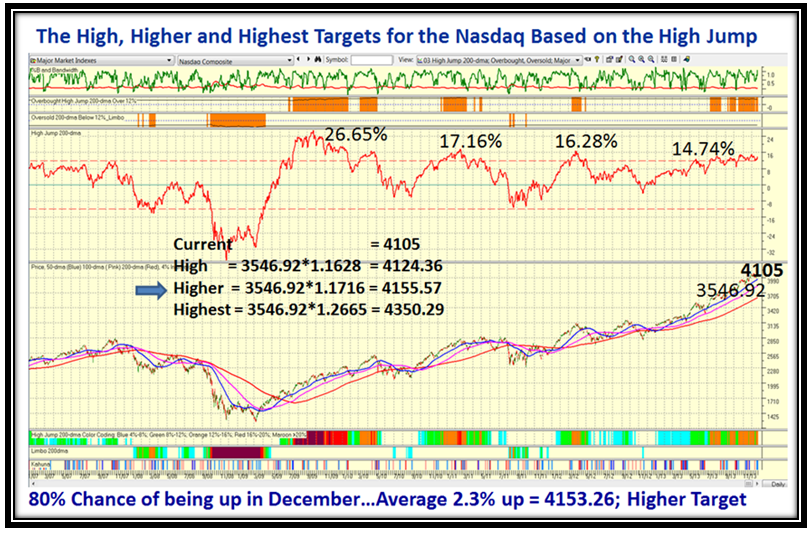

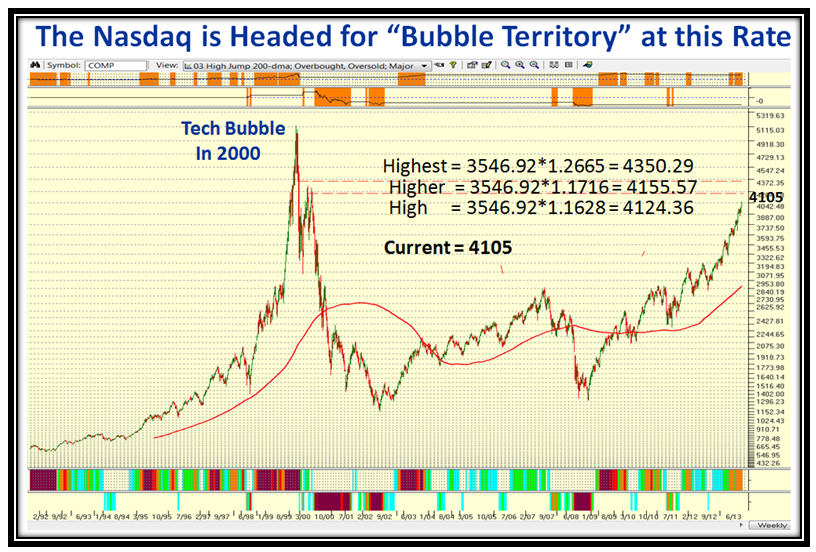

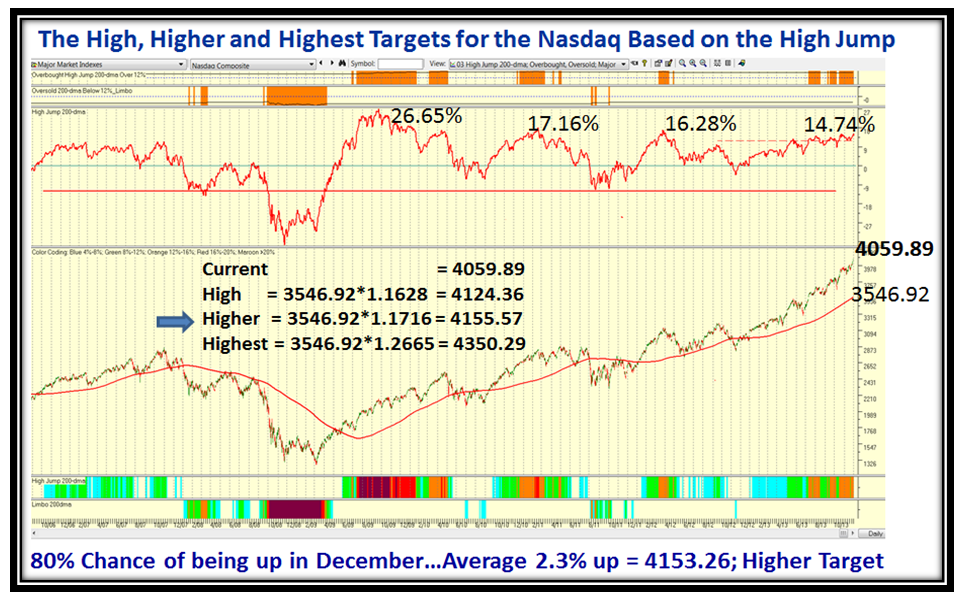

Stock Market: Nasdaq hit “Higher Target” and Still Rising

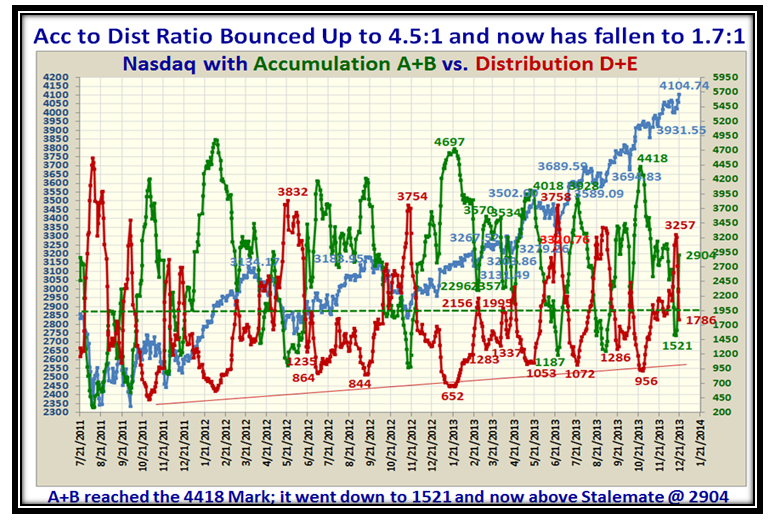

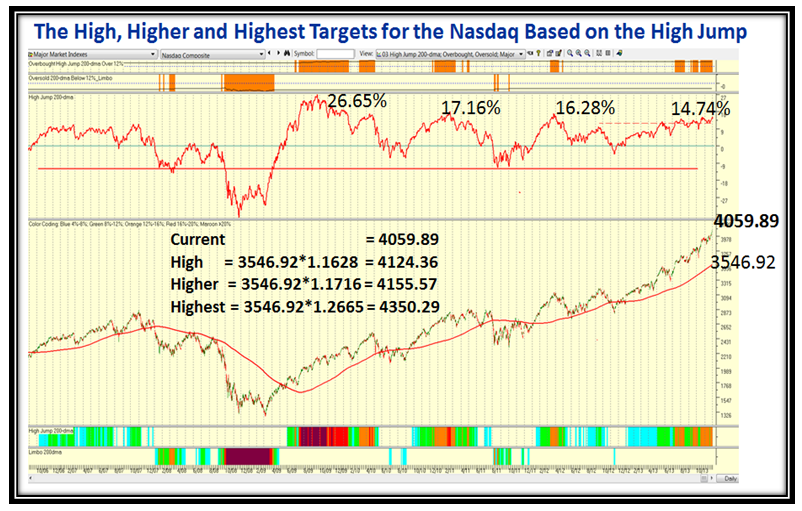

Thursday, December 26th, 2013I am delighted to mention that the High Jump Tool has proven itself invaluable yet again, while the Market continues upwards and onwards:

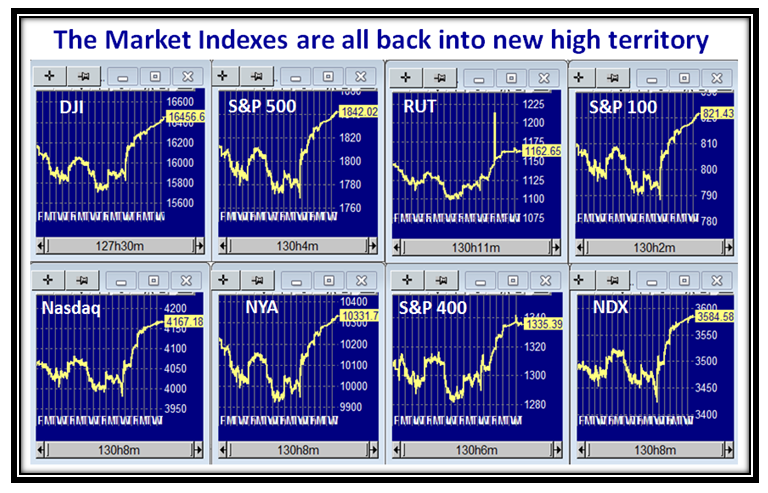

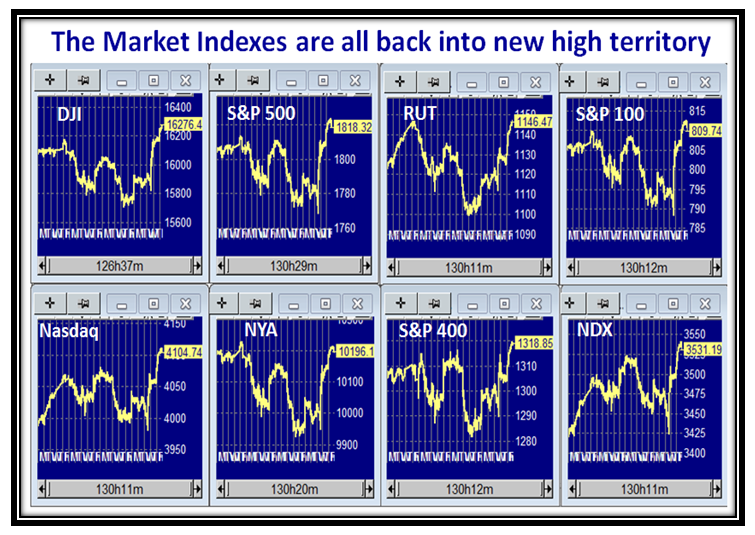

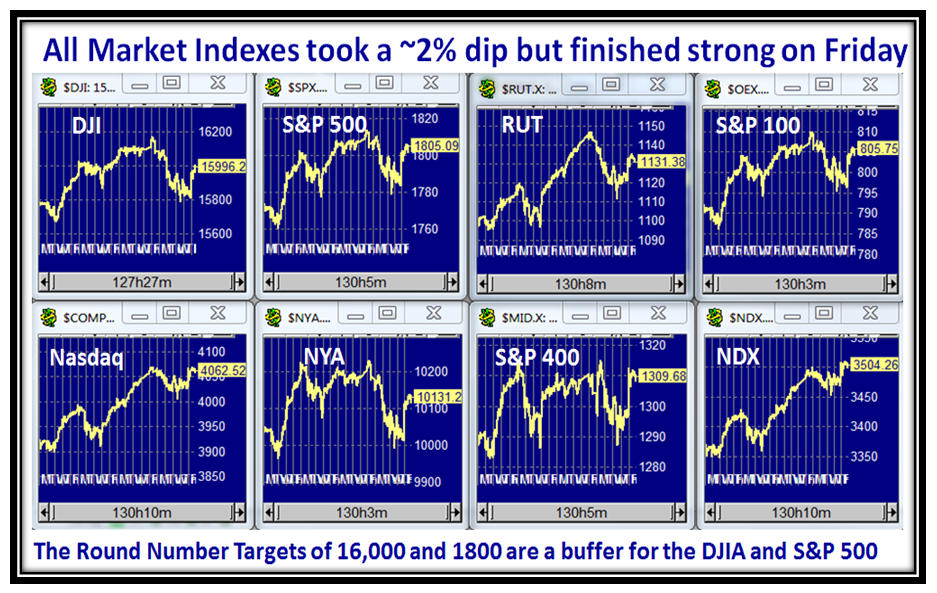

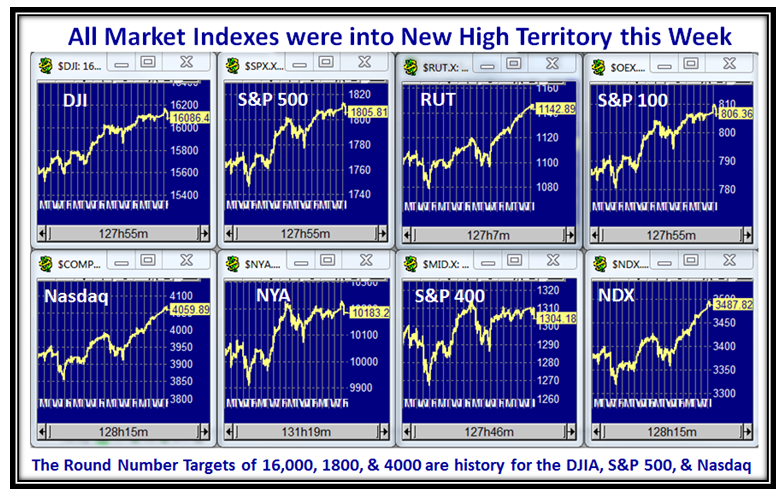

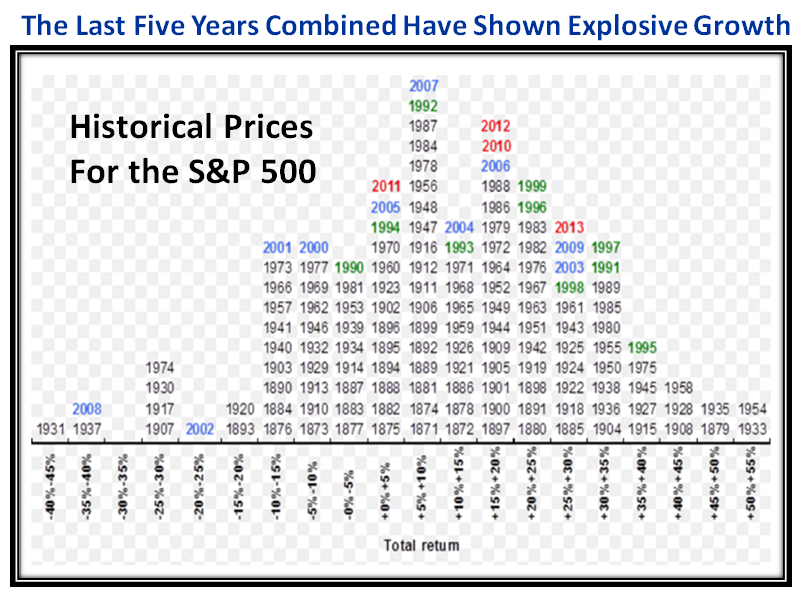

The Market Indexes are all into New High Territory:

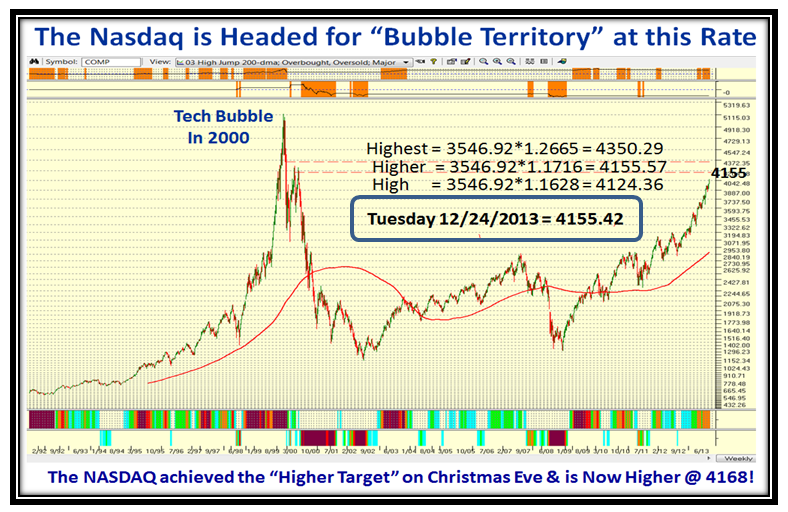

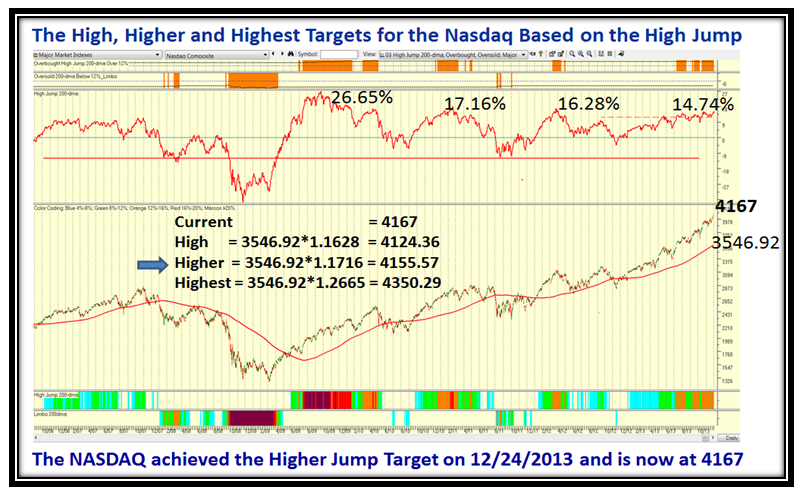

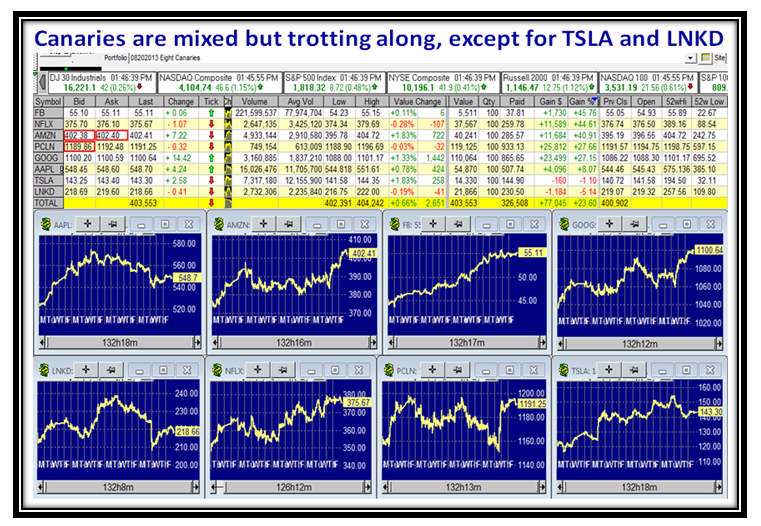

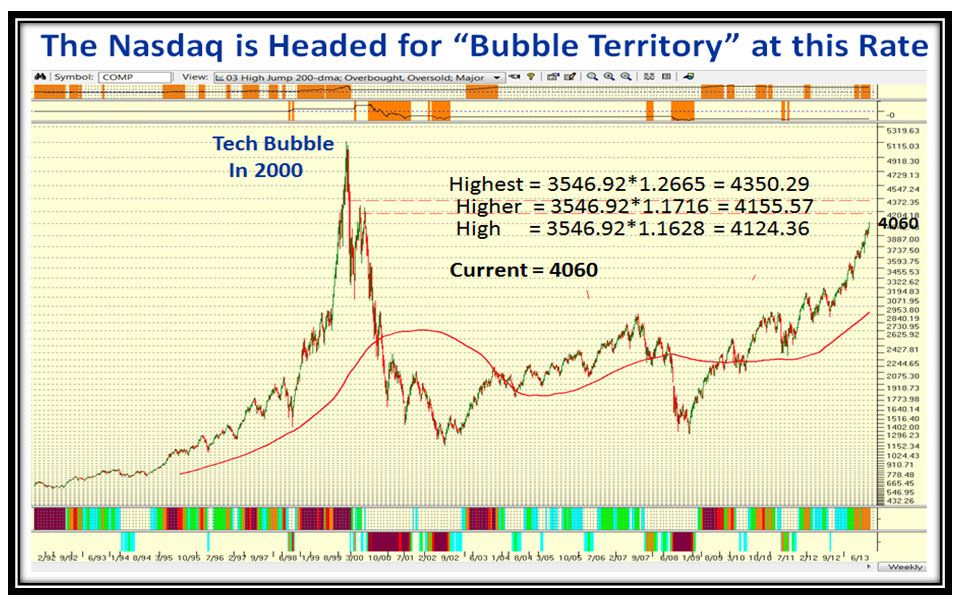

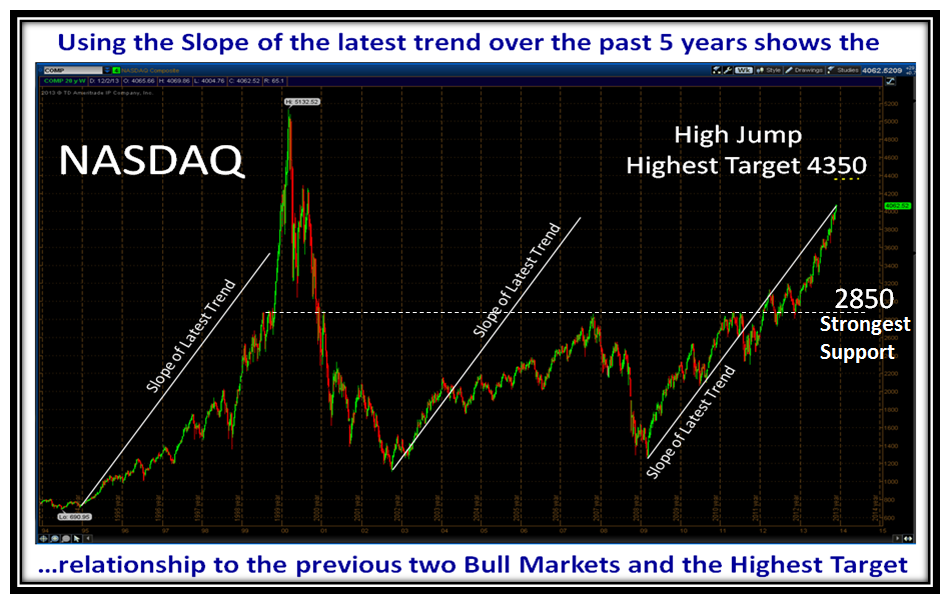

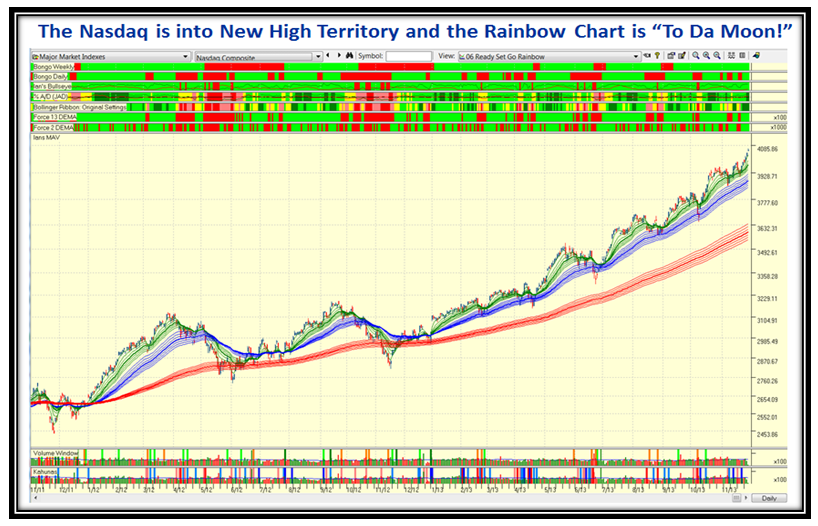

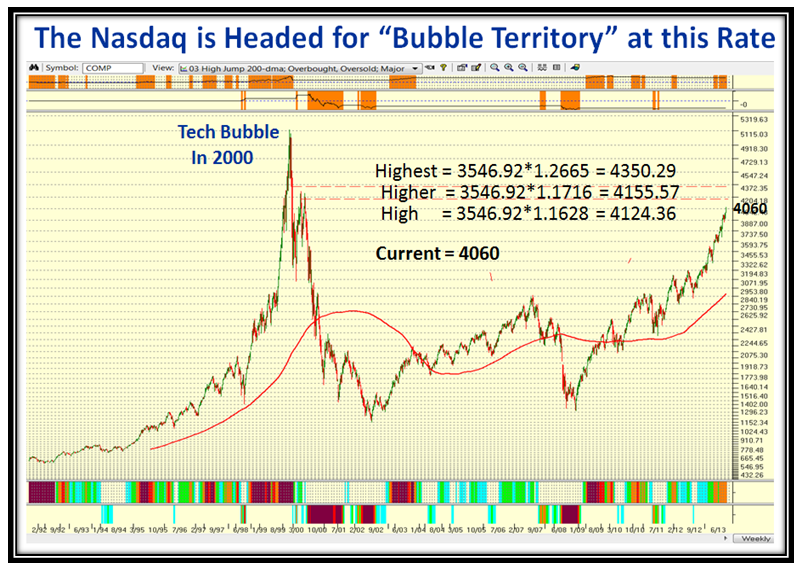

You will recall from earlier Blog Notes how we keep a tally of the High Jump Targets and the NASDAQ met the “Higher Target” of 4155 on Christmas Eve.

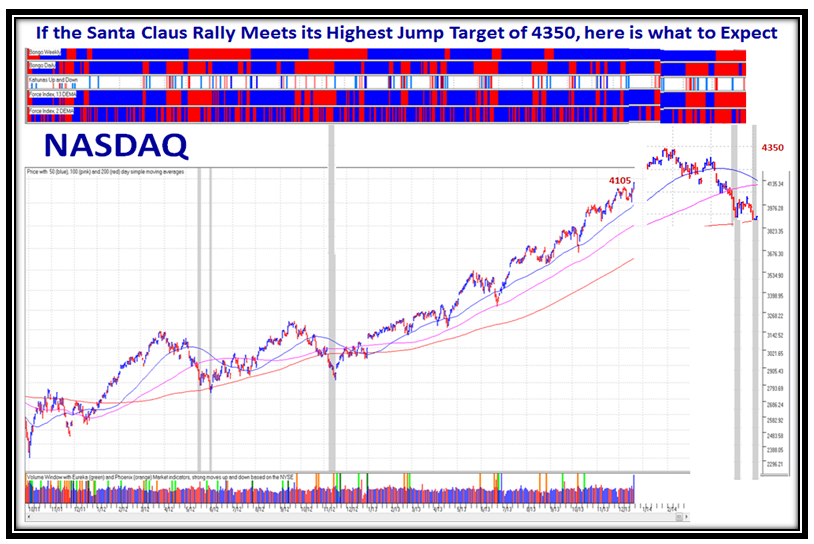

The Nasdaq is currently at 4167 and now on its way to the Highest Target of 4350 to complete the next rung of the ladder based on it reaching 16.28% up from where the measurements were taken from the 200-dma when it was at 3546.92:

At this stage with the Indexes all reaching for overdrive, it is natural that the VIX is reaching for a recent all-time new low. It reached an interim low during the course of today of 11.75 as shown on the following chart and bounced back to finish the day at 12.33. More importantly, the Bulls have a huge cushion before the VIX can signal major danger.

Take it a day at a time, but the odds are very good to play towards the upside for now until there is a serious shot across the bow, which we well know from all the signs I have taught you.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog