The Game Plan for the Short Term

The previous blog note covered the gloomy side of the equation. What can we see for the upside, and what should be the signs that the rot has stopped, and what should one do under these circumstances?

-

The first and most important thing on our minds is Capital Preservation. Just move your money to the sidelines and take a deep breath and regroup if you suffered a loss these last couple of weeks. There is nothing worse than a leaky faucet.

-

The second point is to be careful of the small caps…the Russell 2000 is in bad shape and may present some shorting opportunities, but it is already so beaten down that one may get caught if there is a snap-back. Ron Brown showed how to address the ETF’s in his movie today, so see what opportunities appeal to you on that score. The QID/QLD are a good pair for gamblers but one must be very, very quick on the trigger both ways.

-

The only saving grace is Strong Industry Earnings. We are very fortunate that the S&P 500 earnings are still on their way to achieving 90.00+ by year end. However, that means very little right at this moment. It will be of great value when the dust settles.

-

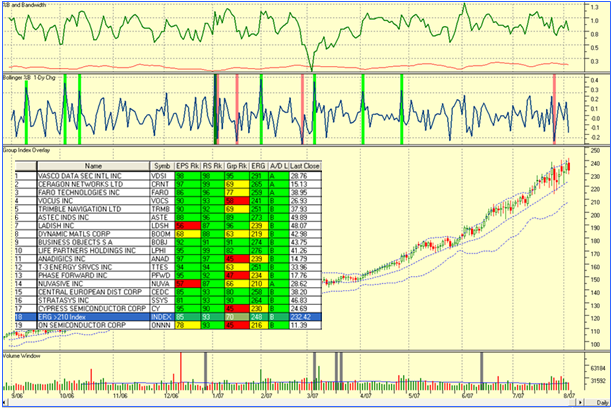

Now is the time to be sharpening the pencil and observing how leaders behave to see if the rot has stopped:

- Stocks whose Trailing Twelve Months (TTM) earnings are out and are stellar, i.e. >20%.

- Stocks that have A or at most B Accumulation since they are the current leaders.

- Stocks that have a Rel Str of at least 87 and preferably 95.

- Stocks that have an ERG >210

- Stocks that are still above their 50-dma and preferably above their 17-dma.

- Stocks that have not corrected more than 15% at most from their high and/or basing

Here is a list to keep an eye on. If this Index can’t hold, this Market is in a lot more trouble:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog