Get Off My Back…Will You?

Alan Greenspan made headlines again yesterday with his comparison of the current period to 1987 and 1998. This has come when for the first time in four years the non-farm payrolls printed a negative number. The occurrence of a negative print does not necessarily mean a recession is imminent, but the change in non-farm payrolls does turn negative leading up to a recession. So, naturally the dreaded “R” word is on the airwaves yet again. This time for good reason as the measurement of reality to estimate is so far off base that “jobs” can now be added to the list of turmoil, especially as the two previous month’s were also taken down sharply.

It is not amazing how the psychology of the Market has changed so rapidly from the FOMC will reduce Interest Rates at their next meeting to it must do so and should have done it sooner. Now the clamor is for 50 basis points instead of 25. Our Grand Old Duke of York, aka BB, is now caught between a rock and a hard place.

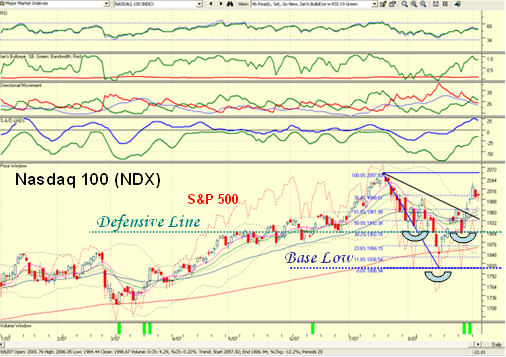

It goes without saying that it is now the Bears’ turn to have some fun, as we head down to test recent support. Fortunately, we have had a recent short-term reverse Head and Shoulders pattern in all of the Indexes on the Bounce Play. With the defensive team now out on the field, one can raise the bar, i.e., lines in the sand, to the right shoulder level to know if it will hold or we head back down lower to the previous Base Low area. So remember that trick for the future. When the markets have taken a beating, a reverse Head and Shoulders that is already imprinted gives better support than waiting for a double bottom that has yet to come.

My colleague, Ron Brown, did a great job this morning focusing on the Market Internals. When one has an unusual distribution day, especially at the top of a Bounce Play, take heed of what he has shown us as one gets a lot more information than just looking at the Index charts alone.

The Case for the Bears

- Their swan song is a recession is inevitable, with chinks showing in Housing, Sub-Prime lending and mortgages in general, Carry Trade with a strong Yen and a weak Dollar, a disastrous jobs report, and lack of consumer spending.

- A recession does not have to mean a Bear Market or vice versa, but if there is no super glue to put Humpty together again, then the bears rule the roost. They will play cautiously, as once bitten twice shy with what happened two Fridays ago, when the Grand Old Duke of York, aka BB, dropped a bombshell on them and said “Charge”.

- Gloom and doom talk by the media on the market usually is self-fulfilling and people like you and I just trot off to cash and wait for sunnier times. Even those who are good short artists are confounded, but if you have learned the tricks of the trade with the likes of the QID, and other double your money bets on the various Indexes, you can enjoy this volatility. There are two pre-requisites, very nimble and glued to your screen, but after a bit even that gets a trifle stale.

The Case for the Bulls

-

Only one or two points from what I can see at this time, Uncle Ben with Super Glue, and he can’t fiddle around. Since he is cautious, and he has vowed he will not act to just save the markets, but that there must be some bona fide case regarding liquidity for the Banks and/or sluggish signs in the Economy. Don’t expect a Greenspan slash, dash, slash action from him. In addition, any precipitous slash would be looked upon with suspicion as pandering to the media.

-

The second point is the injection from the Fed a couple of weeks ago did at least produce a decent bounce play, so there is breathing room to the downside before the Bulls get too morose, and completely throw in the towel. After all we now have a yo-yo market and at the drop of a hat this beast can turn around and produce another 200 point up day. There are enough players who recognize the decent earnings reports and that is exemplified by the types of stocks we normally are attracted to, i.e, strong growth stocks with stellar earnings reports. The NASDAQ 100 (NDX) is leading the way which says that technology is the place to be. It has been aptly demonstrated 10% in a week or less is still a good bet for the day or swing trader with these types of stocks with Relative Strength (RS) >95 right now.

The Game Plan for Next Week

-

You can see what I mean about having Head and Shoulders Patterns when playing Defense.

-

I have used the NDX as a learning lesson…it is the strongest case for the Bulls. There are several lines of defense the chart shows:

-

a. Just look at the strong breakout above the black line which is the 405 Freeway, on the way up

-

b. Note how it retraced all the way back to the 76.4% Fibonacci line. That’s a strong bounce

- c. Also note that the 4-dma, 9-dma and 17-dma all fanned up through the 50-dma…shows strength

- d. The first line of defense is when it tries to hold at the 405 Freeway at around 1932

- e. The next line in the sand is at the bottom of the right shoulder which is at 1899

- f. The third line in the sand is the 200-dma at 1862

- g. The final line in the sand is the recent Temporary Base Low of 1806

3. The gap down at the open on the NASDAQ Indexes is significant, and it essentially left the NDX with an Island Gap…between friends. In this case the Bulls were caught napping with euphoria so to speak. It is unusual for me to not concentrate on either the NASDAQ or the S&P 500, but a tip to you is to always seek out the strongest market index on a bounce play as that index will probably give more clues as to whether the rally will continue or seize up and die. So my advice is to watch the behavior of the NDX over the short term, and I have identified the various lines of support so that we can get a feel for whether the new leaders in Technology continue to show resilience or were just a flash in the pan.

4. At this very instant, the one stock which should give us the biggest clue is Apple (APPL), since it recently announced price cuts and its behavior in the short term should be useful.

5. I’m sure you get the picture that there is a lot of room for the Bulls to play defense. Given that the NDX is the strongest of the Indexes, if this is broken then there will be major damage and we are in for a bad correction. With the big gap down on Friday, the Index is already down to 1950, a 2% drop. It has to snap back and close that gap quickly for the Bulls to have any re-assurance that there is still support to drive the market higher. Net-net, out of all that turmoil, the one simple item to watch in next week’s game plan is will the gap be closed on the NDX or will the problems around us take that index down through those support lines like a hot knife cuts through butter. Let’s see how it plays out.

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog