A Review of the Value of the Iandex and RonIandex

I am very pleased to see so many other Blogs referencing my Blog since it seems there is an amazing interest in the Hindenburg Omen. I have a Russian Blog and a Greek Blog referencing my work to say nothing of the many US Blogs that like to keep track of the Hindenburg Omen. So let me take this opportunity to thank them for their kindness and I hope it helps them too. It started that way, but it seems that the interest is now more than that as I note from the statistics that the most popular Blog of late is the one called “The Hindenburg Omen Keeps Dropping Big Shoes”. It seems that the list of Silverback Chinese Stocks shown in that Blog is the key attraction as these got hard hit today. Few seem to care about Guy Fawkes Night!

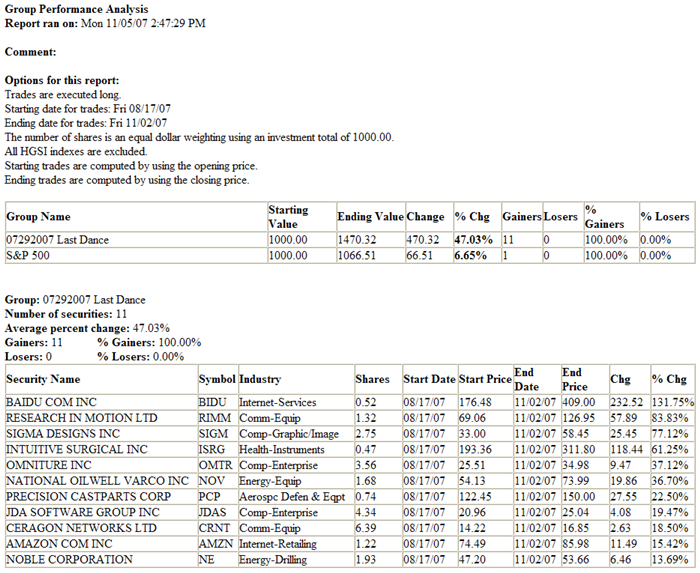

Today I celebrate the highest number of hits I have had in the four months I started this blog. I am not complaining for one minute with this new found interest in what I have to say. However, I do want to give some perspective of the context in which Ron and I give you pointers of where to catch the big fish and yet at the same time know when the pond is drained and the Index’ we post give you an early warning of a downturn in the market. Those of you who follow our work on a routine basis will recall that one of the earliest Iandex I posted on July 29, 2007 was eleven stocks called “The Last Chance for the Last Dance” implying that these gorilla stocks were the pick of the bunch at that time and if they broke we were due for a decent correction. It turned out that was correct as it was little more than two weeks later that we hit a low in the market on August 16. What our supporters also know from past experience is that if there is not a complete rotation and/or more than an Intermediate Correction these same stocks often go on to give major gains.

Of course, we are all busy people and have so many other tempting stocks to buy from, but I want to wake you up one more time that Ron’s and my purpose in life is to both help to show you how to make good money and also to suggest when to protect the money you make. I am a glass half full type with a healthy respect for Market Corrections. I am not a gloom and doom type though the exposure I have had on the Hindenburg Omen may suggest that to people who don’t know me. It is a proprietary Indicator in the HGSI Software, along with several other proprietary indicators just as useful, and it is satisfying to us all on the HGSI Team to see its popularity grow. Here is what I mean about knowing when to pounce and when to pull back. 10% to 15% per month is a pretty good return in a rough market:

The Last Dance Index is still as strong as the first day I published it and will tell you when the Market has given up the ghost, as it tried to do back in August. Watch it like a hawk! Also note that I have repeatedly said that GOOG, AAPL, RIMM and GRMN are the four to watch and GRMN has fallen. Add BIDU to that list and if these die so goes our Market as well as the Chinese Market! As an exercise left to the student, I suggest you look at the other Index’s I have listed throughout the past three months and see how they have performed. Once you begin to see them turn blood red, the party is over and there are no more leaders until a rotation takes place and a fresh set of leaders emerge. Those of you who are not day traders or swing traders hopefully have learnt a lesson that the Principles of High Growth Stock Investing apply to the gamut of Investing Styles, but it is your stomach for Risk/Reward preference that determines the degree of success you have.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog