Caught Between a Rock and a Hard Place

Helicopter Ben didn’t have any golden parachutes today for the Stock Market in his address to the Finance Committee and it was apparent he had no real solutions to the difficult alternatives he faces…hence he is caught between a rock and a hard place. If he continues to placate the Financial Community with more rate cuts, the lower the dollar goes, the higher the price of oil, the more the risk to inflation. If he does nothing, the financial fiasco can continue to bubble and ultimately lead to a financial crisis. Be that as it may, the Stock Market didn’t like what it was hearing and Big Foot came out of the bushes again today after that heavy 360 point down day in the DOW and another big wallop today until the bargain hunters came back in during the last hour. Big Foot disappeared in the bushes but is still lurking in the wings. Anyone who was nimble had a field day today, but most conservative longer term buy and hold types were either sitting on the sidelines or already in their foxholes. But you know all that and the $64 question is where next? It’s not difficult: For the first time, the big five have been hit, not enough to cause severe damage but enough to put a spanner in the works:

-

RIMM had an $18 spread and eventually gained back half the drop for a 6.15% loss.

-

BIDU had a $52 drop and recovered $10 but finished with a 10% loss for the day.

-

AAPL had a spread of $19, recovered$8 and finished with a 6% loss.

-

GOOG dropped $57, recovered $14 and finished with about a 6% loss.

-

GRMN had already been badly hit and is at least 24% off its highs so is a broken stock.

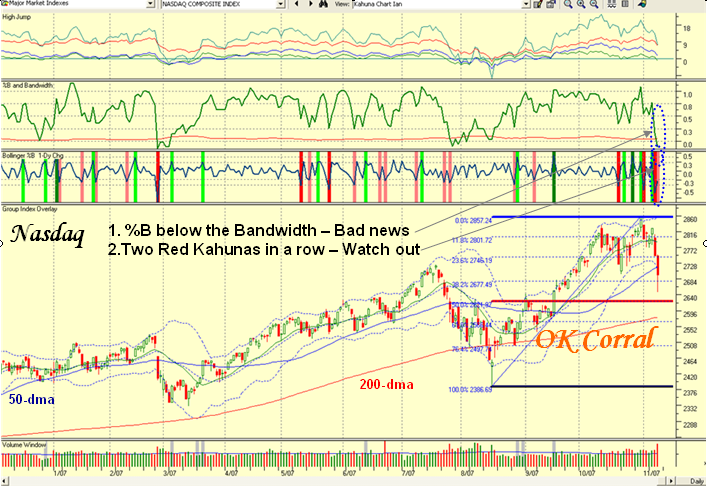

It goes without saying that the Leaders which are all in the NDX (Nasdaq 100) were hit with a -2.92% haircut today and the Nasdaq was little better with a 53 point drop and down 1.92%. Surprisingly, the S&P 500 recovered to be essentially even and the NYSE and Russell 2000 were actually positive. It’s far too early to say there is rotation until we see the follow through reaction tomorrow and being Friday we can expect that many traders will be looking to vacate their positions before the weekend.

To rub salt in the wounds, the Chinese Silverbacks I gave you the other day have collectively given up 9.15% in a week! On the rosy side, FSLR and JASO are flying high so the Solar Stocks are back in big business due to the blockbuster earnings report by the former. Likewise, the Chemical Specialty Group was tight and held up well. Net-net, I can’t make a silk purse out of a sow’s ear. The prudent approach is to wait and see till the dust settles and sit on the sidelines, UNLESS you enjoy volatility and know how to use your trump card which is “Nimble”. If you do, then sharpen your pencils for both sides of the coin, shorts and longs and you will do extremely well if you make the right calls quickly. Late breaking news says there is now an Ultra Short Chinese ETF called FXP, which came out today. You judge for yourself where the odds are right now with the picture below. There is more to go on the downside before it gets to the OK Corral again. Just watch the Red Line in the Sand.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog