The Santa Claus Rally is in the Balance

The Bargain Hunters were out in full force on Friday both in the Shopping Malls and in the Stock Market. The nation’s retailers had a robust start to the holiday shopping season, according to results announced Saturday by a national research group that tracks sales at retail outlets across the country. According to ShopperTrak RCT Corp., which tracks sales at more than 50,000 retail outlets, total sales rose 8.3 percent to about $10.3 billion on Friday, the day after Thanksgiving, compared with $9.5 billion on the same day a year ago. ShopperTrak had expected an increase of no more than 4 percent to 5 percent.

In the Stock Market the Index gains were impressive but as usual it was primarily bargain hunters on very light volume. The Eureka Signal we got indicating an unusually strong day must be discounted as such signals at holiday time are usually meaningless. None-the-less after a brutal three weeks where the Nasdaq lost over 11%, the respite on Friday was a welcome fillip to those who were looking for a decent bounce day with an oversold market. The big question is whether the Financial Media will hype the Strong Black Friday Retail results sufficiently to propel the Nasdaq back above the 17-dma and 50-dma above the 2680 mark…a gain of 100 points from its current 200-dma line. The big leaders such as GOOG, AAPL, RIMM and BIDU have either found a base at their 50-dma or have bounced up off it. However, GRMN is a casualty in this correction, and the others, especially BIDU, are looking vulnerable should the Santa Claus Rally not materialize as they are all sitting waiting for the bears to pounce with any signs of weakness in the Indexes. It goes without saying that the likes of the Transportation – Shipping group has been pummeled with DRYS and EXM down 44 and 51% respectively.

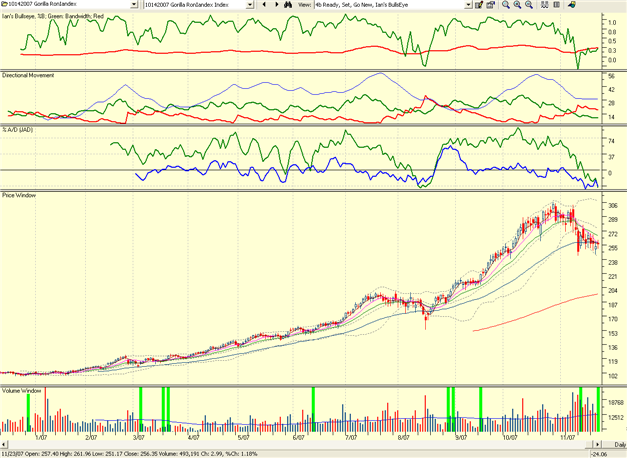

The summation of all of this can be seen by looking at the Gorilla RonIandex, which was put together 6 weeks ago on 10/14/2007. It is right at the 50-dma and can go either way, with the odds suggesting downwards, UNLESS there is a dramatic change in sentiment and a drive to move the stock market up for the December rally. Net-net, the Short term direction is down, but the intermediate and long term direction is still up, though the intermediate term is hanging on by a thread!

It will be interesting to see how the next month plays out as the litany of problems in favor of the bears need not be listed as they are well chewed over, and the case for the Bulls are based more on folklore and hope than anything solid. Appreciate that the EPS guidance for the 4th qtr has also been lowered since we visited the pros and cons so that too is a damper for the Bulls. It is worth reciting the thin thread the Bulls have for posterity sake:

-

The Retail Stores report for this past Friday gives an uplift to an oversold market

-

The Fund Managers have a vested interest in their Year End bonuses being propped up

-

Our friends at the FOMC pull another rabbit out of the hat with yet another drop in rates

This year will be especially good for the 350,000 or so who work in the City. Bonuses this year are expected to reach £8.8bn, with stock markets trading at five-year highs, a raft of mergers and acquisitions and competition for top executives.

That last thought in item #3 would really show the FOMC’s hand in making sure that the market stays up at all costs despite the serious threat of a run on the already weakened dollar and further increases in oil prices to over the $100 mark. It’s a given this is a day-trader and very nimble swing trader’s market, as the intra-day swings on the DOW are routinely well over 100 points and invariably as much as 200! Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog