Santa’s Gift from the White House

We have had a few visits from Helicopter Ben to save the day in November, and now we have Santa Claus bringing the Bulls a gift on Mortgage Loans from the White House in December. President Bush outlined a plan to help struggling homeowners avoid losing their properties, including a five year freeze on low and introductory mortgage loans. Treasury Secretary Paulson said the effort isn’t a “silver bullet”, for the housing crisis but should provide some relief.

The upshot of all of that is with a proper follow through day yesterday on the Stock market Indexes, we had another rip roaring session today to send the Indexes back up into respectable territories from their recent lows. Since my last blog on Sunday where I laid out the Game Plan for the recovery from a Base Low in three steps using the 405-Freeway as the lynchpin to success, we trotted down calmly for two days at the start of the week to pause to refresh and yesterday and today have been blockbuster moves in the Stock Market.

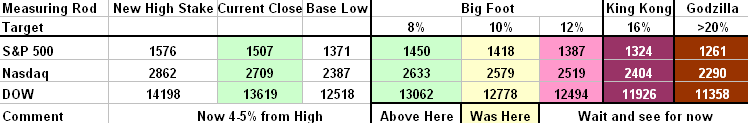

That was my early Christmas Present to all of you last weekend, and here we are like magic sitting right at the 405-Freeway on all three Major Market Indexes (between friends). I show the previous move on the S&P 500 so that you can see there can possibly be a slight hesitation similar to the yellow dotted oval last time, before the Indexes can push their way through that overhead supply depicted by the line I show; especially since there have been two powerful moves these last two days. It goes without saying that the bear’s scenario is “Don’t count your chickens before they hatch” and “There is many a slip twixt cup and lip!” So let’s review the bidding:

-

It all hinges on two important pieces of news starting tomorrow with the Jobs Report and on Dec 11th when the FOMC Meeting delivers their much awaited decision on lowering Fed Funds Rates once again. Whether it is 25 or 50 basis points or none at all remains to be seen.

-

Bad news on either or both of these two items can get the bears dancing and prancing once again, but good news of course will provide the booster rocket to propel the market for a decent Santa Claus Rally.

In the meantime, the work that my friends have done suggests with a big winky-winky that stocks with ERG 270 is where the action is since the market started its correction on Nov 1, and I will show you that in the Newsletter next week. When the market is jittery always go for those with the strongest credentials in ERG for the smoothest rides. For sure you need Stocks with EPS Rank >90 and Rel Str >90 and preferably Group Ranks greater than 70 if not higher. Some Wolf Packs such as the Transportation – Shipping are a trifle tired, and others trying bottom fishing for the umpteenth time with the Home Builders are still trying to find a bottom. The Chemicals – Specialty are white hot, the Energy Alternatives run hot and cold and it is good to see that after a shaky week or so in the Technology Stocks they seem to be rebounding nicely with the likes of GOOG, AAPL, GRMN as well as fresher ones such as VIP, SIGM, PTT are worth a look based on their strong Fundamental credentials

With regard to the Rebound, we can see that there has been substantial repair in the market Indexes this past week as we are essentially only 4 to 5% from the Oct/Nov highs. Notice that these stakes in the ground remain the same, and all one has to do is move up and down the scale as the case may be based on the Markets action. Doing it this way gets your stomach in sync with the Fear and Greed Syndrome and which side of the market you should be on.

Net-net, Stakes in the Ground, Frequent Measurements, Base Low, 405-Freeway are all part and parcel of guiding you to victory in mastering the Stock Market during corrections. Best regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog