A Pause to Refresh

Why all this focus on the VIX?

-

It is now nearly four months since I put up a blog entitled “One Good Turn Deserves Another” and pointed to Bill Luby’s blog site vixandmore.blogspot.com and suggested there is substantial worthwhile reading at that site. I strongly advise you that if this subject has peeked your interest you trot over to his site and read among other interesting notes “Ten Things Everyone Should Know About The VIX”. More importantly, it is obvious that here is a person who likes to measure both sides of the coin and is sufficiently open minded to point to other bloggers who may have similar interests but have different points of view. He again mentioned this site in his April 14, 2008 blog entitled “Three Top Bloggers Look at the VIX”…and I for one learned a lot from the other two! My point is that “bloggers” can only feel their work is appreciated if the number of hits at their site continues to grow and that comes from mentions from others including the blogging community.

-

My overnight claim to fame as a blogger on the Internet came from the first note I put up on the Hindenburg Omen when the number of hits tripled overnight, and I found a following from Greece, Finland, and as far away as Singapore among others. However, the sad state of affairs is that despite my efforts to keep you on the right side of the market with several notes per week at critical points in time, my number of hits is back to the normal clientele I can bank on from those who read Ron and my Monthly Newsletter.

-

I’m not looking for “attaboys”, but I am certainly looking for positive feedback or other points of view, and questions and occasional thank you notes for all the work I put into this stuff. There are always the faithful few who take the time to show their appreciation, but it doesn’t excuse the many that don’t. Maybe I am spoon-feeding you too much and since this is the day of the Internet where everything is taken for granted with little thought of the hours it takes to put cogent stuff together, I should not be surprised that it comes with the territory.

-

I will watch with interest in the next couple of months as it will be a year since I first started this effort and true to what I always say “It’s Your Call”, implying that it will be my turn to make that call!

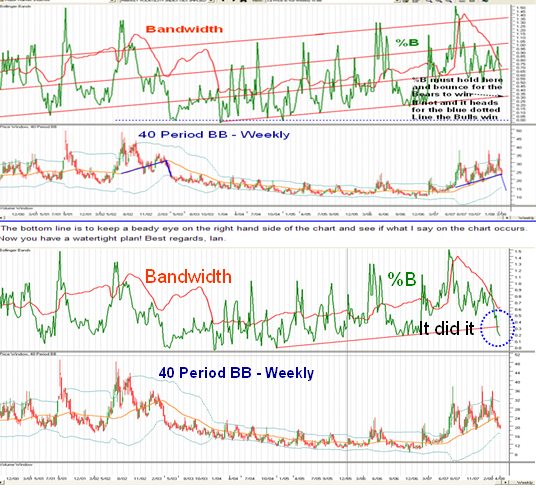

Now for a further review of what has transpired since the blog I put up a month ago on the VIX:

-

Naturally, the Bears are licking their chops and sharpening their pencils that it is now time to turn to shorting, since there is undue complacency, the put/call ratio suggests there is too much optimism, and the VIX has not only corrected but is a lot lower than previous support levels. Likewise, it is not surprising that having gone through one resistance level at 2440 on the Nasdaq, all indexes are now reaching the bigger challenge of getting through the 200-dma ceiling, so obviously, at some point there should be a pause to refresh and the Bears will have their turn.

-

The $64 question at that point will be is it a small correction and the Bear Market Rally continues in which case we can look forward to the worst being over for now, unless there is a major surprise. The other side of the coin is that it turns down for a deep correction in which case we can look forward to a retest of the lows again.

-

Meanwhile, we see that most boats are rising, most old Leaders are finding support, along with many new breakouts from decent bases and fresh leaders, so let the market guide you as to what to do rather than ANTICIPATING what you want it to do. By all means watch both sides of the coin, but don’t become a jack-in-the-box.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog