Mountain of Worry for the Fed

Fed meeting in Wyoming against a backdrop of challenges: It is a year to the week since I first posted a note with the little fellow on the right of the picture asking the same question. When Fed officials gather for their annual retreat at Jackson Hole, Wyo., on Friday, they’ll cover all the possible avalanches, crevices and cliffs that could send the economy dangerously off course. Conference goers are going to be debating the Fed’s dramatic actions to stem the financial crisis and protect the economy. They’ll be pondering what more could or should be done.

Recent developments in commodity prices and the dollar, combined with slow growth, should lead inflation to moderate this year and next year, said Fed chairman Ben Bernanke on Friday. The recent decline in commodity prices and the increased stability of the dollar have been welcome trends, Bernanke told policymakers and economists at the Fed’s annual retreat in Jackson Hole. The Fed chairman stressed that the central bank was committed to price stability over the medium term and that the Fed will have to monitor inflation carefully as the outlook remains uncertain. Bernanke noted that the financial turmoil that began last August has not yet subsided and its effects on the broader economy are becoming apparent in the form of softening economic activity and rising unemployment.The market has been most erratic of late, with undercurrents and crosscurrents that can snap you in two if you are not nimble. Even the day and moment traders are having a tough time of it and stock market forums are more silent these days as they enjoy other things such as the Olympics, vacations, graduations and weddings rather than lose money in the stock market.

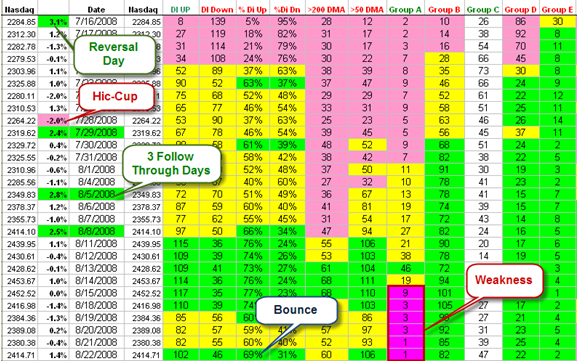

The recent attempted rally fizzled with a bad week this week, and today we are experiencing an oversold bounce. What else can one call it when the market swings a couple of hundred points every other day? The underlying internals are putrid and it suggests to me that unless one sees some excessive irrational exuberance by the bulls’ ala a Eureka or two, we are always doomed to failure on attempted rallies when the market is so oversold.

The “Internals” of the Industry Groups are discouraging with only one Group having “A” Accumulation (Insur-Brokers), and 83 with A+B ratings out of 154 Industry Groups overall or 54%. DI+/DI- is much better with a 69:31 split. Note that the three follow through days on 7/29, 8/5, and 8/8, eventually turned the picture from Red to Yellow to Green. However, the choppiness is very evident with the Industry Groups still weak as shown in the last six readings in red. The only saving grace is a benign VIX Index which despite all this upheaval has remained placid. Let’s take a roll call:

1. The Oils: Now very erratic as we would expect. The oil ETF, USO did come close to 90 as I told you to watch, bounced to 98 with the Russia-Georgia fracas and headed down again. If it breaks 88 to the downside, the oil stocks will be hit badly but the market will probably head upwards as Oil heads below $110/barrel (say).

2. Favorite Old Wolf-Packs: These include The Solars, the Coals, the Fertilizers, the Steels, the Transport-Shipping, the Machine-Generals, the Chinese Silverbacks. The only way to play these is to have Wolf-Packs at the ready and on the day, moment-trade or day-trade them. Solars and Fertilizers and an iffy Coal group have bounced nicely this past week, but nimble is the word.

3. Reviving Industry Groups: The Health Care including Bio-Med, HMO, Nursing Homes and Health Instruments have all bounced nicely and are generally strong.

4. Technology is gaining momentum especially the Small Caps, and there is the usual litany of Groups for this lot.

5. Dredging and Bottom Fishing: Of course, Financials, Home-builders, Leisure-Gaming and on and on is where the value is.

6. False breakouts: The real problem is that too many false breakouts are occurring on what potentially are leading stocks with ERG and RS high at >240 and 90, respectively, that the only players making money are extremely nimble day traders.

7. Folklore: This is not unlike the late 2002 and early 2003 timeframe, where the Market itself is so oversold that it requires a major groundswell of committed buyers to show their commitment. Although it was excusable these past weeks for one to see a void in Eurekas from an extremely oversold position, it is now time to expect these to appear or one should continue to be very suspect of this market.

We shall see what the Jackson Hole Meeting of the FOMC brings, but don’t expect anything more than platitudes and a wait-and-see announcement. Meanwhile, I continue to enjoy the Olympics, which I told you would bring major focus to China!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog