The High Jump Indicator to the Rescue!

You can’t say I didn’t give you enough warning in the newsletter and on this blog.

I have repeatedly shown you the value of the High Jump Indicator and once again

it has turned up trumps. I explained in the Newsletter that the Nasdaq had not

exceeded 24% from its 200-dma since 2003 and then only four times at that. I

also said that we were about to break 25% and if it did we would either swoon and

Pause to Refresh, or head into a Climax Run. Well it peaked yesterday, and as the

pundits have said it was a classic reversal day and there is a follow through to the

downside again today.

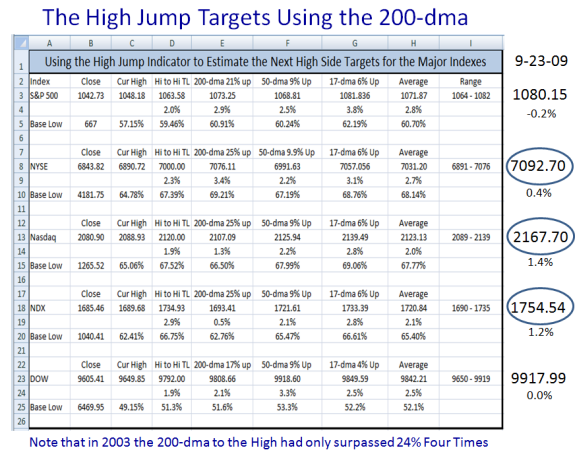

For Posterity sake, so that you can review the bidding at a future date to know how and when to use this technique, I give you the Targets and Results at the Peak, and you can see it hit them spot on for the DOW and the S&P 500, and overshot less than 1.5% for the Nasdaq, NDX and NYSE:

You might ask “Is that the end of using the High Jump for this round?” The answer

is “No”, but instead of focusing on the 200-dma as the next HIGHER target, you will

need to use the 50-dma and/or the 17-dma to figure out the next levels, should

the Market decide to go higher. I will show you how at the upcoming seminar, so

that is something to look forward to.

The two views of “The News & Plan in a Nutshell” and the “Saw Tooth Game Plan”

from the last blog are still fresh as a daisy, so review them and I won’t repeat them.

For completeness I show what transpired with the VIX today and you need to keep a beady eye on this chart to see if it heads up to 28 like a rocket or subsides back into its shell as the momentary Fear turns into Complacency again.

Understand the action in the last hour yesterday and all of today says this was a

warning shot across the bow and you need to be on guard.

This view of the VIX was taken at 10.20 am Pacific Time.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog