Gone Fishing – Are you the Trout or the Fly?

When the Market goes into oscillation as it did last week, many just throw up their hands and go fishing. However, with Volatility back in full force, those who are good at playing both ways and can turn on a dime make good money though I am sure it is both exhilarating and exhausting.

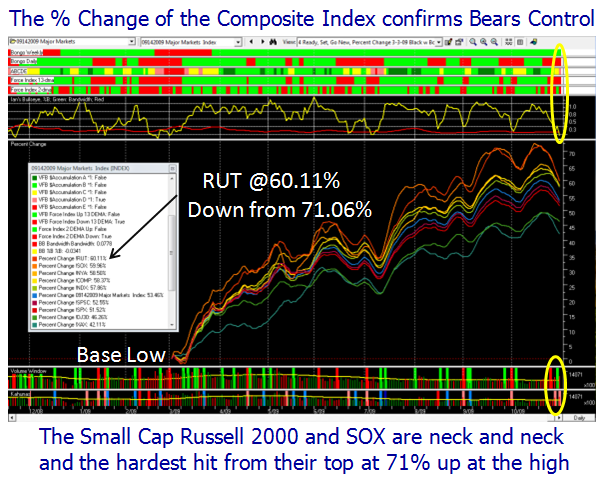

It goes without saying that next week will be critical as we try to read the tea-leaves as to whether the Bulls can regain control or the Bears have it firmly in their grasp and are taking this Market into a reasonable correction. The chart below shows that the simple red and green count of +1 and -1, respectively shows more minuses than plusses. The Weekly Bongo is still showing Green but as we well know that is by design a longer term indicator and is the last to either turn green or roll over and turn to red. Note that the Russell 2000 (RUT) and the Semiconductor Index (SOX) have been neck and neck in rising above all other Major Indexes, but the higher they go the bigger the fall, and as you can see from the slope down from their peaks a couple of weeks ago they have been the hardest hit.

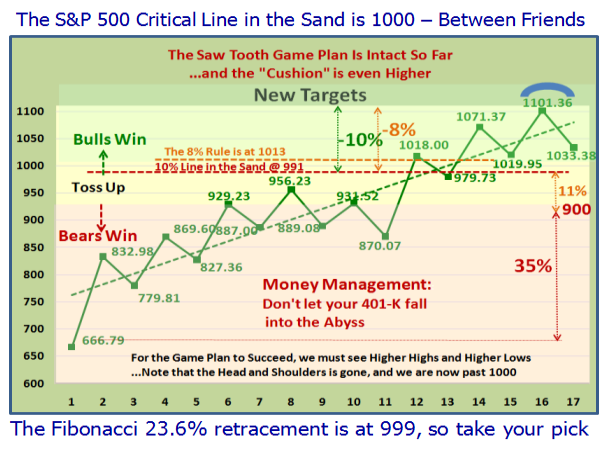

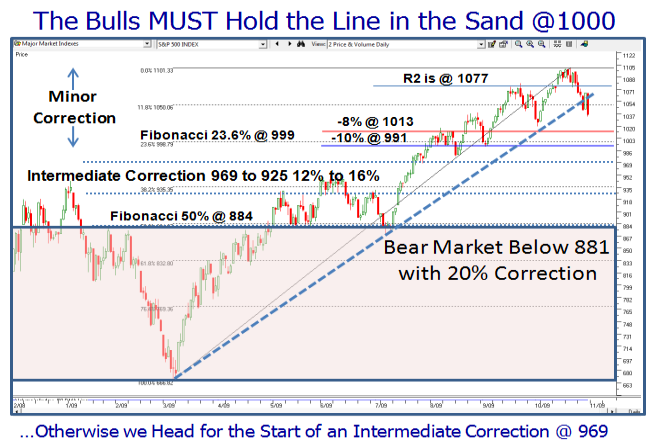

I introduced the Game Plan concept at the March 2009 Seminar of Higher Highs and Higher Lows to make it easy for us to follow when the Rally was strong and when it might falter. It is still intact, but I show you that the lines in the sand all congregate around the convenient and easy number to remember of 1000. Below that the famous Line in the Sand of -8% from High to Low is broken and the correction becomes serious and the Saw Tooth Game Plan is in jeapordy.

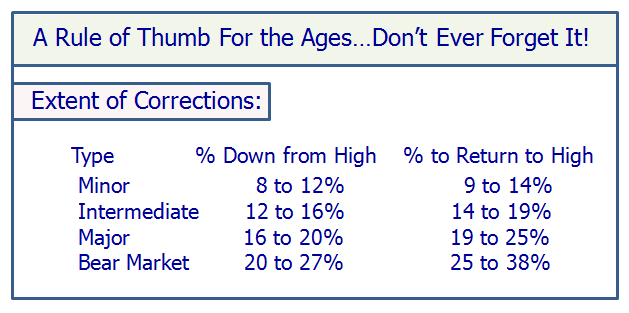

As attendees at the Seminar know well by now, I always give them Rules of Thumb which are golden and here is one set which establishes the degree of severity as we move from a Minor Correction to a Bear Market. Of course anything more severe than the 27% shown gets to be godzilla proportions, but even that requires a 38% return to just get back to even. Imagine 50% down requires your portfolio to come back 100% before you are back to the 2007 levels you enjoyed and you will understand how important it is to preserve your capital during a serious correction:

In the next chart I have combined the thoughts of the two previous charts as well as thrown in one which I do not normally pay a lot of attention to, shown as “R2 is @ 1077”. We gave you the link in “Useful Financial Websites” at my pivots…it takes the mystery out of this stuff. The main reason for putting that on the chart is to know where the Gann and Elliott Wave thinkers sit, and isn’t it interesting this level is right at where a Head and Shoulders Top would be trumpeted should the Bulls try to recover their control…a potential Bull Trap.

The conclusion I come to is that we are essentially at the halfway point of a Bull or a Bear Trap, so be very careful how you commit unless you are prepared to turn on a dime and are equally comfortable going both ways. From the above chart we can see that with the S&P 500 at 1036 it is 41 points to 1077 for the Bull Trap and 36 points to 1000, for the Bear Trap, where 77% of all S&P Corrections turn back up. Of course if it breaks 991, the Bears win and we head down further to an Intermediate Correction.

There are two sides to the thinking of the Composite Man at this stage, and make no bones about it the Big Players control the direction:

A. Camp Sunshine says “Who wants to sell? No Fund Manager or Hedge Fund wants to sell here. There are big bonuses waiting 8 weeks away…hold the line, and no one sells and everyone is happy”. i.e., the Santa Claus Rally and the Nov/Dec best months scenario.

B. The Gloom and Doom Camp’s case, is two fold:

1. This Rally is running on fumes and there is little more to fuel it now that the bulk of the Earnings Reports are out, and we have had yet another large Bank failure this weekend to boot, and

2. The 10% Unemployment is the Millstone and must come down to reduce the Fear. It’s back to the same old song – Jobs, Jobs, Jobs.

Is all that an oversimplification? Sure it is. When will we know this current Bull Market rally in a Consolidation Phase is over? When the Composite Man decides there is a disconnect between the Stock Market and the Job Market.

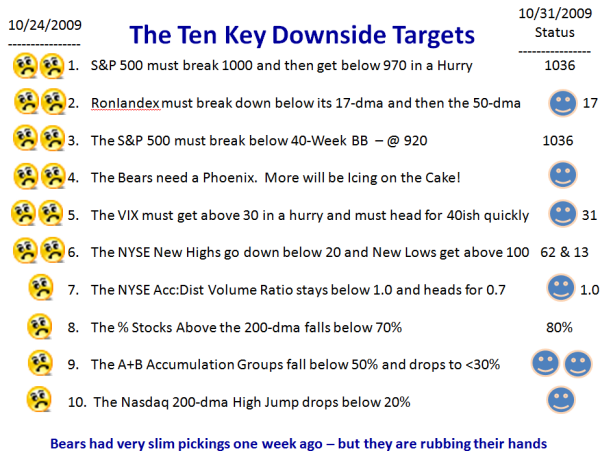

Since this past week has the Bears in command I felt it would be worthwhile to show how they have gained control in just one week since the Seminar. It is striking:

The HGSI Team thanks you for your continued support and the fun we all had this time last week at the Seminar, some of which I tried to capture in this note.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog