Phoenix and Kahunas Volleyed and Thundered

It’s that time of the year again, so Season’s Greetings to you all, thanks for your continued support and all Best Wishes for 2010 from the HGSI Team…George, Matt, Ron and Ian.

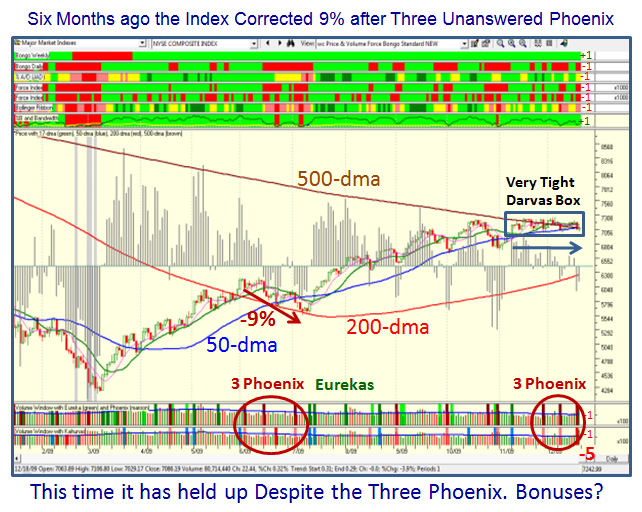

After another ho-hum week, the Bulls and Bears are still at the 50 Yard Line in this tug-o’-war. You have the weekend to digest my gift to you at this festive season. It kills several birds with one stone, particularly after registering the third Phoenix Signal yesterday in the last month, with no response from the Bulls to counteract it. Please don’t interpret this at this stage as anything but caution, as the basic internals have not changed significantly. The note is in three parts:

1. How to read what has transpired over the last nine months to understand the signals working together.

2. The Current Status

3. What to look for and anticipate MUST happen for a move in either direction, though in this case I have only covered the downside criteria. I am not saying they will happen, that is in the lap of the gods, but at least you’ll recognize it when you see it.

The upside scenario is simple: Get above 1111 on the S&P 500 with gusto; until then concern yourself with what I cover below on the downside.

The Last Nine Months:

Here is my latest interpretation of Phoenix’s at this level when the Market is at or close to a High as opposed to being at a Low, when indeed a Phoenix coupled with a Bingo on the same day would signal capitulation. We know when that occurs, and is followed by a Eureka either the next day or a few days later that there has been exhaustion to the downside. It is time to look to the upside, be it a bounce play or a full blown rally.

I hope by now that you have understood that I am using a combination of Richard Arms and John Bollinger through my impulse indicators measured at the EXTREMES of their formulas to show which way the wind is blowing. In other words when they “fire”, they are rare beasts and one should sit up and take notice. Hence, I use the NYSE with the “wc” chart to see the relationship between Eureka, Phoenix and Kahunas, but will toggle to the S&P 500 and Nasdaq for confirmation:

Let me first set the stage by saying we all recognize that to all intents and purposes, the market for the last 30 days has been in a very tight range between 1089 and 1111 on the S&P500. The line in the sand is at 1100 as the point of demarcation between Snakes and Ladders as described in my recent blogs.

1. Three Phoenix signals in a row without a response from an Eureka spell the Bears are gaining control with no serious response from the Bulls.

2. The most recent example was the period from 6/3/09, 6/15/09 to 7/02/09, where we had just achieved a 42% Rally off the bottom on the S&P 500…so it was no surprise we had a correction of 9% during this period for both the S&P 500 and NYSE, and about 9.3% for the Nasdaq.

3. During these past nine months it is the only period where there were no Eurekas in between, suggesting the Bulls were not defending with vigor, and the Bears ruled the roost.

4. Since then, we have noticed that every Phoenix has been trumped by a Eureka, or even two in a row within two or three days which have signaled the Rally is on again and the Bulls were flexing their muscles.

5. …Until we get to the Dubai Caper on 11/27 which started the first shot across the bow with a Phoenix, and the market had already been in the tight Darvas Box I mentioned above. The second was 12/8/09 (Dave doesn’t show one on 12/8 because he should have set the ARMS portion of the Phoenix to 2.43), and the latest today on 12/17/09. What has held the Rally together is the unusual yo-yo that the market has played for the past seven weeks ever since the last Eureka on 11/9/09. However, yesterday’s Phoenix is accompanied with a big Kahuna to the downside and on heavy volume, being expiration week. It is also understood that much of this volume was due to CITI.

The Current Status:

Just stare at the extreme right hand side of the chart using the “wc” view and the NYSE:

A. We can quibble about the exact count, but most will give me a score of at least -5, which is a strong shot across the bow. However, that is hardly any different than the last two occasions we had a Phoenix.

B. The two remaining greens are the Weekly Bongo and %B which is still just above the Bandwidth.

C. Sooner rather than later we will know if this Market will break to the downside or continue up, but all are waiting for “When will that happen?”

So here is what to look for on the Downside:

1. The %B will go down through the Bandwidth and turn from green to red. The reading is 0.15, so it should be the first to go. If the drop at this stage is >-0.35, with another Kahuna to the downside, we will have the key one day signal that this Rally is over.

2. The NYSE Index is just below the 50-dma and for that matter the 500-dma, and any move down further, coupled with the S&P 500 crossing below the 50-dma, i.e., below 1089 with gusto will do the trick.

3. Bongo Weekly at last turns negative and that will really open up Dave’s beady eyes! Stay calm until then, but it is a late signal.

4. However, the real zinger will be when the %B reaches a reading of -0.2 or worse, as that has only happened nine times before in the last 12 years, three of which led to the 1987 crash, and two during the 2008 Black Swan dive.

5. Now please understand that when the Bollinger Bands are as tight as they are now, i.e., Bandwidths of less than 0.03, it is an unusual state and last happened for any length of time around the late 2006 to early 2007 timeframe, before there was a sharp drop of about 5% in a week.

6. Don’t expect any Bingos to appear before the RSI on the NYSE gets below 30…the reading is up at 47 at the moment, so we would have to see a total deterioration of the Index for that to happen.

The Three Scenarios to the Downside:

A. No worse than an 8% correction

B. A 12% to 16% Intermediate Correction, and you will feel the pain

C. A complete Nose Dive for another Bear Market Correction, and you already know what that feels like.

I say to you “Follow the Signposts with the wc chart”and you will stay on the right side of the Market.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog