Stock Market To Da Moon

I couldn’t avoid a tongue in cheek headline for this blog note. Everyone is aghast at the way this Stock Market Rally keeps sluffing off bad news and keeps trotting along the yellow brick road. Sooner or later it will end, but there is only one way to behave – it’s YOUR stocks in YOUR Portfolio that matter. This was an unusual week after the GS Caper, where the mood of Fear was soon tested…Fear for a day and a half, which dissolved as quickly as it appeared with the mood swinging back to recognizing many good Earnings Reports. So the Bulls are still looking to a full moon.

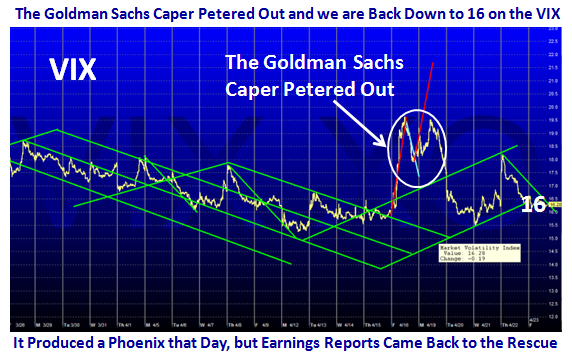

We are back down to 16ish on the VIX, so that sudden hiccup never followed through, the Bears tried but no cigar:

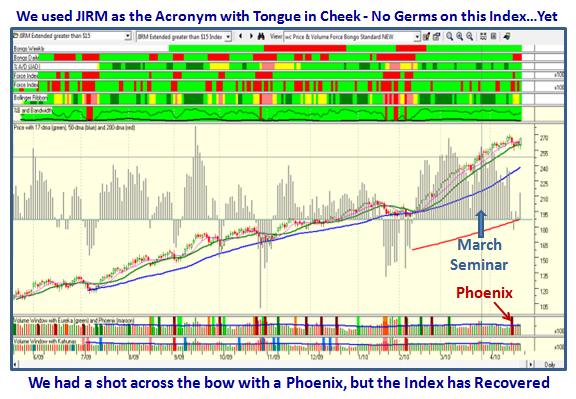

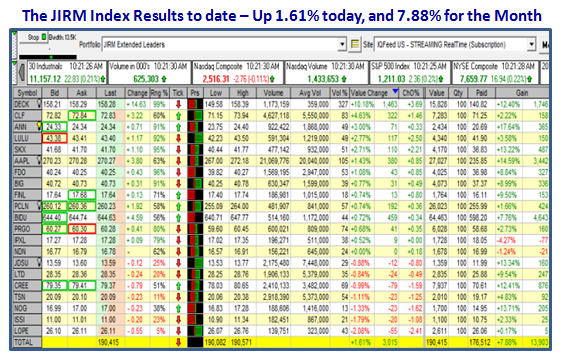

So far, so good. There are no Germs on the JIRM Index which has gained about 8% in the past month since it was generated, or about 2%/week, which includes the downdraft that occurred from the GS Caper, as these stocks were hit hard for two days. Note that only two stocks are under water and not by much:

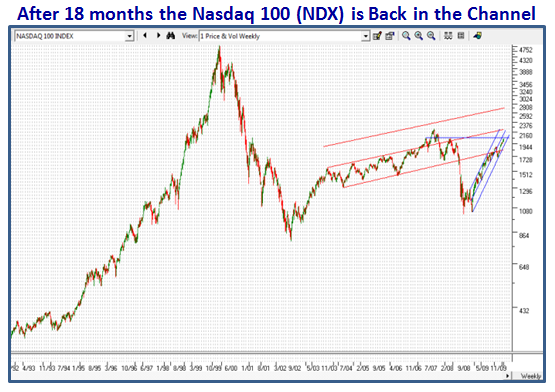

It sometimes pays to step back and see where we stand in the bigger picture. The Nasdaq 100 (NDX) is already in the 2003 to 2007 Channel, and the Bulls hope it will stay there. Whether it can push through to 2300 is another matter, but what does matter is when it is tested again on the downside at around 1825 or so:

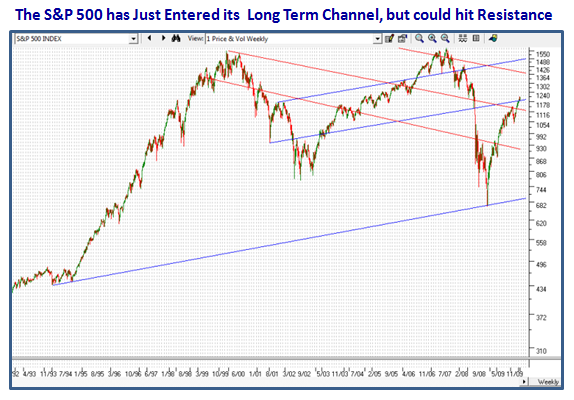

Prolonging the theme suggests that the S&P 500 is already close to running out of steam or can push on to new heights at certainly 1365. Wonders never cease, but we shall see if this Stock Market Rally has enough legs to last to 100% Gain!

By the looks of things, the Bears don’t yet have the fight en masse, and the Bulls continue to buy every dip. Realize that the Large Players have the control, so play close to the vest, especially if this Market goes into a Climax Run as that will signal the Small Players have gone ga-ga.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog