Stock market: Three Road Scenarios

At this stage of events, it seems easier to hypothesize the three Main Road Scenarios. The Stock Market has played into our hands and here is what may unfold in the next week or so.

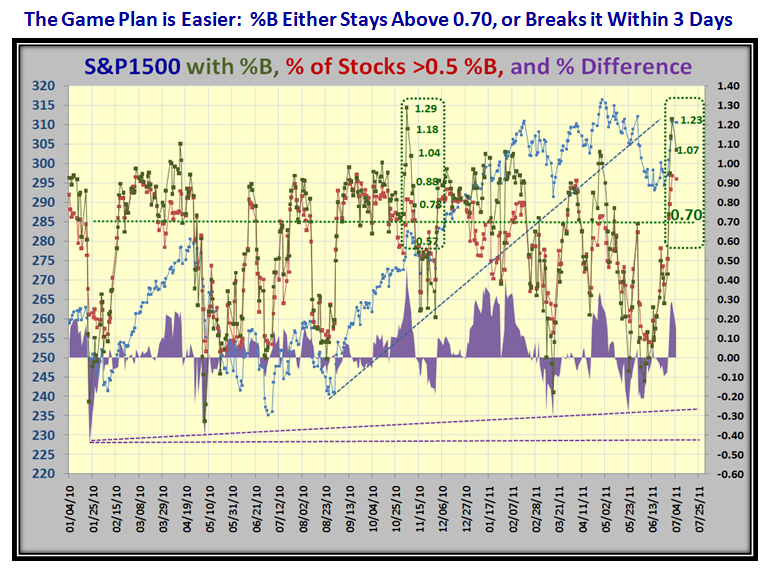

You have seen the chart below when I coined it as the Purple Chart, which helps when a Market is either Overbought or Oversold:

Please compare the current stage with that around mid November last year to identify what “MIGHT HAPPEN”:

1. The Middle Road Scenario: The S&P 1500 will fall to below 0.70 for %B within the next week

a. We should expect at least a Kahuna to the downside…that implies a one-day skip of two buckets down

b. It also suggests a Price drop of >1.5% in the S&P 1500 or about $4 in one day

c. %B for the S&P 1500 will drop BELOW the reading of the % of stocks in the S&P 1500 >0.5 %B

d. Subsequently in the ensuing week %B MUST not fall below 0.25, and then must rebound

e. The Price of the S&P 1500 will HOLD above its current low of ~ 294 at or near a triple bottom

f. The Canaries give up their significant recent gains and again will be testing their lows

2. The Low Road Scenario: Given the Middle Road Scenario to 0.2, %B falls further below the Bandwidth

a. Invariably this requires at least a 2% Price Drop and one can expect repeated one day Bucket Skips

b. At this stage, the Bears will have control and the Floodgates can open on full throttle

c. The S&P 1500 can suffer several 1-Day Price drops of 2% or more

d. %B (green line) will drop faster than the % of Stocks above 0.5% (red line)

e. The Purple Area Chart will once again go negative to around -0.2 or lower

3. The High Road Scenario: Given the Middle Road Scenario to 0.2

a. %B RISES and recoups to 0.9 or higher

b. The S&P 1500 quickly rebounds and attempts a double top, either blowing through or being rebuffed

c. We review the bidding at that stage, but it will certainly require good news on the Debt Ceiling Fru-frau

d. There is no further unrest or negative surprises on the PIIGS front

e. Volume picks up to give conviction that the Bulls are ready to flex their muscles

Always let the Market tell you which Scenario it is on. At least we now have a cushion from the Strong Bounce Play of last week to give breathing room to the downside.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog