The Fed’s Twist is No Chubby Checker!

I know you folks have been eagerly looking out for my take on the two items I told you to watch ten days ago and now we have both items behind us, the American Jobs Act and the Fed Meeting which ended today in a flop as far as the Stock Market is concerned. I didn’t want to disappoint you so enjoy the charts which speak for themselves as I want to get this out early enough so that the East Coast supporters can chew on this before they go to bed:

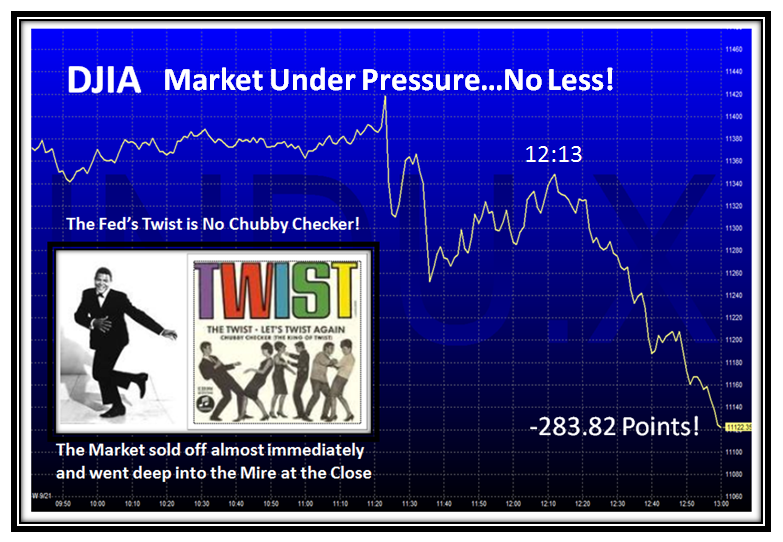

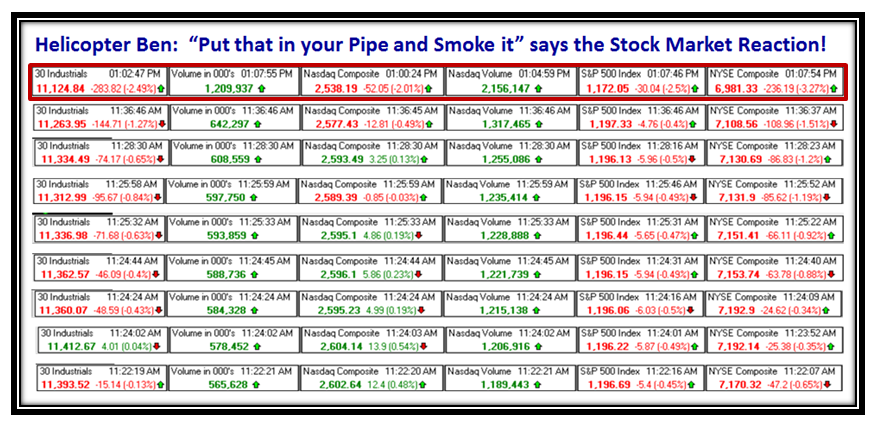

One of my favorite pastimes is to record the Market Action on the day of a FOMC announcement, so true to form, here is what Ron and I observed as we chatted on Skype at 11.15 am onwards:

It didn’t take but two minutes to see we were headed down, and it was a landslide all the way down to the close:

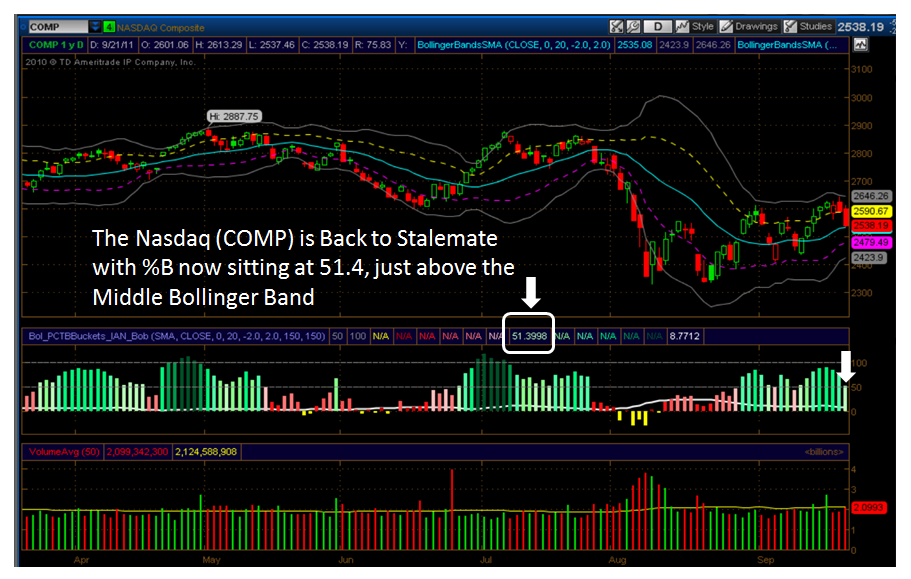

This Next Chart has all you need to know for the immediate short term these next few days. Make no mistake about it, we are extremely fortunate to have a BIG Cushion from the lows of 2300 or so. We need a >1% Bounce Play tomorrow:

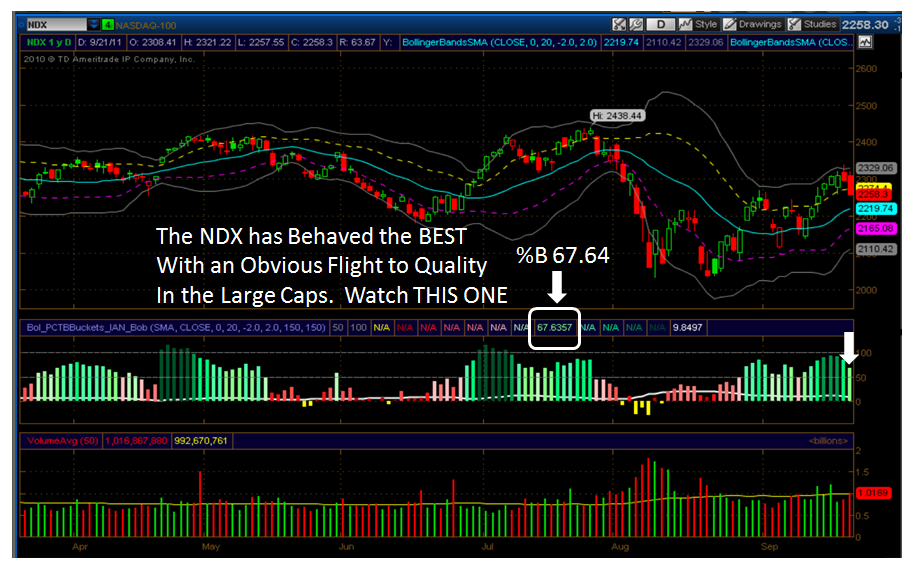

Now let me show you a different view relating to %B and Bandwidth as developed in Think or Swim by my good friend Bob Meagher who will be at the HGS Investor Seminar in just four week’s time, and will be only too glad to help you when you see him there. This picture is in real time and the bar at the end of the chart for %B wiggles up and down with the market so that I can tell when we are due for a Bucket Skip to the upside or the downside.

If you have been watching the various Market Indexes as I do, I am sure you will have noticed that the NDX has behaved the best with a flight to the Big Cap stocks for safety. I strongly advise you to watch the NDX as it will be a true guide as to the health of the Market and if it can weather the storm created by today’s reaction to the Fed’s attempt at a cha-cha-cha on the twist. Start dancing Helicopter Ben:

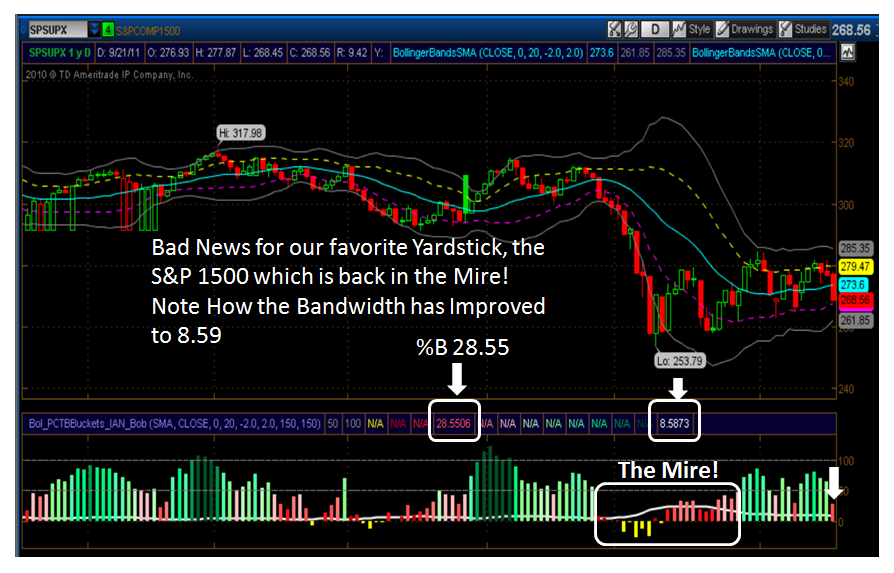

…And now for the bad news relating to our favorite surrogate for the market, the S&P 1500, which is back once more in the Mire. Judge for yourself:

If we break down below the Lower Bollinger Band, the Bandwidth which has recovered nicely to <9.0 (8.59 to be exact), will quickly grow and if it heads back to 24 or more you know that we will be back to Black Swan days!

So the Game Plan is very easy. If the S&P 1500 breaks 261.85…the Lower Bollinger Band, then you need to either short the market or run for the hills.

It is no secret that HFT’s (High Frequency Traders) rule the roost, so be mighty careful where Angels Fear to Tread:

What is the Moral of this Story and the lesson learned? Always keep an eye on impending Fed Actions and Political Decisions that may affect the Market’s reaction, especially when the Market itself is very jittery and is primarily NEWS DRIVEN. 40% to 60% of your Portfolio’s movement depends on the Market, 20% to 30% depends on the Industry Group and the remainder is due to the Security itself…therefore, always watch the Market and Industry Group FIRST!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog