Sequel: Market Double & Triple Tops

Let me pick up from where I left off on my last blog note. The “PIGS” story has got a trifle stale along with the QE-3 stuff, but none-the-less enough to cause jittery markets.

Counts of distribution days abound, so the topping action in this rally continues to be the headlines. However, AAPL and PCLN continue to hold and grow so they are the ones to watch for signs of serious knee jerks. I gave you chapter and verse in my last blog note so I thought I would focus on the one point that matters at this stage of the Game Plan…a Knee Jerk Volatility action in the VIX leading to a full blown swoon of 5 Buckets down in the Market Indexes.

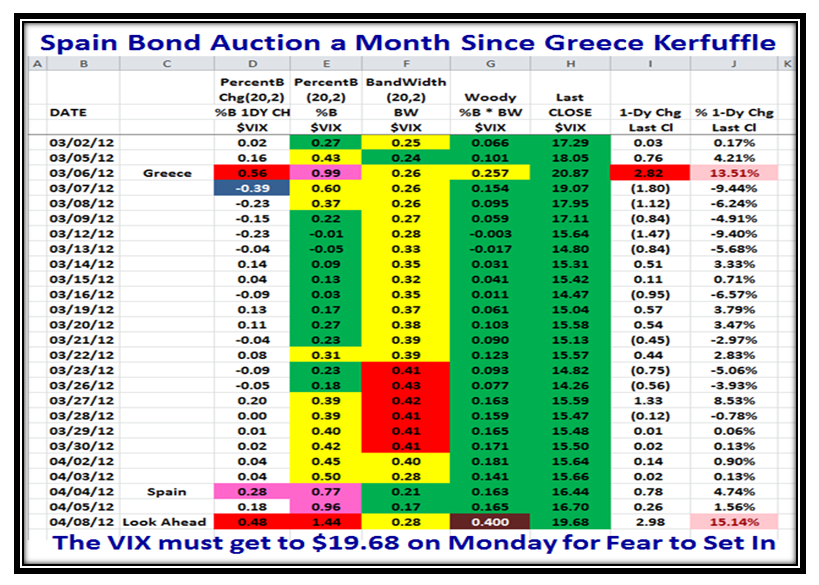

I have a confession to make regarding my last Blog Note picture of the Look Ahead function I use with the VIX and %B x BW. The hour was late when I put that note up and I inadvertently used a “rough and ready reckoner” template which helps me stay on top of the “What If” game I play to watch the VIX action in real time. Far be it for me to lead you astray as I am usually meticulous in my work, but although the Concept of the Look Ahead was golden, the numbers were not quite according to Hoyle! I thank you for your feedback that you have your beady eyes on me! Note that the Woody Indicator is still green at 0.165 after yesterday’s tepid action and is a long way from the 0.400 level to cause serious concern.

You all know that the work Chris White of EdgeRater does is impeccable, so when in doubt use his numbers and do your own What If exercises to look one day ahead. So with that preamble, here is the Look Ahead for Monday if we are to see a Run for the Hills clue on the Woody Indicator:

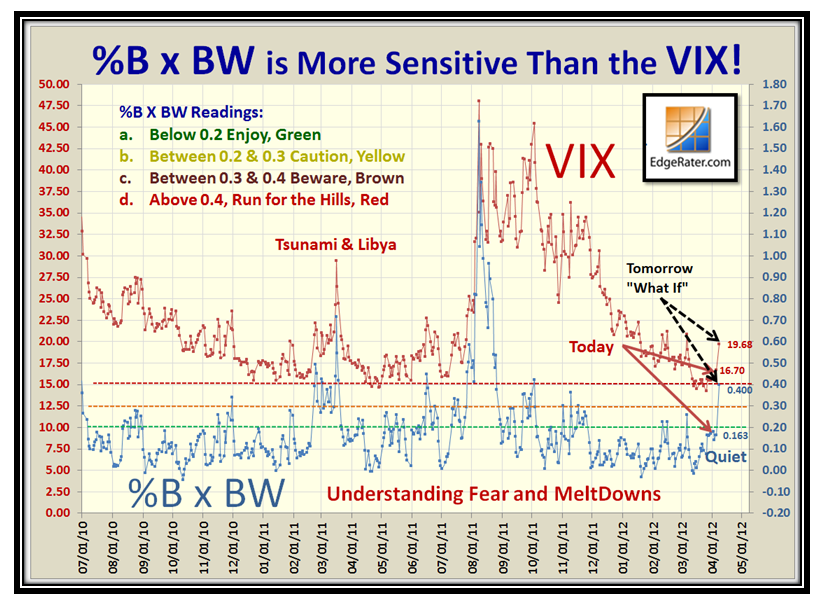

If there is a Landslide day next week, the quick answer is around $20 on the VIX will do the trick to Run for the Hills. For those who prefer to look at Charts instead of numbers, here is the familiar picture of the VIX and %B x BW:

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog