Stock Market: Helicopter Ben on his Way?

It goes without saying that the miserable Jobs Report yesterday may have spurted Helicopter Ben to pop in again, but heaven help us if he has engine trouble in not getting a consensus on doing Q-E 3 after all the hype and expectations that the press has set up for next week:

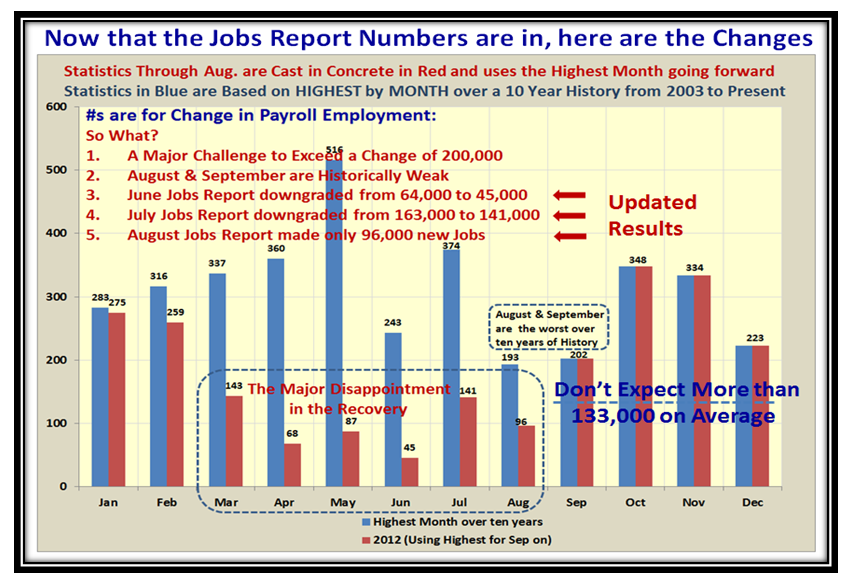

We have the so called “Draghi Plan” to thank for a supercharged boost in the Market Indexes on Thursday and for then staying up the following day, yesterday, despite the poor Jobs Report. Now that we have all the changes in, here is the updated picture, together with my assessment of what to expect all on the chart:

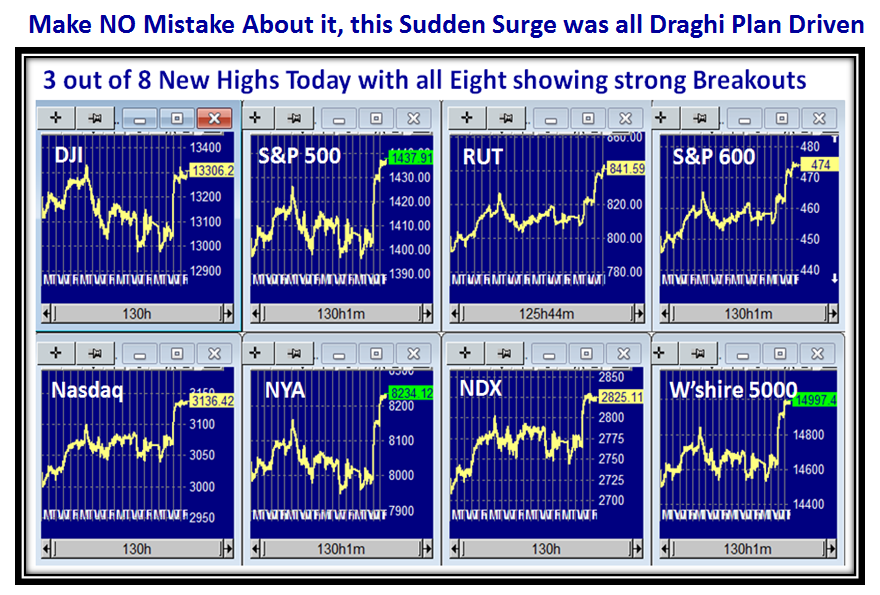

It is very evident that the dire straits worldwide with all eyes on the Euro and the expected actions for the Draghi Plan gave such a strong action all around the world and certainly here in the USA with huge breakouts in two days:

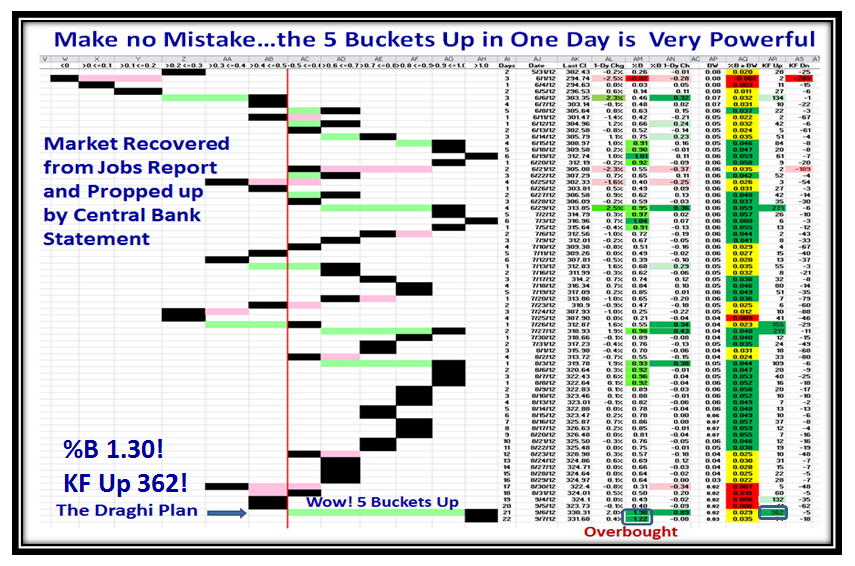

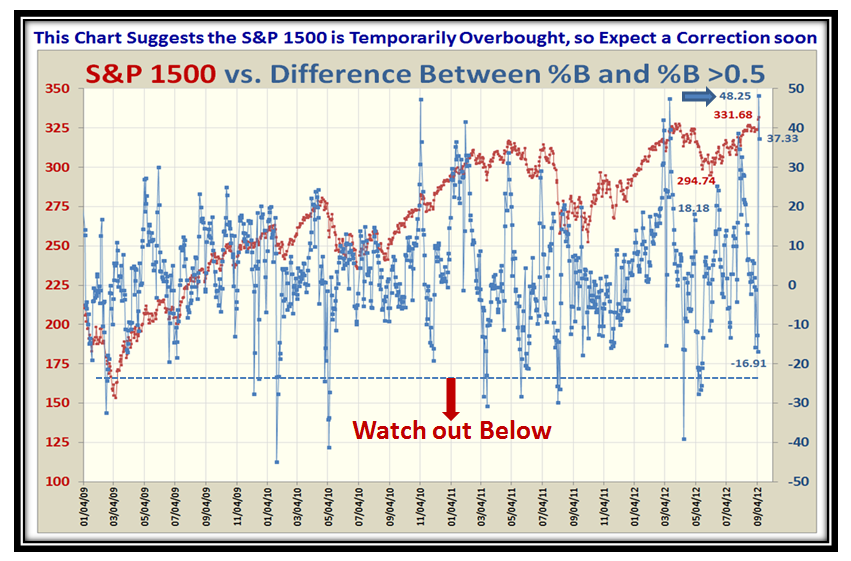

Here is the five Bucket rise from a couple of days ago, which quickly drove the S&P 1500 into Overbought status:

With the %B for the S&P 1500 up at 1.30, it is no wonder that we shot up to a difference between it and the % of Stocks above 0.5 to be as high as 48.25 to drop back to 37.33 yesterday, still very strong:

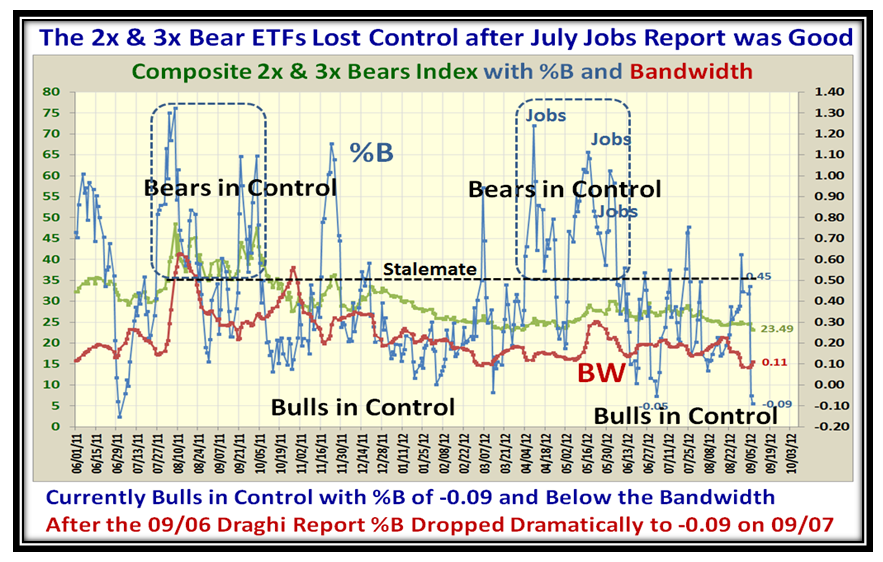

The 2x & 3x Bear ETFs always give insight quickly of who is in control and it is obvious that the Bulls have it:

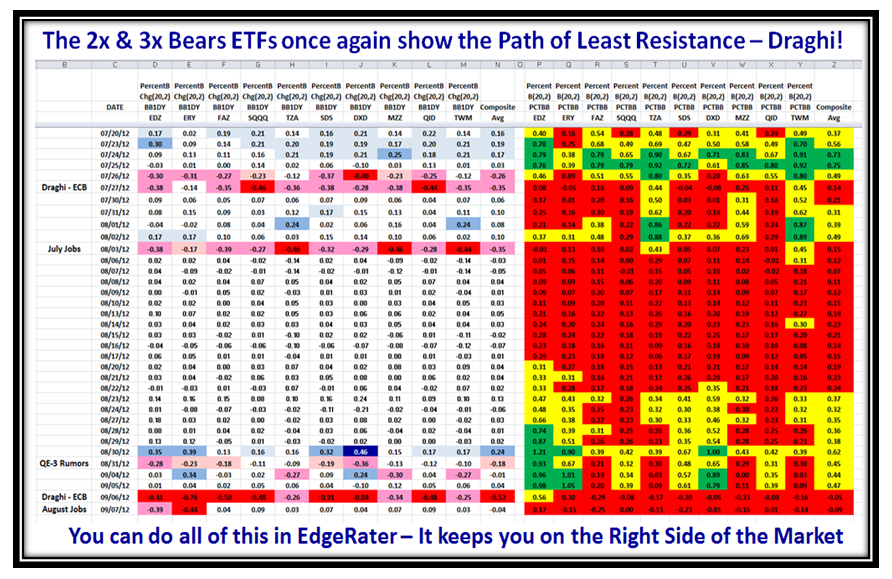

…And here is the ugly picture as the Bears ran for cover quickly when the Draghi Plan seemed golden:

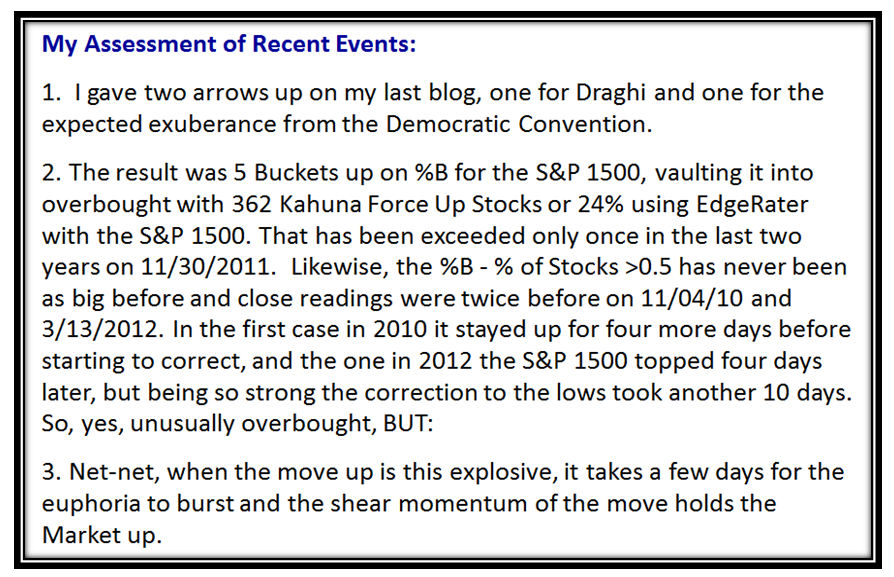

The next two slides give you my assessment of the events of the past few days and then a third one which repeats what I said in the last blog for your convenience of the events to look out for next week:

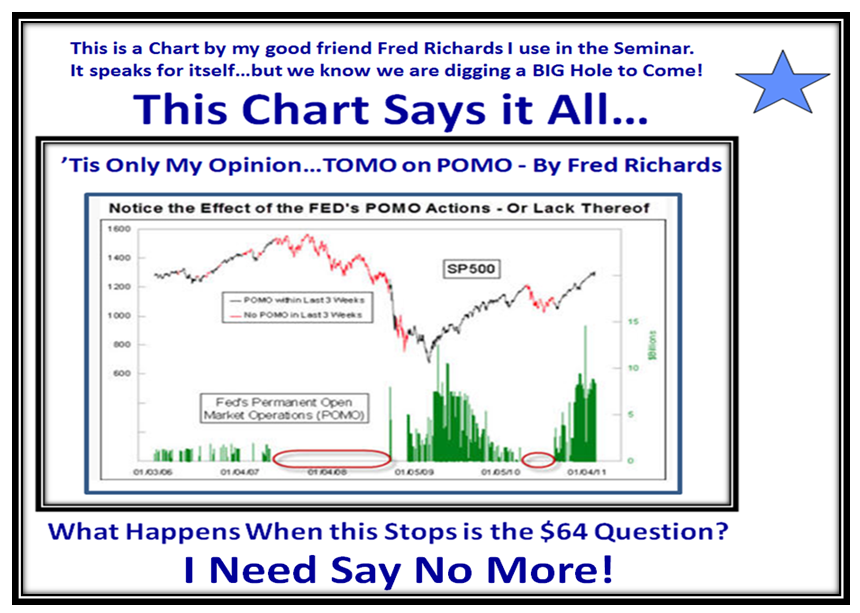

“No Body knows the Trouble I see”, but enjoy POMO while you can if it comes next week…this chart by Fred Richards is worth remembering with his TOMO on POMO of more than a year ago:

Enjoying the Golf while I write this…have a great weekend and many thanks to all of you for my Birthday Wishes and appreciations for my work to keep you on the right side of the market. Understanding Fear and Greed are Key to Buy Rockets and Sell Rocks as I coined over 20 Years ago!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog