Stock Market: Fed and Wall Street Game Playing

Well of course we should expect the Market to go up with vigor when the FED announced QE-3, and as before they are scratching each other’s back:

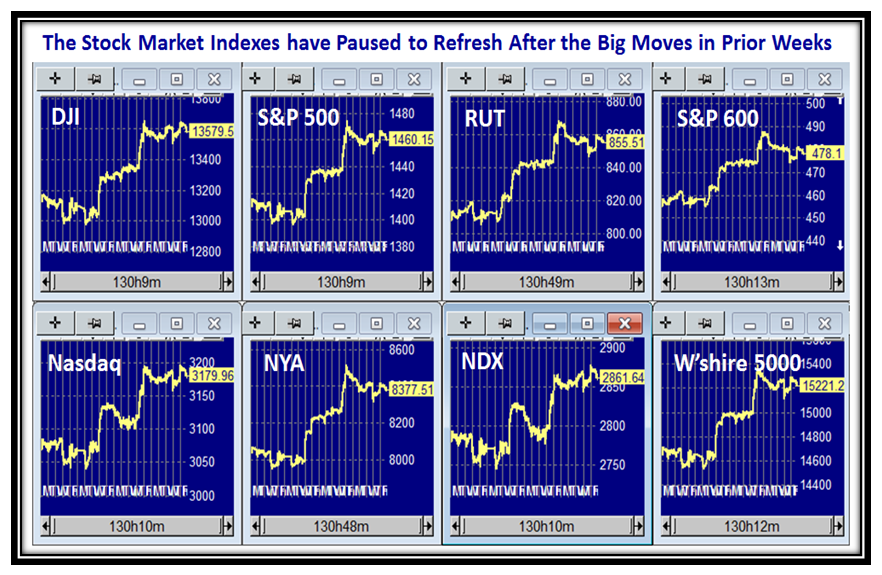

Here is the Double Flag up due to Draghi and Helicopter Ben two weeks ago that catapulted the Markets Up:

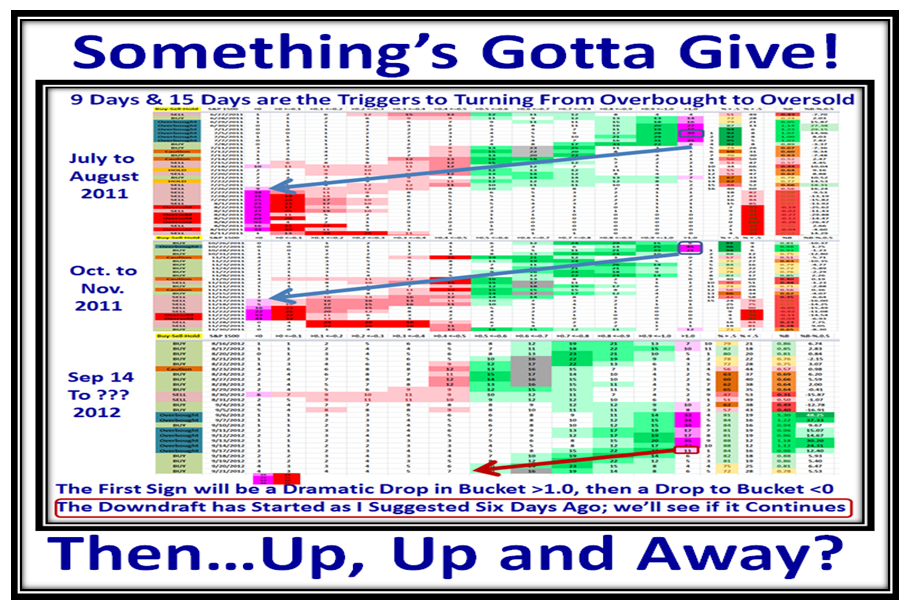

In the last Blog, I gave you a hint of what to expect based on recent past history, and so far it is working out. Here is the updated chart which shows we have been trotting down in %B strength in the last six days:

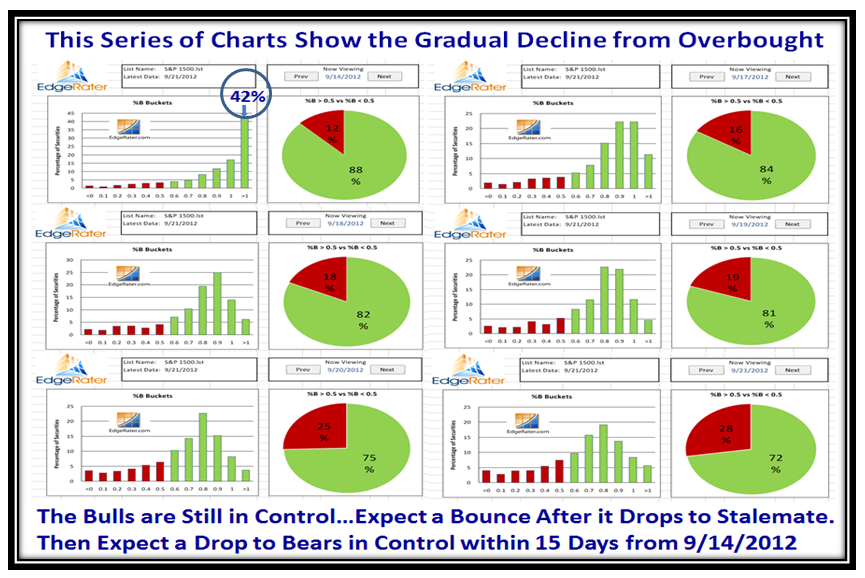

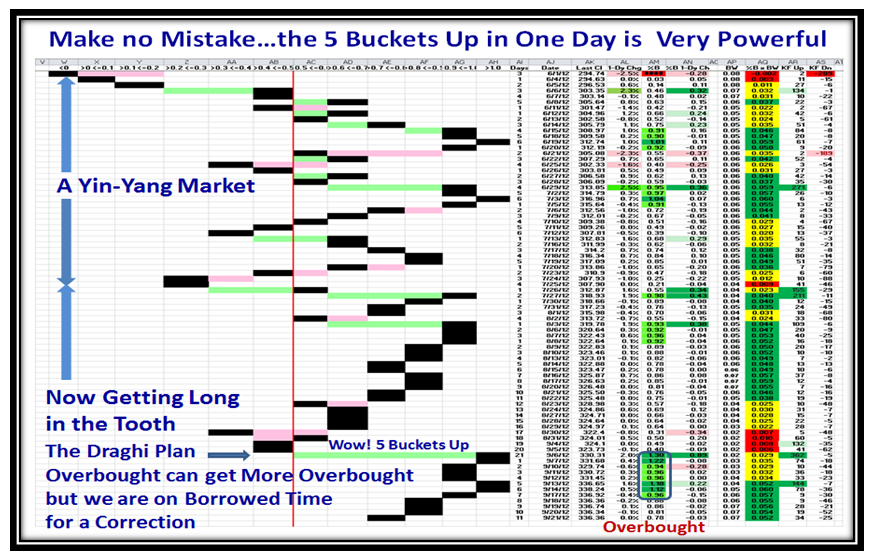

…And this next chart will show you how Grandma’s Pies have weakened over the same period. The Bulls are still in control but it won’t take much to move to stalemate of around 55:45 or so. Since the trot down has been orderly, expect another small bounce from those who feel they should hop in and catch the next move up before the %B trots all the way down to seek a bottom as shown above:

Here is another view to confirm the gradual trot down in %B for the S&P 1500, since it was overbought:

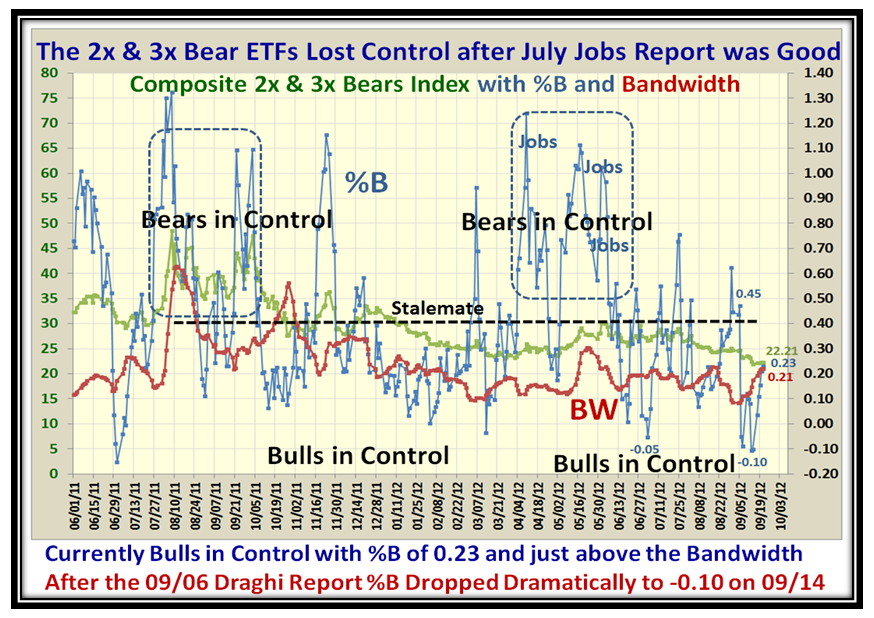

…And this next chart caps it off for you that the Bulls are still in control using the 2x and 3x Bears ETFs:

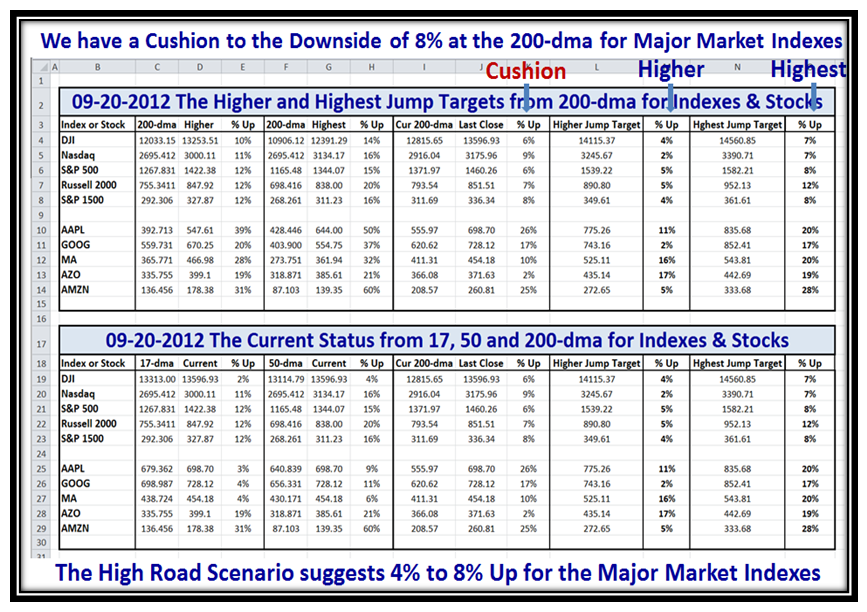

By now you are asking “So What and Then What, Ian? What does your Crystal Ball tell you?” Stick to the discipline and be ready for any eventuality. When the Market Rally has got a trifle long in the tooth and you see breakaways from the 200-dma, your mind MUST turn to the High Jump!! Don’t ever forget it. So to show you what I mean, I took the time and patience to produce the following chart, which reveals some interesting pieces of information.

Get your Beady Eyes on the Arrows called CUSHION and the two to the right for % Up for Higher and Highest Road Scenarios. We see we have a safe cushion of 6% to 9% for all the Market Indexes shown. We also note that GOOG which is heading straight up is only 2% from its historic Higher Perch, so GOOG is the one to watch to see if it stutters or carries on to up at $743. Also if this market continues up expect 2% to 5% on the upside for the Major Market Indexes, before we either stutter or continue on up:

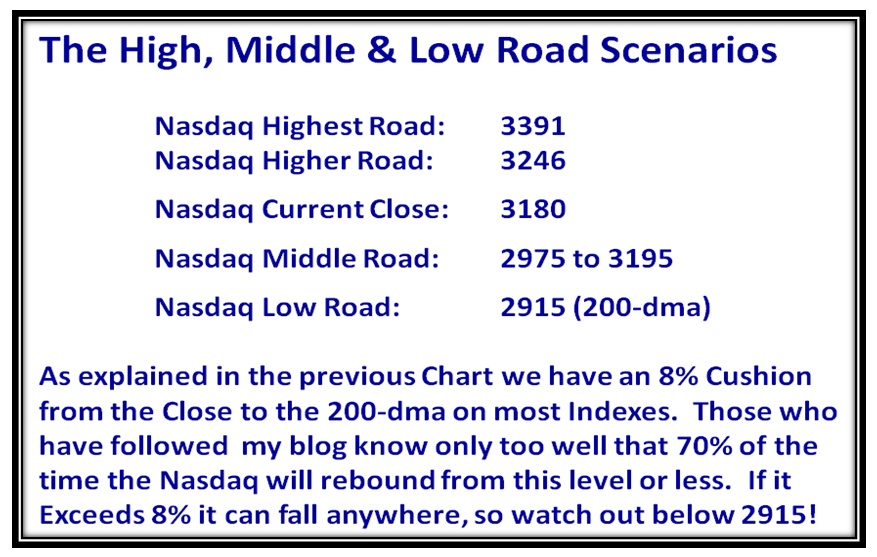

To simplify all of that down to one chart to keep next to your elbow, here are the key factors for the Nasdaq:

Now you are armed for the next few days to weeks at least with the above scenarios. Never fall in love with any scenario, but let the Market tell you which one it is on against this plan.

Our Seminar is just five weeks away and we have plenty of seats available for those who feel they would like to come and learn how Ron and I keep you challenged to cope with Fear and Greed and make the most of the Rallies in between!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog